84 Current Video Conferencing Statistics for the 2021 Market

69% of people agree that the COVID-19 pandemic will permanently change the nature of work.

Video conferencing software made that possible.

This market exploded in 2020 after the coronavirus hit. Most companies sent their entire workforce home for the foreseeable future. And every single one of them relied on tools like Zoom, Microsoft Teams, and Webex to keep their business going.

These statistics show how crucial web conferencing software is to our past, present, and future.

Click on a Section:

Top 10 Video Conferencing Statistics

- The video conferencing market is expected to surpass $50 billion by 2026. (Global Market Insights Inc. 2020)

- 90% of North American businesses are likely to spend more on video conferencing in 2022. (Vox 2021)

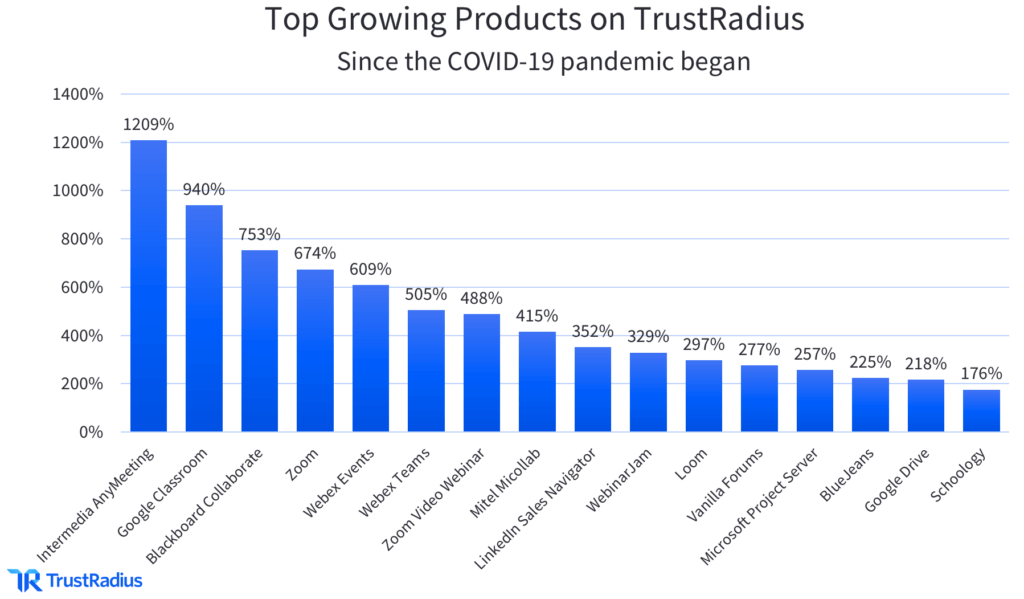

- The web and video conferencing market increased 500% in the first two months of the COVID-19 pandemic. (TrustRadius 2021)

- By 2025, 36.2 million Americans will be working remotely. That represents an 87% percent increase from pre-pandemic levels. (Upwork 2020)

- 79% of workers think video conferencing is at the same level or more productive than in-person meetings. (Owl Labs 2020)

- 31% of business travelers plan to reduce their business travel post-pandemic because teleconferencing and remote working arrangements were as effective as being in the office and traveling. (Oliver Wyman 2020)

- 97% of remote workers would like to work remotely at least some of the time for the rest of their careers (Buffer 2021)

- 82% of company leaders intend to permit remote working some of the time as employees return to the workplace. (Gartner 2020)

- 76% of startup founders reported productivity has either maintained or increased as a result of working remotely during the pandemic. (Kung Group 2020)

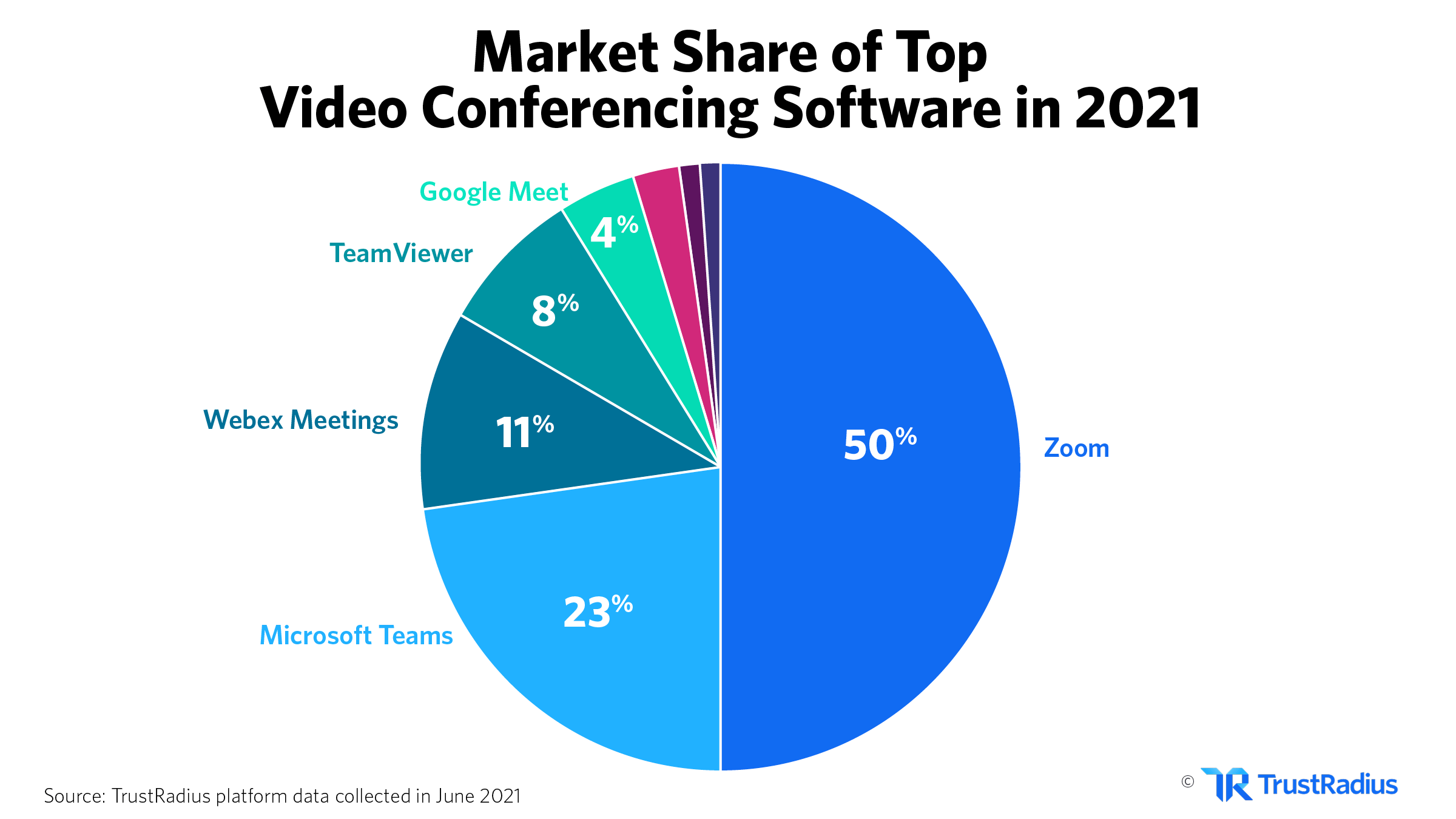

- Zoom dominates 50% of the video conferencing market in 2021. (TrustRadius 2021)

Video Conferencing Market Growth

- The video conferencing market is expected to surpass $50 billion by 2026. (Global Market Insights Inc. 2020)

- The web and video conferencing market increased 500% in the first two months of the COVID-19 pandemic. (TrustRadius 2021)

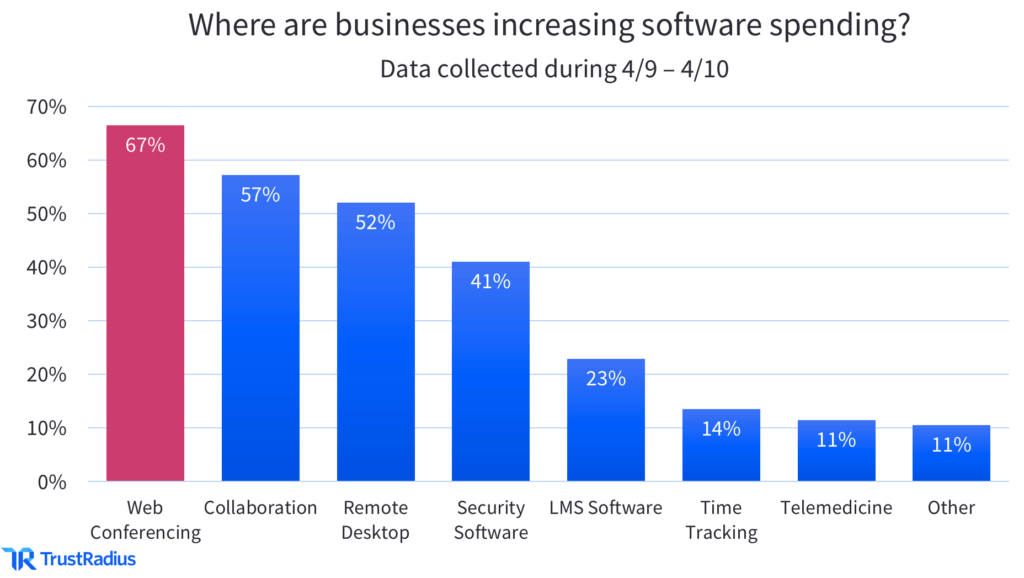

- 67% of companies planned to increase their spending on web & video conferencing in 2021. (TrustRadius 2021)

- 90% of North American businesses are likely to spend more on video conferencing in 2022. (Vox 2021)

- Before the pandemic, usage of video communication at work increased 48% between 2017-2019. (Lifesize 2019)

- The video conferencing market is estimated at $7.9 billion in 2021. Analysts expect the market to grow to an estimated $9.7 billion in 2022. (Vox 2021)

