New Research: The State of B2B Technology Buying in 2020

New industry research for the 2020 business technology market from TrustRadius

This week, TrustRadius published The 2020 B2B Buying Disconnect Report. It provides an outlook for buying and selling business software and hardware in 2020, based on a broad survey of buyers and vendors.

The report tracks year over year trends and changes in the market. It also explores new areas of inquiry, including purchase dynamics within different organizations, the specific impact of reviews in the buyer’s journey, attitudes towards analyst rankings & reports, and how lead handling processes affect relationships.

Grab your free copy of the 2020 B2B Buying Disconnect here.

As a preview, here are ten key research findings of the study business leaders need to be aware of heading into 2020, whether they sell or simply use technology in their own organizations.

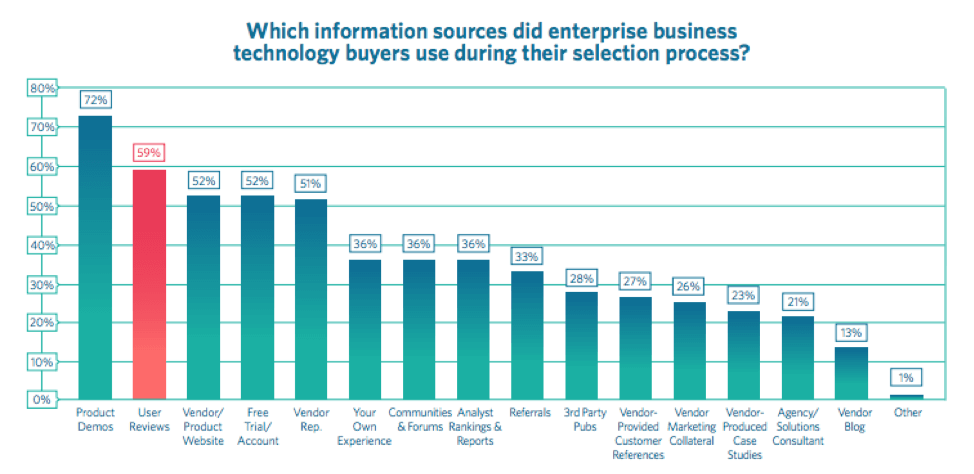

1. The average buyer consults 5.1 sources of information along their path to purchase.

On average, buyers consult just over five different resources during the purchase process. Of the top five most commonly used resources, reviews are the only one not provided or controlled by vendors. Reviews are the #1 way for buyers to access independent information about products.

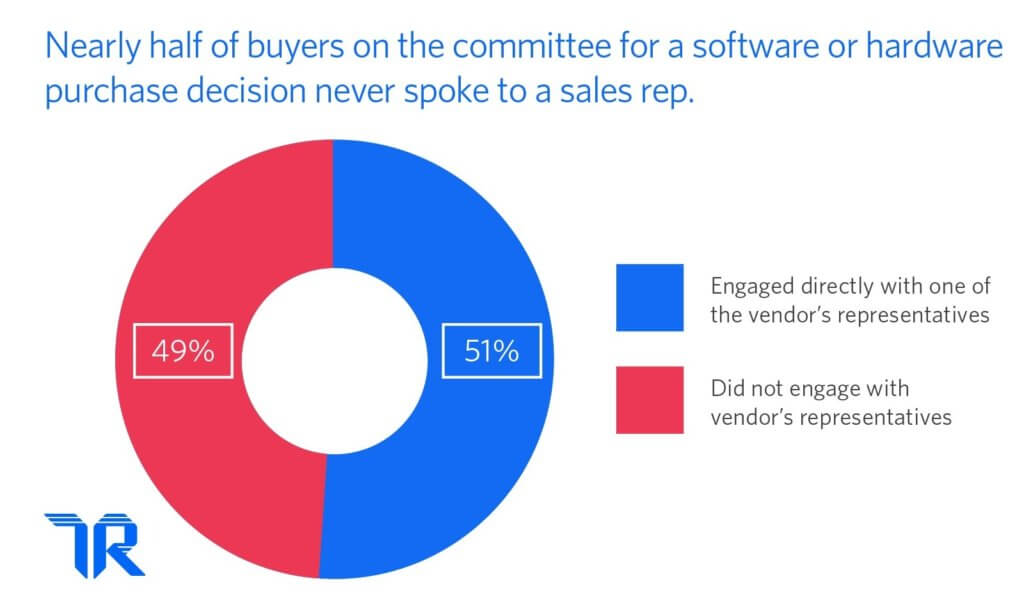

2. 49% of buyers won’t ever interact with a vendor representative.

