The 2019 B2B Buying Disconnect Report

This is old news. We’ve got new research for 2022.

This year, for our annual industry study, we surveyed 941 people who helped buy or sell major business technology for their company in the past year. We asked 712 buyers what they bought, who was involved, how they did their due diligence and why they ultimately picked one solution over the others, as well as what it’s like to be a customer now. We also asked vendor marketers and salespeople for their side of the story, too: from the tactics they use to educate and engage prospects, to the difficulties they face in deal cycles.

What did we find? Well, let’s just say buyers and vendors don’t see eye to eye! Read on for the juiciest results and download the full report here. You can use these to stir the pot, shake things up with your coworkers or clients, and advocate for change.

The trust gap in the B2B buying process is as wide as ever.

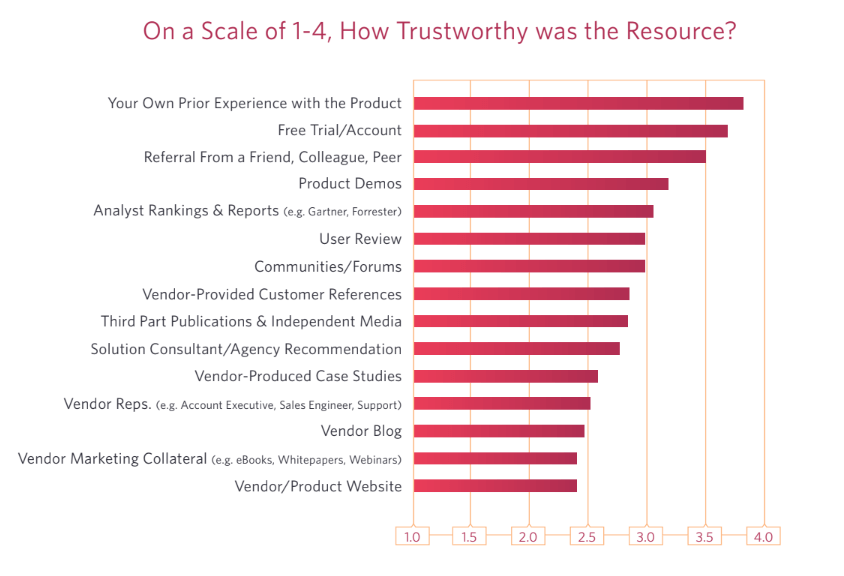

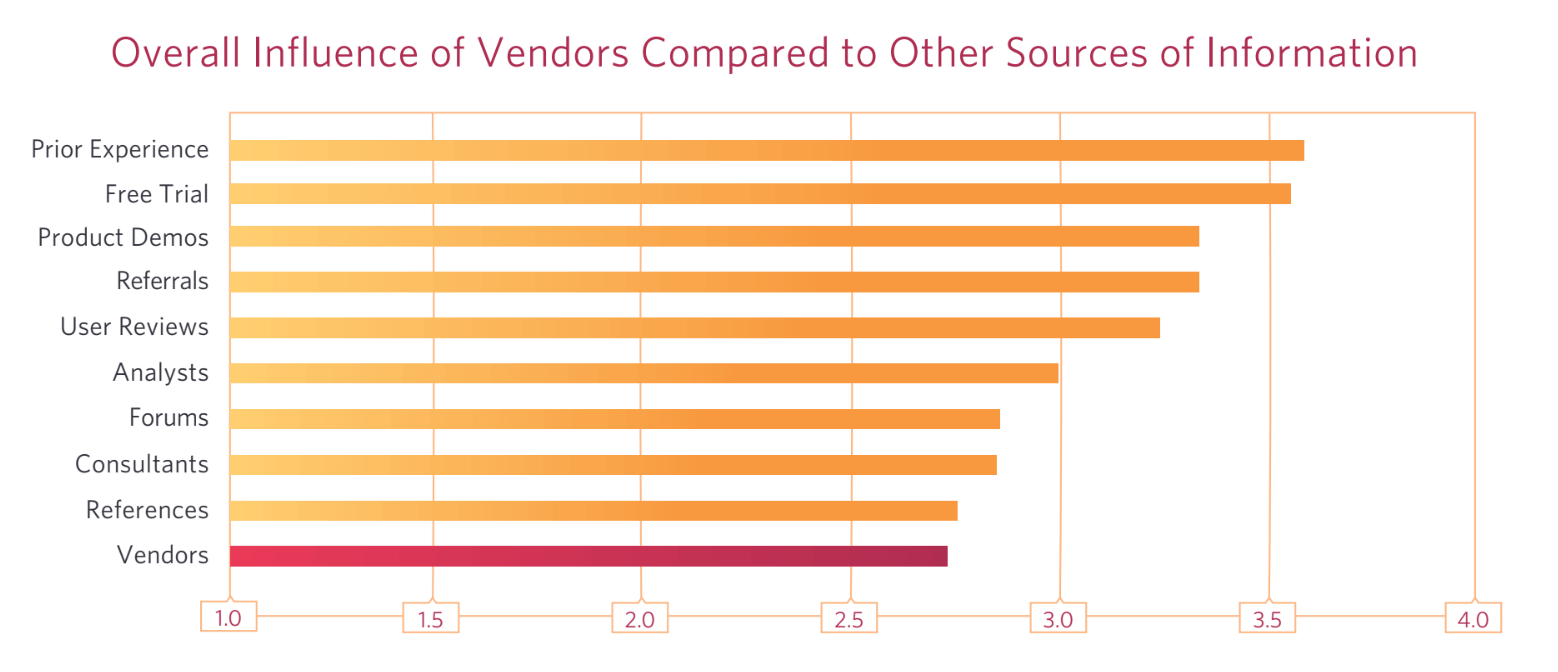

Vendors overestimate their own transparency—i.e. how well they’ve earned buyer trust—by more than 2x! We asked buyers to rank all of the sources they used during the buying process in terms of how trustworthy and influential they were, and it turns out that vendor-controlled sources of information (sales reps, blogs, websites, marketing collateral, etc.) come in dead last.

