2023 B2B Buying Disconnect: The Self-Serve Economy Is Prove It or Lose It

Executive forewords

Welcome to our seventh annual B2B Buying Disconnect Report: The Self-Serve Economy Is Prove It or Lose It. Since 2016, the TrustRadius research team has tracked year-over-year changes in business technology buying and selling trends. With each report, we uncover changes in how technology buyers research, evaluate, and choose tools for their business—and turn those insights into opportunities for tech go-to-market teams looking to better engage with their target audiences.

In this year’s report, we see previous trends—like the rise of the self-serve buyer—further entrench itself as our new reality, and surface new ones driven by today’s economy.

With constrained budgets and uncertain markets, buyers are more likely to take safe bets when it comes to new tech purchases. Technology companies looking to thrive in 2023 and beyond will satisfy their prospective buyers’ demands with provable ROI, easy-to-access information, and a clear case to get the CFO to sign on the dotted line.

As a leader of a B2B go-to-market team, it’s all I can do to keep pace with the rapidly evolving B2B buyer. Their habits are changing at an accelerated clip: their influences more varied, their resources manifold and what’s more, they’re keeping their own counsel and relying on first hand experience and trials to make their buying decisions more than ever before. For sales and marketing teams, the game is changing – demanding new thinking to continue to connect with buyers and deliver resources and information on their terms. This TrustRadius report, now in its 7th year, is an essential guide to help point the way forward for the B2B marketplace.

Economic impact on the B2B buying journey

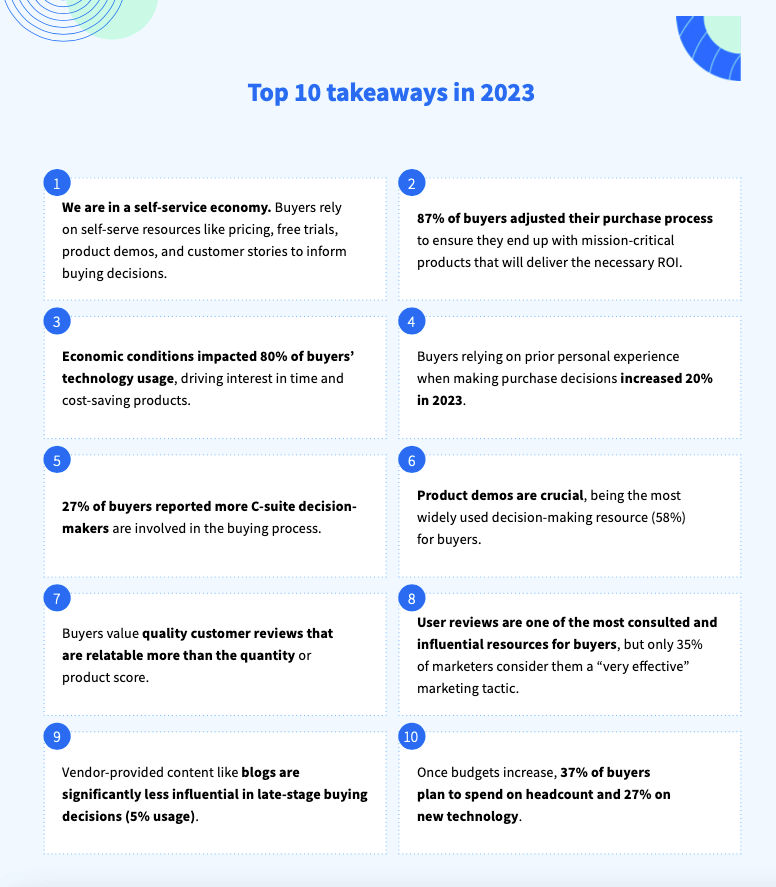

One thing is clear—the recent economic climate has completely challenged the traditional go-to-market playbook. 87% of technology buyers adjusted their buying process to ensure they only buy mission-critical products that will provide ROI. Companies are still making technology purchases, but to earn their attention, consideration, and trust, you have to prove your value early in the decisioning process. In this report, the 2023 B2B Buying Disconnect: The Self-Serve Economy Is Prove It or Lose It, discover what buyers are still spending on, why they are more risk-averse than in the past seven years, and how go-to-market teams can rewrite their strategy to attract their target buyers.

In our 2022 B2B Buying Disconnect: The Age of the Self-Serve Buyer report, we learned that vendor-provided content was quickly dropping out of the top five most-consulted sources for informing a purchasing decision. In fact, five out of six vendor-provided sources saw significant drops from 2021 to 2022, and remained underutilized.

To remain competitive in 2023 and beyond, brands have to prove their worth. Otherwise, they will fall victim to product consolidation.

This year we’ve learned that to make a buyer’s shortlist, it’s essential to prove your value where they’re doing their research—and that goes way beyond your website. Not only that, but the messaging can’t just come from you. In-market buyers are ignoring vendor-provided sources like blogs, websites, and even analyst rankings and cold calls—and turning their focus to self-serve product demos, user reviews, free trials or hands-on experiences, and prior self-experience.

To remain competitive in 2023 and beyond, brands have to prove their worth. Otherwise, they will fall victim to product consolidation.

