HR Management Software Market Update (2021)

12.5 million software buyers use TrustRadius each year—and over 650,000 of them are exploring HR software. HR Management is one of the primary places where they spend their time.

HR management software earns the nickname of “Core HR”. The platforms in this category, often called HCMs or Human Capital Management systems, provide the essentials for an HR department to function—ranging from onboarding to payroll and everything in between.

Understandably, the HR management market is currently valued at over $17.56 billion.

To truly understand the scope of this essential software market, we took a closer look at our data to see which products attract the most attention. This is the 2021 HR management software market update.

Click on a Section to Explore:

Quick Snapshot of the HR Management Software Market

- The global human resource management market size was valued at $17.56 billion in 2020. (Grandview Research 2020)

- The global human resource management market size is projected to grow to $43.29 billion by 2028. (Grandview Research 2020)

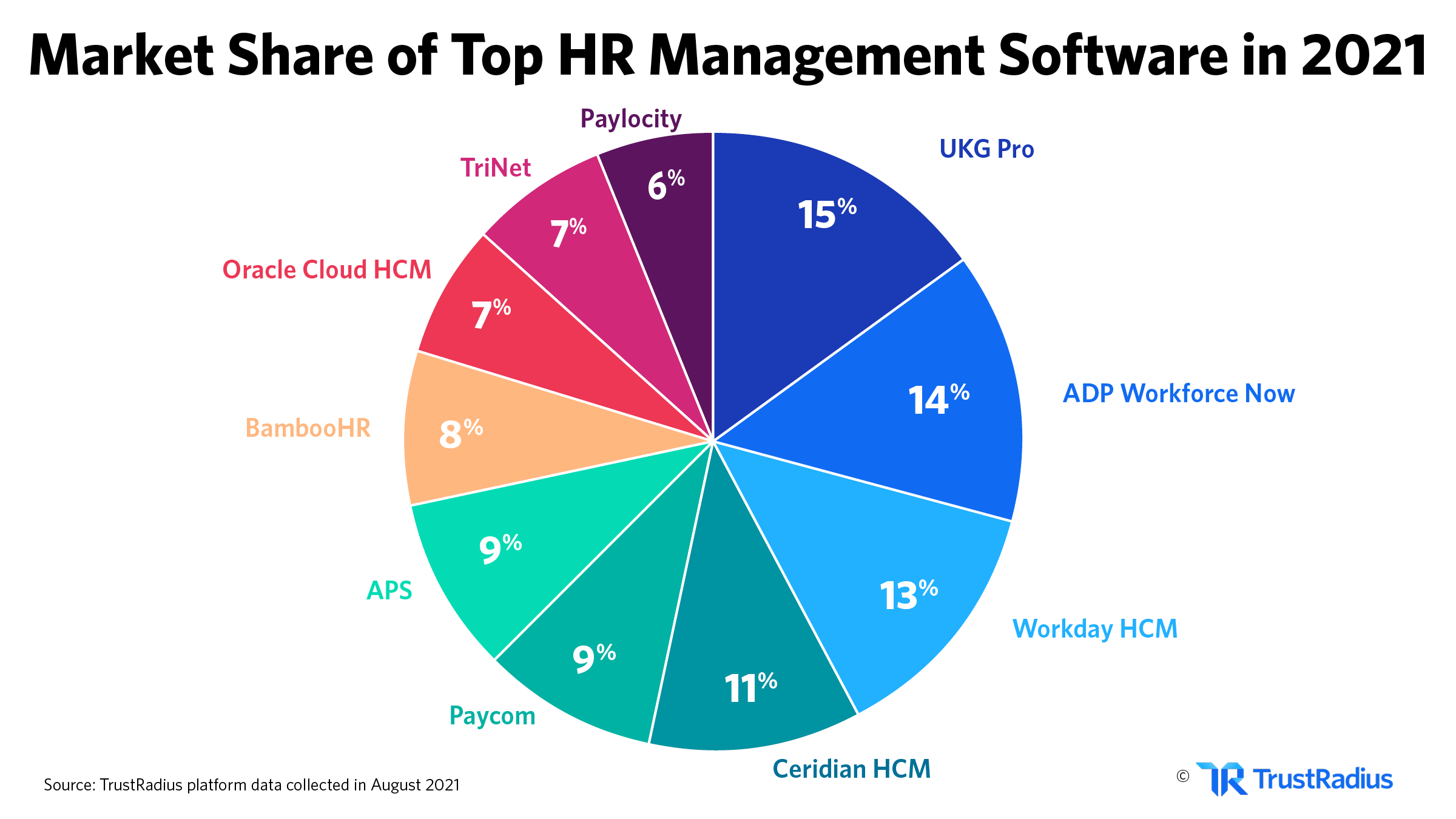

- There’s no clear leader in the HR Management software market in 2021. 50% of the market is nearly evenly controlled by UKG Pro, ADP Workforce Now, Workday HCM, and Ceridian HCM. (TrustRadius 2021)

- Across the HR Management software market, buyers spend the most time comparing two ADP products: RUN and Workforce Now. As a historical market leader, ADP has released many solutions over the years that buyers aren’t sure how to differentiate. (TrustRadius 2021)

- 90% of HR management software reviewers are happy with the feature set of the software they purchased. That percentage increases to 100% for reviewers of UKG Pro, isolved, Sage HR, and Rippling. (TrustRadius 2021)

- 86% of HR management software reviewers say they would buy the product they purchased again. (TrustRadius 2021)

- 73% of HR management software reviewers believe their system offers good value for the price. (TrustRadius 2021)

- Surprisingly, only 54% of HR management reviewers say that their solution lives up to its sales and marketing promises. (TrustRadius 2021)

Who’s Winning HR Management Market Share In 2021?

