How The Tech Industry Has Handled COVID-19

Over the past few months, we’ve collected and analyzed thousands of data points around organizations’ responses to the COVID-19 pandemic. With U.S. cases reaching nearly 3 million and new cases increasing in 39 states, it’s critical that businesses continue evolving and learning from these experiences.

This post presents the groundbreaking B2B research performed by TrustRadius in partnership with tech industry analyst firm IDC. Together we looked ‘under the hood’ to learn how companies are balancing their budgets in these uncertain times—including changes to their software spending. We asked companies to share insights into their changing product roadmap for 2020. We’ve uncovered brand new statistics on employee productivity at home (during a global pandemic). And ultimately, we asked the tech industry to evaluate how well they’ve responded to the crisis.

This data helps us to answer critical questions about the present and future of the tech industry. With these statistics in hand, we’re ready to provide data-backed advice for tech leaders about what strategies their peers are using to navigate the pandemic and move towards recovery.

This information first appeared in a three-part webinar series TrustRadius co-hosted with tech industry analyst firm IDC. These webinars are available to watch on-demand (for free) here.

Quick access

- Organizational Response

- Impact on Revenue & Expenses

- Changes to the Tech Industry

- New Business Directions

- Impact on Employee Productivity

- The Role of Social Capital

- Learnings so Far

How Well Has the Tech Industry Responded to COVID-19?

Tech giants like Facebook, Twitter, Apple, and Google have played a critical role in coronavirus prevention by providing their users with necessary information about the spread of COVID-19. Companies like Apple have also contributed medical supplies such as N95 respirator masks to U.S. and European health organizations.

However, we were curious about how organizations have been handling business internally, behind the curtain of social media and press releases.

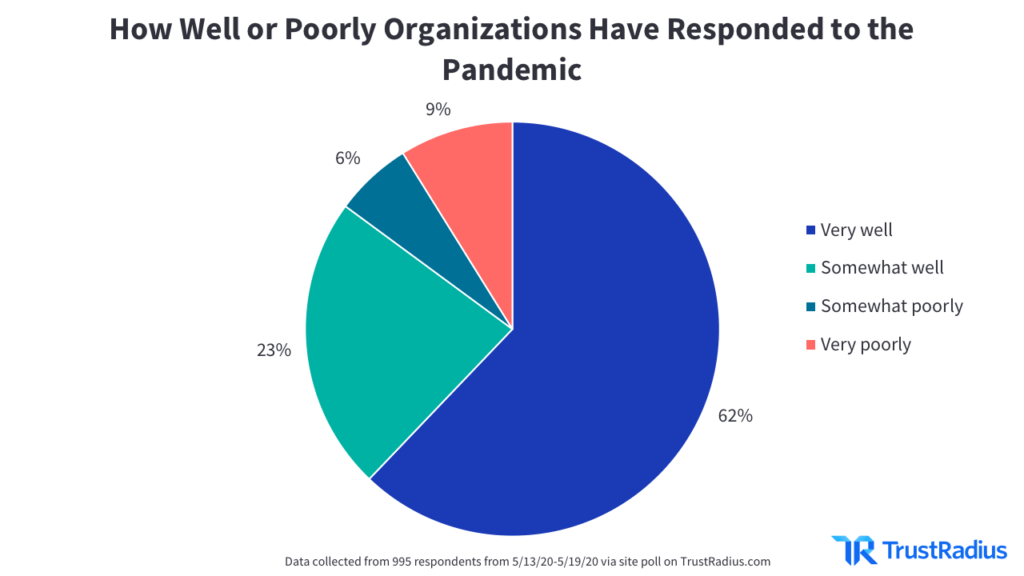

Of the almost 1,000 business professionals we polled, 62% thought their organization had responded to the pandemic very well. Another 23% thought their organization had handled these changes somewhat well. For executives and business leaders, it should be a relief to hear that only 16% of respondents thought their organization had not responded well to the changes brought about by the pandemic.