That means half of the purchase power exists beyond reps’ direct influence. 95% of business technology purchases are collaborative; it’s most common for there to be 2-5 stakeholders working together as a buying committee. Vendors won’t get to talk to every buyer who’s part of a given deal. Buyers who don’t engage directly with a vendor rep themselves are doing their own anonymous research. Review sites are a major resource for these buyers.

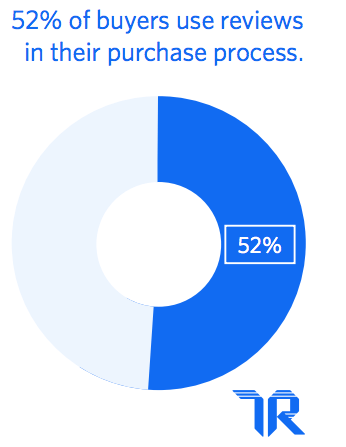

3. Over half of buyers use reviews.

User reviews are now used by 52% of business technology buyers. Indeed, traffic to B2B review sites (including TrustRadius) has been on the rise. There are more reviews available now than ever. Buyers know to Google for user reviews and are even visiting their favorite review sites directly. They expect to be able to find reviews before purchasing any new software or hardware product.

Changing demographics in the workplace is one among many factors driving the rise of reviews. For example, millennials are more likely to consult user reviews than older generations–and heading into 2020, 59% of professionals involved in business technology purchases are millennials.

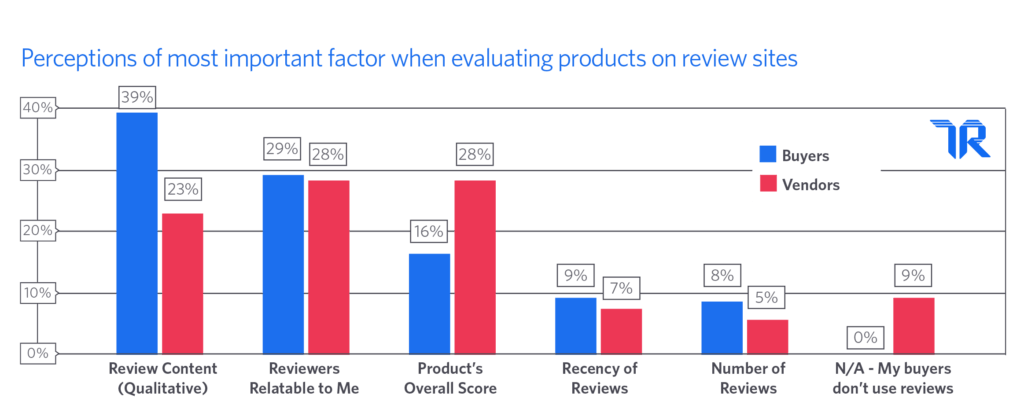

4. Scores and rankings are not the focus for buyers on review sites. They’ve become less important over time.

The review content (the qualitative feedback itself) is the most important tool buyers use to evaluate products on third-party review sites. Not scores! Score has shrunk in importance over the past few years. 30% fewer buyers place emphasis on product scores now than in 2017. However, vendors are still overly focused on their product scores, because they think it’s important to buyers. What’s really important is review content and not the review score or ranking.