According to buyer interest (as measured by total pageviews), the top 10 leaders in today’s HR management market are:

However, we’re not seeing clear winners when it comes to market share.

HR Management is a well-established category with strong legacy players and a growing number of contenders fighting for market share.

As you can see, the total combined pageviews of the top 10 vendors in this space are nearly evenly distributed:

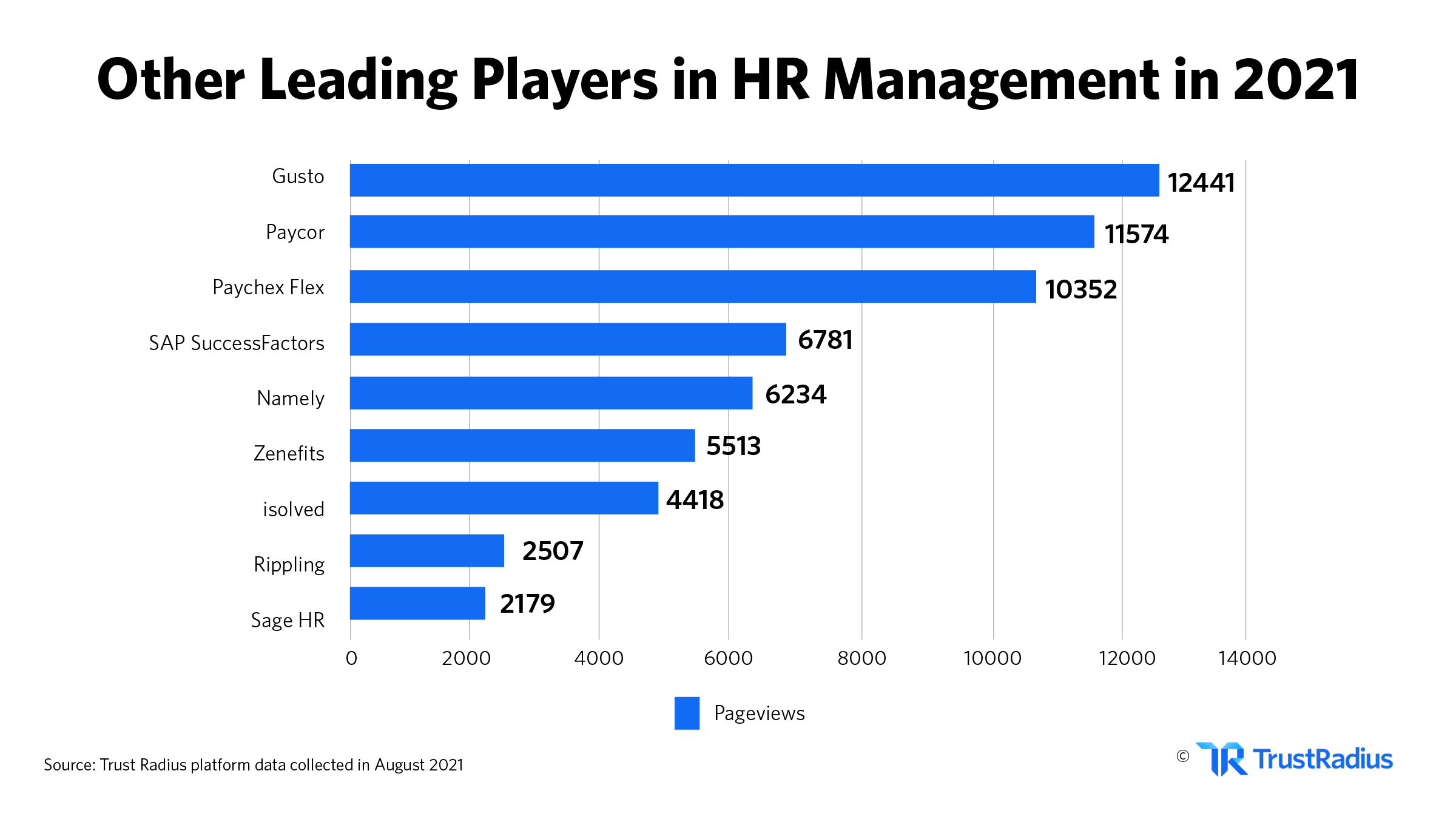

Other Key Players in HR Management

There’s a lot more to this market beyond the top 10 companies.

The following players each control less than 5% of the total HCM attention on TrustRadius. But due to the sheer size of the market, they’re still attracting thousands of interested buyers per year:

We anticipate seeing a lot of movement in the HR Management space over the coming years.