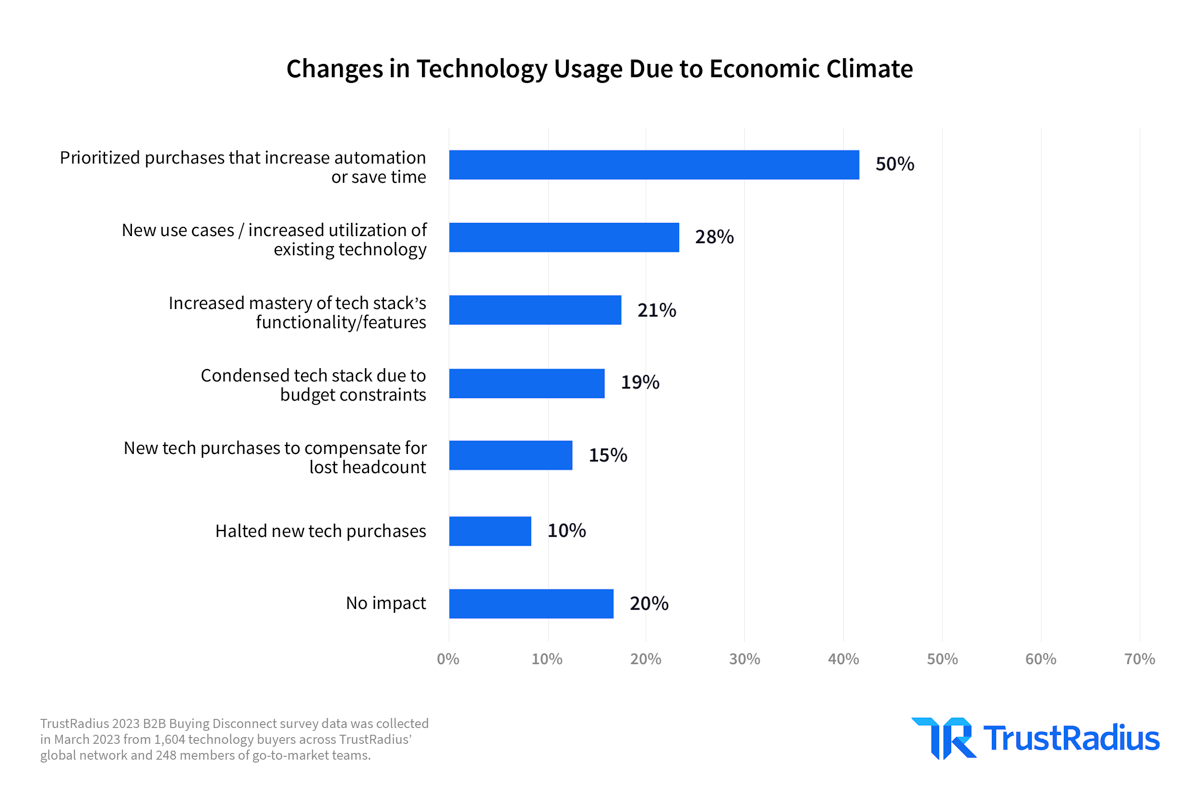

Changes in technology usage due to economic climate

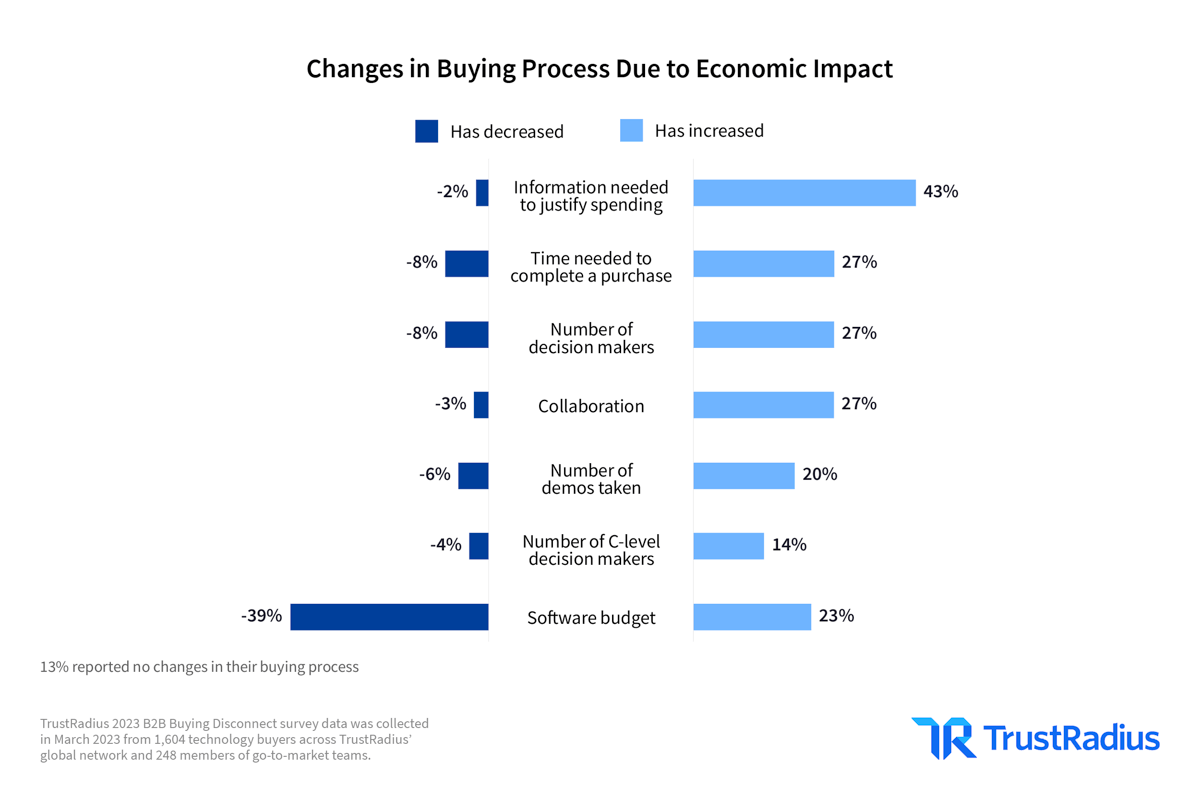

We know the economic climate has changed how buyers use technology, as well as their process for making new purchase decisions. The good news is that while budgets have decreased, spending hasn’t stopped. Instead, buyers are more risk-averse and their decisions require more time, input, collaboration, and proof of ROI.

With a reduction in budgets and headcount, it should come as no surprise that 50% of buyers have prioritized purchases that enhance automation or save time, with an additional 15% looking at new tech purchases to compensate for headcount loss. Only 10% have halted new tech purchases.

The oversaturated technology space has hit its tipping point and buyers are challenged to do more with less, make strategic technology purchases, and collaborate even more than the prior year on decision-making. 43% say the information needed to justify spending has increased, and 27% across the board say that the amount of time, number of decision-makers, and amount of collaboration have all increased as well. Meanwhile, 39% say their budget has decreased.

50% of buyers have prioritized purchases that enhance automation or save time.

Collaboration among decision-makers in today’s economy

You may recall in our 2022 B2B Buying Disconnect report, 1/3 of buyers said that collaboration among decision-makers had increased since the pandemic. In times of economic uncertainties, and as buyers continue to become more risk averse, buying committees are getting larger (even more so for enterprise companies with 10,000+ employees).

In this year’s report, 27% of buyers said there were more decision-makers involved in their buying process due to the current economic climate. 14% of buyers said there were more C-level decision-makers involved, especially in enterprise organizations. The CFO is holding the purse strings, and that means buyers are on the hook to prove value up front to get the approval they need. This is an important shift that go-to-market teams have to address in their strategy.

One of the most notable increases from 2022 is that 51% of buyers are more likely to purchase a product they already know and have experience with. (You’ll read more on this in the next section). But, since 43% of buyers stated they need more information to justify software spend, it’s likely they want to avoid uncertainties and select a proven product.

27% of buyers said that there were more decision-makers involved in their buying process due to the current economic climate.

Diving into the data

Buyer decision-making and resource usage

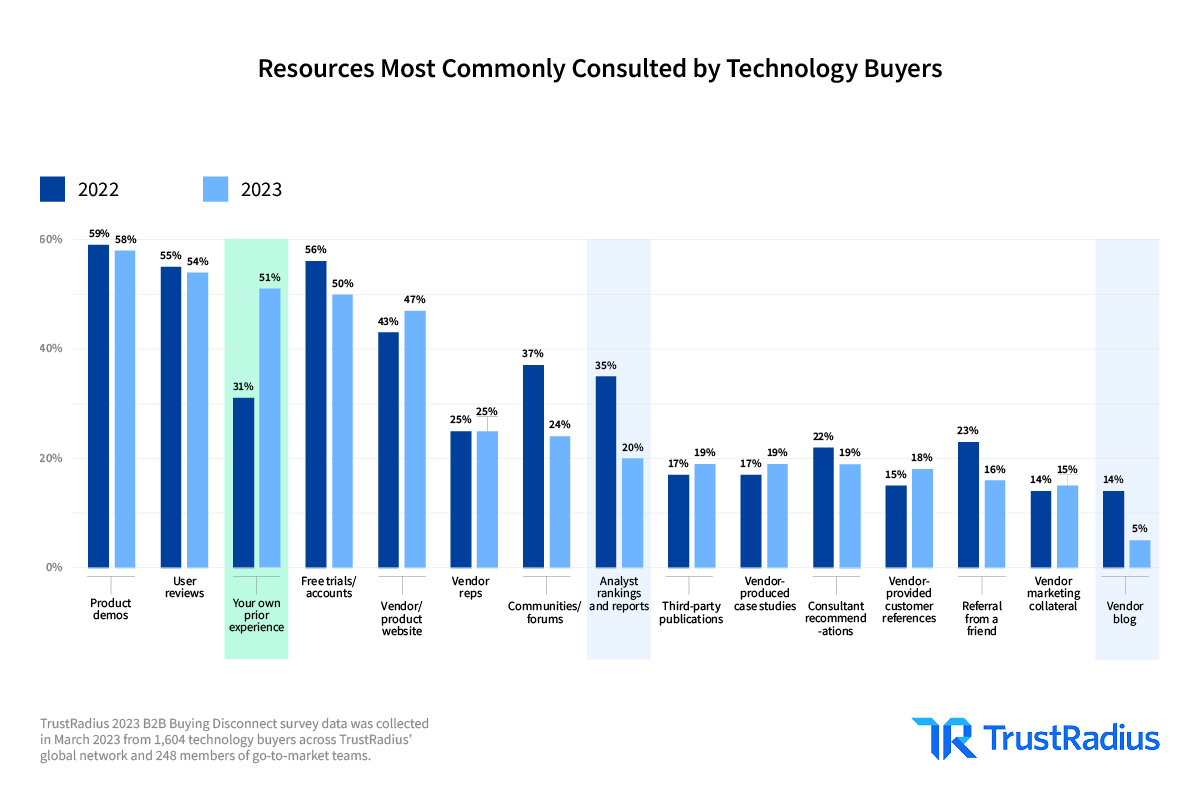

Each year we ask buyers which resources they consult to inform their purchasing decisions; among them are 15 answer choices plus a write-in option. For the past six years, use of product demos, user reviews, and free trial/accounts have consistently been in the top five most commonly used information sources by buyers.

That said, use of vendor-provided resources has been in constant decline year-over-year. In fact, in 2022, significantly fewer buyers reported consulting vendor representatives, dropping that resource out of the top five completely. This drop proved true across all company sizes and purchase price segments. Also, use of vendor/product websites have dropped from the second spot at 51% in 2021 to the fifth spot at 47% in 2023. Meanwhile, product demos remain strong in the first spot, while user reviews (+10%) and free trials/accounts (+9%) have both seen record growth since 2021.