- North America commands 39% of the video conferencing market in 2021. (Grandview Research 2021)

Zoom Statistics (Plus Microsoft, Google, and Cisco)

- Zoom surpassed 350 million daily meeting participants in 2020. (Zoom 2020)

- Zoom’s daily active users increased 2,900% in the span of 4 months during 2020. (Bloomberg 2020)

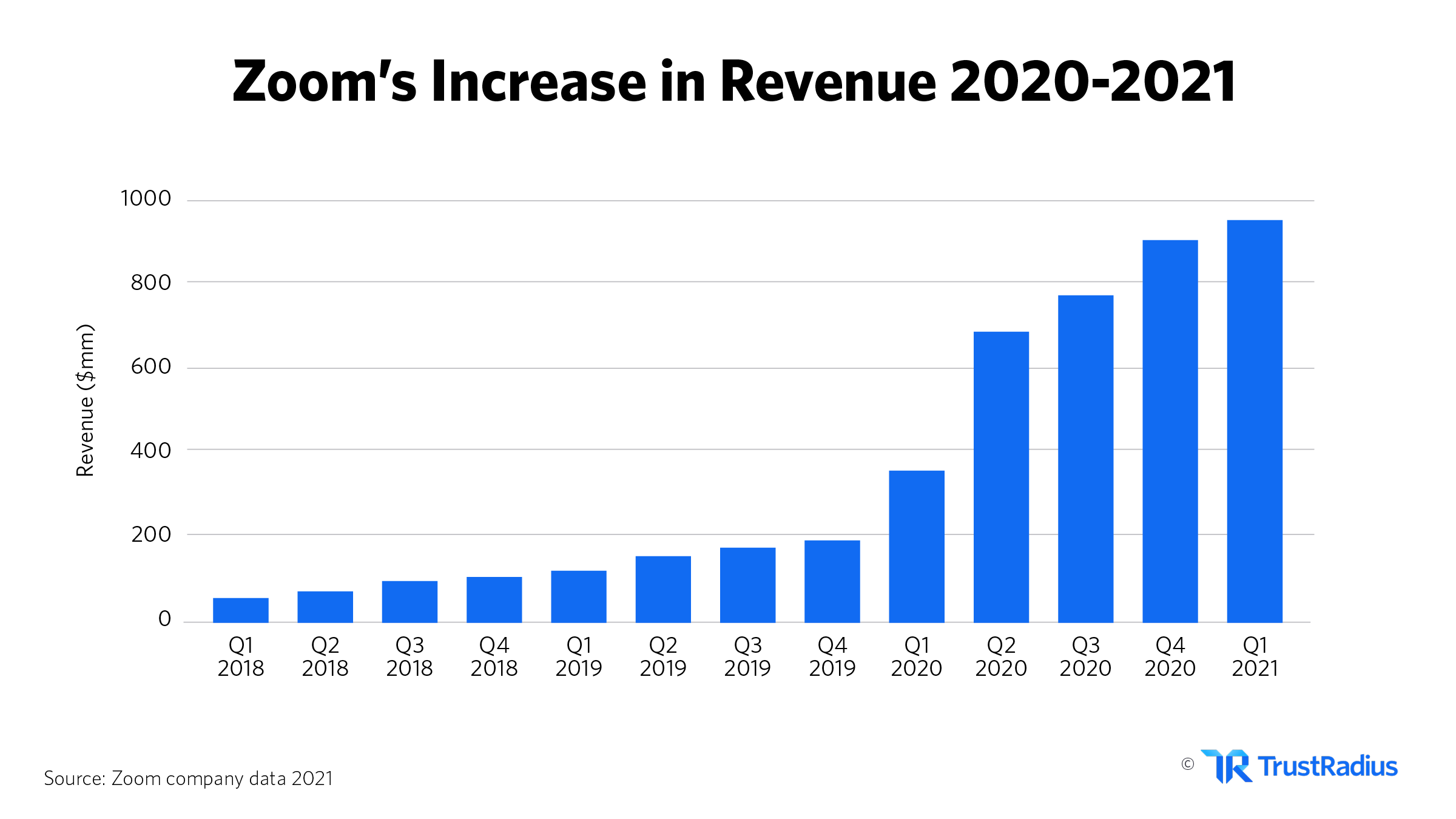

- Zoom generated $2.6 billion in revenue in 2020, a 317% increase year-over-year. (Zoom 2021)

- Zoom had over 470,000 business customers as of December 2020. (Zoom 2021)

- Zoom’s valuation exceeded $100 billion during the pandemic, a 383% increase from January 2020. (Zoom 2021)

- Over 90,000 schools used Zoom at the height of the pandemic. (Zoom 2021)

- In 2020, over 45 billion minutes of webinars were hosted on Zoom. (Zoom 2021)

- Zoom users have logged over 3.3 trillion annual meeting minutes. (Zoom 2021)

- The Zoom mobile app was downloaded 485 million times in 2020. (Zoom 2021)

- Microsoft reported 75 million daily active users of Teams in April 2020, an increase of 70% from the previous month. (Windows Central 2020)

- Microsoft recorded 200 million meeting participants in a single day in April 2020, which generated more than 4.1 billion meeting minutes overall. (Windows Central 2020)

- In April 2020, Google Meet added roughly 2 million new users each day and hit over 100 million daily Meet meeting participants. (Google 2020)

- Cisco had a total of 300 million Webex users in April 2020 and saw close to 240,000 sign-ups in a 24-hour period. (The Verge 2020)

Zoom Dominates Video Conferencing Market Share in 2021

Over 1.2 million software buyers use TrustRadius each month. Many of them are shopping for web conferencing software—so we took a closer look at our data to see which products attract the most attention.

According to buyer interest, the top 8 leaders in today’s video conferencing market are:

Out of those companies, Zoom is the clear winner when it comes to market share.

- Zoom dominates 50% of the video conferencing market in 2021. (TrustRadius 2021)

- Popular alternatives to Zoom include Microsoft Teams (which commands 23% of market share), Webex Meetings (11%), and TeamViewer (8%). (TrustRadius 2021)

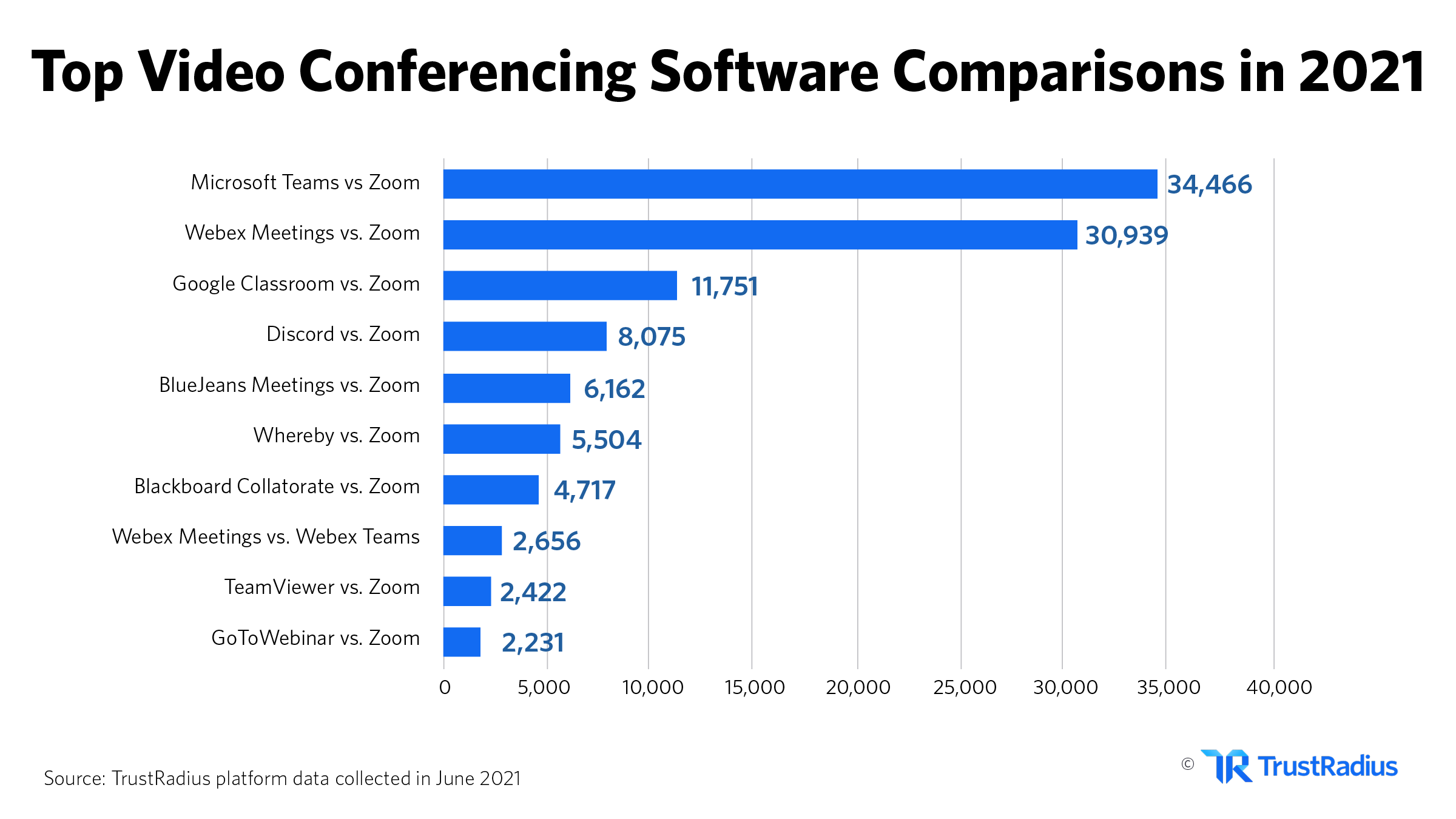

- Microsoft Teams and Webex Meetings are the products most often compared to Zoom in 2021. (TrustRadius 2021)

Current Remote Work Statistics for 2021

- By 2025, 36.2 million Americans will be working remotely. That represents an 87% percent increase from pre-pandemic levels. (Upwork 2020)

- 70% of full-time workers in the U.S are working from home during COVID-19 (Owl Labs 2020)

- Economists estimate that only 37% of jobs in the United States can be performed entirely at home. (University of Chicago 2020)

- 50% of people would move if they were able to work from home all or most of the time. (Owl Labs 2020)

- 2 out of 3 tech workers would leave San Francisco permanently if they could work remotely (Blind 2020)

- 86% of organizations incorporated new virtual technology to interview candidates due to the COVID-19 pandemic. (Gartner 2020)

- 82% of workers would describe their company’s transition to remote work as smooth. (Buffer 2021)

- When asked about the primary change to their work now that they work remotely, 41% of workers indicated that their collaboration and communication have changed the most. (Buffer 2021)

- 30% of IT executives believe that the most significant lasting change of the Covid-19 pandemic from a technology perspective will be the ability of workers to effectively incorporate online collaboration tools into daily work. (ESG 2020)

The Future of Remote Work

- 81% of workers think their employer will support remote work after COVID-19 (Owl Labs 2020)

- 82% of company leaders intend to permit remote working some of the time as employees return to the workplace. (Gartner 2020)

- 65% of startup founders stated that if stay-at-home orders were lifted tomorrow, they would not return their companies to the office. (Kung Group 2020)

- Facebook, Twitter, and Shopify were among many larger tech companies who made headlines in 2020 for making a permanent move to remote work.