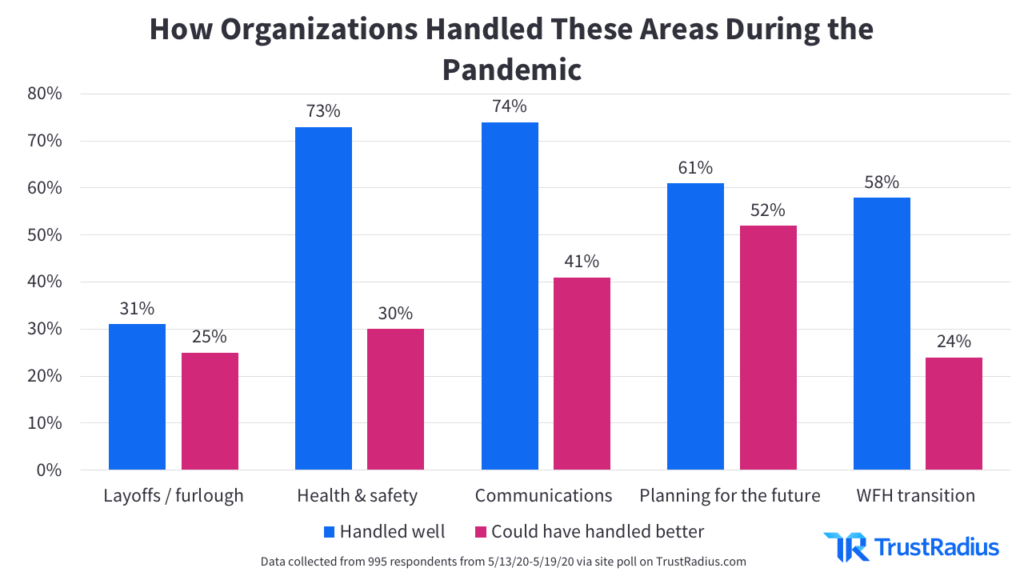

Along with the transition to working from home, many companies have been faced with difficult decisions about layoffs, health and safety, and planning for quarters ahead. Of the respondents who said their organization had responded to the pandemic poorly, 1 out of 5 thought their company could have handled layoffs or furloughs better. On the other hand, of the respondents that said their company had responded to the pandemic well, about 3 out of 4 respondents felt their organization had handled decisions about health & safety and communications well.

Interestingly, ‘planning for the future’ appears to be a topic that many disagree on. Respondents were roughly split down the middle in terms of how they felt their organization had handled planning for the future during the pandemic. Note, the graph below displays two sets of respondents. The blue bars correspond to respondents who said their organization had handled the pandemic well and the pink bars refer to the group of respondents who said their organization had handled the pandemic poorly.

One likely explanation for this lack of consensus is that the future still looks extremely uncertain for many organizations. While expectations around software spending are stabilizing, other indicators do not look as positive. For example, the number of new COVID-19 cases is now increasing in 39 states. The unemployment rate is also at 13.3%, the highest it’s been in the U.S. since 1940.

Tech Companies Cut Costs in Response to Revenue Reduction

Worries about revenue have been at the front of everyone’s mind for the past four months, and with good reason. During the COVID-19 pandemic, it’s been incredibly difficult for many companies to maintain the positive cash flow that’s critical for business success.

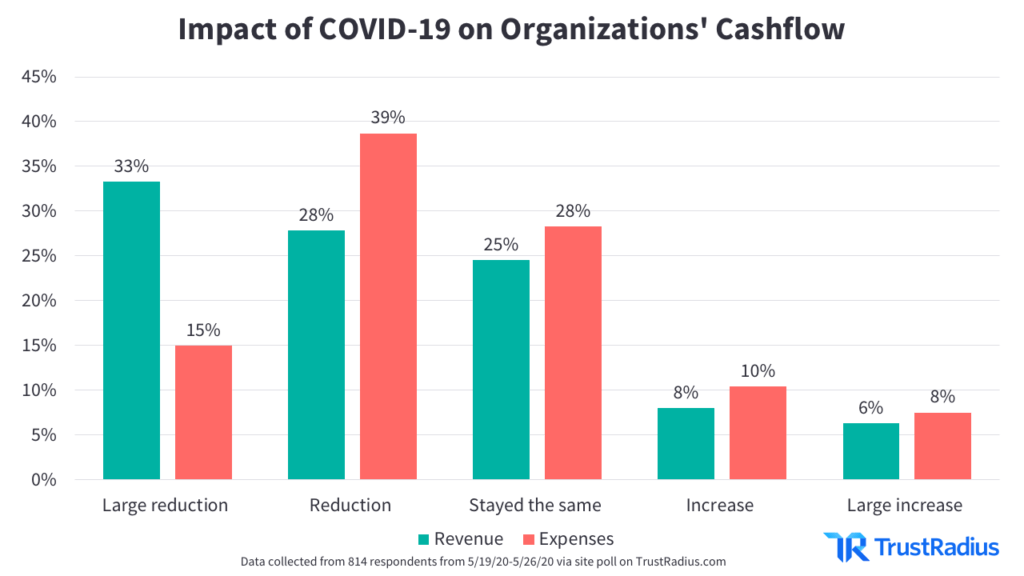

It should come as no surprise that in a survey of 814 TrustRadius users, a large percentage (61%) said their organizations have seen a reduction in revenue these past few months. About 1 out of 3 experienced a large reduction while 28% have seen a moderate reduction in revenue.

As you might expect, this has been matched by a reduction in expenses. About 54% of respondents reported that their organization has reduced their spending. It should be noted that only 15% of respondents said their organizations had a large reduction in expenses, while 33% experienced a large reduction in revenue.

This indicates that some companies have not been able to, or chose not to, balance out their loss in revenue by decreasing expenses. This could be because companies that experienced a relatively small reduction in revenue found that cutting expenses (usually via laying off employees) would be potentially more damaging to their business in the long-run than the hopefully temporary decrease in revenue.

For about a quarter of respondents, revenue and expenses were not impacted by the pandemic (25% and 28% respectively). This likely indicates that there is a small group of companies in the tech industry that have largely not been impacted by the pandemic. This may include companies that produce hardware and software whose demand is just as high for people working from home as for people working in the office.

