Best Invoicing Software for Small Businesses

Many invoicing software are built with larger organizations and financial professionals in mind with features that a small business doesn’t need to use or pay for. Small business owners should consider price, ease of use, integration with other software, and specialized features that would be beneficial to their specific use case. Invoicing is a service that is often included in general accounting software.

If you’re looking for general accounting options, consider reading our blog post on the best free accounting software for small businesses.

If you’re totally new to the process of invoicing and billing, check out this helpful guide that covers the basics.

Overview of Small Business Invoicing

Of the numerous options available for small business invoicing, this blog will discuss the top five options both paid and free. If you are looking for a totally free option consider reading our blog post on the best free invoicing options available.

| Software Name | trScore | Price | Free Trial | Unique Features |

| QuickBooks Online | 8.2/10 | Variable Based on Number of Users, Starting at $25/Month | Yes | Email or Chat With Customer Support, Accounting Tools |

| Zoho Invoice | 9.8/10 | Free | N/A | Multi-Currency Invoicing, Invoice Templates |

| FreshBooks | 8.2/10 | Variable Based on Number of Clients, Starting at $15/Month | Yes | Integration with Gusto, Live Customer Support, |

| Stripe | 8.8/10 | 25 Free Invoices/Month, Then 0.4% of the Invoice Amount | No | Payment Dispute Support, 24/7 Customer Service |

| Xero | 8.6/10 | Variable, Starting at $11/Month | Yes | Bulk Invoicing, Attach Files to Invoices, 24/7 Customer Service |

| Square Invoicing | 9.3/10 | Free, with processing fees | N/a | Extremely Simple, Good integrations |

| PayPal | Varied | Free, with Standard Paypal processing fee | N/a | Fantastic name recognition, unrivaled international feasibility |

Quickbooks Online – Invoicing as Part of a Comprehensive Accounting Suite

QuickBooks Online offers a full suite of accounting services, including invoicing. Other services include bookkeeping, inventory management, expense tracking, time tracking, and payroll. As one of the first accounting software to hit the market, most people in the accounting world are familiar with it. QuickBooks will make it easy for you to share information with an outside accountant if the need arises.

Pricing

QuickBooks offers a free invoice generator for small businesses on their website. To access any other feature, such as online payments for customers, a paid subscription is required.

As there are many QuickBooks products on the market, each with their unique features and pricing, consider reading our in depth breakdown of pricing of QuickBooks products.

QuickBooks Online is the most affordable option, with features well suited to small businesses. The Simple Start package costs $25/month and is limited to one user.

The Essentials package costs $50/month and includes up to three users. The Plus package, which is the most popular package, is $80/month and includes up to five users. The Advanced package is $180/month and includes up to 25 users. A discounted Self-Employed package aimed at freelancers is available. It includes limited features for one user at the price of $15/month.

All packages are eligible for a 30-day free trial. Payroll is available at an additional cost for all packages except the Self-Employed package.

This may not be a feasible expense for most small businesses if they are seeking a solution solely for invoicing. The cost may be worth it if they are able to streamline their accounting and invoicing software.

Unique Features

QuickBooks’ mobile app, compatible with iOS and Android, offers mobile invoicing and a mobile card reader. With these features, invoices can be generated and payments collected on-site.

Ease of Use

QuickBooks requires a significant time investment to learn that is likely not worth it to generate invoices for most small businesses. Since the product offers a full suite of accounting software, it may be a worthwhile investment to learn. QuickBooks provides a streamlined process with all accounting functions housed in one program.

Integration with Other Products

As a well-established software favored by small businesses, QuickBooks plays well with others. It integrates with third-party applications, including credit card processors and payroll software.