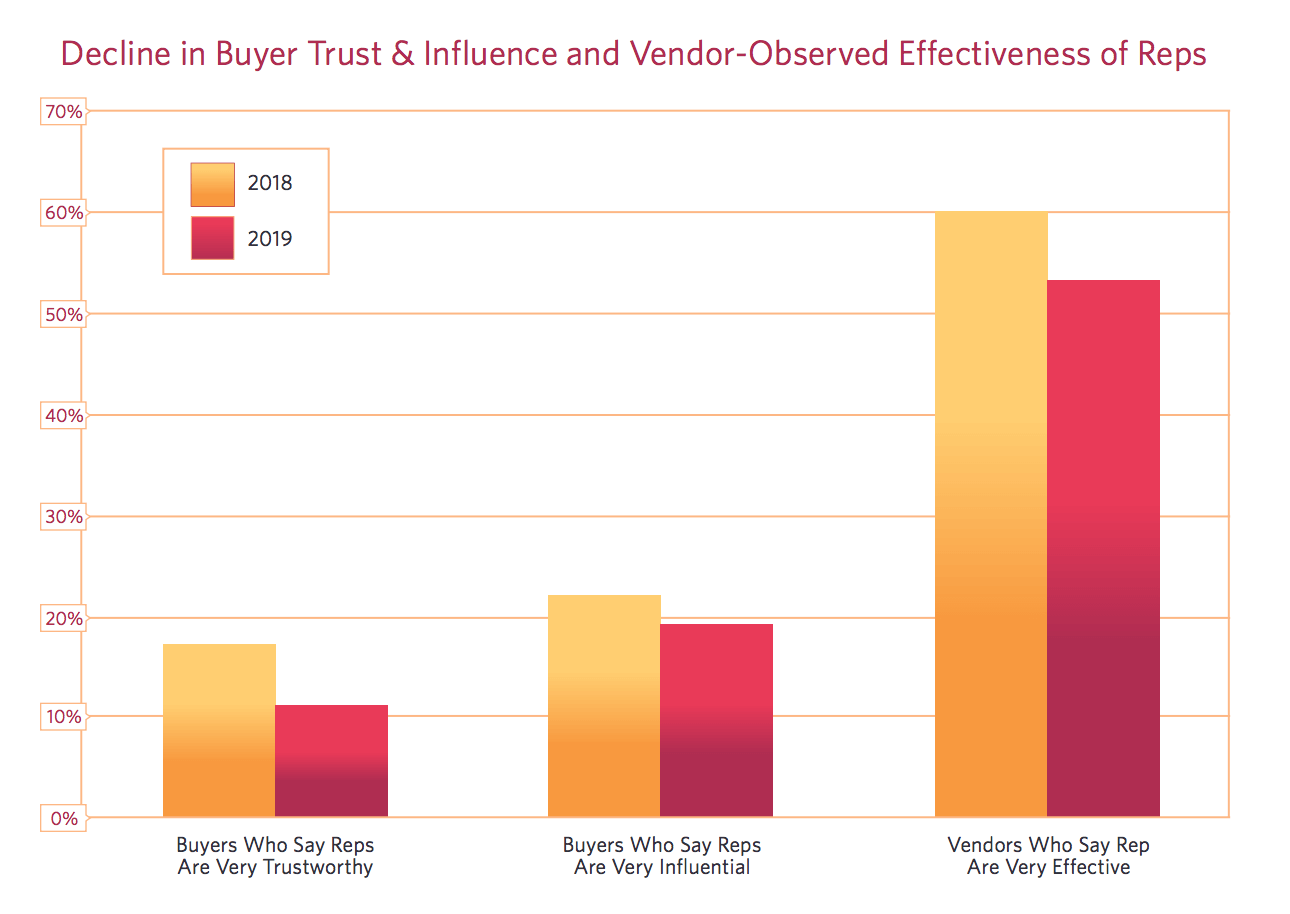

The effects of the trust gap are starting to snowball and fewer customers than ever take your representatives seriously.

Vendors’ failure to meet buyer expectations year over year is starting to lead to a decline in the trustworthiness, influence, and effectiveness of vendor representatives. This year, only 11% of buyers said vendor representatives were very trustworthy, and only 19% said vendor representatives were very influential in making their decision.

This is far below the 53% of vendors who said they thought reps were very effective at helping move their buyers towards a decision. But even technology vendors recognize the effectiveness of reps is slipping—that number fell 7 points from last year.

There’s no sugar-coating it. Doubt and uncertainty are at an all-time high.

Only 1 in 5 buyers said the vendor they bought from was very influential in helping them choose that product over alternatives

On average, across buyers, vendor reps and vendor-provided resources had low influence during the purchasing process. Buyers tend to see vendors’ overall influence as less than that of every other individual source of information available except for third-party publications, independent media, and the sources of info produced by vendors themselves (vendor reps, case studies, websites, marketing collateral, and blogs)!

That means that the work vendors are doing to influence buyers isn’t working as it should.