New to the top five in 2023, is the use of “your own prior experience” as a commonly consulted resource, with a massive 20% jump from 31% in 2022 to 51% in 2023.

61% of buyers named "own prior experience" as the #1 most commonly used resource at the largest companies (10,000+ employees.)

Most influential resources for technology buyers

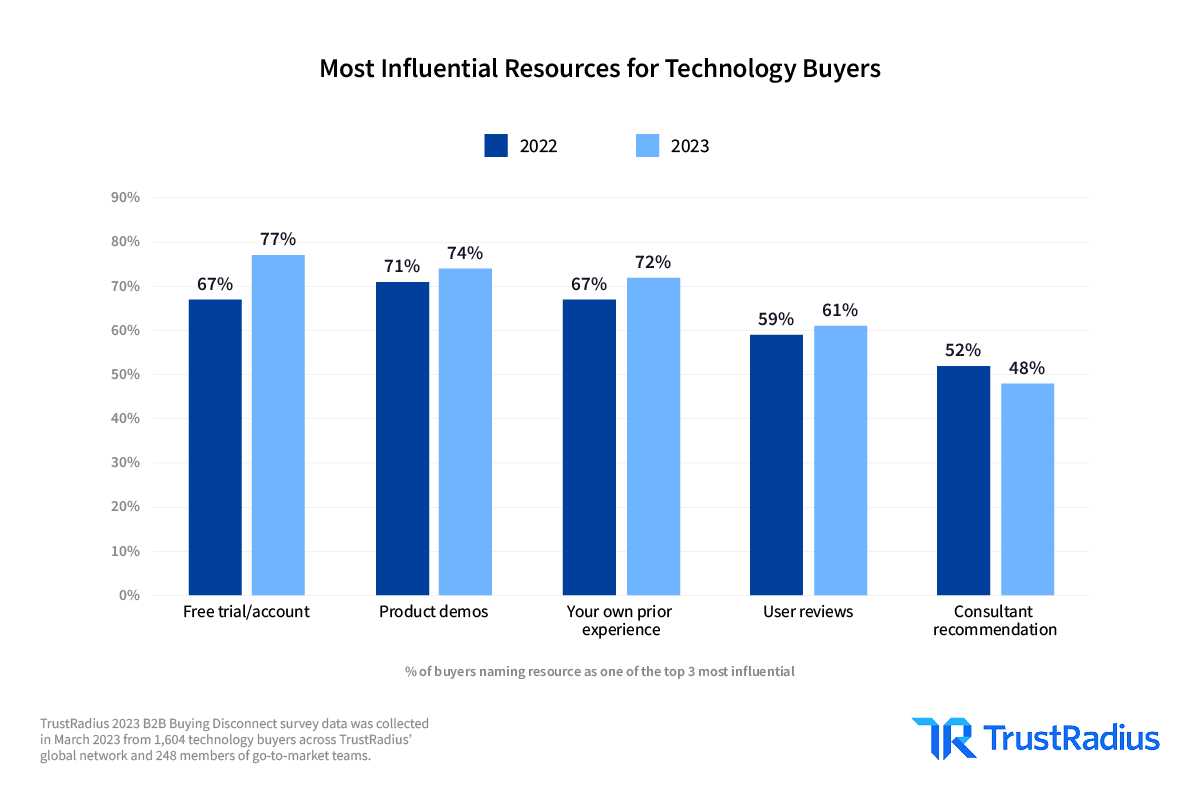

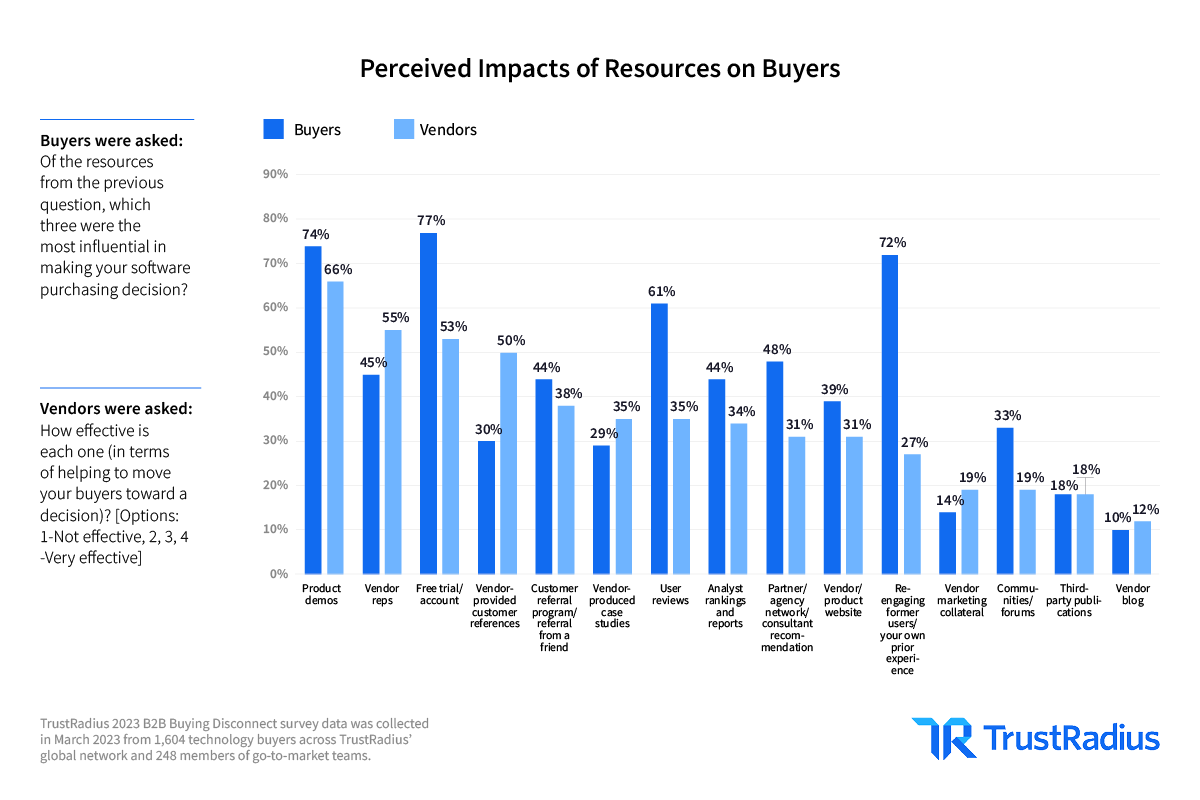

We asked buyers to select the top three information sources they consulted and influenced their decision the most.

As you can see from the top five most influential resources, buyers are becoming increasingly self-sufficient, relying mostly on self-serve resources to inform their buying decisions. Free trials now lead the pack, growing 10% from 67% in 2022 to 77% in 2023—moving it from the second most influential resource for buyers to the first. Product demos, prior experience, and user reviews are also highly influential. Buyers want to try before they buy and they want to understand a current customer’s experience with the product.

Product demos rank second at 74%, which is no surprise as it has consistently ranked in the top five resources used by buyers for seven years running. But what’s interesting is the growth in the buyer’s own experience, with 72% naming it as one of their top three most influential sources impacting a purchasing decision.

Risk-averse buyers require more justification for software spend. They consult their peers, seek hands-on experience, and rely on their own personal experience with a product.

TIP: Product demos showcase real-life applications, but experience matters. To offset a buyer’s lack of familiarity, and since 54% of buyers consult reviews, offer diverse quality reviews that tell a story through the customers’ eyes, building trust with peers. #ProveItOrLoseIt

What does this mean for vendors? Buyers want to see tangible proof that your product will solve their business problem, and taking your word for it just won’t float. Given buyers are in a “prove it to me” mindset, they want to self-serve accessible product information that gives them the tangible experience needed to make a confident decision, and most importantly, that includes a solid ROI story supported by customer proof points.