It’s all about who can centralize all of the core HR functions in the most efficient and cost-effective manner possible. Multiple acquisitions in this space are a strong signal that this market is moving toward centralization and consolidation.

We expect that point solutions and legacy “core HR” products will struggle to compete as extended features like performance management, integrated recruiting, etc. become expected functions for HR departments across the globe.

Players on this list may rise to claim new market share in their wake.

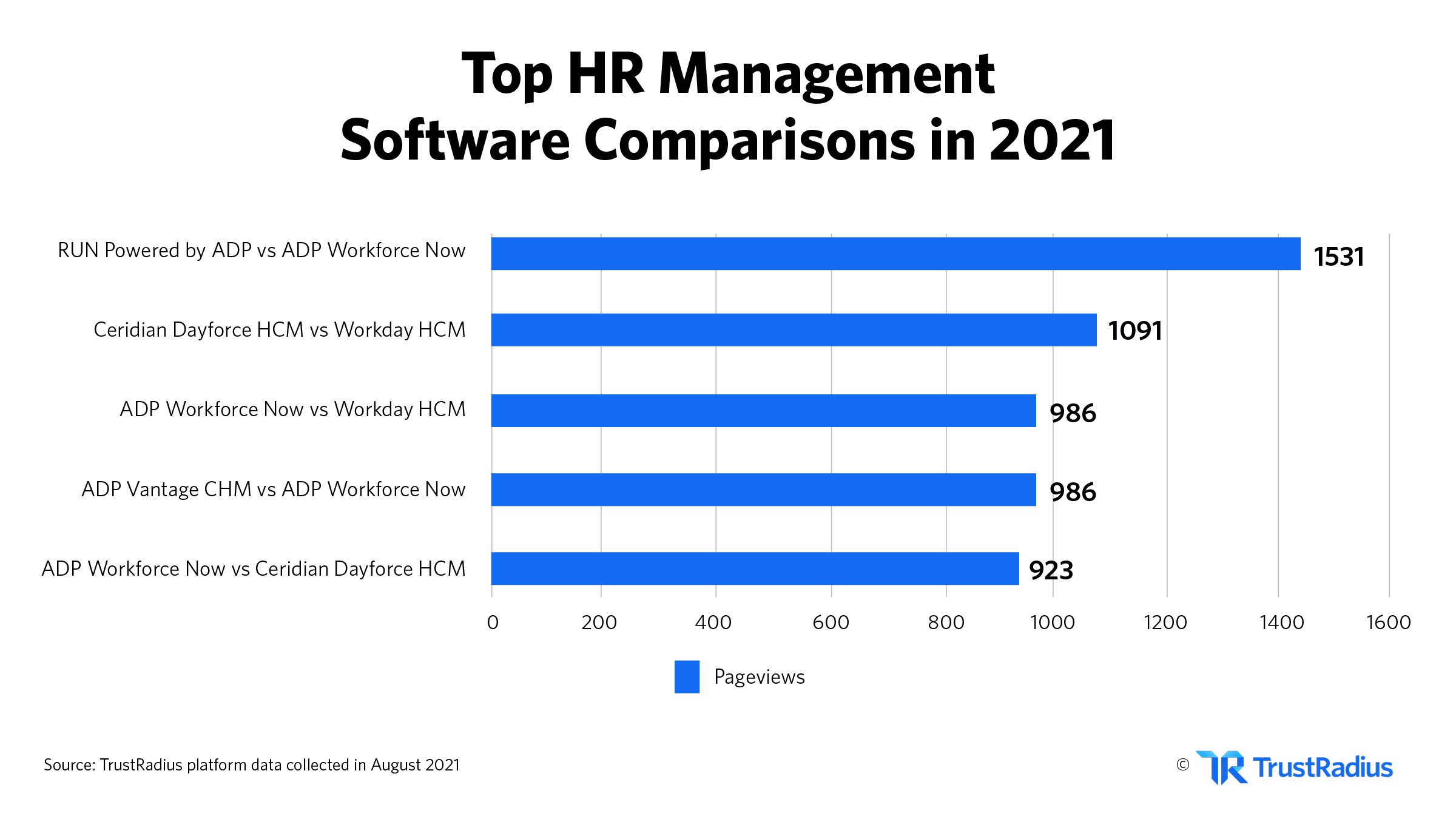

ADP Dominates HR Management Software Comparisons

Buyers spend an average of 12 minutes comparing products side-by-side on TrustRadius—which indicates that they’re very close to making a purchase.

While we couldn’t identify a clear winner across the entire HR Management market, we do see a winner in comparisons.

ADP products are featured in 4 out of the top 5 HR Management comparisons in 2021. And the top comparison, by a long shot, is between two separate ADP products.

This isn’t particularly surprising to those who are familiar with HR software.

ADP has historically led this market for years. They began by releasing robust payroll solutions and later expanded, flooding the market with a mix of products across the HR space.

Many of these products had certain critiques from reviewers in the beginning. But many have steadily improved in usability and user experience over time.

As a result, buyers are often at a loss. They know that ADP is an HR market leader. But they’re not sure which of their many solutions is worth their purchase. That’s one reason why so many buyers are spending precious minutes comparing ADP products on TrustRadius.

