How Coronavirus Impacted B2B Software Spending

**Updated on December 11, 2020 with new data from the TrustRadius research team

The coronavirus pandemic caused radical changes in software spending.

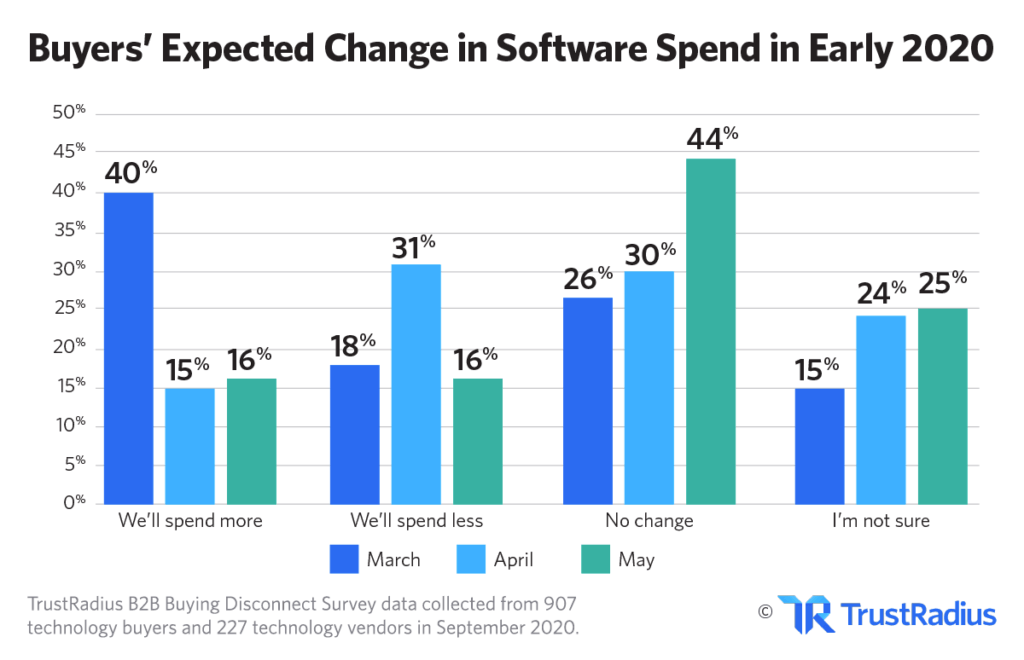

We were shocked to see tech spending skyrocket in March as companies bought new B2B software to help navigate the new normal. Then we saw spending decline alongside a hurting economy. After a few months, the tech industry breathed a collective sigh of relief when spending finally stabilized.

Now, with brand new data from our 2021 B2B Buying Disconnect report, we’ve got a complete picture of how COVID-19 impacted the software industry over the course of 2020.

Even better, we’re revealing brand new data that forecasts how tech buyers plan to increase (and decrease) their spending in 2021.