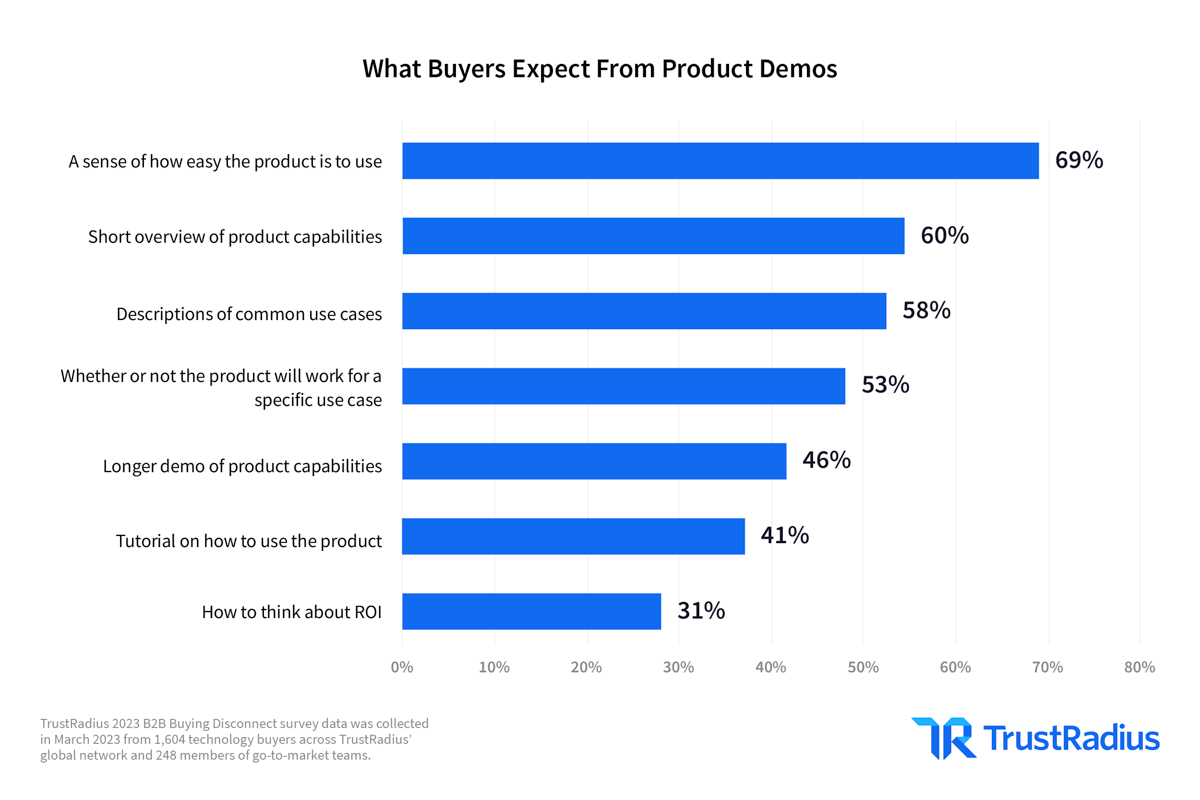

What buyers expect from product demos

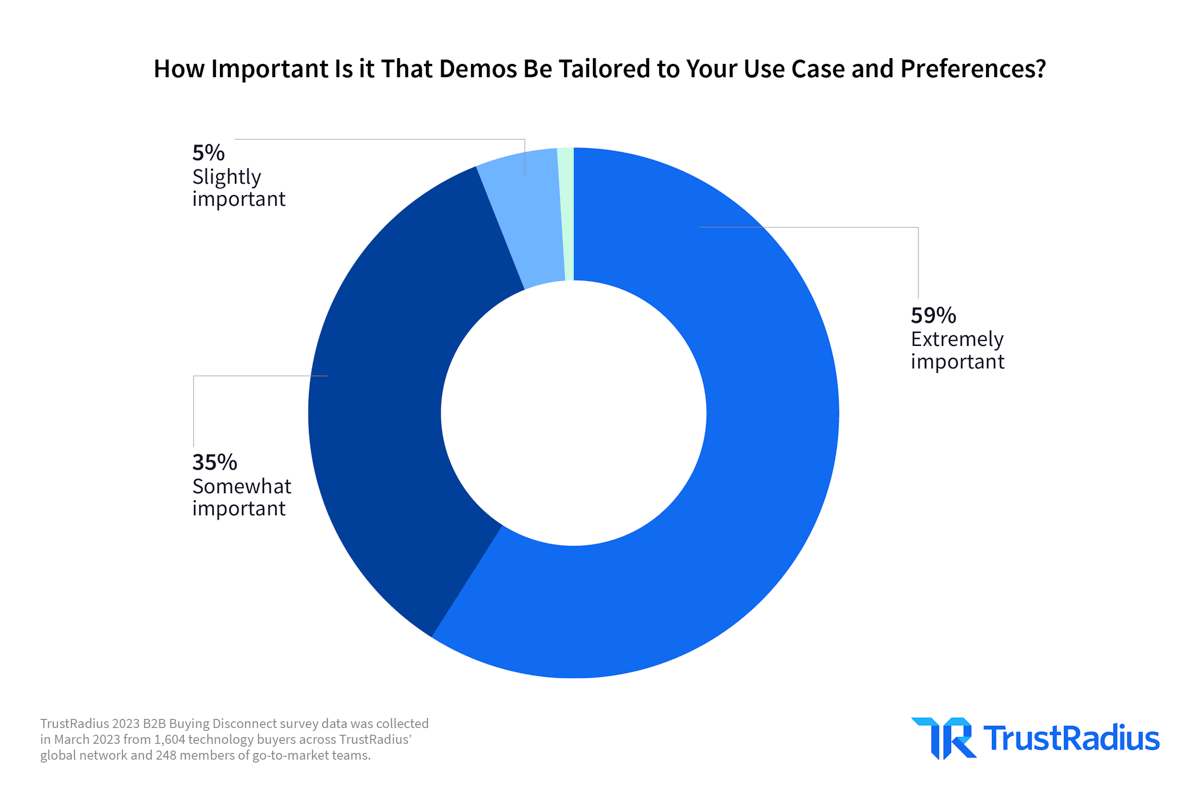

Not all product demos are created equal. Product demos span everything from a customized, engaging session with a sales rep to self-serve interactive demos to recorded demos by the vendor or even other users. When viewing a demo, buyers especially want to learn about product capabilities and ease of use. Additionally, 94% of buyers stated demos tailored to their specific use case and preferences were important when evaluating different products.

94% of buyer stated demos tailored to their specific use case and preferences were important when evaluating different products.

TIP: Make sure you’re providing multiple self-serve demo options for buyers, and that sales rep-led demos are tailored to the buyers’ needs and use cases. TrustRadius partners with six different interactive demo providers to offer this for free on our product profile pages. Your first interactive demo with each provider is free and there is no limit to the number you can have on your profile. Here’s a quick way to get started. #ProveItOrLoseIt

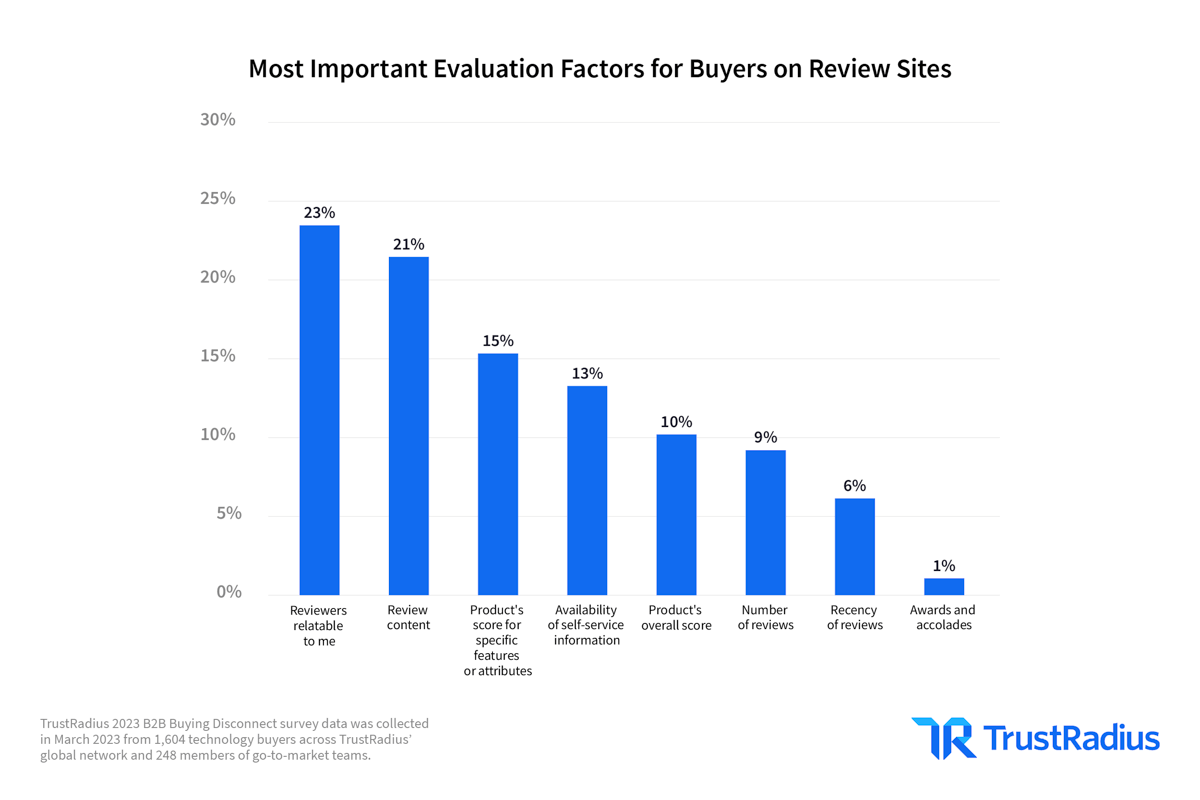

What buyers expect from user reviews

We know only 9% of buyers care about the number of reviews you have so don’t waste time on traditional review sites generating thousands of threesentence reviews. Buyers disregard surface-level reviews in search of indepth customer feedback—the good, the bad and the ugly.