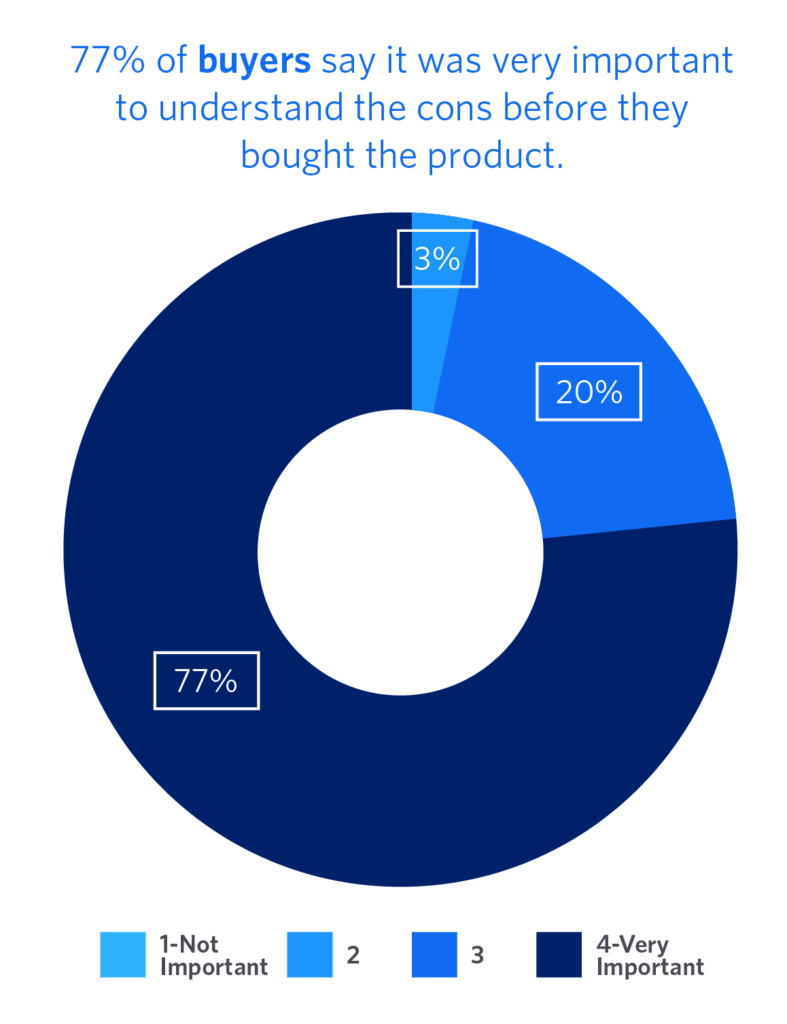

5. More than 3 out of 4 buyers say they need to know the cons before buying a product, but vendors aren’t serving that need.

77% of buyers say it’s very important to understand the cons before making a purchase. Only 33% of vendors agree. This gap in trust has increased year over year. Buyers feel the need for a full and balanced perspective stronger than ever. But vendors are under-prepared to meet it.

Reviews are the main way for buyers to figure out what the product limitations really are, which issues might apply to them, and what challenges to prepare for. That’s why detailed qualitative feedback in reviews is so crucial. Buyers need plenty of context so they can interpret the pros, cons, and other answers in a meaningful way.

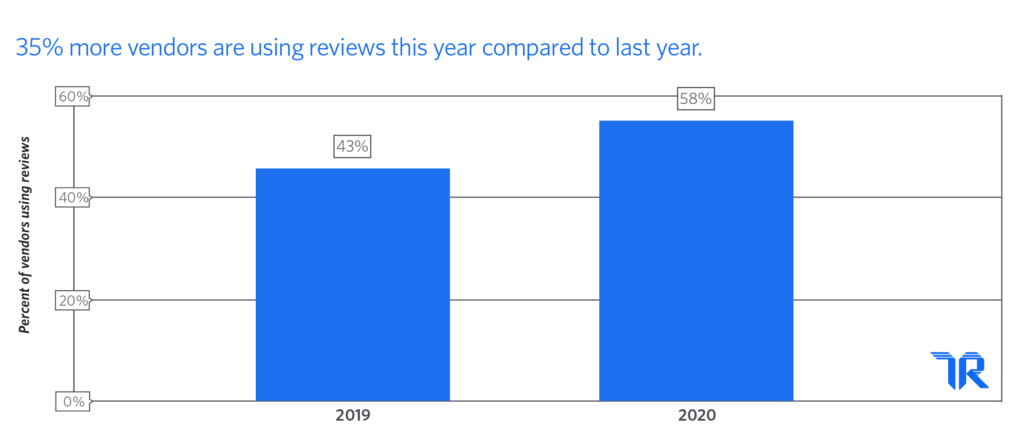

6. 35% more vendors will have a review strategy this year.