How COVID-19 has Changed the Tech Industry

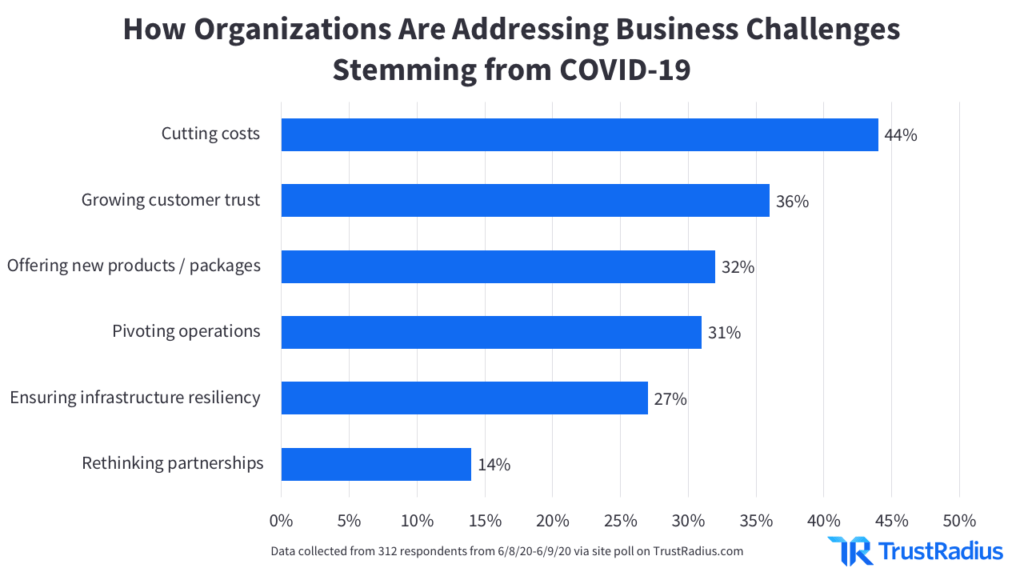

Along with shifts in revenue and expenses, many tech companies have changed their 2020 product roadmaps in response to the coronavirus pandemic. When asked how their organization is responding to business challenges brought about by COVID-19, 63% said they were either pivoting business operations or offering new products/packages.

This indicates that a majority of tech companies are seeking out new business directions. Organizations are developing new offerings or starting new projects to help handle changing business and consumer environments. For example, Salesforce has released four new ‘quick-start’ commerce packages. Large brand name grocery stores like WholeFoods are also converting some locations to ‘dark stores’ that are only used for curbside pickup or delivery.

Notably, 1 out of 3 respondents said they were focusing on ‘growing customer trust’ during this time. This is more important than ever, given that the business world has transitioned to an almost 100% digital environment.

Prospects and customers are not able to meet with vendor representatives in person, so marketing leaders need to focus on growing trust and confidence in their brand through digital channels. Many companies are partnering with customer voice platforms like TrustRadius to grow their online presence, collect customer testimonials and references, and ultimately influence their in-market buyers in lieu of face-to-face interaction.

Another 27% of respondents are focusing on “ensuring infrastructure resiliency” as a way to handle COVID-19-induced business challenges. For many companies, this means relying more on technologies that streamline business operations. According to data collected by IDC, the top five technologies tech companies are increasing their adoption of include:

- Video conferencing software

- Remote learning/training tools

- Secure connectivity software

- Virtual workspace platforms

- Cloud computing technology

New Projects for the 2020 Roadmap

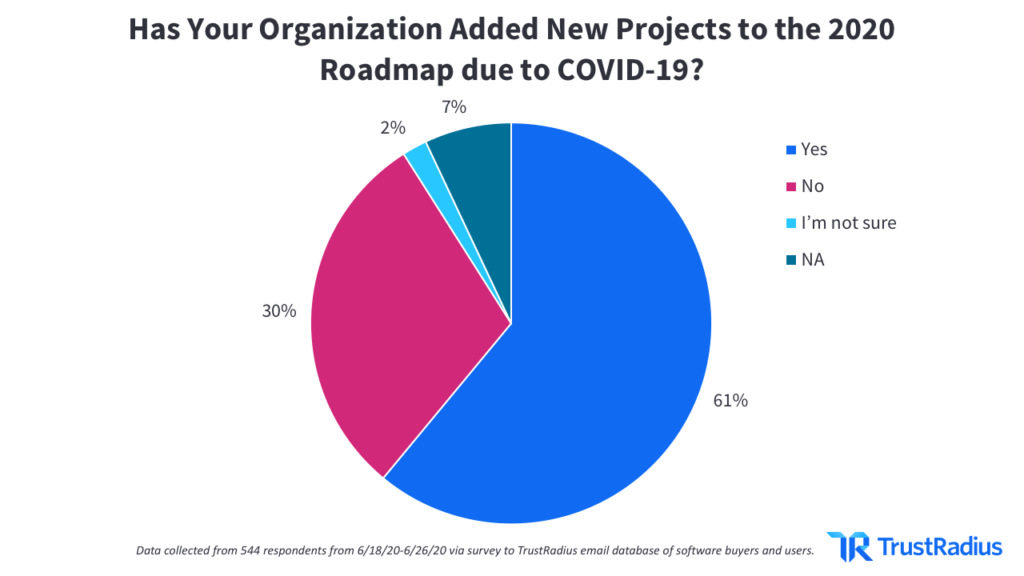

61% of our audience of business professionals said their organization has added new projects to their 2020 roadmap due to impacts from the pandemic. Notably, 30% said they had not added new projects. For many companies, balancing costs and incoming revenue during the pandemic has been difficult enough. These organizations likely don’t have the bandwidth or resources to add new projects, since most of their energy is being devoted to keeping their head above water.