- 97% of remote workers would like to work remotely at least some of the time for the rest of their careers (Buffer 2021)

- 92% of full-time workers expect to work from home at least 1x per week after COVID-19 guidelines are lifted and companies and workspaces are able to re-open. 80% expect to work from home at least 3x per week. (Owl Labs 2020)

- 58% of current remote workers would like this to be their primary way of working from now on. Only 10% say they want to return to their workplace exclusively. (IBM 2020)

- 1 in 2 people won’t return to jobs that don’t offer remote work after COVID-19. (Owl Labs 2020)

- 46% of workers say that if their companies no longer allowed remote work after COVID-19, they would look for another job where they could work from home. 44% say they would stay but expect a pay increase. (Owl Labs 2020)

Pre-Pandemic Video Conferencing Statistics

- Before COVID-19, the Bureau of Labor Statistics estimated that 43.6% of American workers were able to telework. But only 10.8% of all U.S. workers chose to work remotely. (Bureau of Labor Statistics 2018)

- Before the pandemic, 25% of 18 to 29-year-old respondents used video conferencing daily for work, as compared to 15% in the 45 to 60-year-old segment. (Lifesize 2019)

- Before the pandemic, 63% of workers expected video’s impact on their work would meet or exceed that of augmented reality and virtual reality. Another 51% agree video communication will be just as or more important to their work than enterprise

collaboration platforms like Slack and Microsoft Teams, and 51% foresee it being equally or more impactful than AI and machine learning. (Lifesize 2019) - 51% of workers before the pandemic thought that companies using video conferencing were more innovative. 41% believed those companies had more engaged employees and 31% perceived those companies as more successful. (Lifesize 2019)

- 55% of pre-pandemic workers agreed that companies that use video conferencing are more collaborative. (Lifesize 2019)

- Before the pandemic, 80% of business professionals used video conferencing for 1:1 meetings. 78% used it to facilitate team meetings, 77% used it for large group meetings/company town halls, and 62% used it for customer/partner meetings. (Lifesize 2019)

- Before COVID-19 hit, 51% of workers had taken video calls for work from a home office, 21% from their bedroom, and 21% while on vacation. (Lifesize 2019)

- Before the pandemic, 77% of employees used a laptop or desktop computer for video calls at work, while 31% used mobile phones for video conferencing. (Lifesize 2019)

Remote Work Productivity Statistics

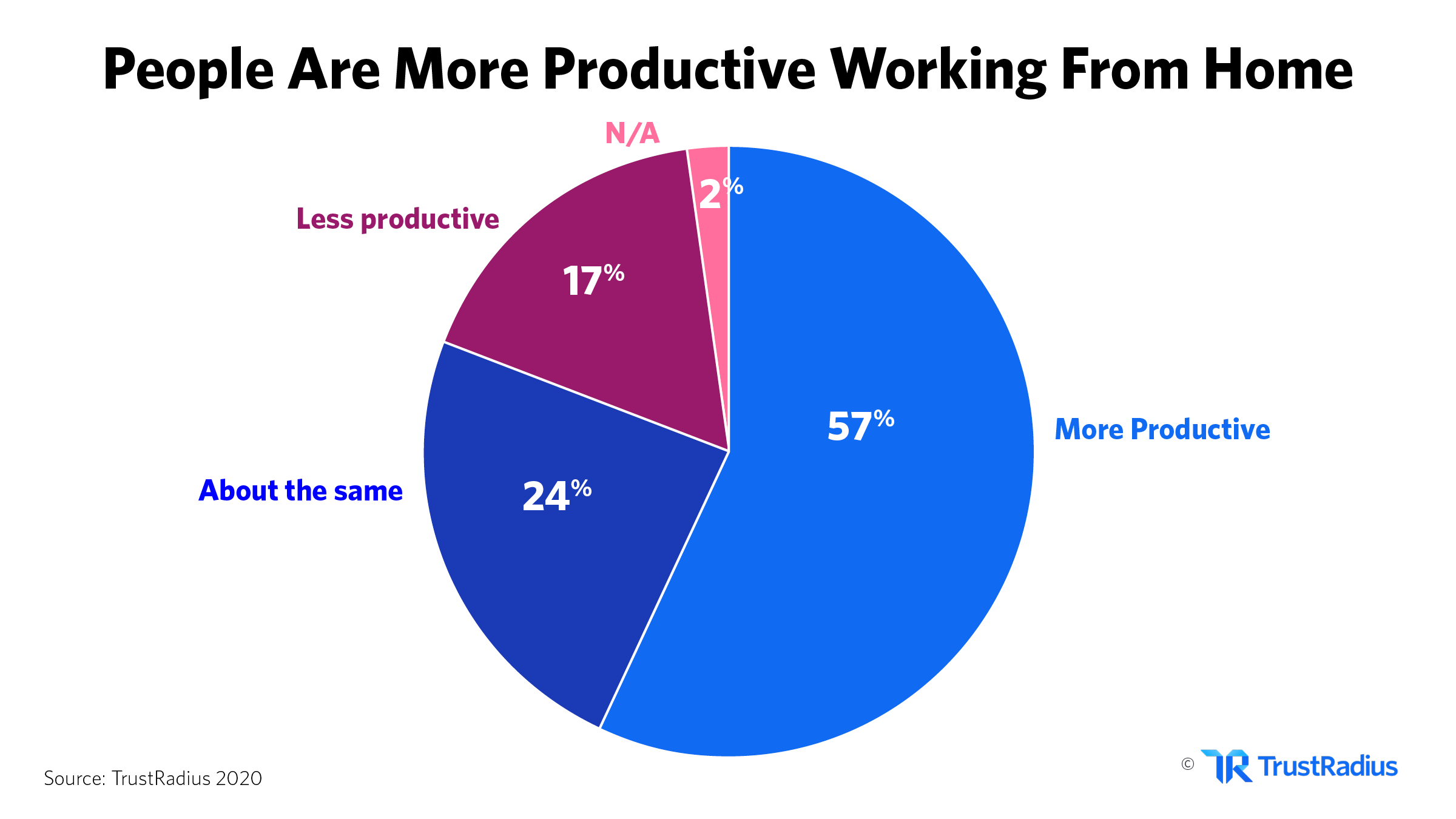

- 57% of business professionals reported they are more productive now while working remotely than they were before the pandemic. Another 24% said their productivity levels are about the same. Only 17% said they are less productive. (TrustRadius 2020)

- 45% of workers believe they are working more now that they are remote. 42% believe they are working the same amount, and 13% say they’re working less (Buffer 2021)

- 76% of startup founders reported productivity has either maintained or increased as a result of working remotely during the pandemic. (Kung Group 2020)

- Only 13% of business leaders voiced concerns over sustaining productivity while working from home. (Gartner 2020)

- 79% of workers think video conferencing is at the same level or more productive than in-person meetings. (Owl Labs 2020)

- In 2020, people are using video meetings 50% more than pre-COVID-19 (Owl Labs 2020)

- 52% of workers say they’re in more meetings now as a result of the shift to remote work (Buffer 2021)

- 80% of remote workers agree that there should be one day a week with no meetings at all. 70% agree that there should be a day each week without video meetings. (Owl Labs 2020)

- 34% of workers think video conferencing calls are more enjoyable than teleconferencing. 30% think they’re more enjoyable than in-person. (Owl Labs 2020)

The Major Benefits of Working Remotely

- Nearly 80% of remote American workers described their average stress level during the workweek as either “not stressed” or only “moderately stressed.” (Amerisleep 2020)

- 72% of all survey respondents agreed that the ability to work remotely would make them less stressed. 77% report that working remotely would make them better able to manage work-life balance. (Owl Labs 2020)

- Remote American workers are 57% more likely than average to feel satisfied with their job. (Amerisleep 2020)

- 82% of survey respondents agree that working remotely would make them feel more trusted at work. (Owl Labs 2020)

- 80% of workers say that a top factor in their desire to continue working remotely is saving time from not commuting. People report they save an average of 40 minutes a day when they work remotely. (Owl Labs 2020)

- During COVID-19, on average, people are saving almost $500 per month by working from home. (Owl Labs 2020)