As reviews become more important for buyers, vendors are recognizing that reviews serve a real need. 58% of vendors have adopted reviews as a tactic to educate and engage prospects. They are exploring the best ways to incorporate user reviews in their funnels.

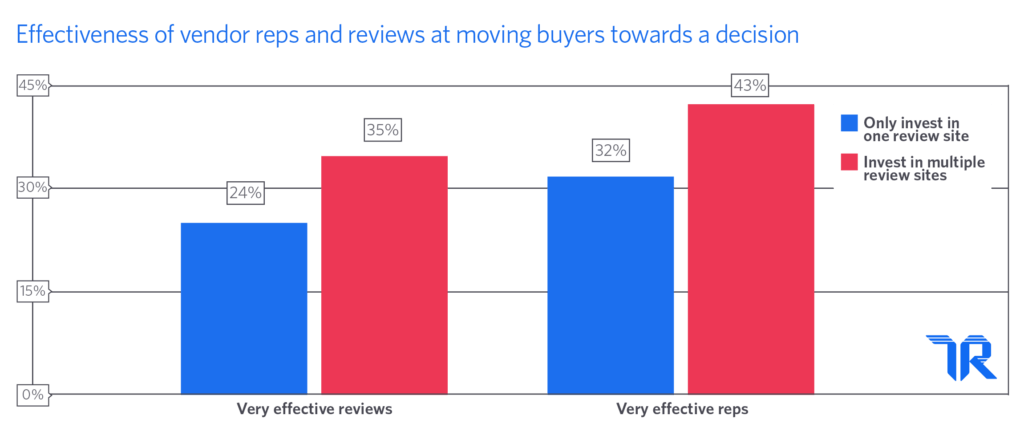

7. Most vendors are investing in paid review programs with multiple review sites – and that has measurable benefit.

Nearly 4 out of 5 partner with at least one review site in a paid capacity. Most (81%) are investing with multiple review sites to power their review strategy. And, vendors who work with multiple review sites report better results. Their reviews were more effective at moving buyers towards a decision, compared to vendors who only partner with one review site. Their sales rep performance saw a boost, too.

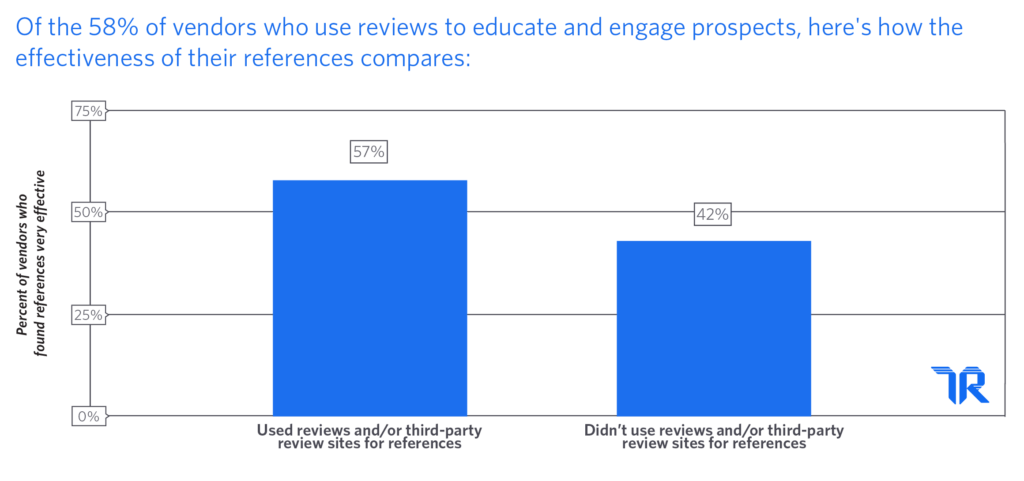

8. Sales collateral, social proof on websites, and reference generation are emerging as some of the most effective ways vendors are using reviews.