23% of buyers are looking for previous or current users who are relatable to them. So, instead of cherry picking your best customers to leave reviews, think about the variety of job titles and companies that use your product to solicit for reviews.

The number of reviews, your overall score, and the recency of those reviews matter less to buyers. It’s a quality play, not quantity.

TIP: On traditional review sites, you need thousands of reviews just to land on a grid. Find a platform that helps you attract the modern buyer by providing in-depth customer reviews that highlight your differentiators while also providing customer quotes that you can use in your marketing and sales efforts. Check out this guide to getting quality reviews.

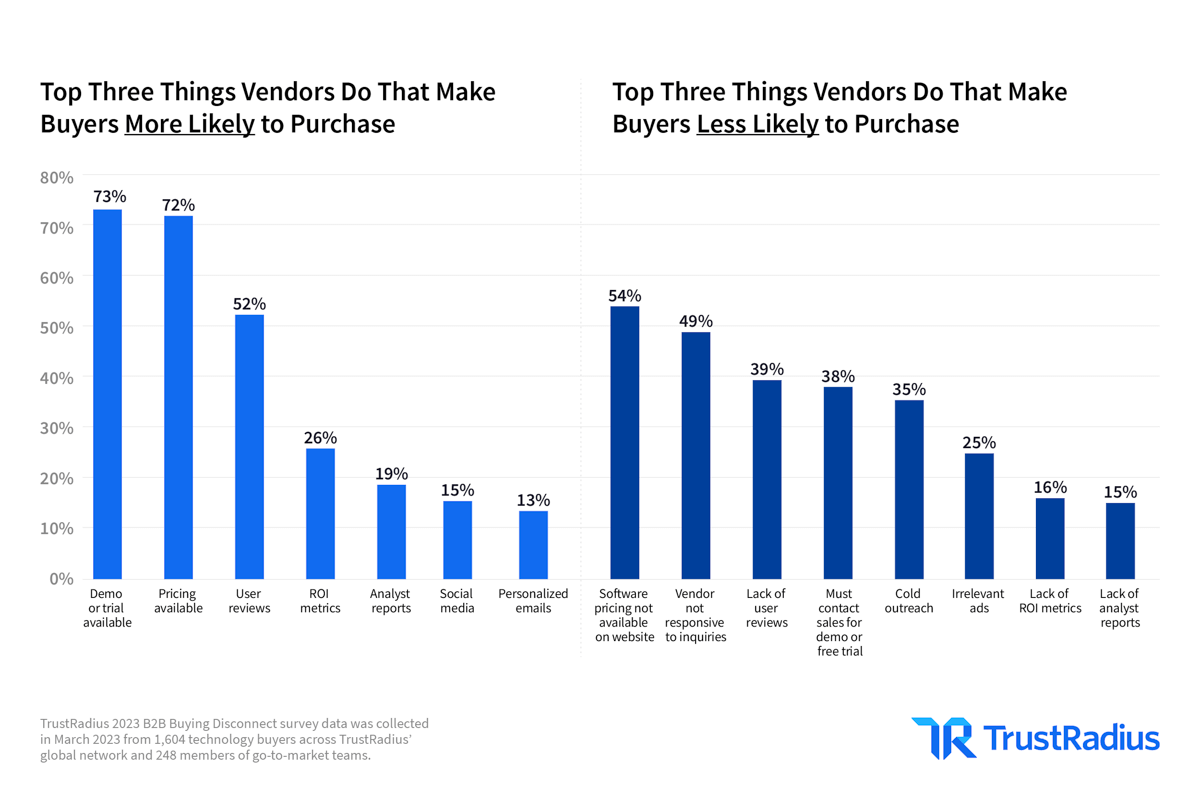

What makes buyers more likely to purchase from you?

Demos or free trials and pricing transparency are key to winning over buyers. Remember: 95% of buyers said it’s extremely or somewhat important that demos be tailored to their use case and preferences. Make sure these important, table stakes-resources are easy for buyers to find and access.

72% of buyers indicated access to transparent pricing made them more likely to purchase a product. It’s also a top reason they’d be less likely to purchase and we discuss this in the next section.

User reviews are next up—with a 17% increase year-over-year, buyers need to hear from your customers, and generating user reviews is a scalable way to do that. Vendors should not be afraid to let their customers do the talking. Your customer’s voice is the last differentiator you have that your competitors cannot copy. Now is the opportunity for technology vendors to stand out from the competition and quickly gain a spot on a vendor’s short list.

TIP: Buyers trust peer reviews over your brand marketing. Make sure you position the customer voice front and center in your go-to-market strategies. Including award badges alongside reviews in digital ads is a great way to decrease cost-per-click. #ProveItOrLoseIt

What makes buyers less likely to purchase from you?

A lack of transparency will almost always turn off your buyers. Today’s technology buyers want pricing information at their fingertips. Software pricing not being available on your website continues to be the number one reason (54%) buyers would be less likely to purchase from you.

Don’t make the mistake of gating valuable information like pricing behind a fillable form because a vendor not being responsive to inquiries is the second biggest reason (49%) a buyer would cross you off their short list. And forget about asking a buyer to contact sales for a demo or free trial—that is also a no-no—with 38% stating that having to contact sales would also make them less likely to purchase.

100% of buyers want to self-serve all or part of the buying journey.

In our 2022 B2B Buying Disconnect: The Age of the Self-Serve Buyer, we learned that virtually 100% of buyers want to self-serve all or part of the buying journey. This remains to be the case, as buyers are increasingly annoyed with having to track down your product information.

Self-serve buying is still on the rise

Virtually all buyers continue to expect to self-serve important parts of their journey. Buyers want some form of hands-on experience with your product, and they don’t want to always have to go through a sales rep to get it.