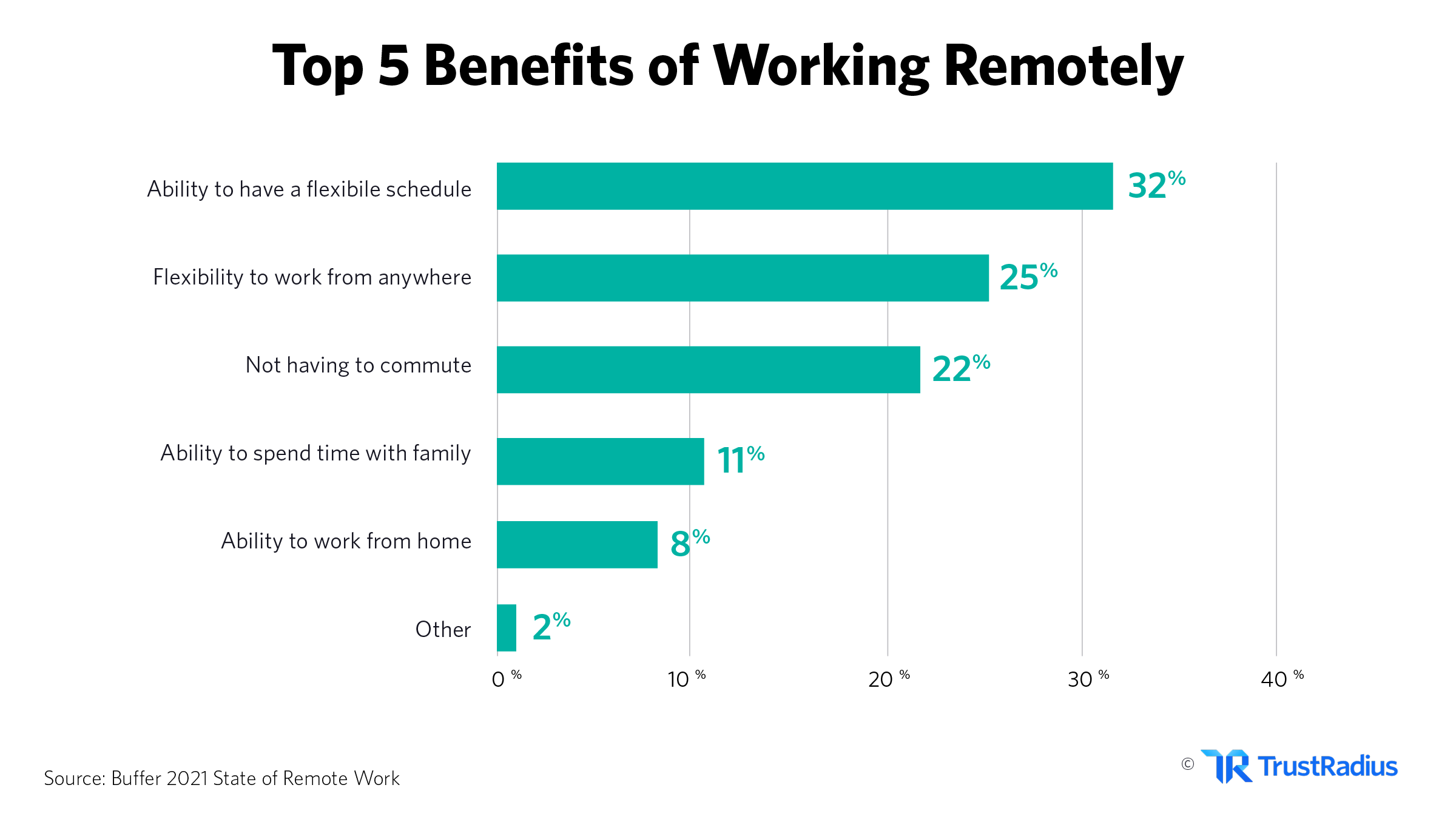

- Having a flexible schedule was the most cited benefit of working remotely in the wake of COVID-19 (36% of respondents), followed by the ability to work from any location (26%) thanks to technologies like virtual conference rooms and web conferencing software. (Buffer 2021)

- 32% of workers say that a flexible schedule is their top benefit from working remotely, followed by 25% who selected the flexibility to work from any location. (Buffer 2021)

- 44% of workers do not find it necessary to get dressed up (think: clothing, hair, makeup) for a video meeting. (Owl Labs 2020)

- During COVID-19, 67% of workers say they worked most often from their home office. 49% said they worked from their dining room, 49% from their couch, 42% from their bedroom, and 15% from their closet. (Owl Labs 2020)

The Biggest Challenges of Working Remotely

- 51% of employees expressed concern for their work-life balance while working remotely. (Kentik 2020)

- 43% of remote workers in 2020 fear that working remotely will impact their career progression. (Owl Labs 2020)

- 27% of remote workers selected not being able to unplug as their biggest struggle with remote work, followed by difficulties with collaboration (16%), and loneliness (16%). (Buffer 2021)

- 30% of business leaders are most concerned with maintaining corporate culture while working remotely. 13% reported concern over creating parity between the remote and in-office experience; 13% also are concerned about providing a seamless employee experience. (Gartner 2020)

Video Conferencing vs Business Travel

- Before the pandemic, 47% of workers had already reduced business travel due to video conferencing. 35% reduced up to half of their business travel in an average year. (Lifesize 2019)

- 43% of frequent business travelers expect to travel less even after the COVID-19 pandemic. (Oliver Wyman 2020)

- 31% of business travelers plan to reduce their business travel post-pandemic because teleconferencing and remote working arrangements were as effective as being in the office and traveling. (Oliver Wyman 2020)

- 61% of workers said they would use video conferencing more after the pandemic because it was as effective as meeting in person and saved time. (Oliver Wyman 2020)

- 43% of business travelers said they would be uncomfortable attending a conference or trade show, while they would be relatively comfortable dining out, taking a flight, and staying at a hotel. (Oliver Wyman 2020)

Video Conferencing News (Funding & Investment)

The video conferencing startup market is super exciting right now. We’re seeing a huge wave of innovation from apps that are transforming the video conferencing experience from end to end.

Here are some of our top picks:

Avail Medsystems

Avail Medsystems provides groundbreaking video conferencing software for the operating room. The company recently raised $100 million in Series B funding. They provide “the only end-to-end system that helps surgical teams in operating rooms collaborate with remote medical experts for live procedures and clinical training.” (Crunchbase)

Fuze

Up-and-comers are seeing significant investment as well. Fuze raised $13.6 million in January, as the company receives praise for its incredible focus on ease of use. The new convenience features allow users to Zoom, Microsoft Teams, and other types of meetings directly from the Fuze interface. This innovation has seen them named a leader in the 2021 Aragon Research Globe for Video Conferencing.

Evercast

Evercast is using web conferencing to build a collaboration system, with a focus on creative media-based industries. To say this model is working for them is an understatement: the company grew 10x in 2020. Evercast raised an additional $4 million to fund its hollywood-focused growth.

Other notable innovators:

- Comunix: A social gaming platform with a video twist

- LiveStorm: The end-to-end video platform that grew its revenue 8x in 2020

- Mmhmm: The app that solves screensharing a la SNL’s “Weekend Update”

- Whereby: Simple, no-download, no-registration meetings

New Video Conferencing Technology Trends 2021

With the sheer amount of investment flooding the video conferencing market this year, we’re expecting big things. Major improvements are just on the horizon.

Here are the major trends we’re following:

-

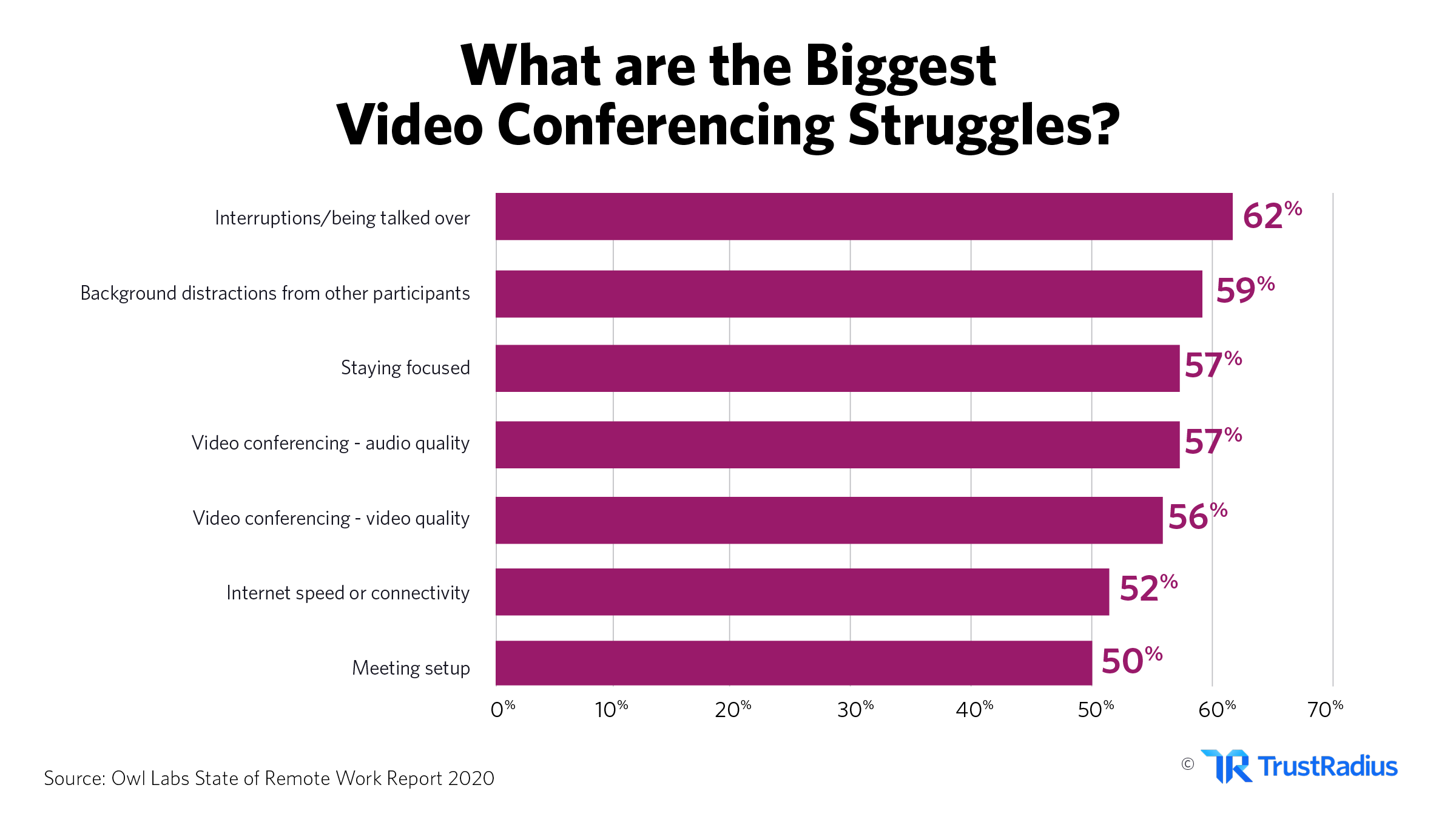

Quality improvements

We’re talking 4K video quality. AI that automatically filters out background noise. Crystal clear and immediate screensharing. We’re watching to see how video platforms step up to address these crucial pain points in 2022.