Altogether, ADP is attracting an additional 5,500 pageviews per year from comparisons alone.

How Top HR Management Software Stack Up

While the “big name players” may command the most mindshare, we’re paying close attention to how other products differentiate themselves in the marketplace.

That’s why we collect feedback from real buyers about their experience with HR Management software.

We typically ask:

- How likely are you to repurchase this product?

- Do you think this product has good value for the price?

- Does this product live up to its sales and marketing promises?

- Did product implementation go as expected?

- How would you rate this product’s customer support?

You may be surprised to see which products rise to the top in each of these areas.

An additional note about product features:

We also asked buyers how satisfied they are with the feature set of their product. In HR Management, 90% of buyers are satisfied. That’s a high number that we believe is due to feature parity.

All of these products deliver the same core functionalities. Therefore, discerning buyers need to judge them based on other criteria like those listed below.

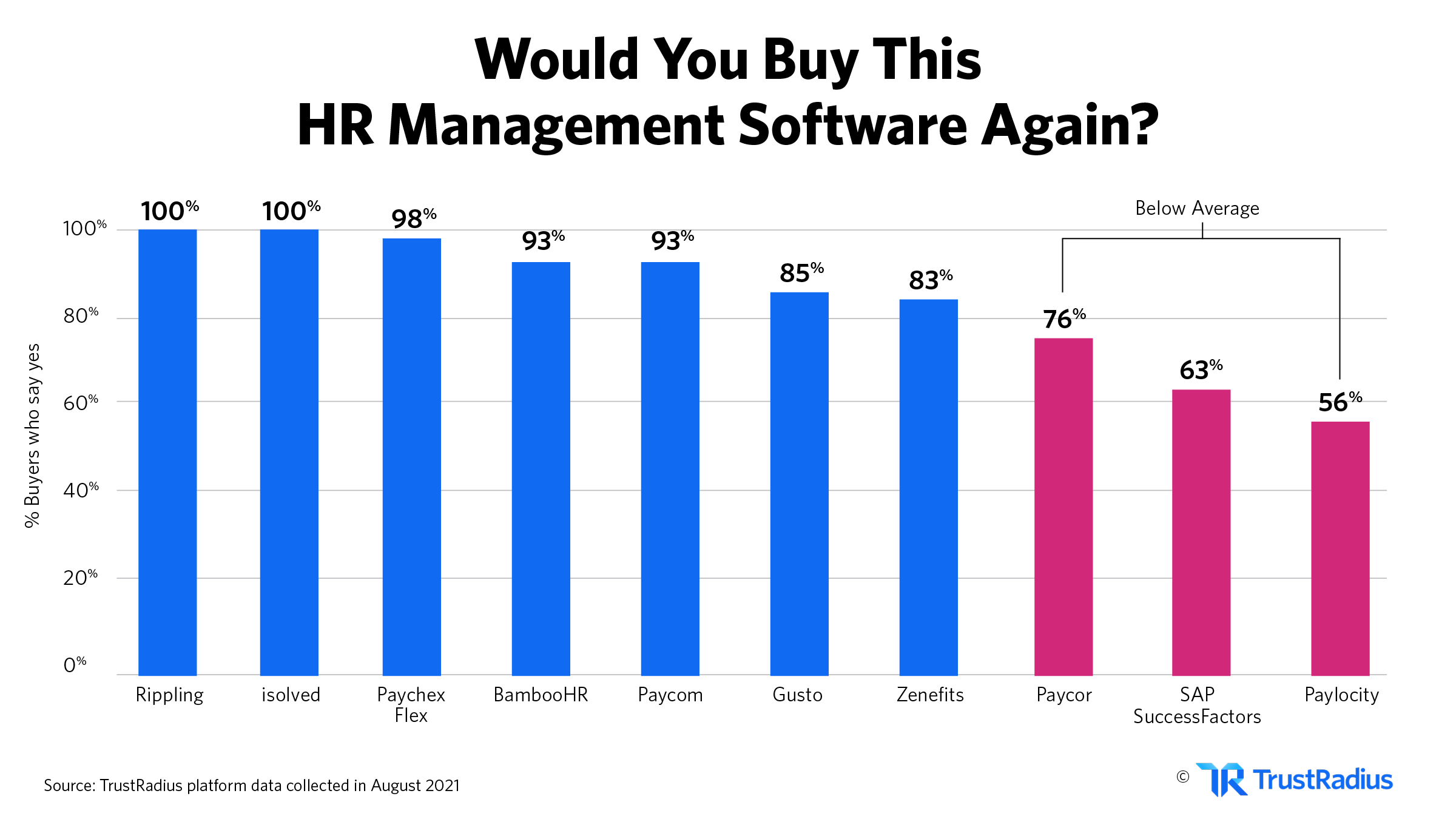

Most HR Management Buyers Would Purchase the Product Again

86% of HR management software reviewers say they would buy the product they purchased again. That’s a really healthy number.

What’s astonishing is how that percentage increases for certain high-performing HCMs.

100% of UKG Pro, Rippling and isolved reviewers say they would buy those products again. 98% of Paychex Flex users say the same.

On the low end, only 56% of Paylocity customers say they would buy the product again.

