IT Buyers Trust Hands-On Experience Above All Else

IT professionals want hands-on experience before they buy new products, but look to both vendors and peers for insights to guide evaluations.

As an IT professional, you likely evaluate new software tools through a different lens than other leaders in your company. Of course, in any new system, individuals across all roles care about how well it can meet your company’s needs now, and in the future, and how quickly you’ll be able to see results.

But because you intimately understand the complexities of technology, and because you will probably be more hands-on during implementation, integration, and troubleshooting, you take product evaluations further than the average stakeholder. You’re invested in understanding the nitty gritty of the product’s capabilities up front. And, you know how to push the system to discover limitations or breaking points to get the full picture of what a solution can and can’t do.

You certainly aren’t going to take someone else’s word for it, and rely on that alone. You know your own technology environment best. But you probably do want some input on what to watch out for. You need an insider perspective on the product’s strengths and weaknesses, so that you can test them yourself.

You also want the most up to date technical specs, and straightforward answers to your questions about security, performance, integrations, etc. You see right through marketing fluff, staged demos, and other forms of obfuscation, but you appreciate information right from the source as long as the vendor is a straight shooter.

Read on to learn about how other IT professionals like you use vendors, hands-on experience, and peer reviews to navigate their technology purchase decisions based on a new study about the experience of buying and selling business technology.

The B2B Buying Disconnect

In this recent post, we analyzed the data collected in our 2018 B2B Buying Disconnect Report, focusing on the divide between how vendors sell their solutions and what their potential buyers expect and need. The main theme that surfaced across all buyers in the study was that people buying technology crave more transparency from vendors to win their business.

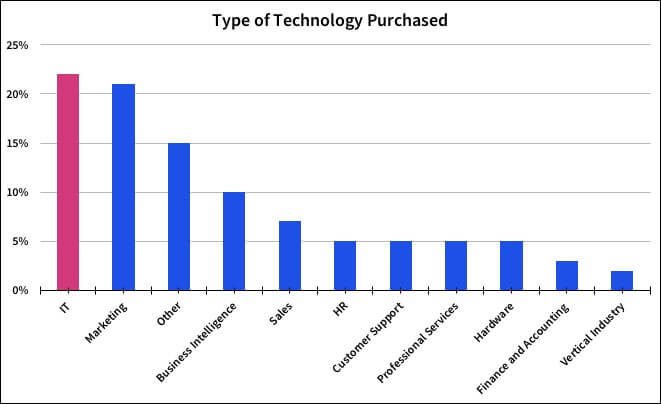

The full report contains the feedback of 438 buyers and 200 vendors, but we thought you might be interested in a deeper analysis of the 22% of buyers who bought IT software — including network virtualization platforms, SIEM software, hyper-converged infrastructure systems, software-defined WAN solutions, SQL server performance monitoring, etc.

How do IT buyers approach the purchase process?

Adaptability, ROI, and scalability are their top priorities.

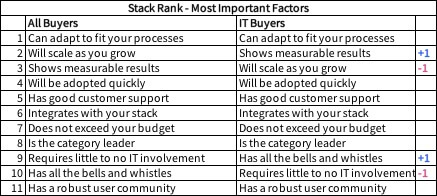

We asked buyers who took the survey to choose the three most important factors they consider when selecting a product. The top three priorities for IT buyers were that a product can adapt to fit their processes, that it shows measurable results, and that it will scale as they grow.

This was pretty similar to the results for all buyers in the study. The ability to measure ROI was slightly more important than scalability for IT buyers, but it was nearly a tie. The two ranked very close: 37% of IT buyers identified a product’s ability to show measurable results as one of the most important factors, and 36% of IT buyers selected a product’s ability to scale with growth.

IT buyers also place slightly more weight on breadth of feature set than other buyers, as they are perhaps more knowledgeable about what is technically possible and more invested in optimizing their technical environment.

Along the same lines, though there wasn’t a difference in ranking, a slightly greater percentage of IT buyers said they prioritize finding a product that is the category leader. This is likely because vendors leading the IT software category are typically the most innovative and quicker to market with new features.

Understandably, IT buyers were less concerned about limiting IT involvement with the product–since they’ll be the primary users of any tools relating to their organization’s network, data storage, security, etc.

This is a bigger concern for buyers of other types of business applications, where some IT administration or help with implementing the product may be required, but the IT department is not the primary user nor the primary beneficiary.