-

Productivity integrations

Within the next 6 months to a year, we expect to see major integration and feature-related news from the biggest players in the video conferencing market. Between whiteboarding, live video editing, real-time transcription, flawless filesharing, and all of the other up-and-coming features, we’re ready to be wowed.

-

Streamlined UX

We envision a world where everyone can access the mute buttons. Zoom has a pretty smooth UX— but even they fail to help users thrive across generational and technical divides. You can expect the big players to significantly streamline their UX in the immediate months to come.

-

Privacy and Security

Zoom’s security fiasco at the beginning of the pandemic taught everyone a lesson. Users are unlikely to see these improvements in their daily video conferencing experience. But you’d better believe companies are working tirelessly to shore up their data right now.

-

Mind-blowing Innovation

Everyone was shocked when Zoom released the “Studio Effects” feature in February 2021. But have you seen the features creators are using over on Tik Tok? We can expect to be completely blown away by similarly unforeseen video conferencing features in the next year. Who knows what they might be?

2021 Video Conferencing Software Price List

| Product | trScore | Starting Price | Free Trial | Free or Freemium | Premium Services | Setup Fee |

| Zoom | 8.7/10 | $14.99 | None | |||

| Microsoft Teams | 8.4/10 | $5 | None | |||

| Webex Meetings | 8.2/10 | $12 | Optional | |||

| TeamViewer | 8.3/10 | $50.90 | Optional | |||

| Google Hangouts Meet | 8.4 | $8 | None | |||

| GoToMeeting | 7.9/10 | $12 | None | |||

| BlueJeans Meeting Management Solutions |

8.5/10 | $9.99 | Optional |

New Video Conferencing Software Statistics

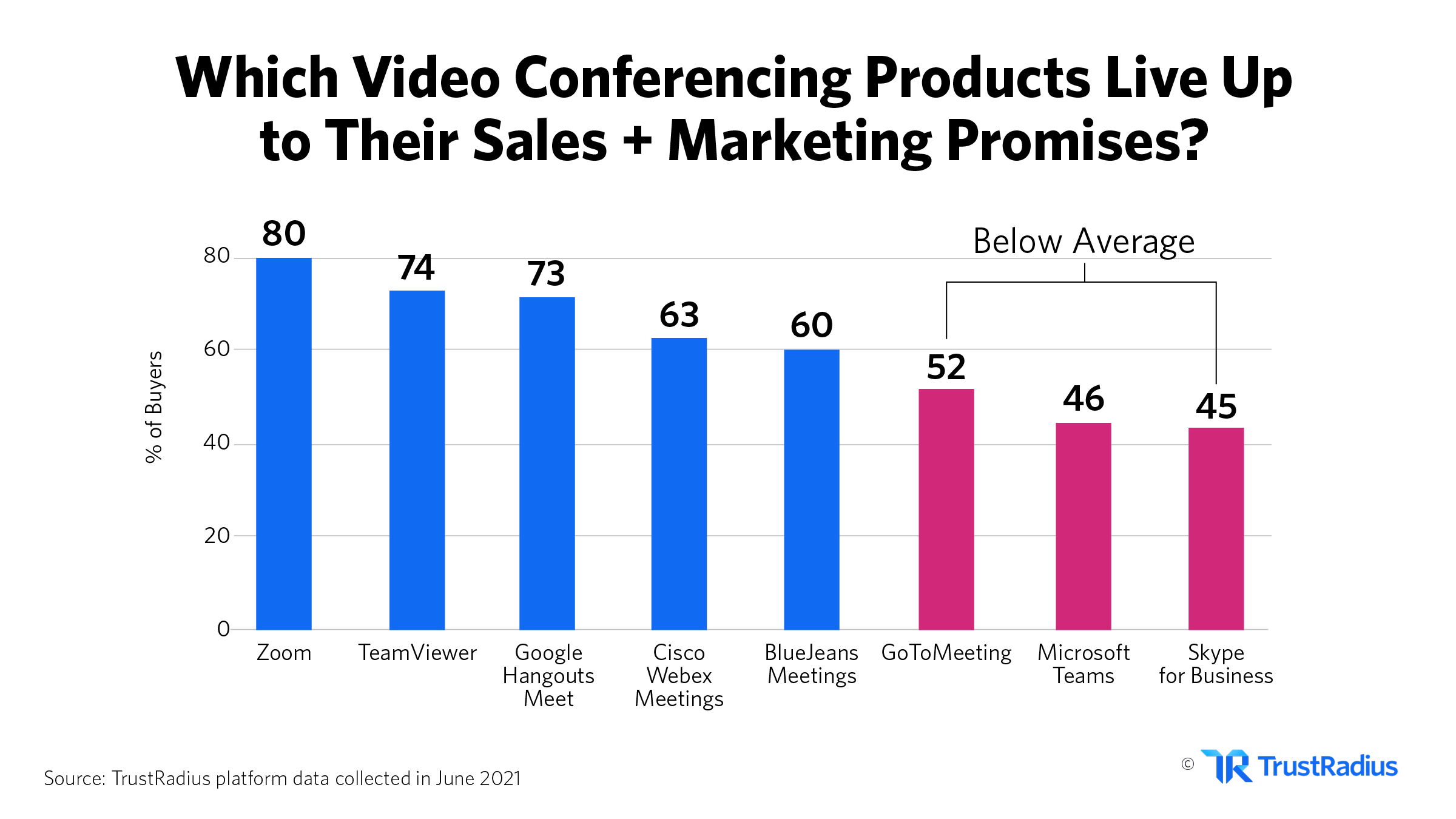

Zoom may be today’s biggest market leader. But that product doesn’t measure up to the competition in several surprising areas.

According to real buyers on TrustRadius, here’s how the leading video conferencing products stack up:

Overall Satisfaction

- Only 58% of video conferencing buyers say that their products live up to sales and marketing promises. (TrustRadius 2021)

- 80% of buyers say that Zoom lives up to its sales and marketing promises. (TrustRadius 2021)

- Only 46% of buyers say that Microsoft Teams lives up to its sales and marketing promises. (TrustRadius 2021)

Product Usability

- On average, video conferencing products have a great usability score of 8.6 out of 10. (TrustRadius 2021)

- Google Hangouts Meet has the highest usability score among leading video conferencing products (9.6 out of 10). (TrustRadius 2021)

- Microsoft Teams has the worst usability score compared to other leading video conferencing products (7.2 out of 10). (TrustRadius 2021)

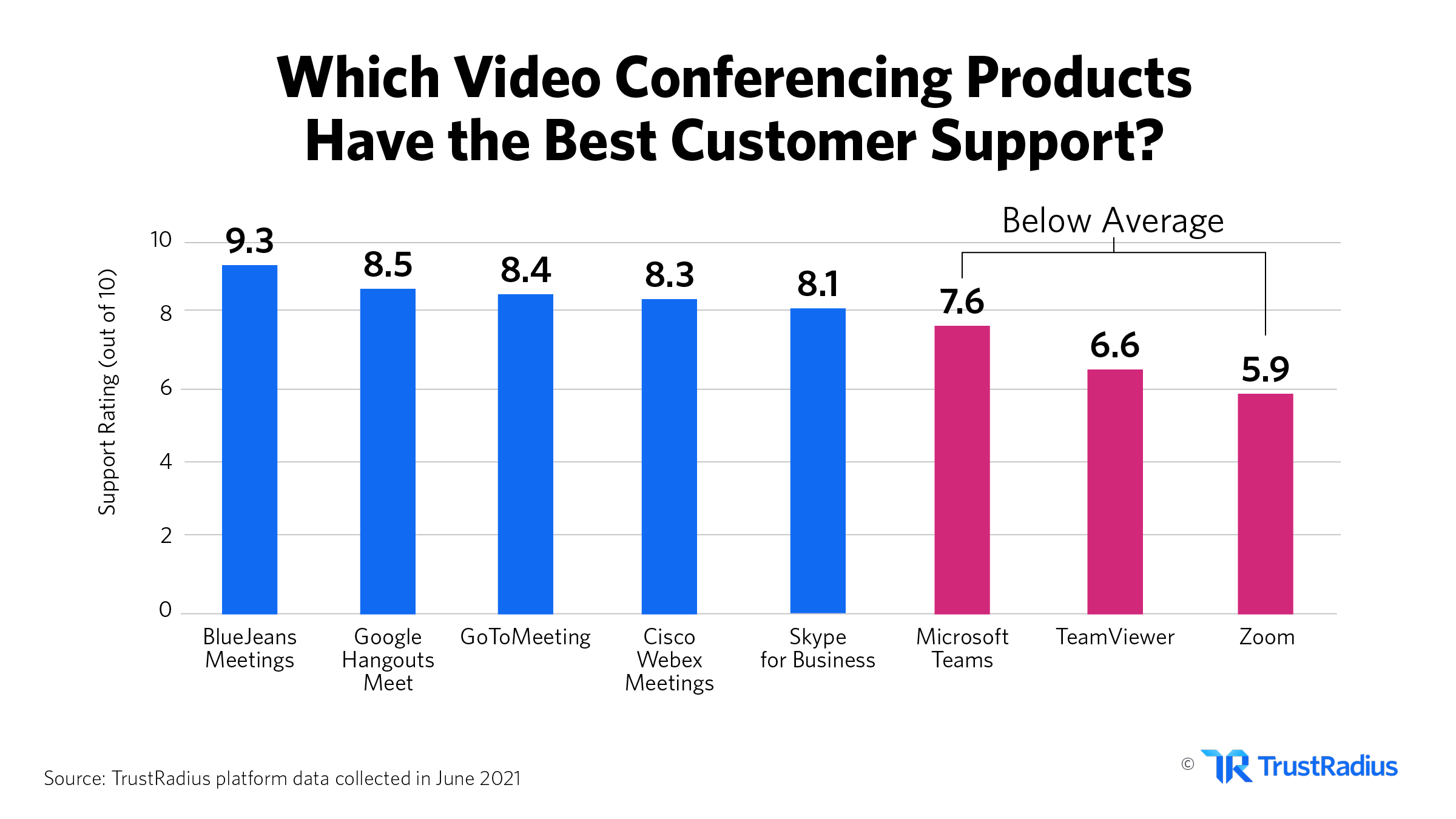

Customer Support

- On average, video conferencing products have a fairly high customer support score of 8 out of 10. (TrustRadius 2021)