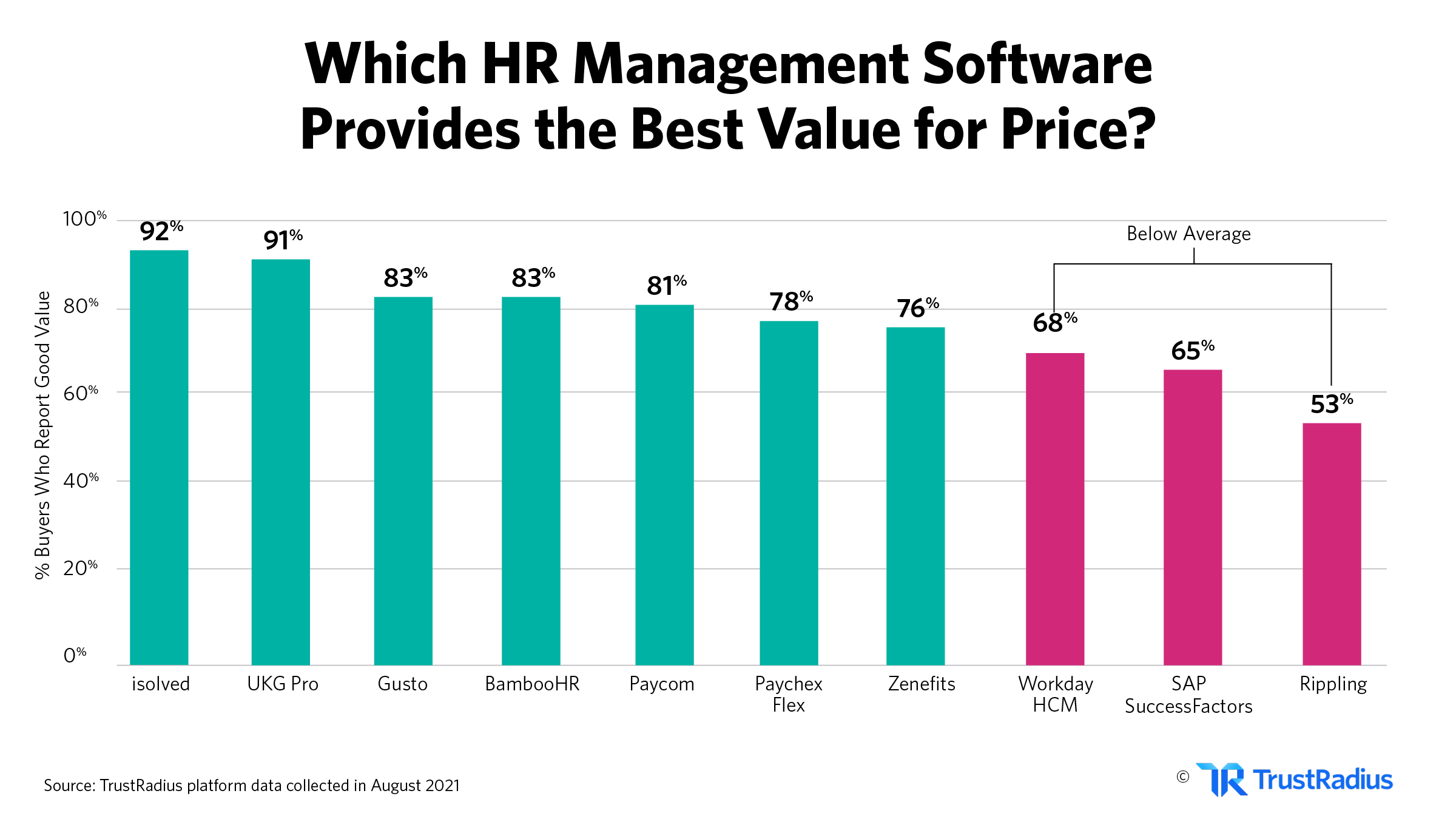

Isolved Offers the Best Value for the Price

When it comes to value for price, the HR management market leaders aren’t exactly winning.

This is one place where isolved in particular shines. They’re inching slightly above UKG Pro, one of the primary leaders in terms of market share.

Other players like Gusto, BambooHR, Paychex, and Zenefits are also edging out market leaders in this space.

On the low end, we see a surprisingly low score from Rippling—a company that leads in likelihood to repurchase.

Not All HR Management Products Live Up to Their Promises

In some markets, buyers feel that products really do live up to their sales and marketing promises. Others clearly do not. The HR management space is mixed.

Only 55% of HR management software reviewers think their software lives up to its promises.

The highest performer here is isolved, with 75% of reviewers saying the product does live up to its promises. The lowest performer is Namely with only 38% of reviewers saying the same.

The truth is, there’s currently a lot of hype in the HCM world around cutting-edge capabilities. But most of those features aren’t quite being realized by vendors in a tangible way.

It’s also possible that vendors are claiming benefits like excellent customer support and easy implementation—but buyers don’t think they measure up.