Technology and COVID-19: The Newest Survey Results

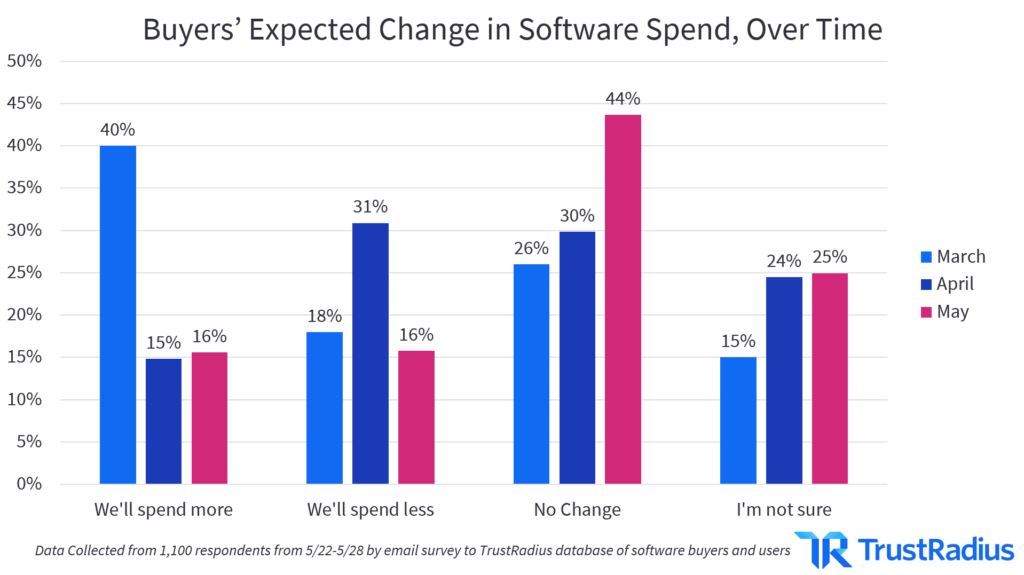

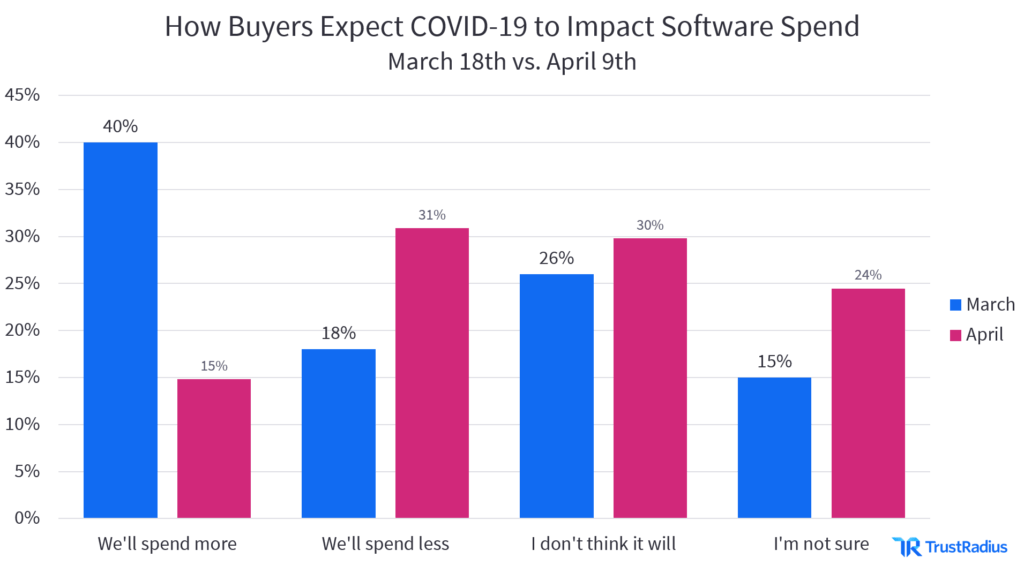

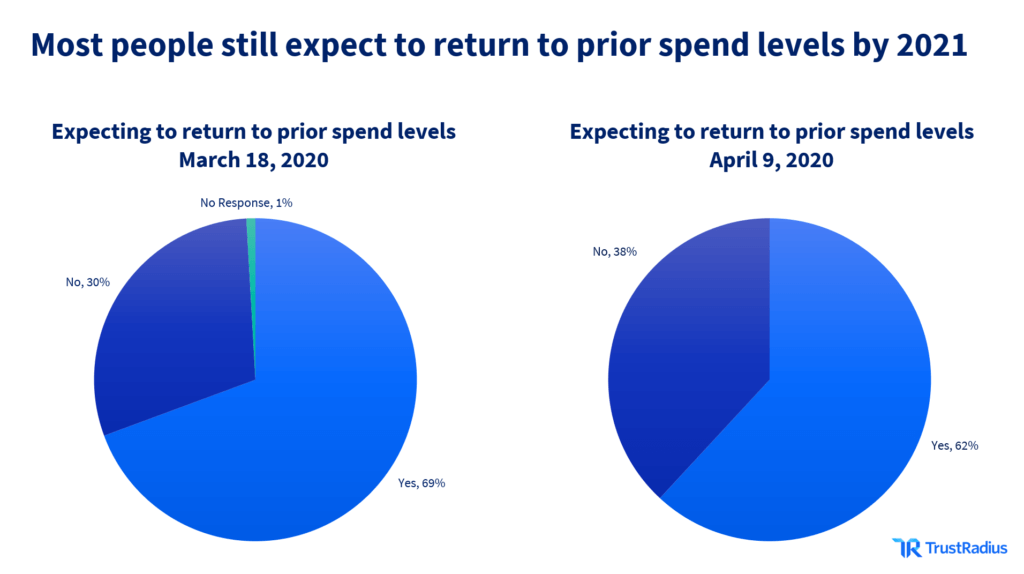

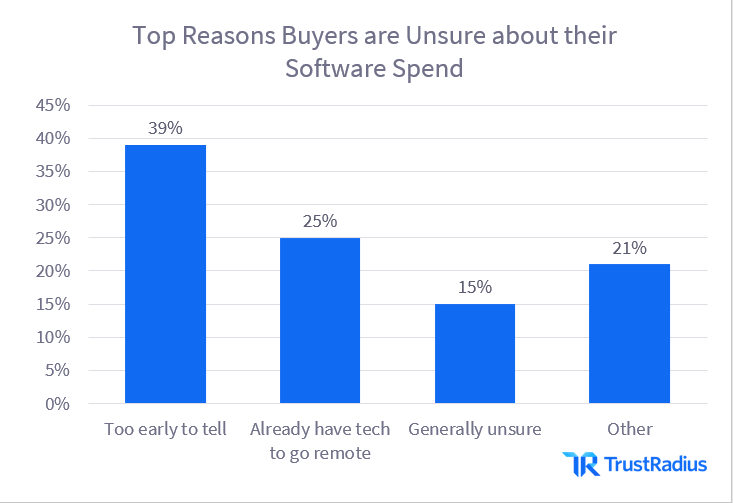

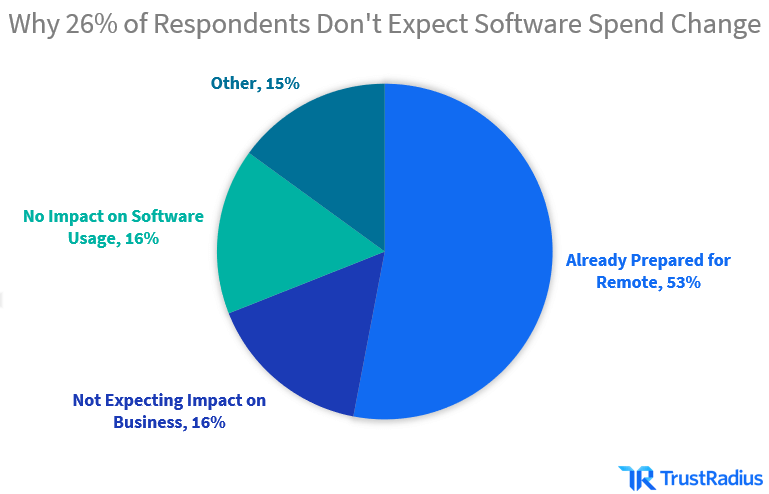

TrustRadius has been monitoring business spending data for many months now. Based on earlier research conducted during March, April, and May of 2020, it’s clear that buyer expectations about tech spend fluctuated in the earlier months of the pandemic:

