What Does the Looming Recession Mean for B2B Marketers?

Changes within the business world and in our society and economy at large just haven’t stopped coming. And now, with talk of a looming recession, businesses are finding themselves needing to pivot yet again.

As Wall Street forecasts a recession, organizations are seeing the need to become smarter and savvier than ever, with tighter budgets and higher demands. With less leeway for extra costs, organizations need to be creative when spending marketing dollars, using their budgets more efficiently, fixing gaps in pipeline/demand generation, and building a closer alignment with sales.

Today’s tech buyers

The news of an upcoming recession not only affects the seller side of B2B marketing, but the buyer side as well. Our 2022 B2B Buying Disconnect report uncovered some prominent shifts in buying habits, likely because of today’s economic landscape, as well as millennial and Gen Z’s B2C buying preferences transferring over to the B2B world.

Self-service research

Today’s buyers want to self-educate, and don’t want to meet directly with a vendor as their first research step. In fact, our research found that virtually 100% of buyers want to self-serve part or all of their buying journey, and a large portion check review sites as their first step after identifying a need.

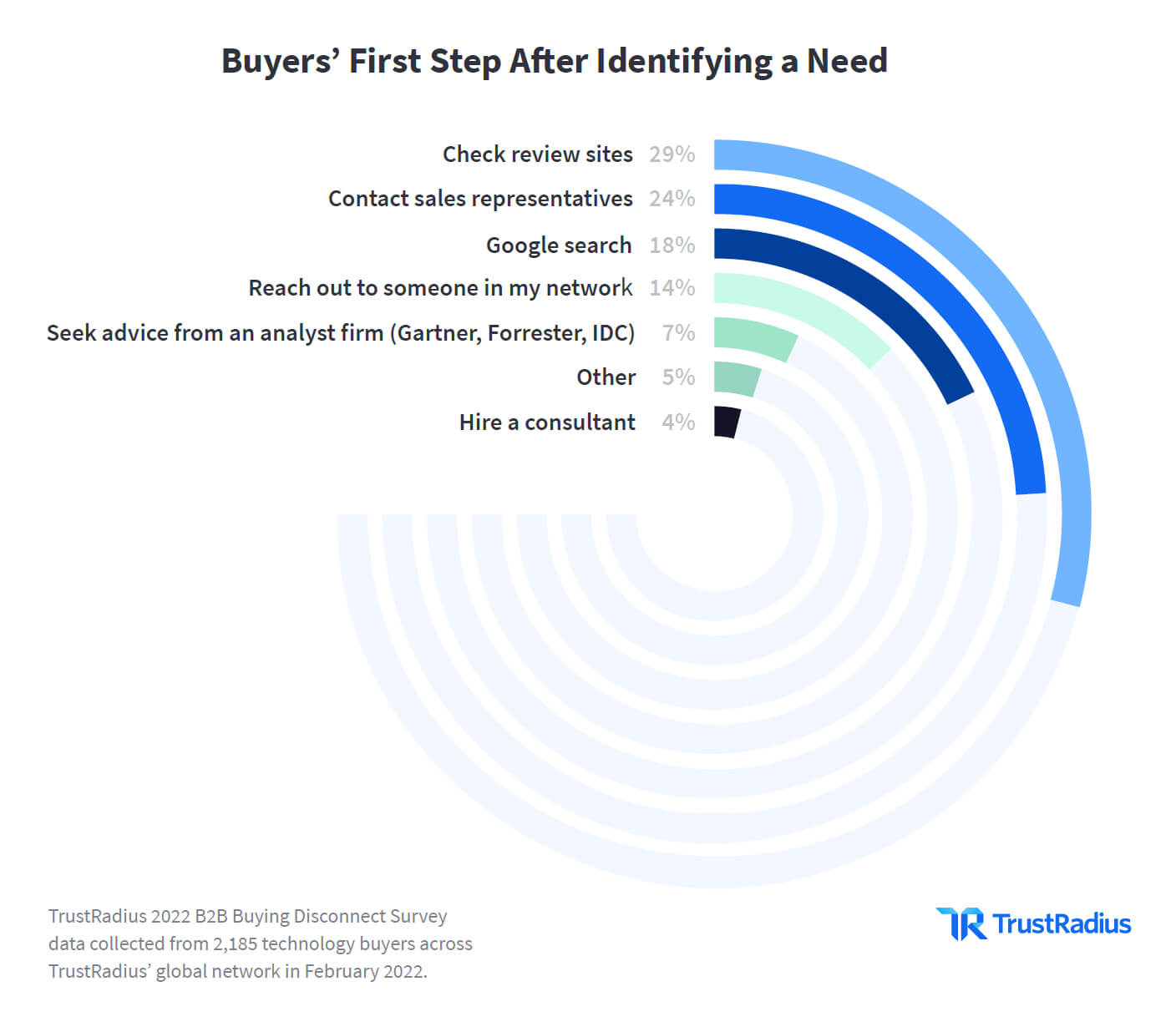

Millennials—and particularly Gen Z—are accustomed to having information readily available at their fingertips. Their online behaviors are now affecting the buying process, as buyers expect more self-service. 77% of buyers say that once they identified a need, their first step was to do their own research: whether checking review sites (29%), conducting a Google search (18%), reaching out to a peer (14%), or seeking advice from a consultant or analyst (7%).

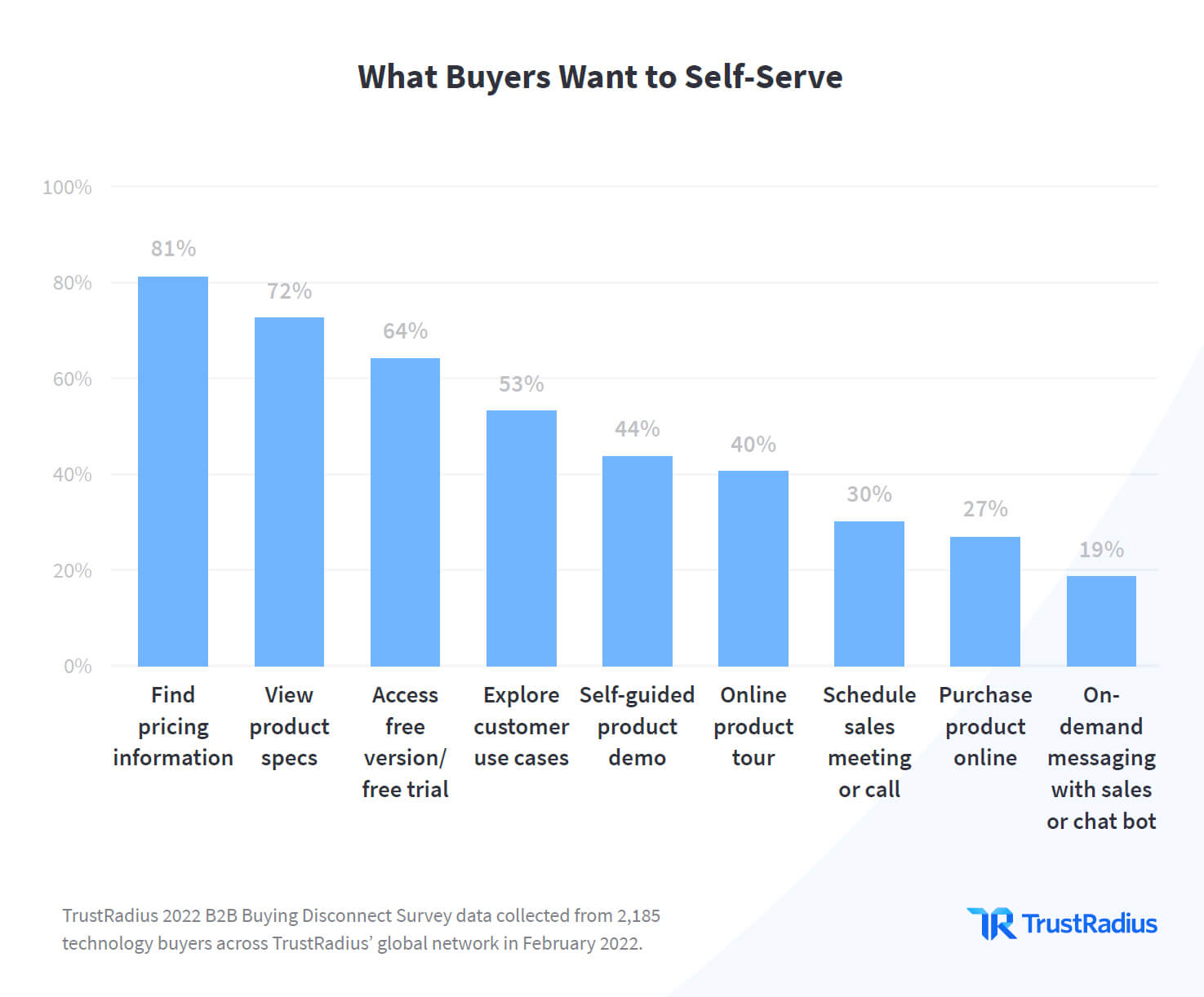

The top three information sources buyers self-serve are pricing (81%), product specs (72%), and access to a free trial (64%).