- BlueJeans Meeting has the highest customer support score by far among video conferencing leaders (9.3 out of 10). (TrustRadius 2021)

- Zoom has the lowest customer support score of any leading video conferencing platform in 2021 (5.9 out of 10). (TrustRadius 2021)

Product Implementation

- 70% of video conferencing buyers say that their product implementation went as expected. (TrustRadius 2021)

- Among web conferencing market leaders, Google Hangouts Meet had the highest product implementation satisfaction score of 93%. (TrustRadius 2021)

- The lowest product implementation satisfaction score in the video conferencing market goes to BlueJeans Meetings (60%). (TrustRadius 2021)

If you’re looking for your next video conferencing solution, check out reviews on TrustRadius. You’ll see 100% authentic reviews from buyers just like you.

Sources

- Video Conferencing Market Size Worth Around $50 Bn by 2026 (Global Market Insights Inc. 2020)

- COVID-19 Software Industry Statistics (TrustRadius 2021)

- How Coronavirus Impacted B2B Software Spending (TrustRadius 2021)

- The pandemic was great for Zoom. What happens when there’s a vaccine? (Vox 2021)

- Lifesize 2019 Impact of Video Conferencing Report (Lifesize 2019)

- Video Conferencing Market Size, Share & Trends Analysis Report (Grandview Research 2021)

- 90-Day Security Plan Progress Report: April 22 (Zoom 2020)

- Zoom Daily Users Surge to 300 Million in Coronavirus Lockdown (Bloomberg 2020)

- Zoom 2021 Earnings Webinar Presentations (Zoom 2021)

- Microsoft Teams hits 75 million daily active users, up from 44 million in March (Windows Central 2020)

- How Google Meet supports two million new users each day (Google 2020)

- Zoom admits it doesn’t have 300 million users, corrects misleading claims (The Verge 2020)

- 84 Current Video Conferencing Statistics for the 2021 Market (TrustRadius 2021)

- Future Workforce Report (Upwork 2020)

- 10 Key Stats from Owl Labs State of Remote Work 2020 (Owl Labs 2020)

- How Many Jobs Can be Done at Home? (University of Chicago 2020)

- A survey of thousands of SF Bay Area techies found that 2 out of 3 would consider leaving if they couldn’t permanently work remotely (Blind 2020)

- Gartner HR Survey Shows 86% of Organizations Are Conducting Virtual Interviews to Hire Candidates During Coronavirus Pandemic (Gartner 2020)

- The 2021 State of Remote Work (Buffer 2021)

- Enterprise Strategy Group Study Finds Knowledge Workers’ Desire to Return to the Office is Directly Correlated to Personal View of COVID-19 Risk (ESG 2020)

- Gartner Survey Reveals 82% of Company Leaders Plan to Allow Employees to Work Remotely Some of the Time (Gartner 2020)

- Survey Reveals 4 Transformational Remote Work Trends (Kung Group 2020)

- State of Remote Work 2020 (Owl Labs 2020)

- COVID-19 trilemma tradeoffs: Public health, economic security and data privacy (IBM 2020)

- How The Tech Industry Has Handled COVID-19 (TrustRadius 2020)

- Remote Workers and Rest (Amerisleep 2020)

- The New Normals of Network Operations (Kentik 2020)

- Anticipating The Travel Recovery (Oliver Wyman 2020)

- Virtual Technologies Will Get a Lasting Boost From COVID-19 (Oliver Wyman 2020)

- Ability to work from home: evidence from two surveys and implications for the labor market in the COVID-19 pandemic : Monthly Labor Review: US Bureau of Labor Statistics (Bureau of Labor Statistics 2018)

Video Conferencing Data From 2020

Throughout the COVID-19 pandemic, TrustRadius has been monitoring where buyer interest rose and fell for key software categories. In early March, we weren’t certain about the impact the pandemic would have on our market, or which software industries would be the proverbial winners and losers. Based on the software industry statistics we’ve been gathering, the impact has now become clear.

The web and video conferencing software category has seen tremendous growth since the beginning of this year. Large and small companies alike have scrambled to outfit their workforce with video conferencing tools and other essential WFH tech. For one popular product, Zoom, this has resulted in an increase of daily active users by 2,900% from 10 million to 300 million in the span of 4 months.

On TrustRadius, the web and video conferencing category has seen a 500% increase in buyer activity since the beginning of the COVID-19 outbreak. According to our poll of over 2,000 business software users, 67% of companies that are increasing their spending plan to invest in web conferencing software.

However, TrustRadius and third-party data now confirm that we’ve passed the point of ‘peak interest’ for web conferencing software.

Below, we offer both a historical and real-time view of web and video conferencing software, including the most popular products and product comparisons today, crucial business insights, and the latest news.

Quick Access

Web Conferencing Software: A Year in Review

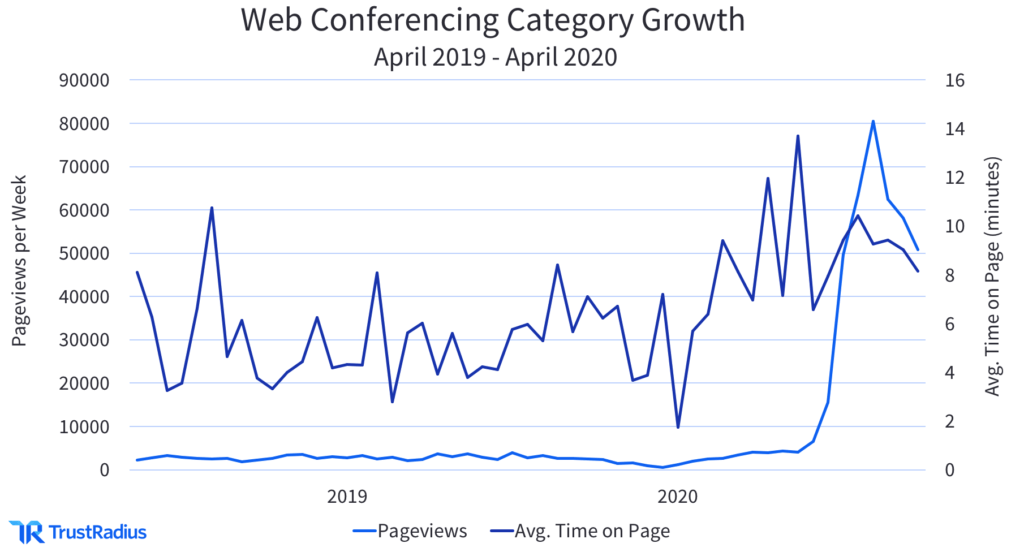

According to data from TrustRadius and Google Trends, the web and video conferencing software category has seen staggering growth in buyer interest since January 2020. On average, buyers spent anywhere from 3 to 6.5 minutes evaluating video conferencing tech prior to the COVID-19 outbreak.

The biggest change we’ve seen was a massive increase in the number of buyers evaluating video conferencing tools. Average time on page for the web conferencing category during this time also increased to a high of nearly 14 minutes, but will likely settle back down between 3-6 minutes in the following months.

Product comparisons have earned some of the highest average time on page. Between April 2019 - April 2020, these were the three most popular web conferencing comparisons made on TrustRadius platform:

- Microsoft Teams vs. Zoom (avg. time on page of 36 minutes)

- Cisco Webex Meetings vs. Zoom (avg. time on page of 26.5 minutes)

- Google Classroom vs. Zoom (avg. time on page of 9 minutes)

One key takeaway from this data is that interest in the web and video conferencing category on TrustRadius peaked at the end of March and has been falling ever since.

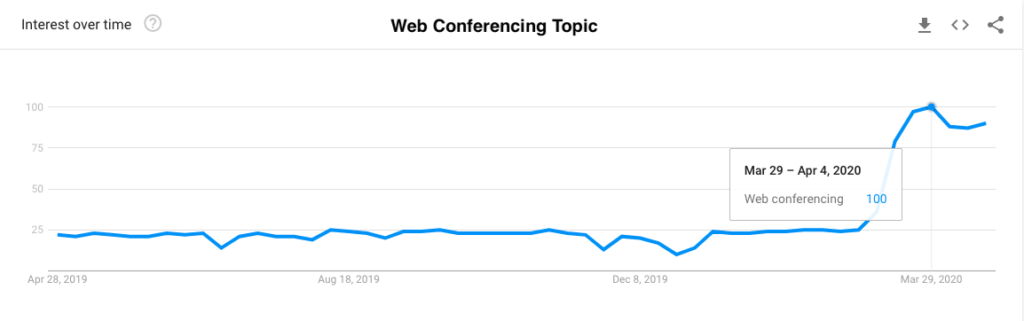

This trend is confirmed by publicly available information from Google Trends. The graph below displays interest in the ‘Web Conferencing’ topic from April 2019 - April 2020, with a visibly sharp spike in interest during the last week of March that starts declining afterwards.