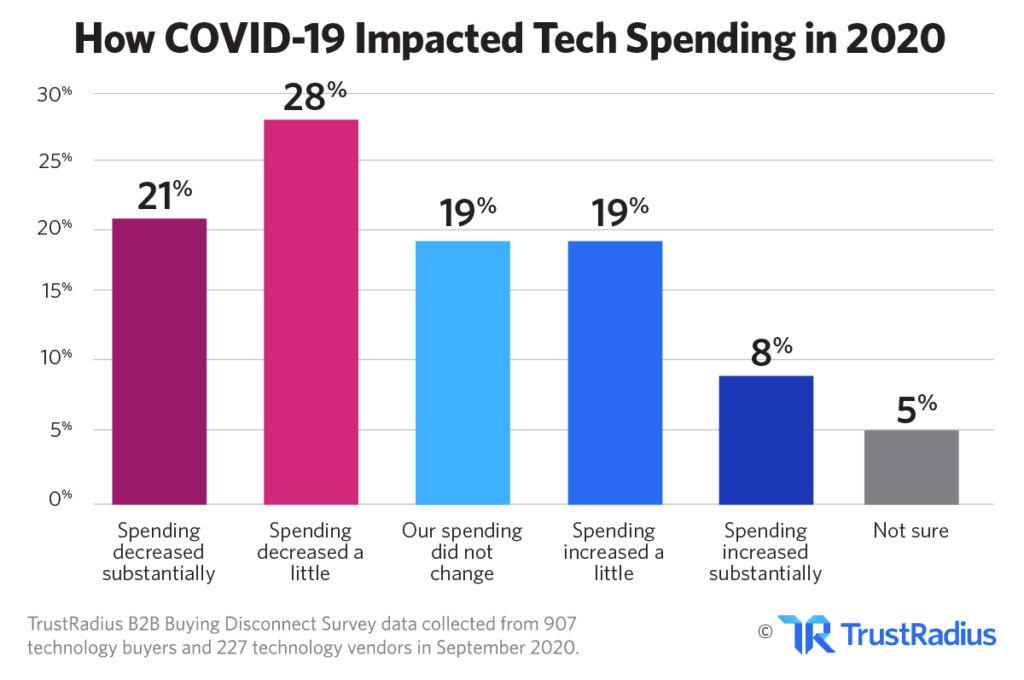

Most recently, when we asked our community of buyers how the global coronavirus pandemic had impacted their overall technology spending in 2020, close to half (49%) of buyers reported reducing tech spend. Notably, about 1 out of 5 said their spending had not changed, and 27% said spending had increased during 2020.

The 2021 B2B Tech Spending Forecast

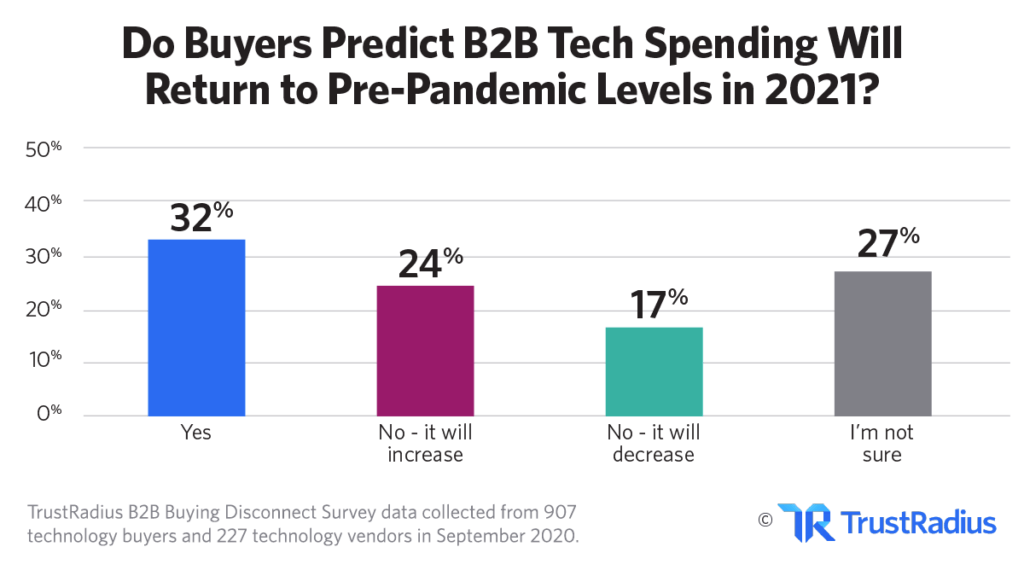

Of those buyers who said their overall technology spending had changed due to the pandemic, 56% predict that spend will either return to previous levels or increase in 2021. However, 16% think spending will decrease in 2021. About 27% of buyer respondents were not sure what tech spending in 2021 would look like for their organization.