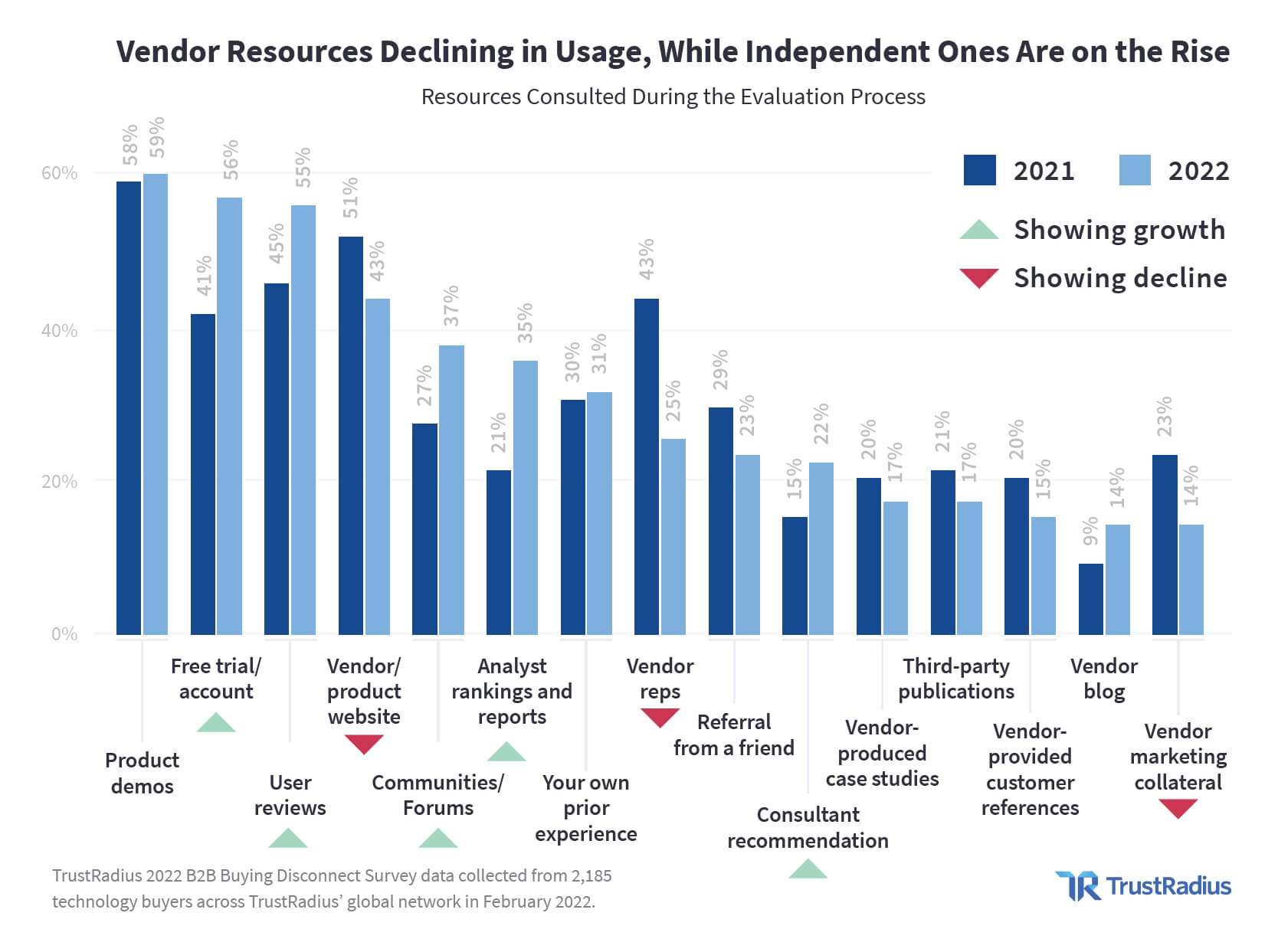

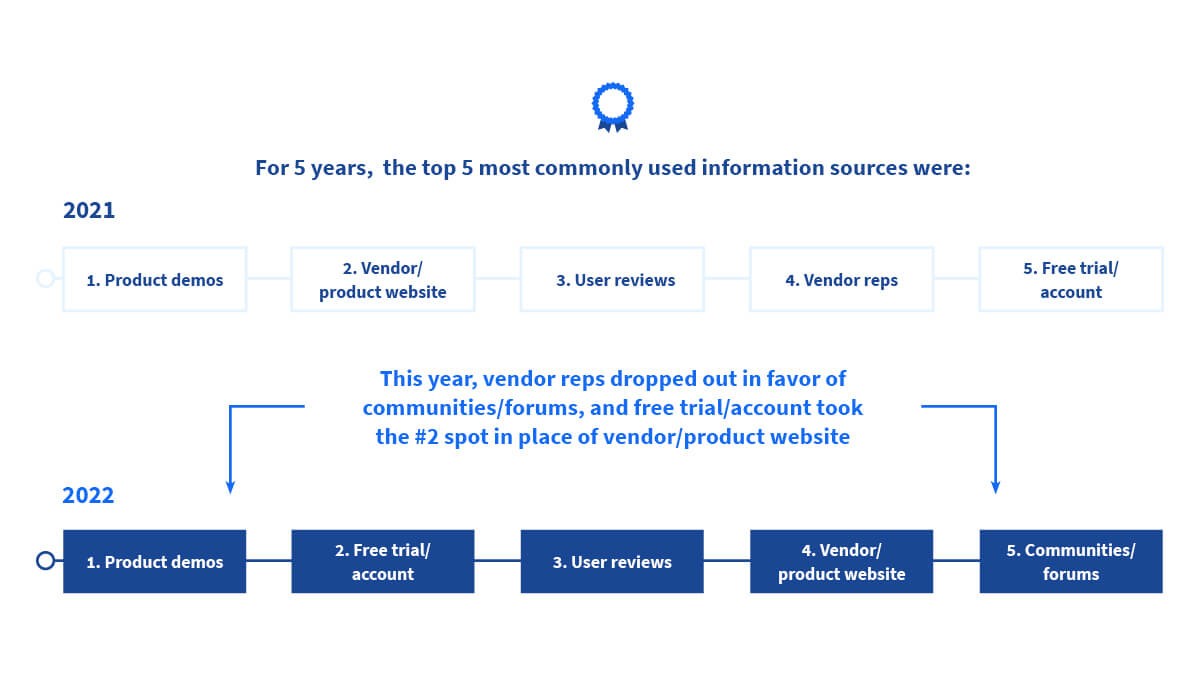

Buyers are looking for information from as many sources as they can—and this doesn’t always include your website or marketing materials. In fact, customers are more likely to read reviews (55%) than visit your website (43%). Today’s buyers want to learn from trusted sources like review sites, community forums, and analyst rankings. Year-over-year usage of vendor-provided content has significantly dropped from 2021 to 2022.

The typical buyer in 2022 does much of their research online, then comes to a conclusion before ever engaging with a sales team. Today’s buyers might still interact with your sales team, but first and foremost, they use social proof and other self-service resources to validate your claims.