The most common use cases for reviews and third-party review sites are lead generation (51%), customer references (51%), and social proof on their website or landing pages (50%). Some vendors are also using reviews more passively, for reputation management (41%) and third-party validation (43%), expecting buyers will find them on their own. Vendors that use reviews more strategically are doing things like creating sales collateral (34%) and generating competitive intelligence (40%), product insights (35%), or buyer intent data (20%).

There are other use cases for reviews as well, of course. But some of the clearest success is seen by vendors who power their sales collateral, websites, and customer references with reviews. Vendors using reviews in their sales and marketing collateral find their sales reps, website and landing pages, and reference gathering capabilities are more effective.

9. Buyers wait until late in the purchase process to fill out lead forms, but vendors can reach them earlier by partnering with review sites.

Buyers raise their hands closer to the purchase than many vendors would like. 60% of buyers who are willing to provide their contact information at all do so only when they’re ready for a product demo, a free trial, a discussion with sales, or after they’ve already decided they’re ready to buy.

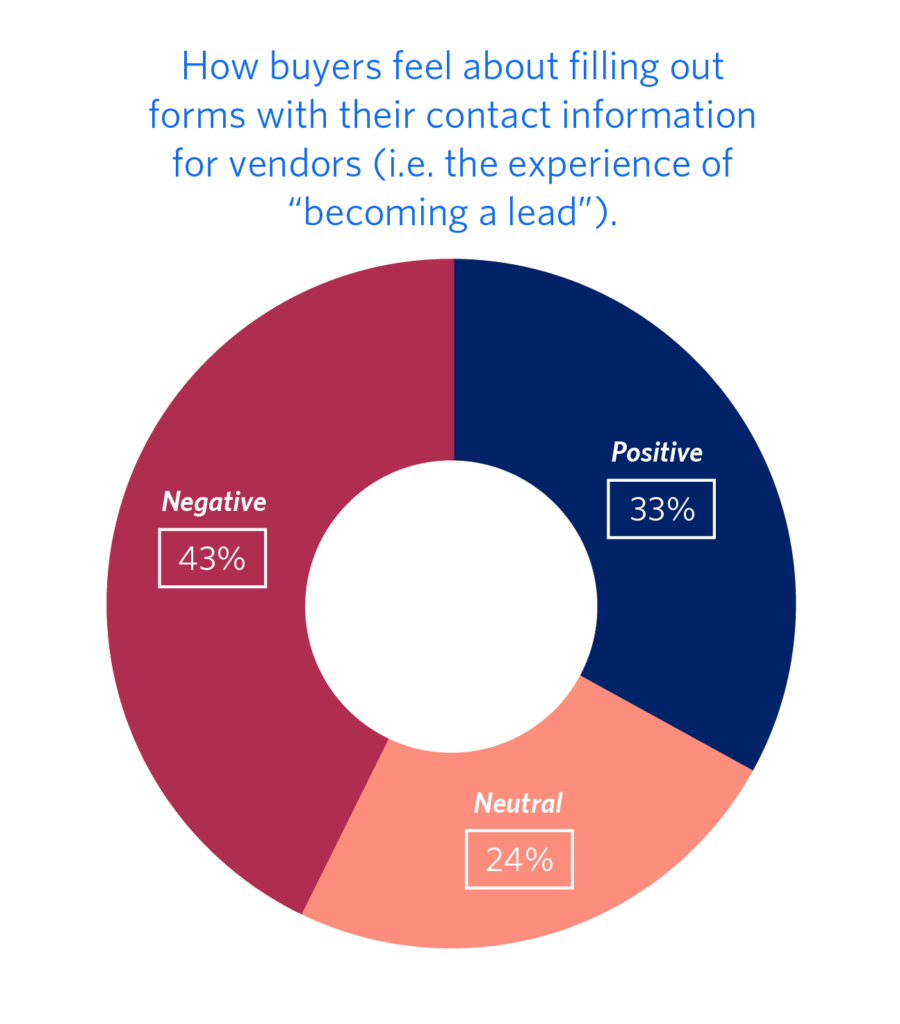

Even then, many buyers dread the experience of becoming a lead. Two-thirds of buyers said they feel negative or neutral about filling out lead forms so that vendors can contact them. Vendors risk their first communications being colored by mistrust, annoyance, or apathy, especially if buyers feel forced into handing over their personal details early to get basic information.