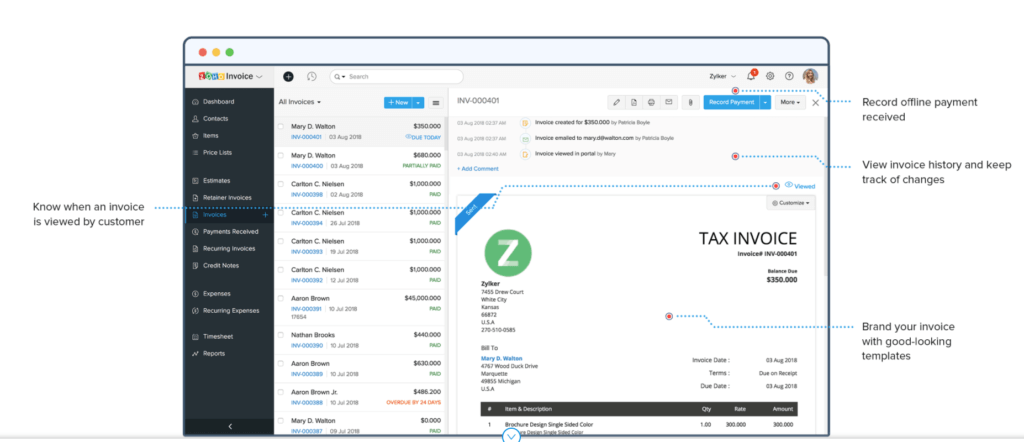

Zoho Invoice – A Free Option with Limited Features

Zoho Invoice is the only free invoicing software on this list (woohoo!) and offers customizable templates and automated recurring billing. Its easy-to-use dashboard simplifies the task of tracking invoices. As the only free plan on this list, it has a major advantage in the budget category but is limited in other features. Zoho does not offer any premium plans. As an option that includes multilingual and multi-currency invoicing for free, Zoho is a good choice for small businesses or freelancers handling international transactions.

Pricing

Zoho Invoice is free to use regardless of the number of clients billed or users added and offers unlimited invoices.

Unique Features

Zoho Invoice stands out most in that it is 100% free. Other notable features include multilingual and multi currency invoicing. Zoho offers an invoice tracking system that allows business owners to know when their customers open the invoice. Zoho has a gallery of customizable templates that are well suited for the small business owner who doesn’t need a fully customizable invoice and doesn’t want to spend the time designing an invoice from scratch.

Ease of Use

Zoho prides itself on its simple interface both on its web and mobile applications, compatible with iOS and Android. Its invoice templates are ideal for someone who doesn’t want to spend time creating their own. The templates are not completely customizable and present a challenge for those with complex needs.

Zoho’s dashboard makes invoice creation and tracking simple. Its integration with most credit card processors makes payments simple for business owners and customers.

Integration with Other Products

Integration is where Zoho Invoice falls short of the other products on this list. It integrates well with most credit card processors and Google Workspace. It lacks integration with any accounting software or CRM beyond other Zoho products. If your business already uses Zoho for its accounting or CRM software, this won’t be a problem for you. For others, this lack of integration could be a real pain. If you’re interested in setting up a CRM for your business, see our guide on the best free options.

For those with several employees or contractors, its lack of integration with payroll software is challenging. Zoho Invoicing may be best suited for freelancers or self-employed individuals.

Freshbooks – A QuickBooks Alternative With a Smaller Learning Curve

Freshbooks offers options for invoicing, expense tracking, time tracking, and estimates, among other services. Their invoicing allows small businesses to automate billing, collections, payment reminders and receipts. With an intuitive mobile platform, Freshbooks allows for invoicing on a mobile device as well as in the office.

Freshbooks is a great choice for freelancers. It has built-in tracking for mileage, expenses, etc. that keep data organized for tax time. Each additional user is an added monthly fee (see pricing for more details), making Freshbooks well suited for freelancers or smaller businesses.

Pricing

Freshbooks only offers paid plans and does not have a free account. Pricing with Freshbooks is variable based on four pricing tiers. All pricing tiers offer a 10% discount for annual payments but can be billed monthly. Additional users are $10/month/user at all tiers.

The Lite Tier offers billing for up to 5 clients and costs $180 if billed annually. The Plus Tier offers billing for up to 50 clients, costs $300 if billed annually, and is the most popular plan offered by Freshbooks. The Premium Tier offers billing for unlimited clients and costs $600 if billed annually. Businesses must reach out to Freshbooks for pricing for the Select Tier, which is their most customizable option. Free trials are available for the Lite, Plus, and Premium tiers and a free demo is available for businesses interested in the Select Tier.

Unique Features

Freshbooks offers significant automation of invoicing. Applicable sales tax is calculated and recurring invoices are sent automatically. Freshbooks stands apart in its customer service which has reps (not robots) available from 8 am to 8 pm Eastern via phone and email. They also offer a weekly webinar with product demos and a Q&A for potential customers or current customers with questions.

Unlike other options on this list, there is no free option for Freshbooks. The native integrations with countless other products and live customer support may make the price worth it. There is a free trial available so that small business owners can see if the product is a good fit for their needs.

Ease of Use

Freshbooks advertises itself as being intuitive and easy to use, and it actually is. Custom invoices can be created and sent quickly through their web or mobile applications, compatible with iOS and Android. This software is also easy to use for the customer receiving the invoice. It offers payment through credit card, debit card or ACH directly on the invoice.

As a product that is quicker to learn and cheaper to learn than QuickBooks, Freshbooks is a good option for small businesses searching for an option that allows them to do invoicing and other accounting tasks in one place.