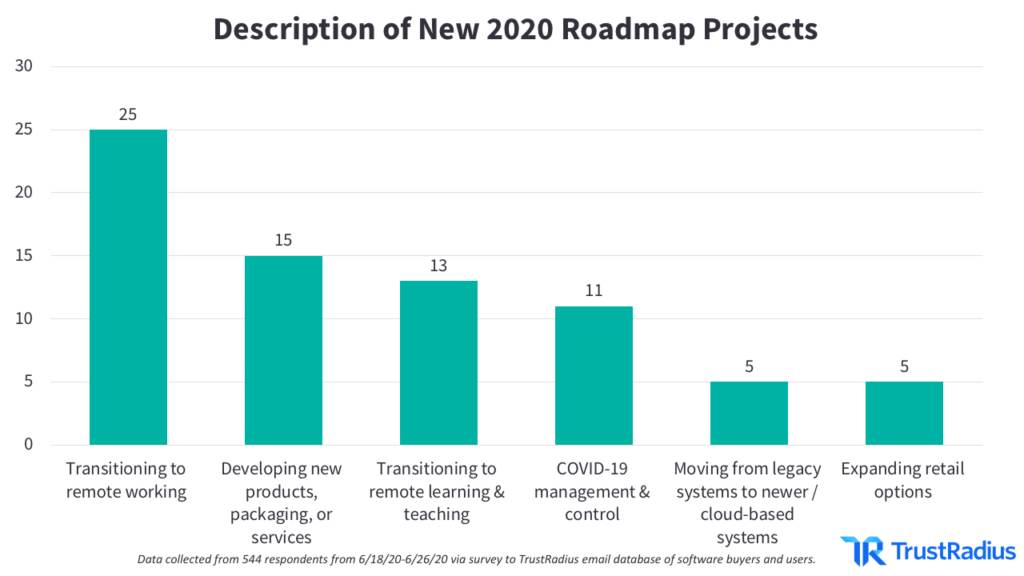

When asked to describe the new project(s) their organization had added to the roadmap, the most common type of project was helping the company transition to a fully remote working environment.

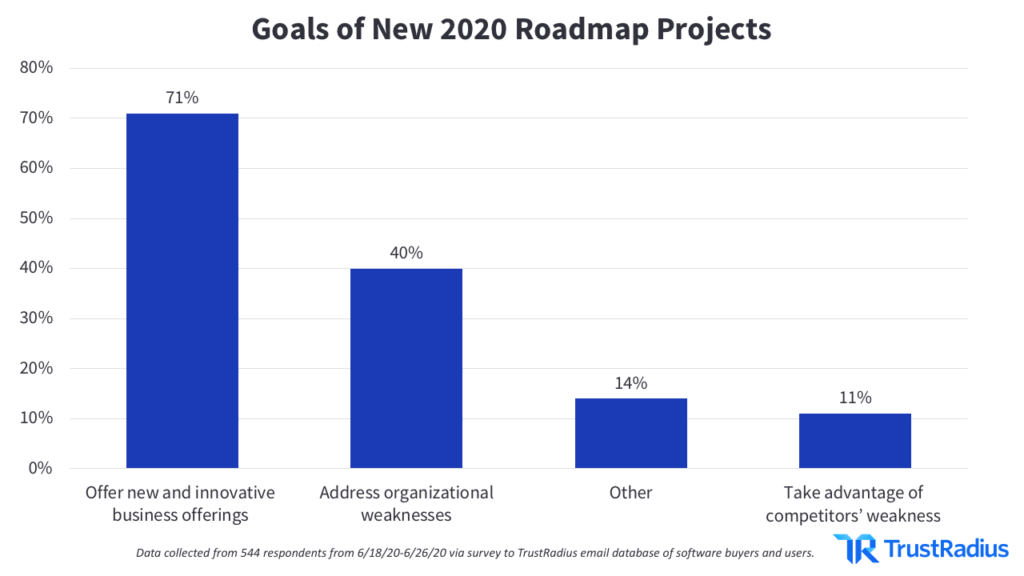

A large majority (71%) of tech companies that are adjusting their roadmaps plan to offer new and innovative products, services, or packages to their customers. Another 40% said the new projects were meant to address organizational weaknesses or inefficiencies.