Buyers want to remain anonymous until they’re ready to talk. They are empowered by information they can easily find on their own. User reviews are one example of a resource buyers use to evaluate vendors without getting in contact. Third-party review sites offer a number of tools–from buyer intent data to retargeting pixels–that can help vendors keep up with active buyers without lead forms.

10. Vendors have an opportunity to make their products stand out by letting buyers “drive” during demos.

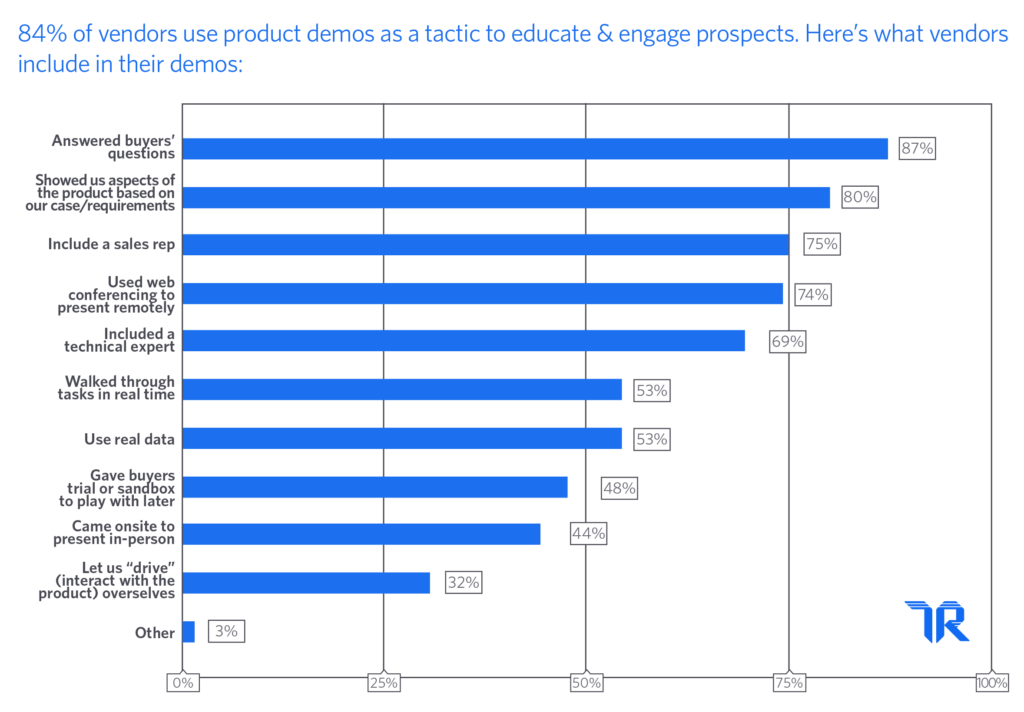

Product demos are widely used, and have the potential to be highly influential. They’re a cornerstone of the relationship vendor representatives build with buyers. The demo is an important moment that cements or casts doubt on how much buyers should trust a vendor, and how much influence they’ll allow vendor reps to have over their decision.

One factor that’s more common in very influential demos is the ability for buyers to interact with the product themselves in real time, while the vendor rep is on the line. (Less influential demos tend to wait until later on, after the call, to let buyers get hands-on.)

But this is the least common aspect included in demos, according to vendors. Only 32% of vendors said they let buyers “drive” (interact with the product themselves) during the course of a normal product demo. Vendors who incorporate interactivity can differentiate their demo experience from competitors, winning more trust and influence over buyer decisions.

Get your free copy of the 2020 B2B Buying Disconnect Report today!

For more insights, tips on leveraging this data in your buying process, or advice on what this means for your marketing and sales strategy, download the report here.