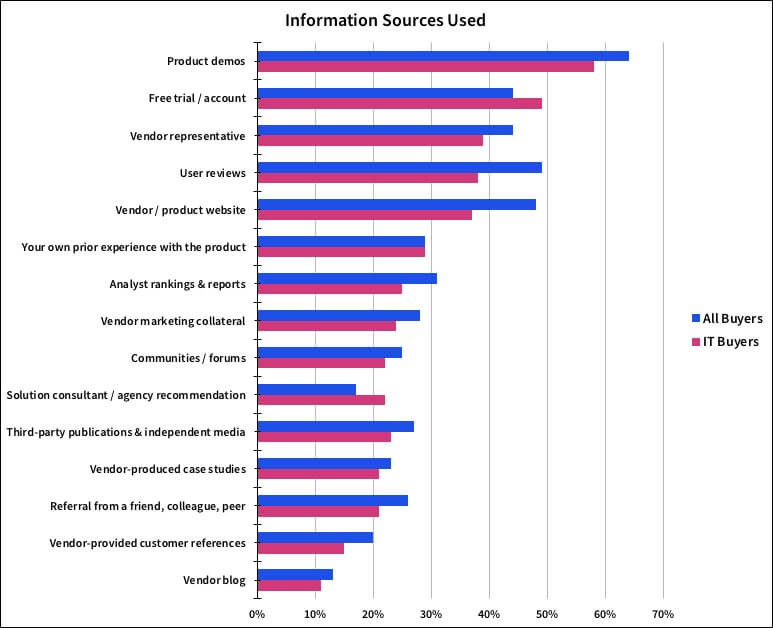

On average, IT buyers use 4 sources of information.

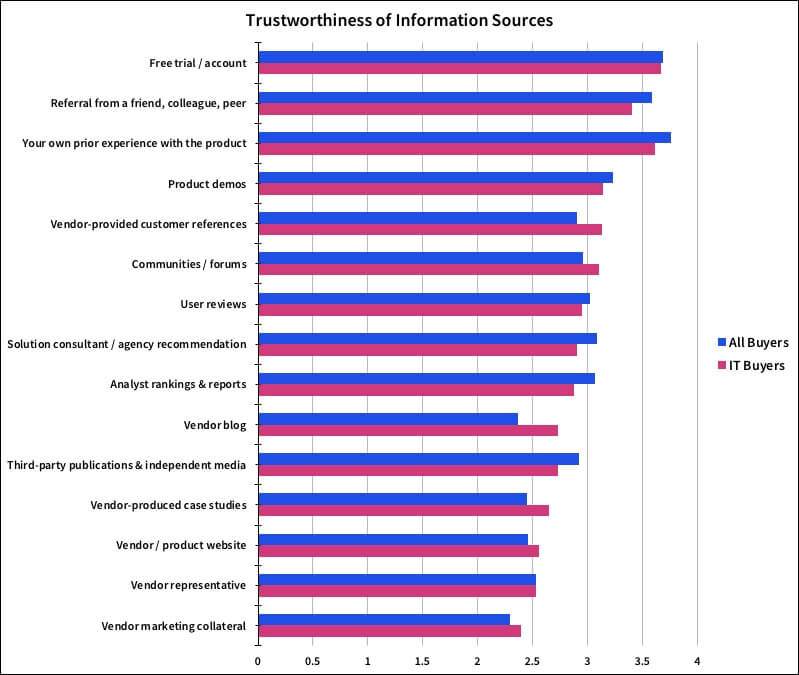

This is lower than for all buyers, who consult 5 sources of information on average. IT buyers have a clear preference for hands-on product experience above all else. They were more likely than the average buyer to use a free trial or account to test the product before buying, and were more skeptical than the average buyer of other forms of information.

In their qualitative responses to the study, IT buyers articulated how important hands-on experience is to their decision-making process. Here’s what they had to say about running a proof of concept to test system limitations:

The ability to “try before you buy” in our environment allowed us to ensure that it worked properly, not just another case study example.

Hands-on testing is better than any pure reading to me.

Product Demos/Trials will give you the chance to break things and to prove if the software will do what you want.

We were able to get a POC device and use it for 30 days before making the decision to buy. This was key to our decision as it proved it performed better than our current storage platform.

User reviews still fall within the top 4 resources used by IT buyers, and they consulted reviews more often than any other type of customer evidence or third-party validation. As with other buyers, reviews complemented IT buyers’ first-hand product experience like trials and demos.