Integration with Other Products

Freshbooks offers integration with countless other products including Gusto, Google Workspace, Microsoft Products like Outlook, and Hubspot. Integration with Google and Outlook allows for invoices to be emailed easily.

Other key integrations include integrations with several tax, timekeeping, and payment processing software.

Freshbooks does not offer integration with QuickBooks or other Intuit products.

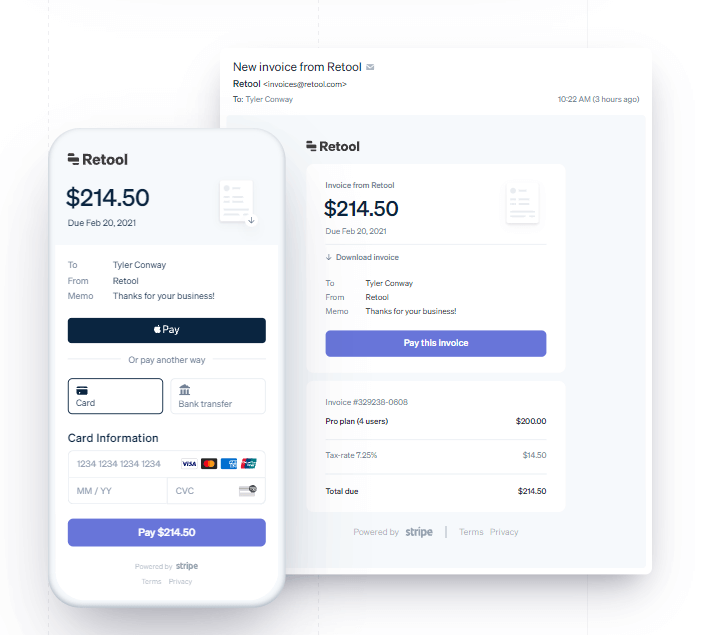

Stripe – Ideal for Card-Only Businesses

Stripe is an online payment processor ideal for e-commerce or cash-free businesses. Since it is primarily a credit card processor, Stripe is not a viable option for businesses that accept payments through cash or check.

Pricing

The first 25 invoices are free each month. Beyond the first 25, there is a fee of 0.4% of the amount of the invoice. Volume discounts are available for businesses and the fee on each invoice is not collected until the customer pays the invoice. Businesses can sign up for a free account but will pay a fee on each transaction of 2.9% plus $0.30.

Unique Features

Stripe differs from the other products listed in that it does not offer the bells and whistles of an accounting system. While it integrates well with popular accounting software, it is built for payment processing. It is a useful solution for individuals who don’t want to do their invoicing through their accounting software. Payment is accepted on a recurring basis or in person at the POS, so Stripe is convenient for retailers and e-commerce businesses.

Stripe is set apart from the other products on this list by its payment structure. Rather than a flat fee, Stripe charges based on the amount of the invoice. If you’re a business sending 25 or fewer invoices a month (which Stripe will do for free), this may be a great option for you. If you’re sending over 25 invoices a month, the 0.4% fee may end up exceeding the price of the other options on this list.

Ease of Use

Stripe’s dashboard allows users to create and send custom invoices. Invoices are customizable by line item and allow for discounts or sales taxes to be included. Invoices can be paid immediately through Stripe. Stripe also makes it easy to set up monthly or recurring subscription-based payments and send payment reminders. It automatically sends reminders to customers with past-due balances.

Integration with Other Products

Stripe integrates well with many tax and accounting software including QuickBooks, Freshbooks. Further, many e-commerce websites offer integration with Stripe. Stripe is useful for payments both at the POS and when invoicing for recurring payments or past due balances.

Xero – A Budget Friendly Full Accounting Suite

Xero offers a suite of accounting tools beyond invoicing. While it is not a free option, it could be a one-stop shop for accounting that makes the investment worthwhile to someone without the time to invest into learning QuickBooks.

Pricing

Price varies based on tier, with the Early tier starting at $11/month. The most popular tier is the Growing tier, at $32/month. The Established tier costs $62/month.

All tiers offer a 30-day free trial and one month’s notice is required to cancel any paid subscription. There are unlimited users available at all tiers. The Early tier is limited to 20 invoices per month, and there are no limits on invoices in the Growing or Established tier.

To collect payment in multiple currencies, businesses must purchase the Established tier. Integration with Gusto payroll software is available at $39/month for all tiers.

Unique Features

Xero offers bulk invoicing and tracks whether the invoice has been read by the customer. Additionally, there is no fee for adding users. Xero allows businesses to generate invoices using quotes or estimates so that they don’t have to enter information a second time.