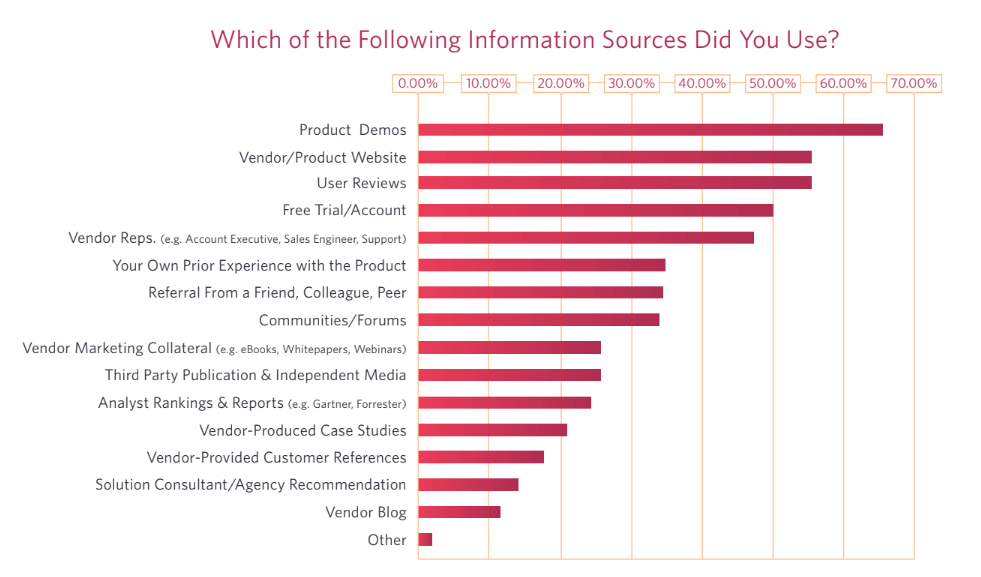

We’ve passed a tipping point—over half of buyers rely on reviews, while less than 1 in 4 buyers relies on analysts.

Reviews grew about 13% in usage in the last year. Reviews are now tied with the vendor/product website for #2 most used information source (behind product demos, which is #1).

Meanwhile, analyst rankings and reports saw a 22% YoY decrease. So why are vendors investing more in analysts, if, according to vendors in our survey, they’re tricky to work with and not particularly effective, and they’re being used less and less by buyers?

You probably want the 2021 version of these stats.