The Impact of COVID-19 on Web and Video Conferencing Tech

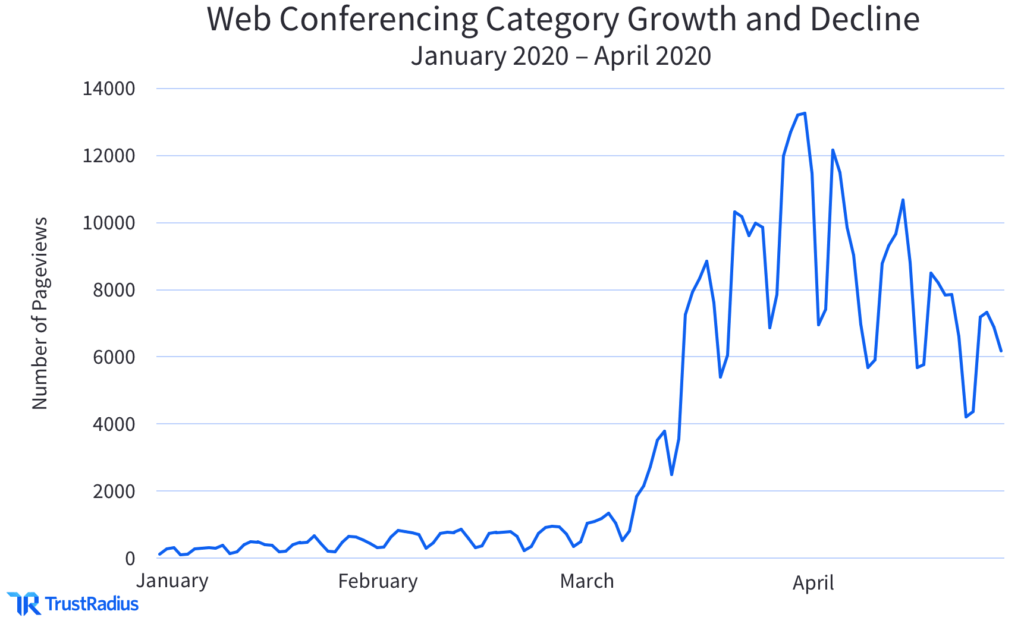

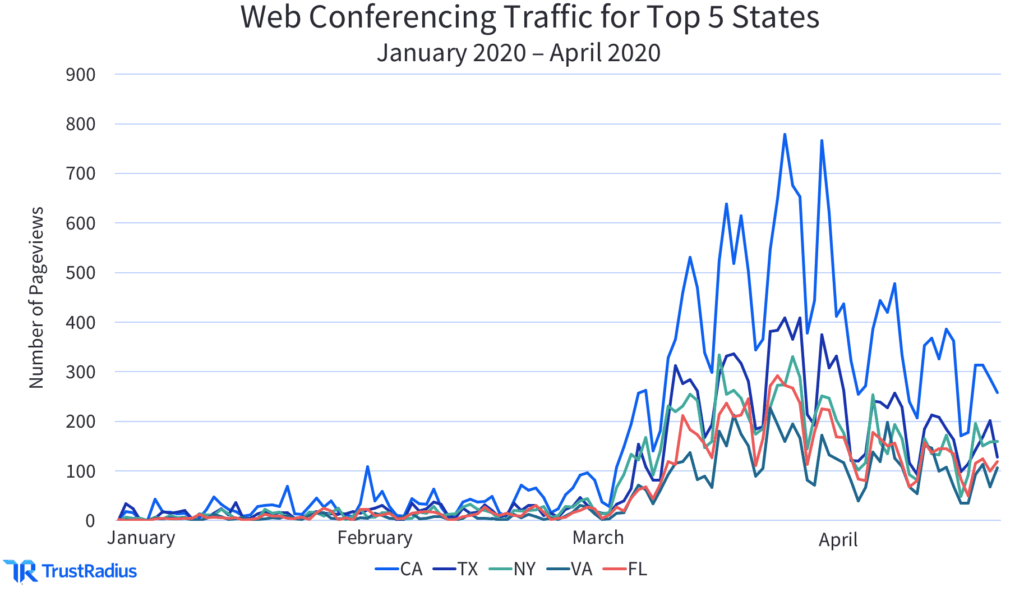

As the graphs above show, interest in video conferencing technology has exploded over the past few months. On TrustRadius, we saw this category grow by 120% from January to February and increase 1080% from February to March.

Traffic numbers for the web conferencing category are still much higher than they were before the pandemic. But interest in this type of software peaked at the beginning of April and has been declining since then.

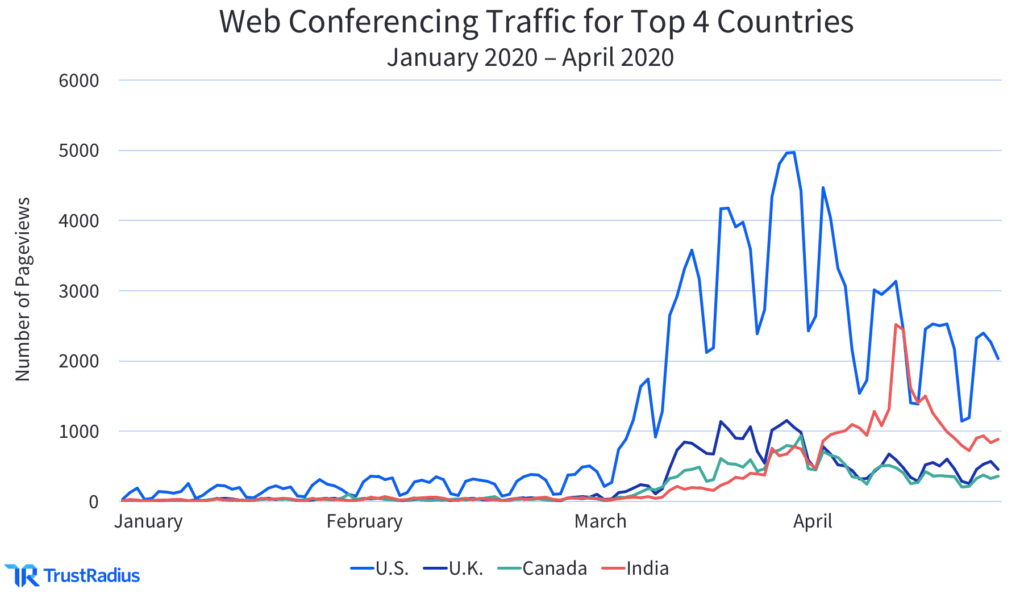

At the global level, world-wide interest in web and video conferencing software shot up drastically in March, with specific countries (like India) seeing hot spots appearing in April.

India, the red line in the chart below, hit its web conferencing software peak later than the three other countries included in the graph.

India’s national lockdown was announced at the end of March, similarly to other countries and some US states. Thus a more compelling reason for this spike in activity may be the Indian government’s push for a national competition to develop an Indian-based video conferencing solution. The competition was announced in the first half of April with the goal of creating a web conferencing tool that can compete with the likes of Zoom, Cisco Webex, and Microsoft Teams.

Overall, buyer interest in video conferencing technology around the world is declining, including in countries like India that hit their peak later.

Important note: The graph above shows significantly higher volumes in the United States, and this is merely a reflection of relative traffic to TrustRadius. While a large portion of TrustRadius traffic is made up of US-based users, this does not mean that video conferencing tech is necessarily more popular in the US than other countries around the world. Rather, this graph is a better reflection of the relative popularity of web conferencing tools over time, within specific countries.

The same pattern is clear for the US as well. For the top 5 states with the highest amount of buyer activity (CA, TX, NY, VA, and FL), there was a giant increase in the number of software buyers researching these tools through the end of March. However, the number of buyers researching web conferencing technology has been decreasing for all states since the beginning of April.

To help explain the decreasing interest, it’s useful to think about when most businesses and schools started searching for web conferencing software. While many organizations were still looking for the right video conferencing solution in March, it’s likely that most businesses and education institutions had selected a software to use by April. Companies and schools alike needed a fast solution to help them deal with the rapidly changing environment brought on by COVID-19.

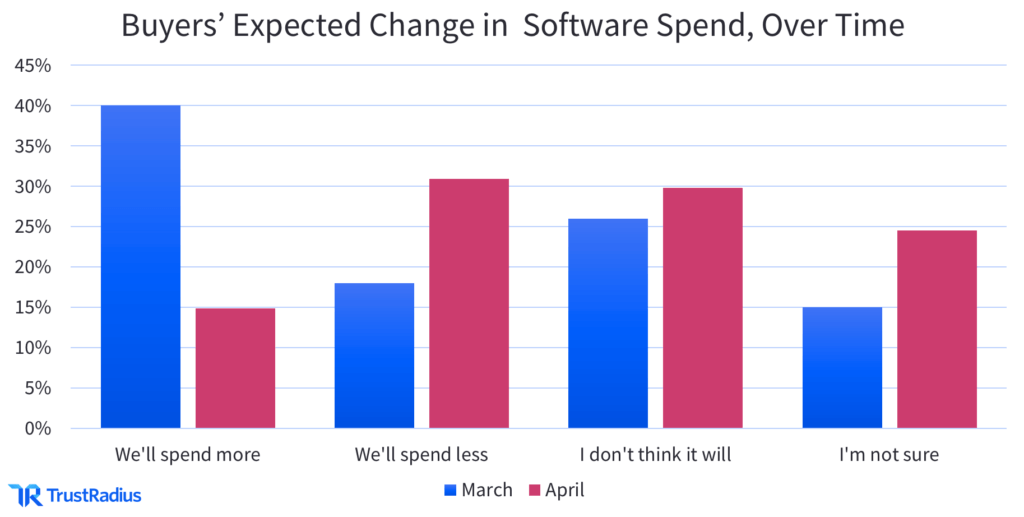

This explanation is strengthened by findings from TrustRadius research on the state of software spending during the pandemic. As of March 19th, 40% of buyers said they expect software spending to increase. However, this number dropped to 15% by the first week of April.