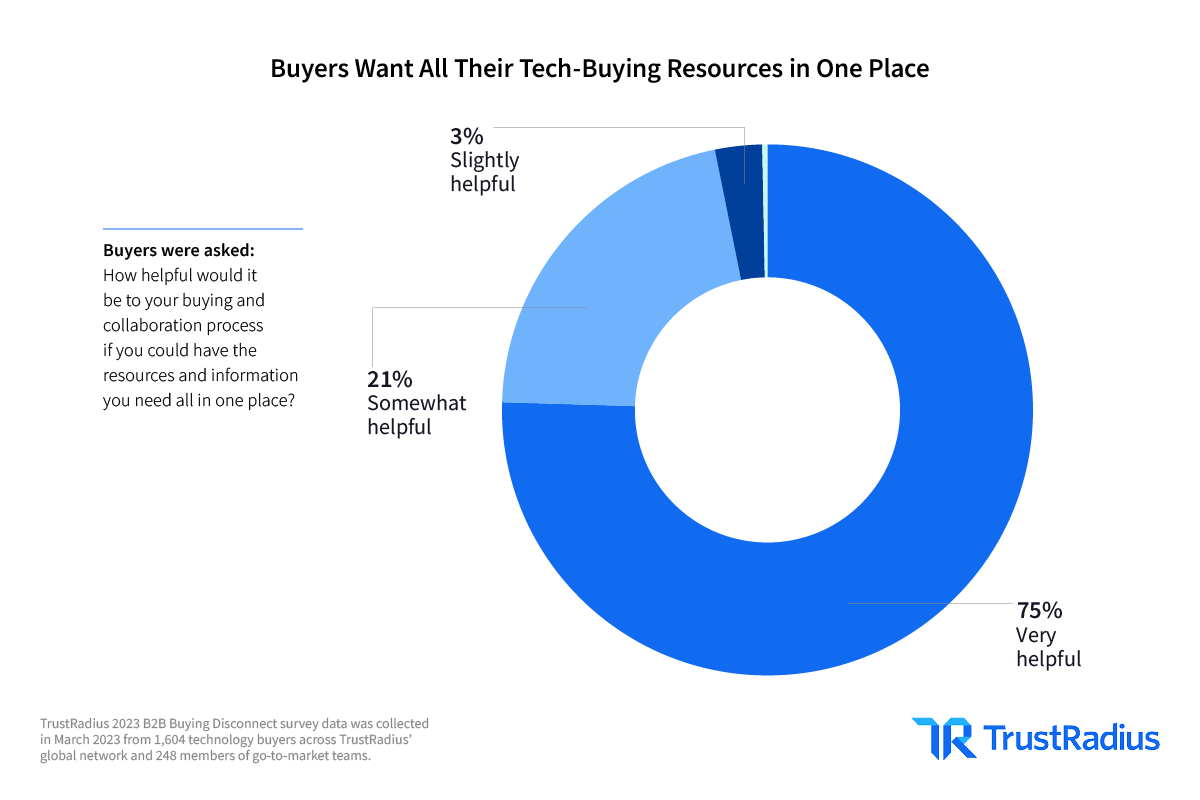

97% of buyers said it would be somewhat or very helpful to have all of their buying research and resources in one place.

Of course, the self-service movement and increased collaboration among decision-makers surfaces an additional challenge for buyers: organizing and tracking all of their research. As a result, 97% of buyers said it would be somewhat or very helpful to have all of their buying research and resources in one place.

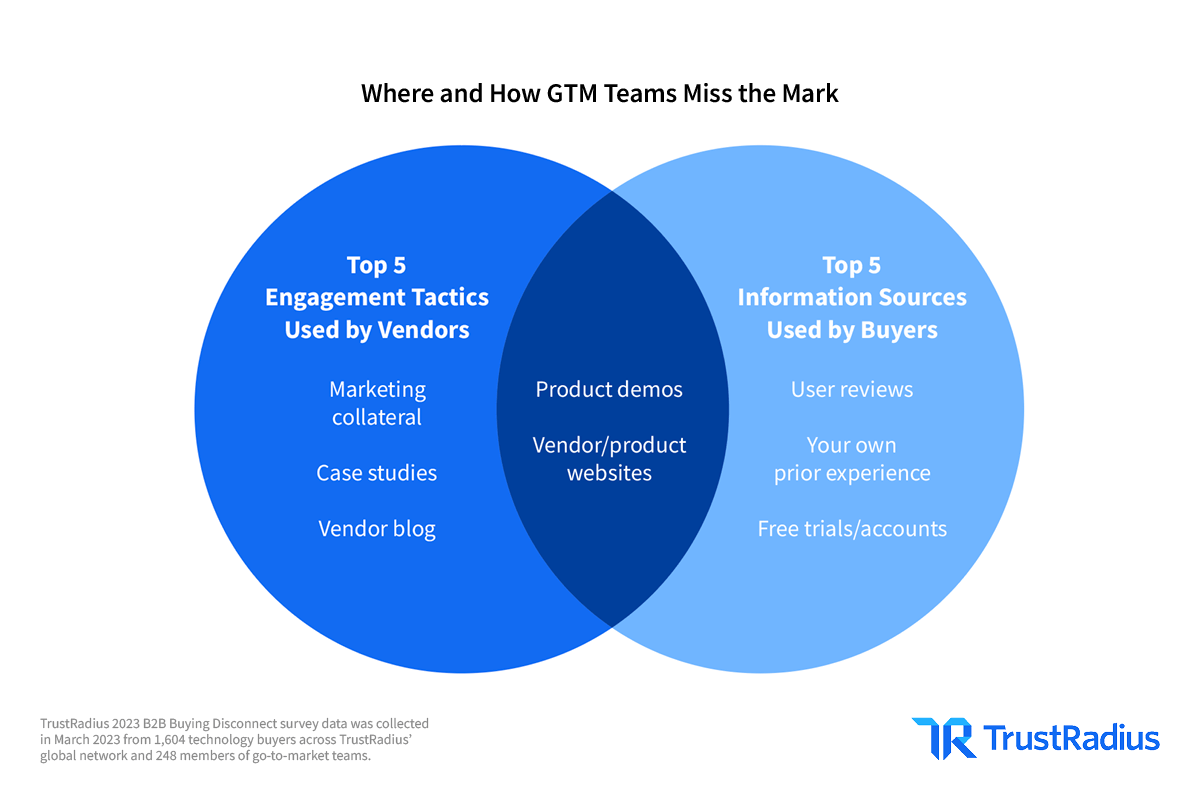

Where and how GTM teams miss the mark

The biggest and most critical disconnect in this year’s report is that marketing-led content is falling out of favor. Only 15% of buyers report consulting vendor-driven marketing materials when making a purchase decision, yet vendors still heavily invest in this top-of-funnel content at the expense of other resources buyers use. Prospective buyers are quite frankly not listening to vendor-created materials like blogs, e-books, and even your own website without verifying your marketing claims with actual customers.

Only 15% of buyers report consulting vendor-driven marketing materials when making a purchase decision.

With less budget and headcount, buyers are more risk averse than ever, and therefore value peer reviews over your marketing claims. They have unique challenges and want to ensure their organization is making a purchase decision that has worked for other buying companies of similar size, industry, and use case. Interestingly, larger company sizes (1,00110,000 employees and 10,001+ employees) are more likely to consult case studies and younger buyers (Gen Zs and millennials) are more likely to consult customer-led content such as user reviews throughout their research process.

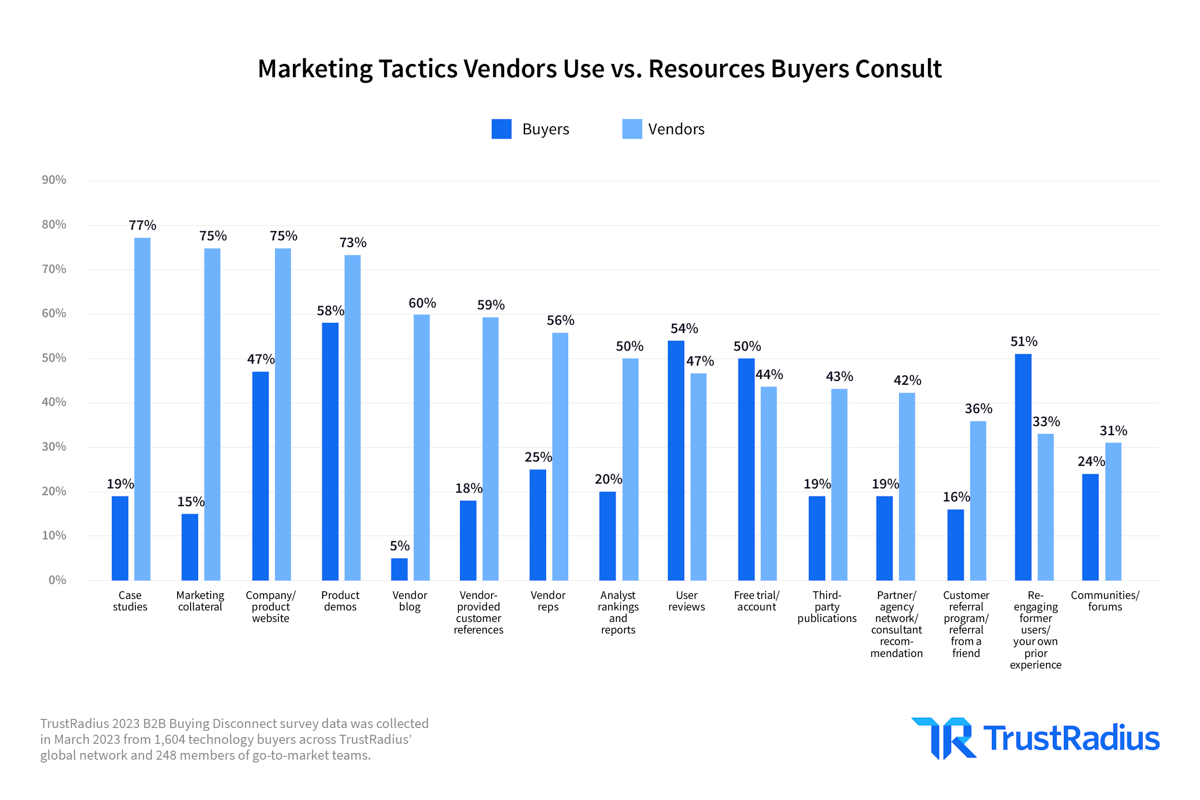

Similar to previous years, the only overlap between the top five marketing tactics used vs. buyer-consulted resources are product demos and company/product website (although that has dropped from second to fifth in the past year.) Product demos were in the top five resources consulted by buyers for seven years in a row. And with the proliferation of free trials and own prior experience, it’s clear that buyers want hands-on access above all else. But are marketers reaching their target buyers?