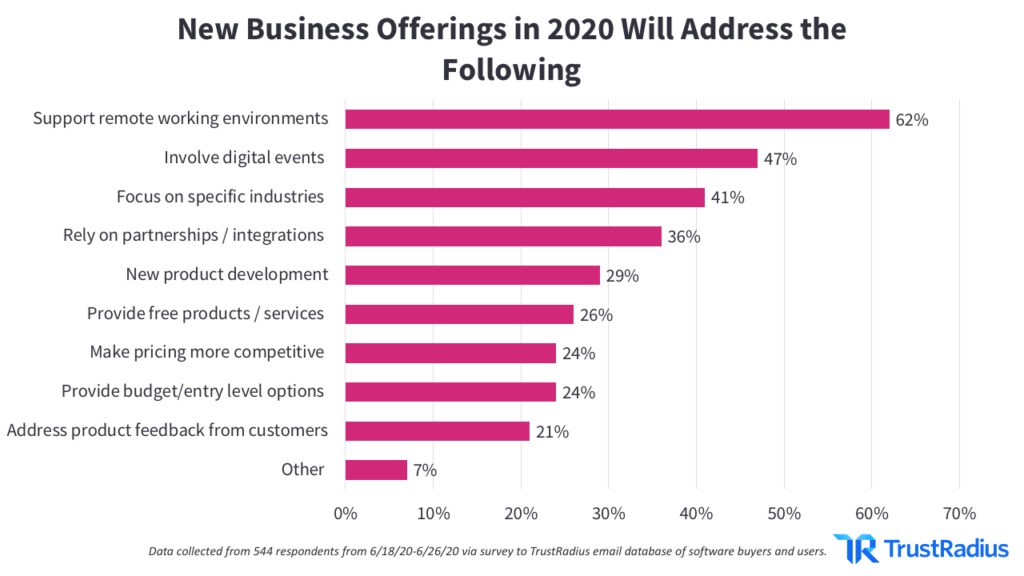

Of the 71% that said the projects will offer new products and services, a majority of new offerings are meant to support remote workforces. These data points further confirm that the main priority for tech businesses during this time is the need to successfully move to a work-from-home environment. Other common areas for innovation include digital events like webinars or online conferences, as well as products/services catered to specific industries.

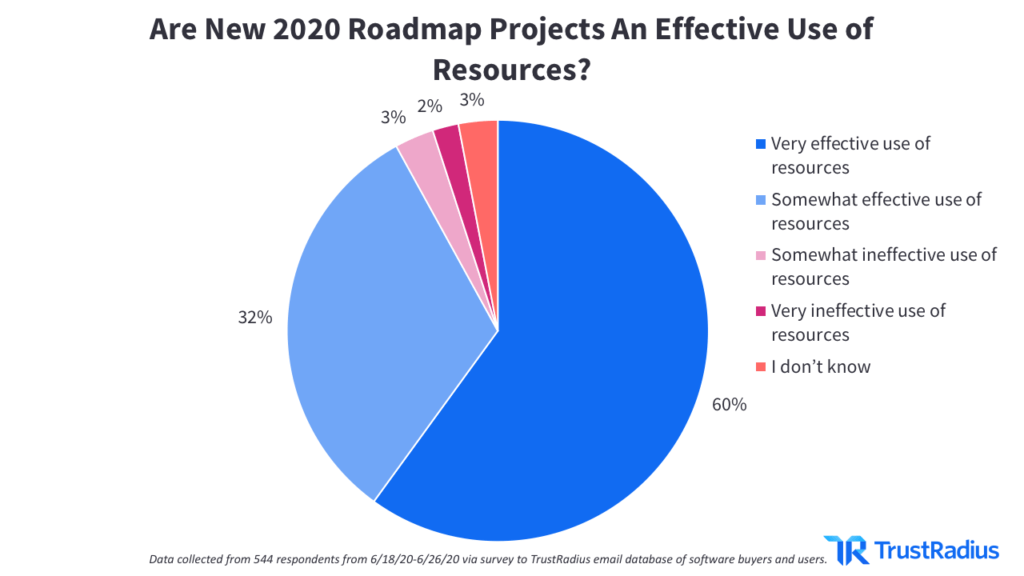

We were also curious about how companies perceive resource allocation for new roadmap projects during the pandemic. Many organizations are already experiencing a strain on resources and/or reduction in revenue, so is starting new projects that soak up funds and labor time a good use of resources?

The good news for tech leaders is that a majority (60%) thought these new projects were a very efficient use of resources, with another 32% saying they were a somewhat efficient use of resources. Over 90% of respondents think these new projects are worth doing.

Expectation vs. Reality With Employee Productivity

Being able to successfully move business operations to a 100% digital environment is no small feat. Concerns about employee productivity and wellbeing have troubled executives throughout this transition.

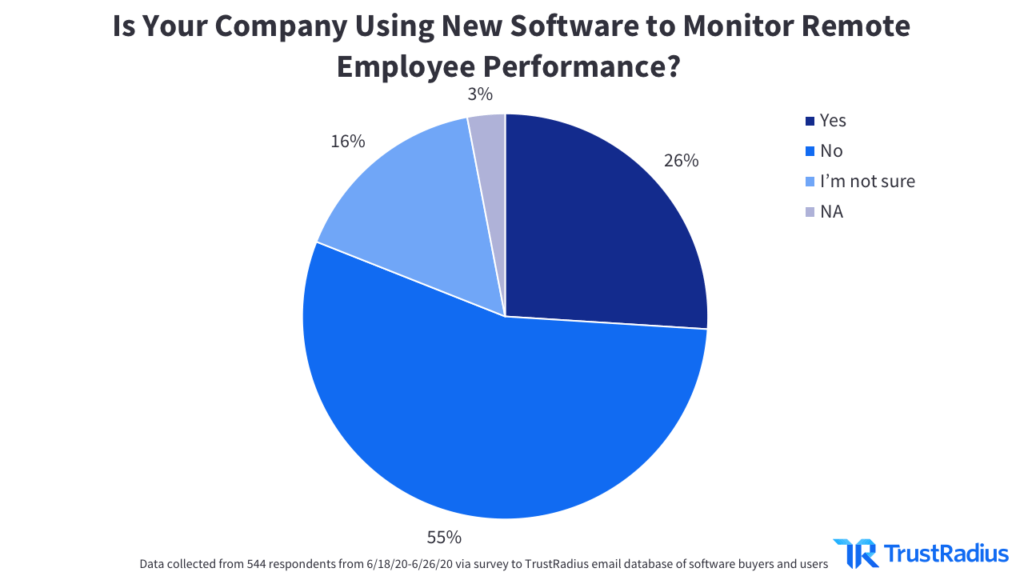

Some companies have turned to employee monitoring software to keep tabs on their workers and ensure they stay productive. However, your employees are probably more productive at home than you think—even in the middle of a global pandemic.