Qualitative responses from IT buyers in the survey echo the quantitative data. Here’s how IT buyers expressed, in their own words, how perspectives from other users who have more experience with the product help their evaluations:

User Reviews provide real authentic feedback about the product that we may not be able to get in the short time frame we test the product. Some are not trustworthy so we go through all of the feedback in depth and only rely on the ones that provide specifics. They definitely impact our decision if they are reliable.

User reviews ensured that the product complied with our needs. Product demos were essential in demonstrating the desired functionality for our company.

Seeing a demo of the product itself, being able to try it out and combining that with actual user feedback was most valuable to us.

But a smaller proportion of IT buyers consulted peer input in general, compared to other buyers–whether it was user reviews, communities and forums, case studies, references, or even referrals from a friend. This may be due somewhat to the particulars of their environment, or to concerns about security and privacy.

IT buyers are also less likely to consult all vendor-provided resources, analyst rankings and reports, and third-party publications and independent media.

The only resource they are more likely to use than other buyers, aside from a free trial, is solution consultants / agency recommendations. This may be because their purchasing budgets are higher and they can afford to hire consultants, because the IT consulting market is well established and consultants are widely available, or because they require more in-depth, consultative advice and want to be under contract with the person giving it for security reasons (but before making a commitment to the vendor).

They are less trusting of most resources, except forums and vendor-provided resources.

While they aren’t necessarily a resource IT buyers use exclusively or universally, forums can provide IT pros with trustworthy, relevant information. This is likely because there are pockets of highly engaged and knowledgeable IT communities found in some forums, which can provide keen, honest assessments of how well a system works and tips for troubleshooting.

Though IT buyers consult vendor-provided resources less often than other types of buyers, when they do turn to vendors, IT buyers find them more trustworthy. IT vendors may do a better job of providing more concrete, technical information and details compared to other software vendors, even in their blogs and marketing collateral.

They likely understand their audience and match their communication style to the buyer personas. In fact, 42% of IT buyers said the vendor was very forthcoming about where the product works well and where it is not a good fit—5 points above the average for all buyers, though still much lower than the 85% of vendors who aim to be forthcoming about product limitations.

How much influence do vendors have over IT buyers?

Slightly more forthcoming, IT vendors are also slightly more influential.

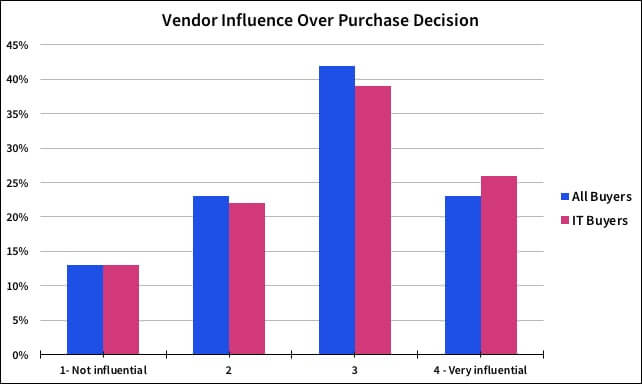

26% of IT buyers said the vendor was very influential in their purchase decision–3 points above the average for all buyers.

IT buyers trust vendors who answer questions with detailed technical information & give access to the product for testing

Overall, our 2018 B2B Buying Disconnect Report revealed a strong link between trust, transparency, and influence. IT vendors were slightly more influential, which may be related to the fact that they were also slightly more forthcoming about product limitations. The higher dependence on vendors can also be due to the fact that IT buyers are highly invested in technical specs, feature availability, and access to test the product itself–which are areas where all buyers in the study saw vendors as the best authority.

Here are quotes from IT buyers that showcase experiences where vendors offered trustworthy support, direct communication on product specifics, and access to hands-on experience and user perspectives:

Vendor provided all the information we were looking for and did not try to hide any limitations.

The vendor rep was always honest and direct when we asked a question.

Everything about the product rang true. From the demos given to the case studies, the vendor represented this product exactly as is. No extra “hype” or “fluff.”

Vendor & communities docs were really detailed and reliable.

Like all buyers, IT buyers are more dubious of vendor-provided materials compared to other information sources. Vendor marketing collateral was the least trusted information source across the board. Ultimately, IT buyers prefer hands-on experience or thorough product demos with technical reps. Information from other users can provide tips and insights to guide testing, and help IT buyers probe the right functionality during demos.

But IT buyers are also slightly more likely than other buyers to trust vendors to provide the specific details they need to make a sound purchasing decision. When information from the vendor lines up with their own observations and feedback from users, IT buyers feel confident that they know enough to move forward with a purchase.

Was this helpful?