75% of marketers are using marketing collateral as a tactic while only 15% of buyers report consulting it.

Marketing tactics used vs. resources buyers consult

Bye bye, marketing collateral?

No. We are not saying get rid of all your marketing collateral, but you should know its purpose. Top-of-funnel resources like your blog and website are helpful to increase brand awareness, but they are not used by buyers to make a purchase decision. 75% of marketers are using marketing collateral as a tactic while only 15% of buyers report consulting it—this is a major disconnect. If that’s not enough, vendor blogs aren’t seeing the light of day—even though they fall in the vendor’s top five marketing tactics at 60%—only 5% of buyers report using them.

Over-investment in top-of-funnel marketing content is coming at the expense of resources that are directly impactful at a later stage. Additionally, vendors could be underestimating the impact of certain marketing tactics on a buyer’s purchasing decisions. User reviews, free trials/accounts, product demos, and own prior experience were all reported by vendors to have a significantly lower impact on the purchase decision than buyers stated. In fact, only 35% of vendors named user reviews impactful, versus 61% of buyers. For self-serve options like free trials/accounts, vendors grossly underestimated their impact with a 24% difference between perceived impact on buyers. Vendors are late to providing buyers the self-serve options they crave, and it’s likely they’re feeling it.

TIP: You can enable free trials/accounts in a sandbox environment shared via your TrustRadius profile. Our TestBox integration allows easy product testing with no sales demo needed. Enhance the presale experience and shorten time to close. #ProveItOrLoseIt

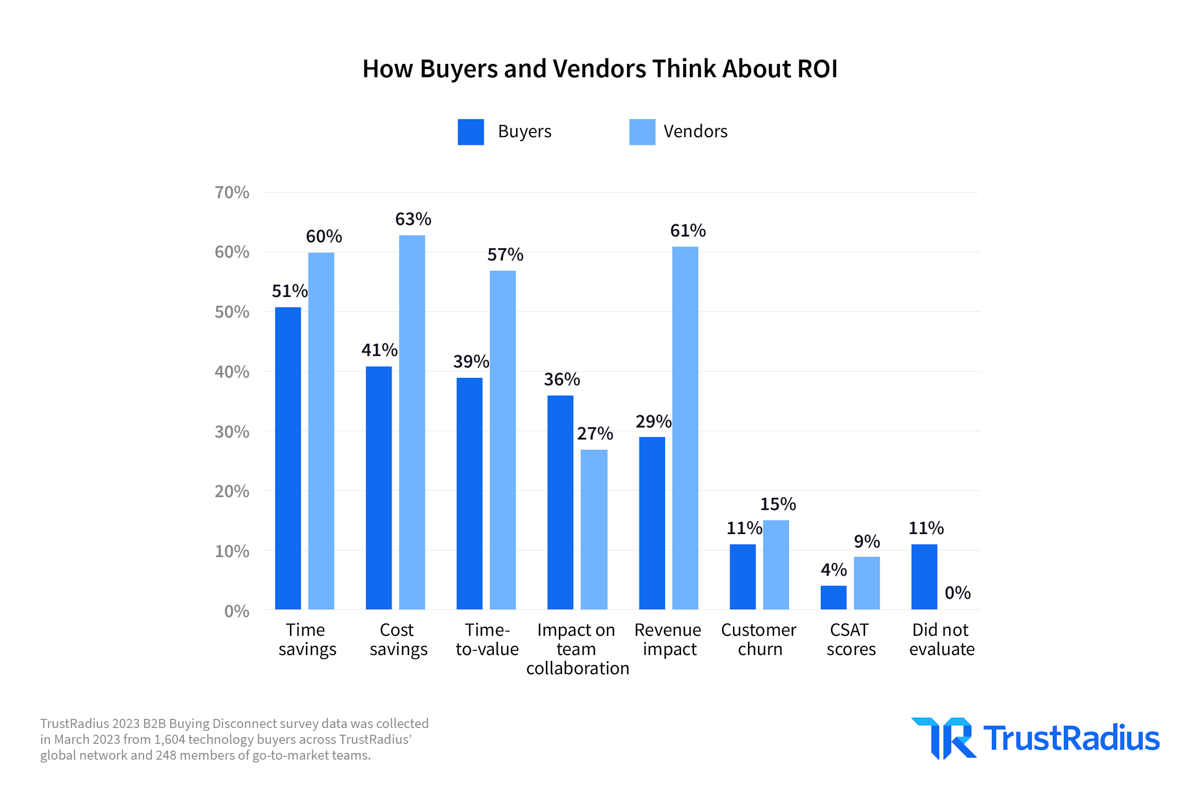

How buyers and vendors think about ROI

Vendors place the most emphasis on cost savings (63%), revenue impact (61%), time savings (60%), and time-to-value (58%). In general, buyers placed less emphasis on revenue impact while prioritizing time savings and, to a lesser extent, cost savings. This remains true across buyers of different job titles and generations. The one exception is purchases of $100,000+, where 57% of buyers include cost savings in their calculus (and 56% include time savings).

User reviews are key to winning over buyers

Using the customer voice is key to telling authentic user stories and sharing a genuine experience about your product. Reviews are especially important when prospective buyers don’t have prior experience with your product (another top five this year). Gathering reviews from multiple points of view helps create relatable content that can take precedence over experience with your product.

Uncovering the disconnect

- 54% of technology buyers consult user reviews during the buying journey

- 35% of marketers believe user reviews are very effective

Using the customer voice is key to telling authentic user stories and sharing a genuine experience about your product.