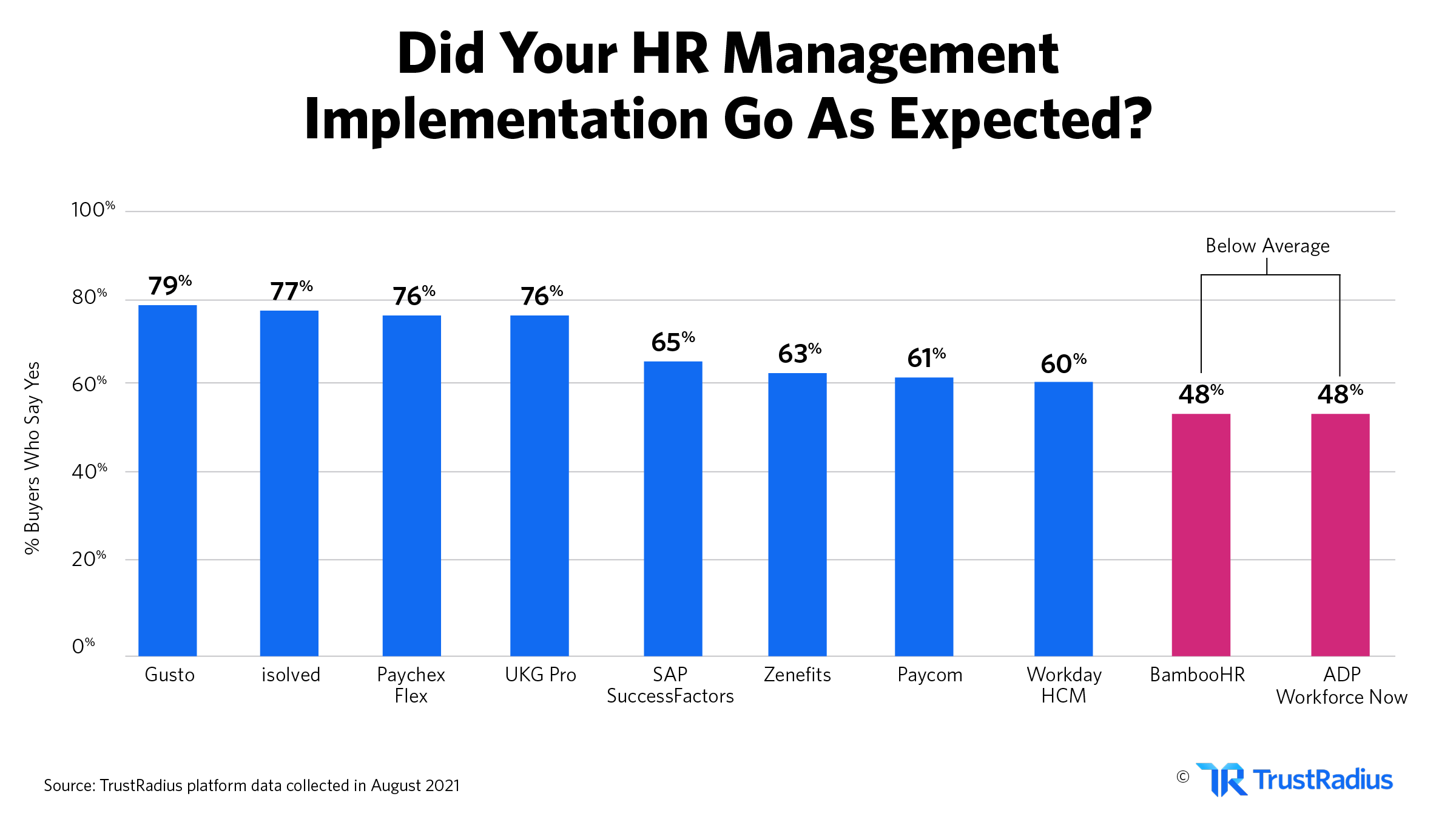

Gusto Shines in Product Implementation

Gusto leads the HR Management market when it comes to implementation.

79% of Gusto users say that their product implementation went as expected. That percentage clearly stands out when compared to market leaders like Workday (60%) and ADP (48%).

This is a clear point of differentiation.