According to Gallup, employee engagement across the U.S. is the highest it’s ever been (38%) since Gallup started reporting on this metric in 2000. A recent study from Airtasker found that “on average, remote employees worked 1.4 more days every month, or 16.8 more days every year, than those who worked in an office.”

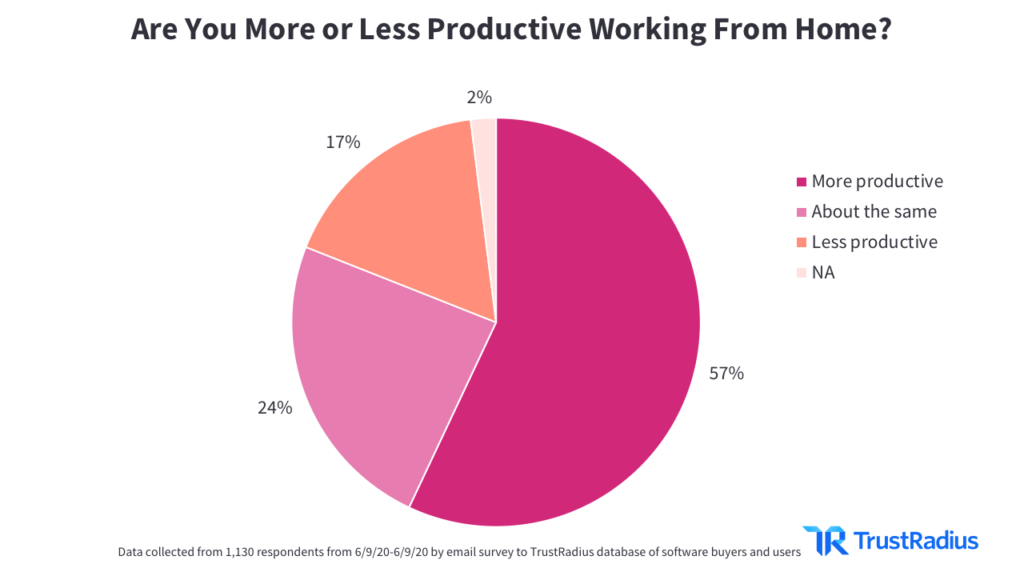

Our recent research supports that employees are actually more productive at home during the COVID-19 pandemic. A majority (57%) of business professionals surveyed reported they are more productive now, while working remotely, than they were before the pandemic. Another 24% said their productivity levels are about the same. Only 17% said they are less productive.

Our research also found that the majority of companies (55%) have not adopted new technologies to monitor employee performance during the pandemic.

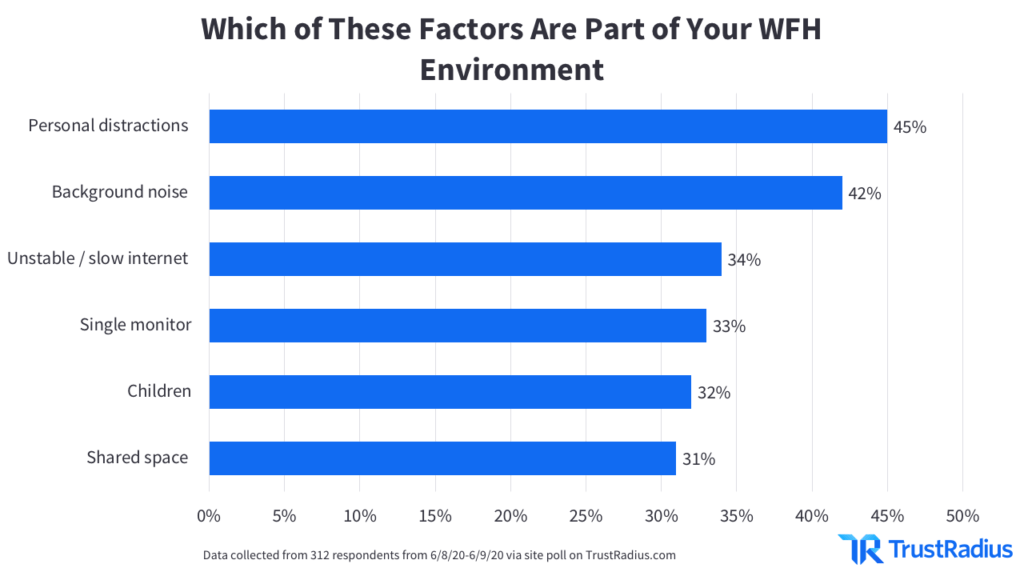

These results are fascinating not only because they help debunk concerns about employee productivity while working from home, but because remote working environments are full of distractions and challenges for many people. 45% of respondents said they have personal distractions in their WFH space, while 42% have background noise and 32% have children to take care of.

However, research suggests that taking ‘microbreaks’, any small activity that takes up to a few minutes, can help improve workers’ concentration levels. Some of the ‘distractions’ in the chart above may be helping boost employee productivity by allowing people to take microbreaks throughout the day.