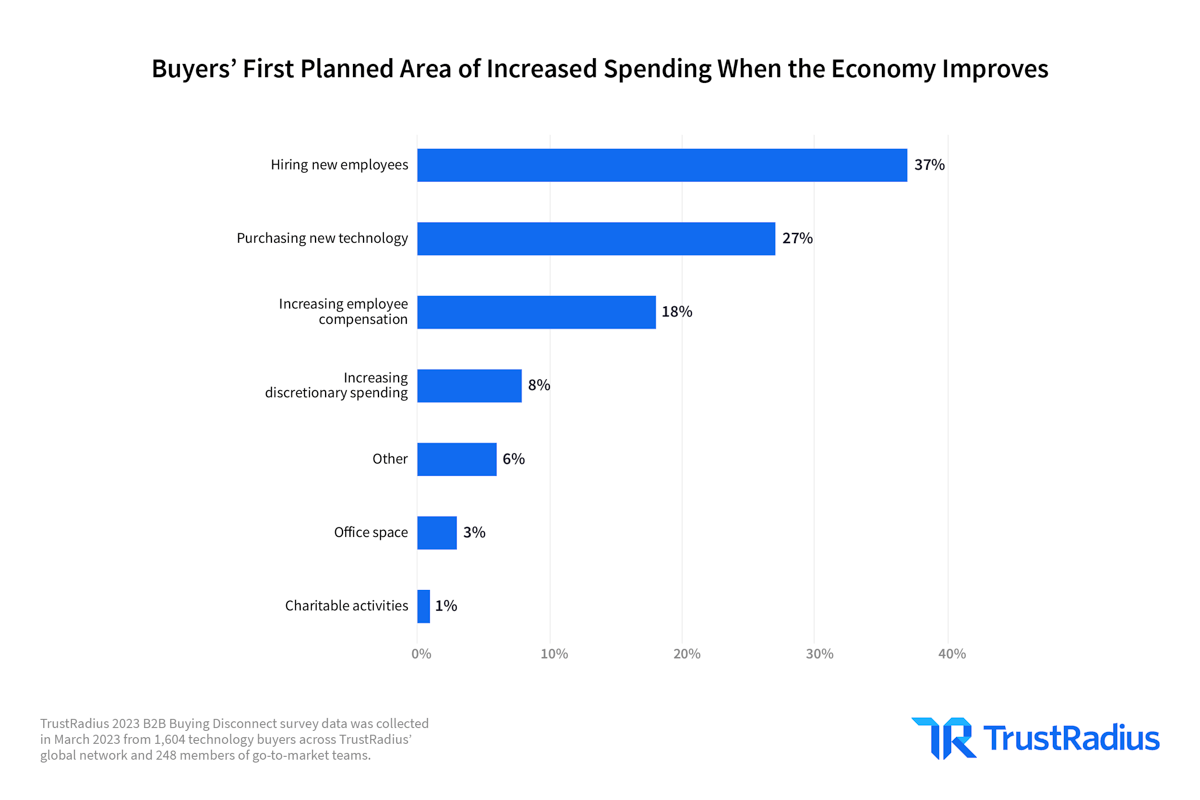

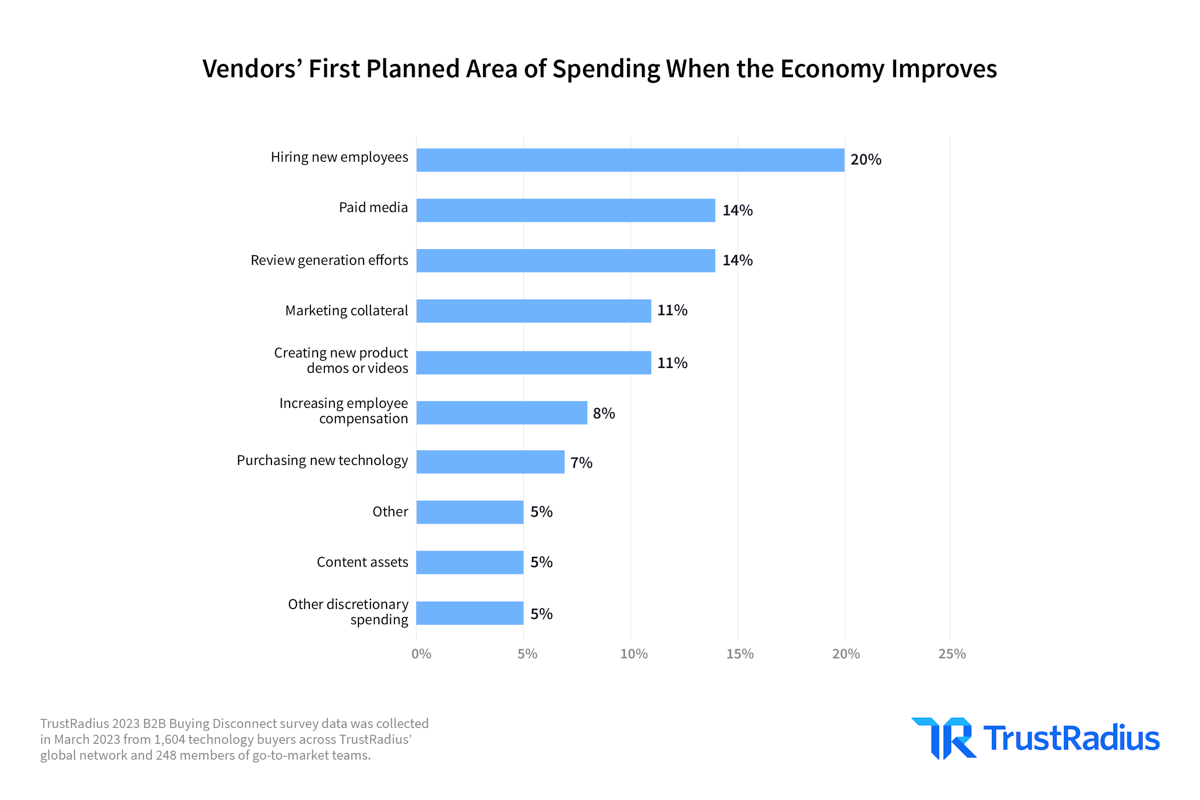

Spending in an evolving economy

Who knows how and when the economy will evolve, but buyers are thinking about the future. Right now, go-to-market teams are focusing on setting expectations across their organizations of what’s possible in the current climate. Once spending picks back up, buyers will want to increase headcount and purchase new technology.

When economic conditions improve, both buyers and vendors want to increase headcount.

Vendors have to focus on strategies that will give them a competitive edge when buyer spending surges. That means taking the learnings from this report and applying that to their go-to-market strategy. Interestingly, both buyers and vendors want to increase headcount. Are vendors making progress on closing the gap? The initial data suggests there’s hope but we have to wait to see the execution of these strategies.

With all these helpful insights into the way buyers think, we are here to help. As the ultimate decisioning platform for B2B technology buyers, TrustRadius has the tools you need to enable buyers to make informed, confident technology choices.

Our comprehensive product profiles make it easier than ever for buyers to find what they’re looking for. TrustRadius gives buyers what they want, all in one place, by providing relevant decision-making information like pricing, product demos, and customer reviews.

TrustRadius gives buyers what they want.

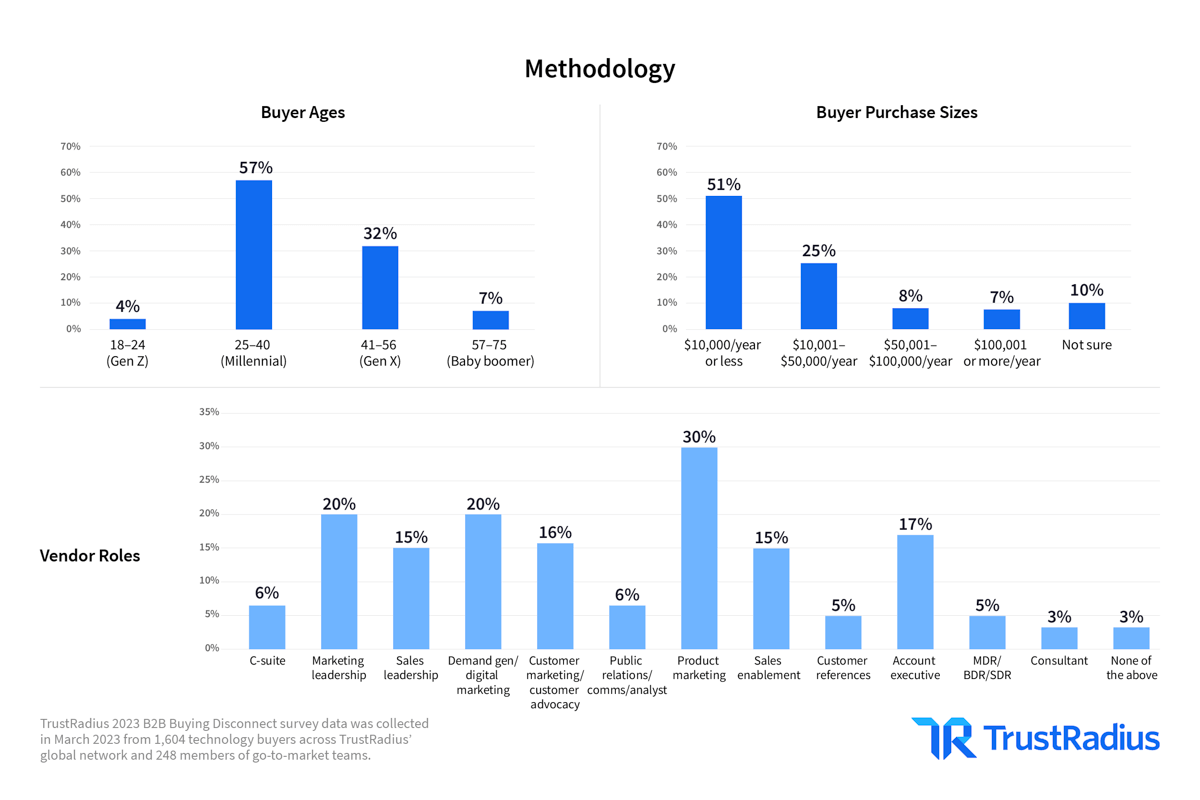

Methodology

Data for the TrustRadius 2023 B2B Buying Disconnect Report was sourced from the TrustRadius global network via an online survey.

In March 2023, we sent online surveys to professionals (technology buyers) who were involved in a new software or hardware purchase for their organization in the past year, and members of go-to-market teams for technology vendors. We received complete, verified responses from 1,604 technology buyers and 248 technology vendors.

All respondents were offered a nominal incentive ($10 gift card) as a thankyou for their time. We analyzed the response data across various segments, including company size, purchase price, generation, job title, and more.

We’ve included information below on the demographics of our survey respondents. For a full list of questions and answer choices, or if you have any questions about the data, email us at research@trustradius.com.

If you have any questions about the data, email us at: research@trustradius.com

To learn more about how TrustRadius can help you connect with in-market buyers researching your competitors, start a conversation with us today.