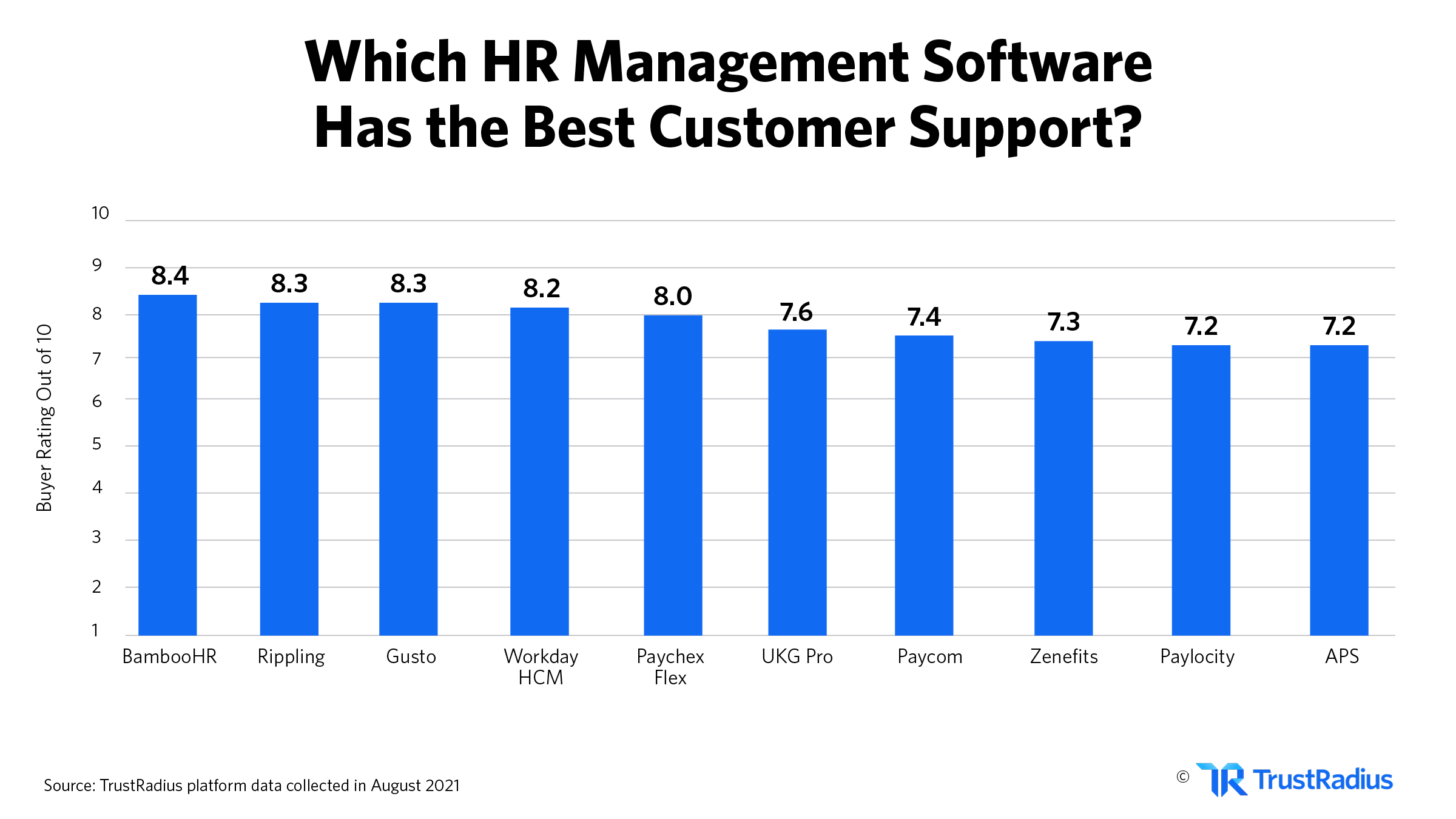

BambooHR Has the Highest Customer Support Rating

In HR Management, it’s clear that some of the smaller players’ customer support teams are beating out the market leaders.

BambooHR, Rippling, and Gusto are currently leading the market in customer support. Market share leaders like Workday, UKG Pro, and Paycom are all sitting in the middle of the pack.

Paycor has the lowest customer support rating of all leading HR Management players in 2021 (with a 5.64 out of 10). Other low scores go to Namely (5.75) and SAP SuccessFactors (6.43).

When HCM customer support goes wrong, things get ugly fast. It’s mission-critical for HR pros to be able to pay employees on time. Onboarding new employees should be seamless and easy.

It’s surprising to see so many big names at the bottom of the customer support list.

Your Guide to HR Management Software Pricing in 2021

| HR Managment Software | trScore | Starting Price | Free Trial | Free or Fremium | Premium Services | Setup Fee |

| UKG Pro | 8.5/10 | Contact Vendor | None | |||

| ADP Workforce Now | 7.7/10 | Contact Vendor | Required | |||

| Workday HCM | 8.1/10 | Contact Vendor | None | |||

| Ceridian Dayforce HCM | 8.0/10 | Contact Vendor | None | |||

| Paycom | 7.4/10 | Contact Vendor | None | |||

| APS | 8.1/10 | Contact Vendor | Required | |||

| BambooHR | 8.6/10 | $59/Month | Optional | |||

| Oracle Cloud HCM | 8.4 | $4/Month | Required | |||

| Paylocity | 6.9/10 | $2/Month | None | |||

| Gusto | 8.2/10 | $19/Month | None | |||

| Paycor | 6.4/10 | $99/Month | None | |||

| Paychex Flex | 7.9/10 | $59/Month | Required | |||

| SAP SuccessFactors | 7.0/10 | Contact Vendor | None | |||

| Namely | 6.7/10 | $12/Month | None | |||

| Zenefits | 5.7/10 | $8/Month | Required | |||

| isolved | 8.4 | $4/Month | None | |||

| Rippling | 8.7/10 | $8/Month | None | |||

| Sage HR | 8.7 | $1.50/Month | None |

Spotlight on Payroll Solutions

Payroll is a staple of most HCMs and core HR products.

Of the market leaders highlighted above, several have a particularly strong payroll component. ADP Workforce Now, Sage HR, UKG Pro, Zenefits, and Ceridian Dayforce are all known for having competitive payroll solutions.