Not needing to spend time commuting to work, taking leisurely lunch breaks, or having multiple casual conversations with colleagues throughout the day is another reason employee productivity levels have remained high in our WFH environment.

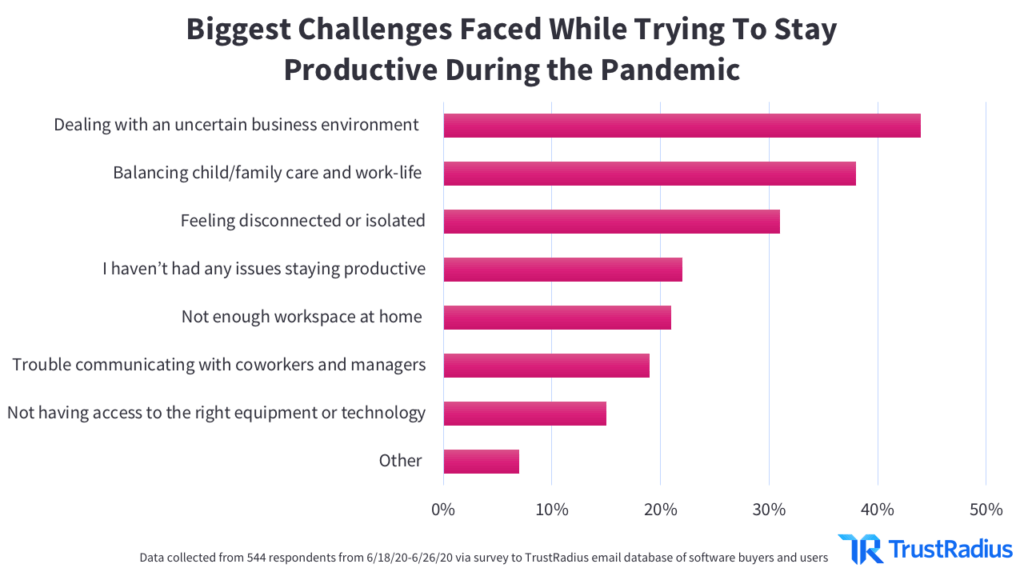

When asked more directly about the biggest challenges faced in terms of staying productive while working remotely during the pandemic, the most common response was coping with an uncertain business environment (44%). Balancing family care with work (38%) and feeling disconnected or isolated (30%) were the second and third most common responses.

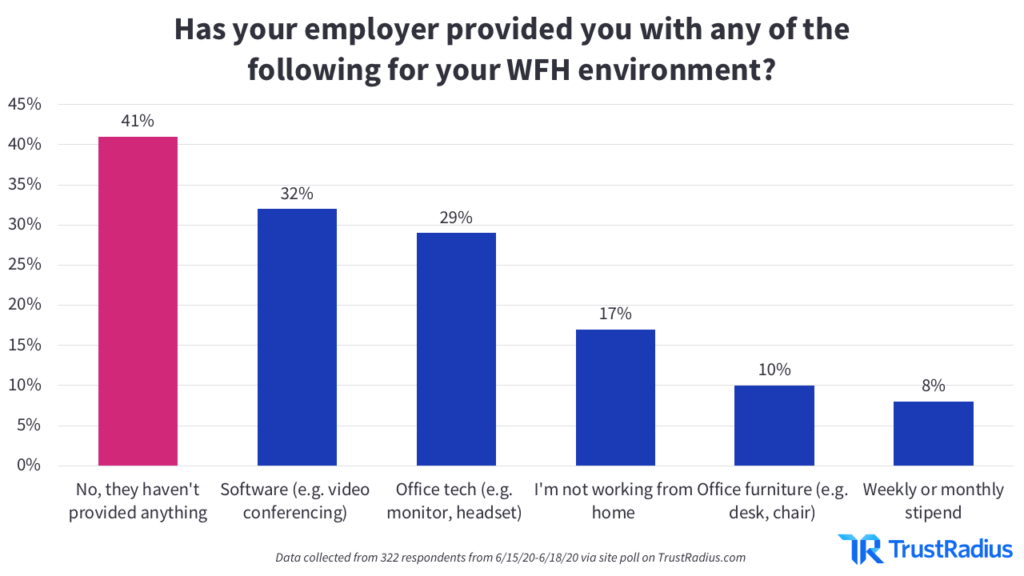

It’s clear that transitioning to working from home full-time is difficult at the company level and individual level. Some companies have stepped up to provide their employees with access to things like office furniture and equipment, weekly or monthly stipends, or software needed to communicate and collaborate online.

However, a large portion of respondents (41%) say their employer has not provided anything to help them transition to working remotely.

The Other Side of the Coin: The Important Role of Social Capital

While your employees are probably more productive than you think, they may be more unhappy than you realize.