Buying committees

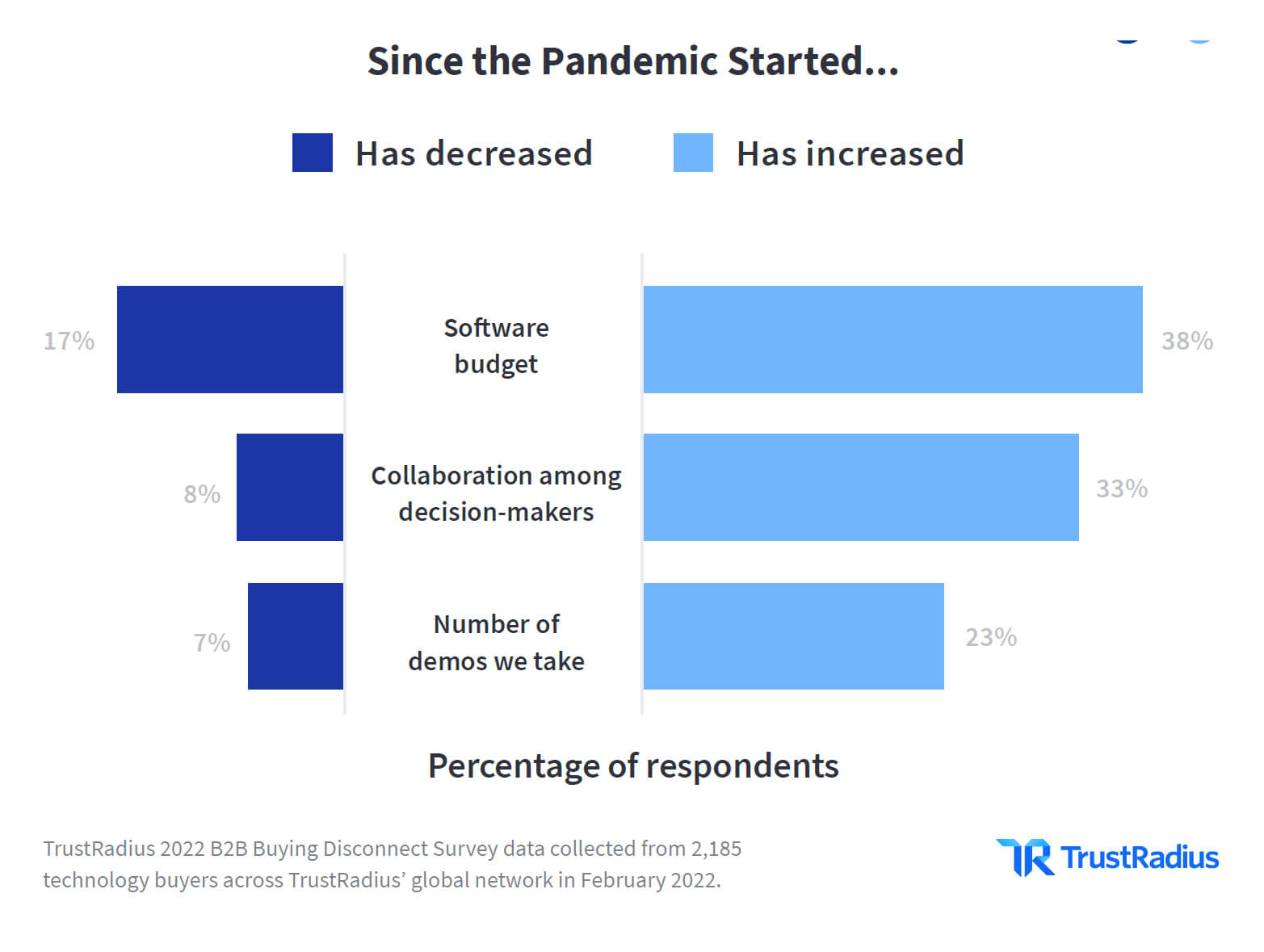

In addition, purchase decisions are now going to committees rather than individuals. 33% of our report respondents said that they have increased collaboration among decision-makers.

Because of this, B2B marketing needs to address a broader audience and a larger variety of personas. And since this variety of decision-makers is researching, marketers need to focus on providing easily shareable and discoverable resources.

A need for social proof

Today’s buyers are also on the search for powerful social proof, often on third-party sites. They no longer trust the claims made by vendors and seek to validate seller claims with proof such as user reviews. Our report revealed that out of the top five resources used by buyers, vendor/product websites dropped from second to fourth place in one year.

In addition, the majority of tech buyers today are millennials (25-40 years old). This demographic has a tendency to value third-party resources, and was most likely to report that the most impactful resource for their research process is “user reviews.”

Fewer cold calls

In times of economic uncertainty, B2B companies tend to put pressure on their marketing and sales teams, but customers don’t want to receive cold outreach anymore. Only 11% of survey respondents indicated outreach from salespeople as a reason they’d be more likely to buy. Conversely, 64% stated cold calls as the number one reason they’d cross a vendor off their short list. Cold outreach—calls or emails—is outdated and ineffective.

How can B2B companies thrive during a recession?

As B2B companies prepare for a looming recession, it’s imperative they tailor their GTM strategy to the age of the self-serve buyer. From the 2022 B2B Buying Disconnect report, we learned that buyers of all generations prefer to self-serve. Vendors that continue to use traditional go-to-market methods, such as cold prospecting and generic marketing campaigns, will find that buyers gravitate to vendors that meet their need for self-service.

In addition, these new buying habits can be leveraged by businesses to work smarter—not harder—in times of economic uncertainty. Rather than spending money on high-cost lead lists or sending out tons of cold outreach, sales/marketing teams have better ways to reach an in-market audience. The changing tides of our economic landscape will push businesses to make the shifts that were on the horizon anyway. Companies will put themselves in the best position for success in the face of a recession by shifting their mindset and meeting buyers where they are in their journey.