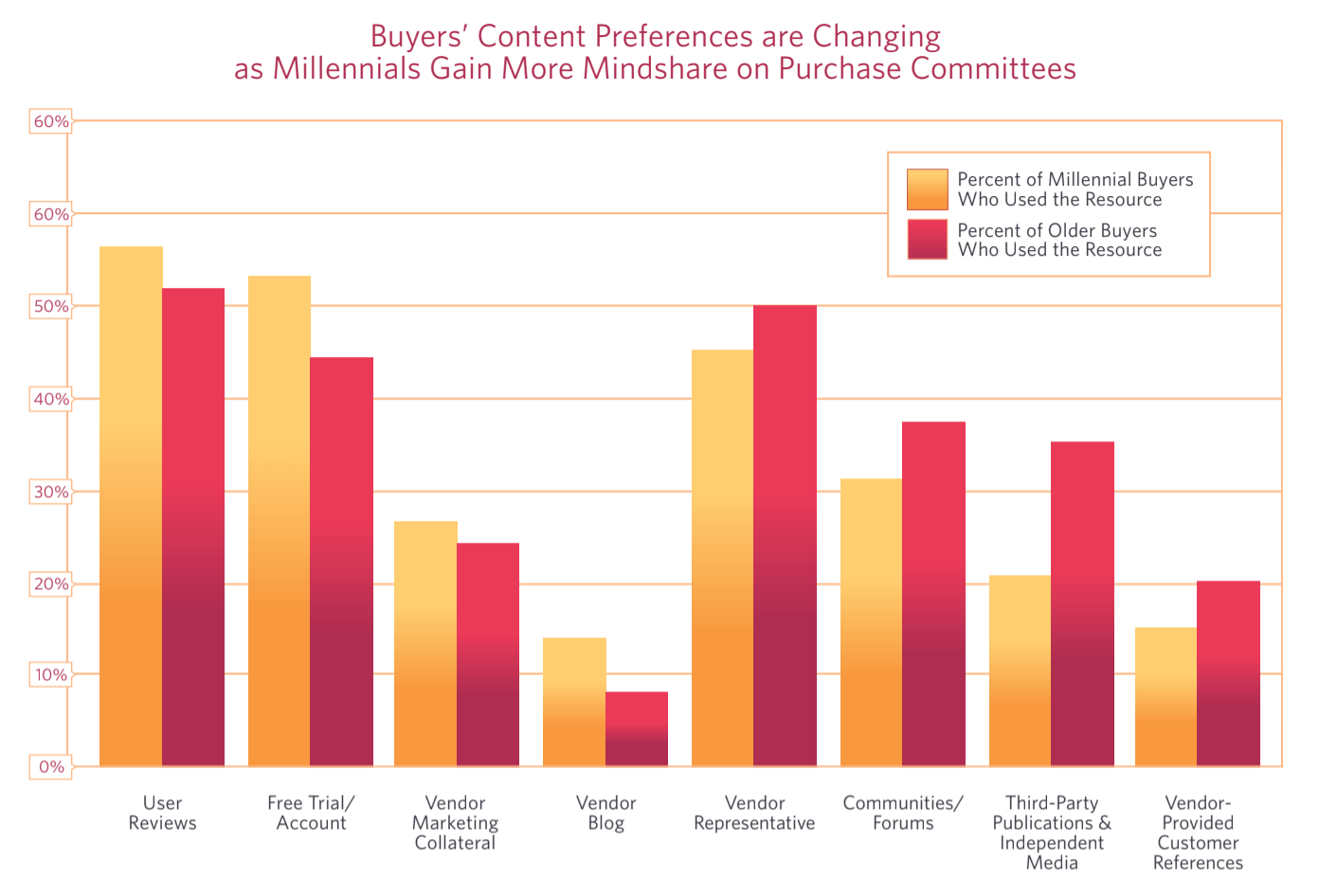

59% of our buyer survey respondents were millennials. Around 1 in 3 millennials identified themselves as the lead buyer.

It turns out that millennials don’t just buy avocado toast—they are also the people you now need to influence to get the deal done. Millennial buyers rely on user reviews, free trials/accounts, and vendor blogs slightly more than other age groups. They also have higher standards for transparency, and trust vendor representatives less than older buyers.