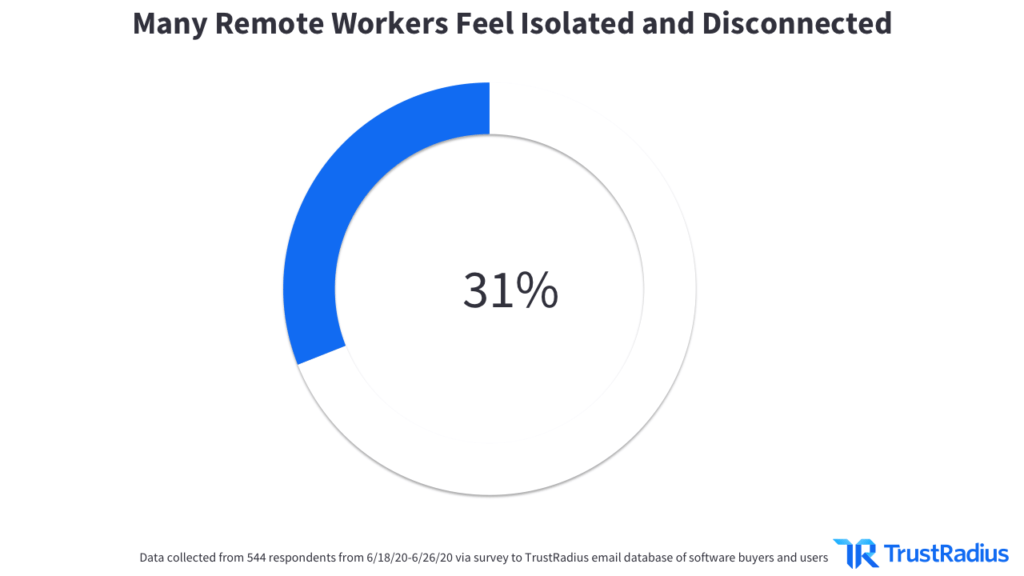

Employees may be more productive than tech leaders feared, maybe even more productive than before the pandemic. But remote workforces are also struggling with challenges such as social isolation, detachment, and lack of motivation. Notably, about 1 out of 3 respondents in our study said ‘feeling disconnected or isolated’ was their biggest productivity blocker.

As a society, we’re burning through the social capital created in the office, happy hours, lunchtime chats, coffee shops, etc., at an alarming rate. Social capital is made up of all the intangible yet essential elements of our daily interactions with the other people in our social network. Things like a shared sense of identity, motivations and goals, norms, values and associations, etc, are all examples of social capital. And businesses rely on social capital much more than they realize.

Social capital is what leads to truly collaborative and innovative thinking. It fosters motivation and allows people to feel like they are contributing to a common goal. Essentially, it’s the ‘secret sauce’ that makes businesses thrive.

For the tech industry especially, which survives on innovation and fast-paced growth, this is a big problem. Tech companies don’t only need to guard against low productivity, but against the hallmarks of low social capital: burnout, de-motivation, and apathy.

So for tech company leaders and executives, what are you doing to help generate more social capital within your organization? What new and inventive opportunities for collaboration are you testing? How are you enabling people to connect on a social level and have conversations not only about work?

This could be as simple as scheduling a non-work-related happy hour once a month, making time to (virtually) eat lunch with people you don’t normally interact with, or creating a fun ‘daily challenge’ that you and coworkers participate in. Here are a few more ideas for how companies can make space for creating connections while working remotely.

Crucial Learnings from Midway Through a Global Pandemic

The U.S. and the rest of the world are not out of the woods yet in terms of seeing the end of COVID-19. However, based on our tech industry and B2B software market research, we’ve learned a few key things so far about how the tech industry is responding and recovering.

1. Software spending is stabilizing

While budgets are still fluctuating, a large portion of companies (44%) don’t expect software spending to change. This follows a few months of instability, where the largest group of respondents in March (40%) expected spending to decrease and the largest group in April expected spending to increase (31%).

2. In some areas, tech companies have responded well

So far, 62% of business professionals think their organization has handled planning for the future well. As the pandemic continues to spread around the world, companies should keep an ear to the ground and be ready to respond to changes in their marketplace.

3. The pandemic presents opportunities for growth too

For a majority of companies (63%), changes stemming from the pandemic also present opportunities to pivot business operations or expand their offerings. In fact, 61% said their organization is planning on adding new projects to their 2020 roadmap due to the impacts of COVID-19. These projects will help businesses transition to remote working environments and provide their customers with new and innovative products & services to help navigate the pandemic.

4. Employees are more productive than you think

While tech leaders have been wary of a giant slump in productivity as a result of new remote working environments, these fears have not been born out. Employee productivity has largely not suffered as a result of the switch to working from home. In fact, research reports that remote employees may be more productive than in-office workers.

5. Productivity and social capital are necessary for success

Rather than worry about employee productivity levels, the things to watch out for are burnout, detachment and isolation, and lack of motivation. These can lead to decreased innovative and divergent thinking. Tech leaders should focus on ways to regain the social capital that’s usually created in the office while everyone is working remotely.

6. Tech leaders should stay up-to-date on what we’ve learned

The global pandemic is far from over, so companies should use the information and insights we’ve gathered so far to help prepare for the months ahead. At TrustRadius, we’ve researched how COVID-19 has impacted different aspects of our industry. These include:

- Women In Tech

- Software purchasing behavior

- Software spending patterns

- When employees will return to work

- Software industry interest

One strategy that many tech companies use to stay on top of today’s evolving software market is intent data. Customer voice platforms like TrustRadius allow software vendors access to a whole new set of buyers who are actively reading reviews, comparing top products, and considering alternatives. This unique bottom-of-the-funnel data helps bolster pipelines and offers invaluable insights that can help you stay ahead in your category.