However, other players exist in the core HR market (or in the form of payroll point solutions) that are also worth considering.

Ascentis, Vibe HCM, and TriNet are all core HR products with powerful payroll options.

If you’re looking for more of a point solution, buyers on TrustRadius tend to consider QuickBooks Online and Patriot Software viable options.

Investment News in the HR Management Market

The past year has seen significant innovation and investment in the HR management market. Here are the biggest fundraising and valuation events from 2021:

Gusto recently raised $175 million in funding in August 2021. The company plans to use the money to scale their business and expand with over 80 Denver-based positions currently open.

Paycor has also had a very busy year. The company raised $270 million in funding in January 2021 before going public in July of 2021. Paycor raised a whopping $451 million from their IPO.

UKG had a strong year as well, announcing 20% growth in subscriptions in the third quarter of 2021. The company also recently acquired EverythingBenefits for an undisclosed amount. This shows UKG’s commitment to remaining a market leader in many areas, including HR management.

Ceridian also recently made an acquisition move into the talent intelligence space. The company acquired Ideal for an undisclosed amount in April 2021.

Odoo, a SaaS company that provides a wide variety of open-source software including HR, recently raised $215 million. The company has a mission of simplifying operations for small and mid-sized companies, and has a store with 30,000+ apps.

HR Trends to Watch in 2021

Adapting to Work From Home

The shift to remote work has had seismic impacts on HR.

In some aspects, work from home improves the HR management situation. Most research finds that employees are at least as productive working remotely. 4 out of 5 HR managers believe remote work reduces absenteeism. In recruitment, HR teams have a wider array of talent to sift through.

On the flip side, more remote work makes onboarding much more challenging. Workplace cohesion can be more difficult to foster. There’s also a disconnect between staff and employers on whether work from home should stay. Far more bosses want staff back than employees want to come back. HR departments will have to mediate the fallout when these conflicting WFH ideas collide.

AI-Based Recruiting

The “great resignation” is ongoing. Remote work fueled an explosion of employee turnover, which will eventually result in a much higher number of applicants for other positions. For HR professionals, these changes accelerate the need to find better ways to evaluate resumes. Like most markets, HR management is turning to AI.

Research shows that 42% of applicants are unqualified for the job they are applying for. Smarter AI tools can help HR teams sift through these faster. Studies also suggest that AI can be used to reduce bias and prejudice in hiring practices—which is understandably a core goal for HR professionals in 2021.

Developments in Training

Savvy HR pros are turning to VR and other hardware to help improve engagement and effectiveness in employee training.

Companies are also becoming better at identifying problems in training, and seeking to address them. Age-gaps, learning style differences, and disability requirements are all gaining more attention than ever before. Creating materials that allow for different types of learning and providing a more employee-focused experience is a trend that will continue beyond 2021.

Providing Equitable Opportunity

Diversity, equity, and inclusion are top priorities for many HR departments. But this may not be enough in a “new normal” work environment. Remote work expanded pre-existing inequalities for a vast number of employees in our global workforce.

For example, HR professionals traditionally manage resources and technology for employees. They may provide or manage the distribution of work laptops. For some employees, this assistance is sufficient. But those in areas with poor internet, or who lack other necessary equipment, may find themselves unfairly impacted by the shift to remote work.

To address this, clear communication lines are essential. Remote work stipends and grants are fantastic for helping with this. In an HCM software, accurately and intelligently recording circumstances like this is essential.

This reality touches recruitment, training, technology, and just about every other aspect HR professionals handle. In the future, developments in resource management could impact how employees are given an equal chance to succeed in the workforce.

10 More HR Management Software Statistics

- 74% of HR professionals think that spending for HR tech will increase. (PWC 2019)

- 36% of HR professionals blame insufficient technology for their inability to automate and better organize onboarding programs. (Kronos 2020)

- 60% of HR managers are planning on investing more in HCM tools with predictive analytics. (KPMG 2019)

- 53% of HR managers are planning on investing more in HCM tools with enhanced process automation. (KPMG 2019)

- 39% of HR Leaders are confident in their ability to transform the workforce for the digital era. 24% are not confident in their ability to do so. (KPMG 2019)

- 50% of HR leaders feel unprepared for advancements in AI and machine learning in their field. (KPMG 2019)

- 62% of HR leaders do not have a clear strategy for the future. (Gartner 2021)

- 13% more HR managers list optimizing cost as a top priority for 2021, compared to 2020. (Gartner 2021)

- Hiring for human resource managers is growing 50% faster than the average across other jobs. (BLS 2021)

- C-level Executives are more than twice as likely to believe their current HR tech is increasing productivity and results than lower level managers. (PWC 2019)

Sources

- Human Resource Management Market Size, Share & Trends Analysis Report (Grandview Research 2020)

- New Hire Momentum: Driving the Onboarding Experience Research Report (Kronos 2020)

- The future of HR 2019: In the Know or in the No (KPMG 2019)

- Top 5 Priorities for HR Leaders in 2021 (Gartner 2021)

- Human Resources Managers Occupational Outlook Handbook (BLS 2021)

- HR Technology Survey 2020 (PWC 2019)

- HR Management Software Market Update (TrustRadius 2021)