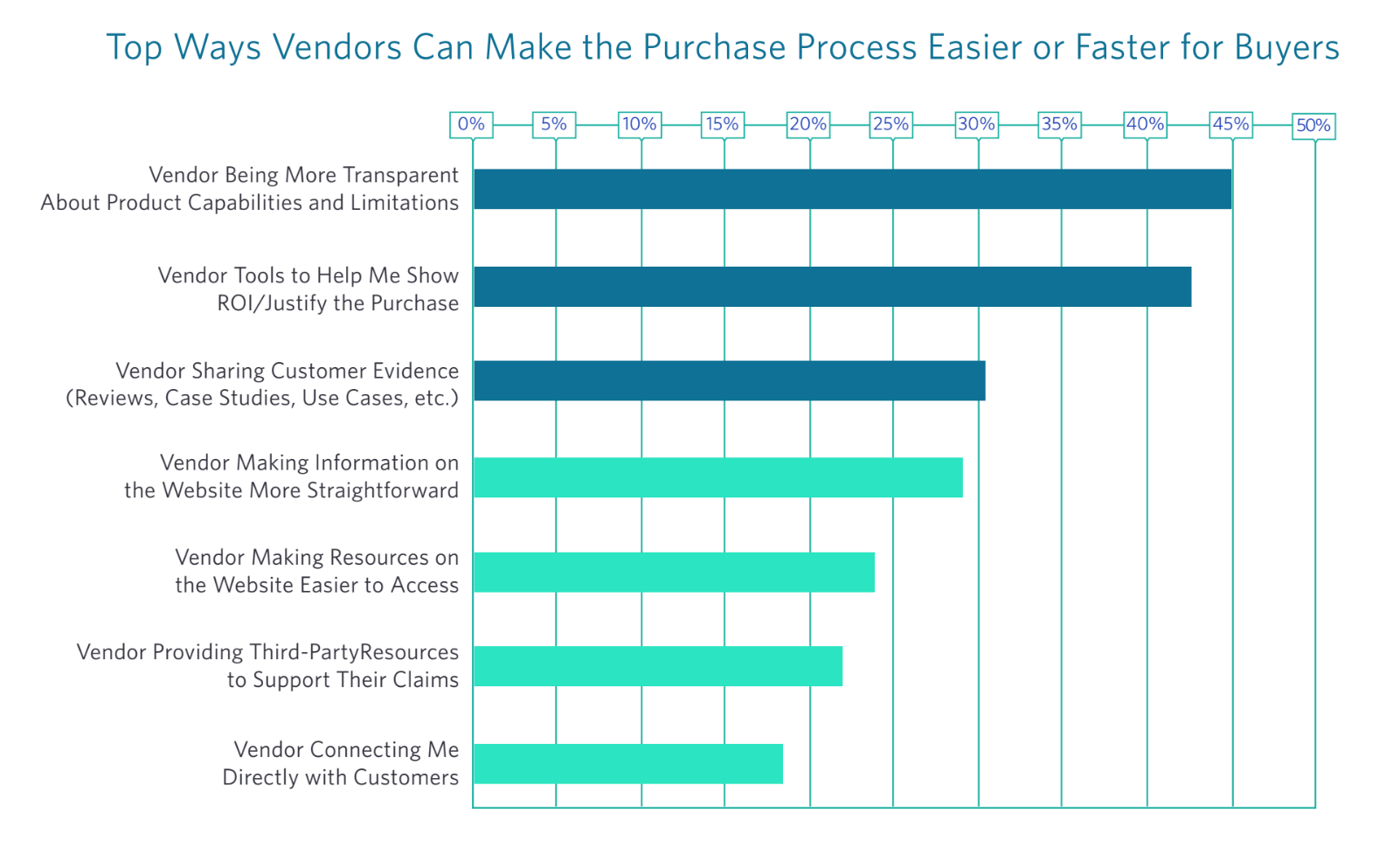

According to buyers, the top thing vendors can do to speed up purchase cycles is to be more transparent about product capabilities and limitations.

But only 42% of vendors thought it was very important to their buyers to understand the cons before buying the product! This perhaps helps explain why only 36% of buyers felt the vendor they bought from was very forthcoming about product limitations—since it’s about the same amount who acknowledge that the cons are crucial information! The reality, of course, is that 71% of buyers say it’s very important to understand the cons before buying. One thing buyers and vendors can agree on: when it comes to investigating the cons, reviews are by far the go-to resource.

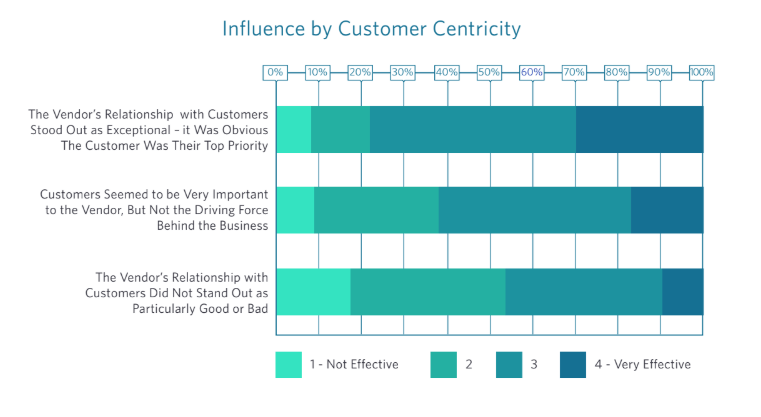

Customer-centric vendors had more influence with their buyers and were 4x more likely to say their reps were very effective.

When vendors made customer voice central to their business strategy, they were more than 4x as likely to say their own reps were very effective. Since 3 out of 4 buyers said they’d be willing to advocate for the product they bought, there’s plenty on the table for vendors to scale their customer voice programs.

This is the key—after all, vendors who infuse customer voice throughout their business end up being more influential with buyers.

Whether you are looking to understand how the buyer’s journey has changed and why your old strategies to sell technology aren’t working as well as they used to, become more customer-obsessed, or you want an edge over your competitors in a hotly contested, crowded space, this report is for you.

Download the 2019 B2B Disconnect today.