Ease of Use

Xero’s interface allows for the easy generation of invoices on its web or mobile applications compatible with both iOS and Android. Businesses can create and save multiple templates for invoices, allowing for customization. Automatic reminders are easy to set up and customers can pay online straight from the invoice.

For a quick look at Xero’s intuitive interface, see this short video below.

Integration with Other Products

Xero integrates with over 800 different applications. Integrations include payroll software and credit card processors.

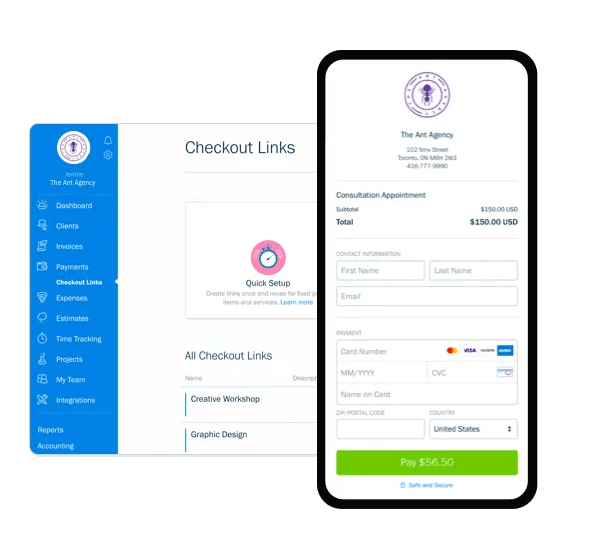

Square Invoicing – “Free” Unlimited Invoices with Great Integrations

Anyone familiar with Square products is aware of their dedication to user-friendly payment systems for a variety of business needs. For small businesses, Square Invoicing offers “free”, unlimited professional invoicing in a remarkably simple billing software

Pricing

Once again, those familiar the Square business model will already be aware of the caveat to the “Free” label on the entry-level of this service. You will incur a 2.7% + 30-cent charge for every invoice charged online. This rate becomes 2.6% + 30 cents for swiped payments and 3.5% + 15 cents for card on file payments. From here, you can choose to go for a paid tier for some more premium invoicing features. This will have the same instance charges, but with an additional $20/Month fee.

It is notable that there are ZERO charges for transactions paid in cash or via check. For this reason, service industries that are paid in this way can save money on the usual fees.

Unique Features

In truth, very little of what Square does is entirely unique. Where this invoicing tool shines is the polish and convenience its payment options and invoicing tools offer to entrepreneurs and small businesses alike. They offer all the basic goodies, like recurring invoices, payment reminders, and real-time tracking for collection. These payments can also be managed with SMS or email links. Estimates and contracts are also easily handled in the service.

Ease Of Use

As mentioned, ease of use is where Square Invoicing shines the most. While limited in its customizability, the home page is extremely friendly and easy to navigate. Customers and business users alike will need little guidance in getting the most out of Square. This invoicing option is less suited to those looking for more advanced add-ons, invoicing automation, or other features often needed for larger organizations. Overall, this is a tool made for small businesses.

PayPal – Extreme Simplicity in a Trusted Package

PayPal is similar to Square Invoicing in its use-case situation. The service is great for those with limited cash flow, who have no need for project management or other tools. This service is simply a payment gateway for those looking to get paid for billable hours, products, or other small business offerings

Pricing

PayPal, at its base, does not have subscription costs. They do charge services fees, which vary depending on the amount received and transaction type. For a full breakdown of their charges, click here. Overall, fees are usually around 3.49% + their standard fixed fee, which varies based on currency. There is an additional 1.5% fee for international commercial transactions. This is slightly more expensive than others on this list. One major reason for this is the acceptance of transactions from bank accounts from nearly anywhere on earth that other providers simply can’t match

Unique Features

PayPal’s uniqueness comes in its brand name and widespread use. The service is extremely well trusted all over the world. This, combined with their unrivaled payment infrastructure makes their invoices a truly international option, even for small businesses. Once you grow it may be worth looking into their more business-focused services, such as PayPal Payments Pro, but these will be unneeded for most smaller organizations.

Ease of Use

Once again, it’s PayPal. It does not get much simpler than this. Accepting card payments, bank transfers, and most other forms, this is a hassle-free invoicing option for any number of industries.

Additional Invoicing Options

Each invoicing software discussed has its own unique features that make it well suited for a small business owner, but none are a one-size-fits-all solution for every small business. When considering which invoicing product is best for your needs, search for the specific features you know your business requires. If those features weren’t mentioned here, you can review more invoicing options and read reviews from verified users on our website.

Was this helpful?

Want to learn more about invoicing options, and see the products available to you? Check out our category page.