Data collected from 2,168 respondents from 4/9-4/10 by email survey to TrustRadius database of software buyers and users

The Most Popular Web Conferencing Tools Today

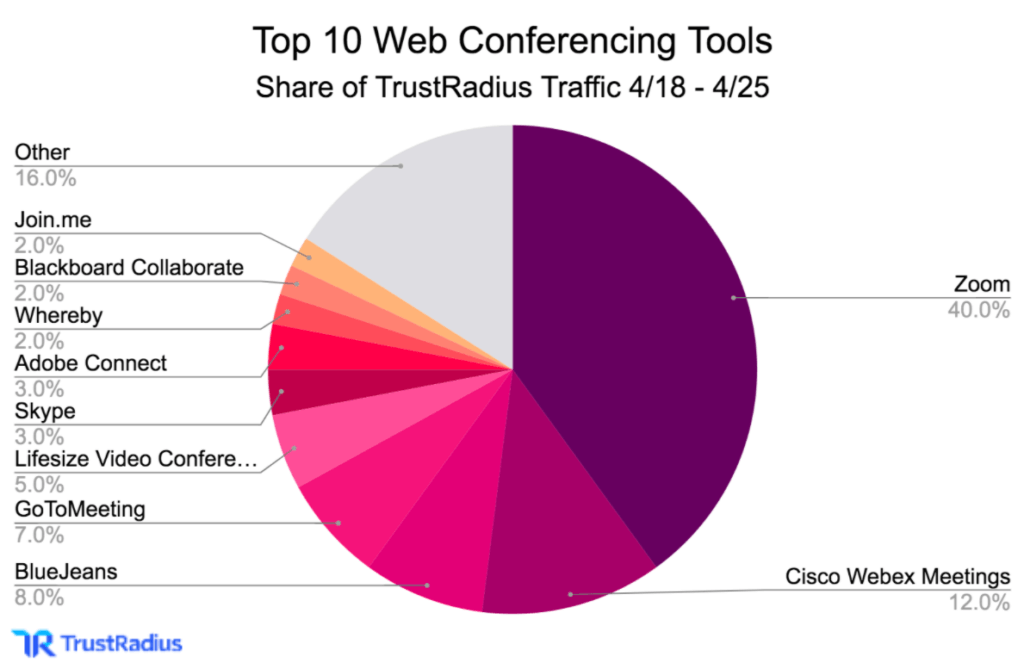

Even though momentum for the web conferencing category as a whole has slowed down, specific products are still attracting a lot of attention.

During the week of April 18th - April 25th, 10 different products received 85% of the traffic directed at all web conferencing products on TrustRadius. Zoom led the pack, earning 40% of buyer interest during this week, followed by Cisco Webex (12%) and BlueJeans (8%).

Zoom’s stock price has shot up 80% over the past year, from 79.18USD on May 3rd, 2019 to 143.44 USD on May 4th, 2020. This, along with the 28 percentage-point gap between buyers evaluating Zoom and Cisco Webex on TrustRadius, illustrates how strong a hold Zoom has on the market.

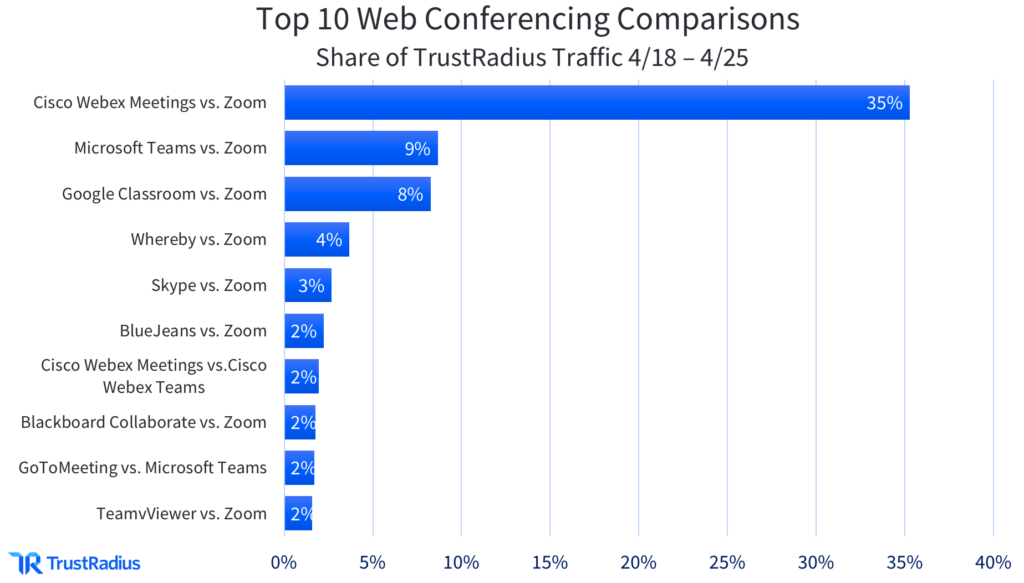

Zoom’s mindshare is even more clear when looking at the top 10 web conferencing product comparisons made on TrustRadius. 8 out of 10 comparisons are between Zoom and another product. The chart below shows the most frequently compared video conferencing products on TrustRadius, with Cisco Webex Meetings vs. Zoom receiving the highest percentage of traffic (35%).

While Zoom has a large amount of market-share right now, other video conferencing companies have made big moves in response. For example, Google is now offering their online meetings solution Google Meet for free. Cisco has added functionality to their free tier of Webex Meetings, including raising the limit to 100 participants, eliminating time limits on meetings, and allowing an unlimited number of meetings. In comparison, the free version of Zoom limits group meetings to 40 minutes.

On the one hand, both Google and Cisco are responding to the needs of the market during the COVID-19 pandemic. But these movements are also clearly meant to help them stay competitive as Zoom’s popularity and usage grows.

How Reviewers are using Web Conferencing Tools Today

Web conferencing tools are now integrated into everyday life for businesses of all sizes, schools, and higher education institutions. While there have been some hiccups along the way (‘Zoom bombing’ comes to mind), video conferencing software has had a positive impact on the daily life of many users.

Though COVID-19 has caused chaos and disruption across the world, some TrustRadius community members have posted reviews describing how web conferencing technology has helped them navigate their new environment. Their testimonials speak to the power these tools have to unite workforces, classrooms, and teams of all sizes during a time of crisis.

[Review text bolded for emphasis]

For this reviewer, Zoom has allowed their college to continue providing quality education to students during the COVID-19 pandemic:

“Zoom was previously used within our IT department on a small scale, however, now during this emergency situation of the coronavirus, now our institution policy is shifted to distance learning. Our students are now attending classes remotely from home and Zoom is widely used to deliver the best education for them.”

—John W. | IT administrator | Information Technology & Services | 51-200 employees

BlueJeans was the platform of choice for another user, who notes that it has become even more essential for their company during these times:

“BlueJeans has been used by our organisation for the past few years and we've found it to be a fully stable environment to hold multi-user conferences. It has become even more vital in the time of COVID and we continue to rely on it as our preferred platform.”

—Verified User | Director in Product Management | Information Technology & Services | 11-50 employees

While the following reviewer has been using Cisco Webex Meetings for two years now, usage has increased dramatically within their company over the past few weeks:

“Two year ago, we started work with Webex, but users couldn't use this tool because my users did not have the culture of using video conferencing. With the events of Covid-19, users realized that it is a platform that they can discuss quickly and easily and started using Webex. Currently, Webex is used on average between 18-22 hours a day and is gradually increasing. Users have now started to use different features such as recording and webinar.”

—Verified User | Manager in Information Technology | Construction Company | 5001-10,000 employees

For this user, Microsoft Teams has become the primary collaboration tool at their company:

“Microsoft Teams is the main collaboration tool across our entire organization. A lot of users had received a crash course in its use because of working from home due to the COVID-19 quarantines but many have stated that they are very pleased with the ease of use and ability to connect with remote co-workers. We have even used it to set up a "water cooler" team just to be able to chit chat with other office workers.”

—Michael E. | Network Systems Analyst | Wholesale | 1001-5000 employees

Web and Video Conferencing in the News

As we continue to watch the web and video conferencing market grow, some products will undoubtedly continue to gain more market share. Here are seven market developments to keep an eye on:

- Techcrunch reports that Google Meet, the video conferencing solution from Google, is now free for all.

- According to The Wall Street Journal, Zoom has chosen Oracle to expand their cloud platform, in part due to the security and scalability Oracle can provide.

- From CNBC—after experiencing incredible growth and then a host of security issues, Zoom is pausing work on new and existing features in favor of making security improvements.

- Business Insider reports that Verizon has acquired BlueJeans to help expand their offerings for enterprise businesses.

- A recent report from Forbes states that Microsoft Teams, one of Zoom’s largest competitors, has also been experiencing password-related security issues.

- TechRepublic confirms that Large Companies and Organizations have begun banning the use of Zoom - including Google, NASA, US Senate, Australian Defense Forces, SpaceX, the government of Taiwan, etc.

- According to Business Insider, after months of increased growth, the next mountain video conferencing companies will need to climb is finding a way to convert new free users into subscribers.

The Future of Web Conferencing Software

Over the next few months, we estimate that the market will experience a proliferation of smaller video conferencing tools. Data from the TrustRadius platform shows that interest in smaller players like Intermedia AnyMeeting, Click Meeting, and ConnectWise Control grew over 400% as a response to the pandemic. This shows that web conferencing is a category ripe for expansion, and smaller players like Namaste, Facebook Rooms, and Houseparty are already rushing in to grab their share.

Alternatively, the market could see consolidation around key vendors in the industry. With established companies like Verizon acquiring smaller solutions like BlueJeans, other companies like Google, Cisco, Microsoft, and Zoom may decide to follow suit. This would allow them to expand and enhance their current video conferencing offering, as well as increase their user-base.

Looking forward, it’s not clear whether the increased usage and adoption of web conferencing tools will be the death knell for the business travel industry, even after the pandemic is resolved and travel is an option. Will businesses decide to save on costly business travel and host or attend ‘virtual conferences’ instead? How will hotels, airline companies, conference venues, and business travel technology be impacted in the long-run?

Some predict that business travel will never be the same again. There are also those who believe the business travel industry will bounce back, rather than be forever diminished by the sudden popularity of video conferencing technology.

TrustRadius will continue to watch the web conferencing software industry, including surging products, spending trends, and key industry developments over the next few months. We’re already following the release of RingCentral’s video conferencing solution in early April and Verizon’s acquisition of BlueJeans, and will continue to publish insights as they develop.