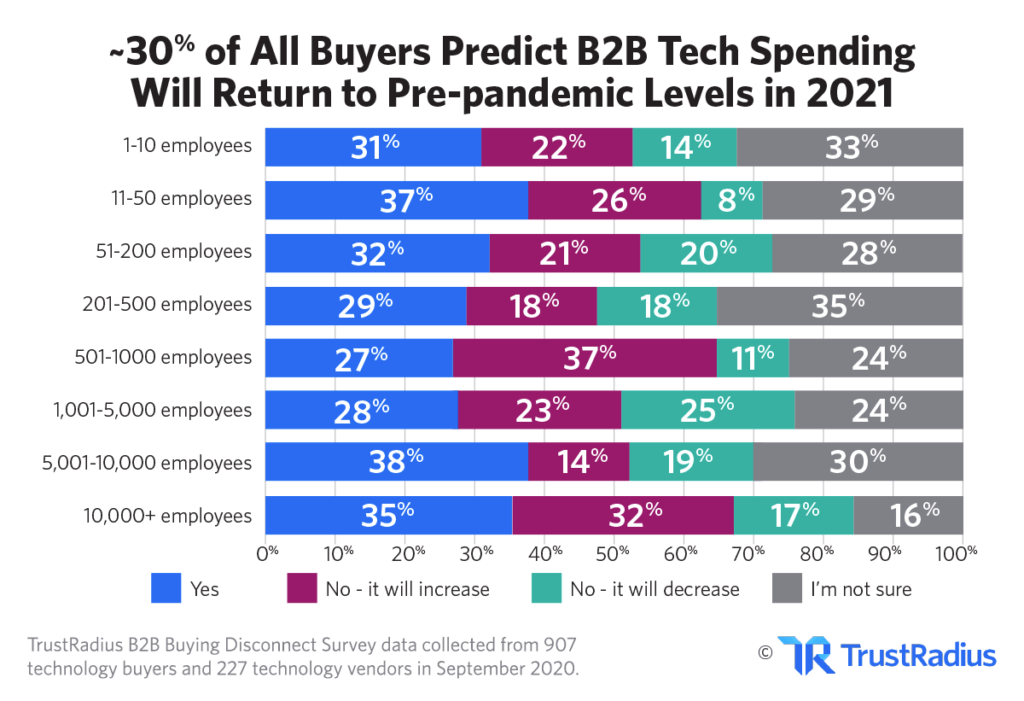

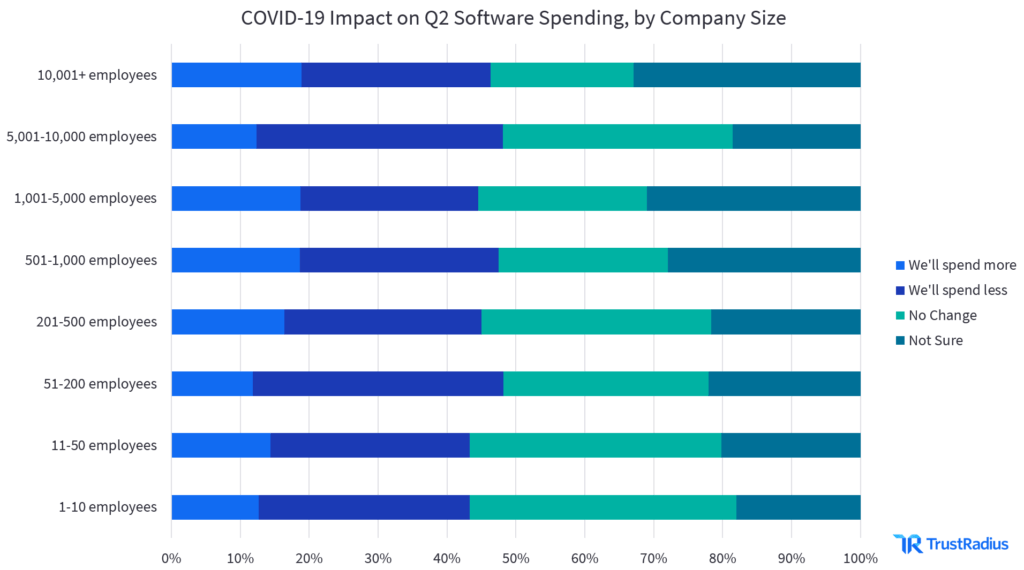

The technology spending outlook for 2021 is still quite uncertain, but over half of buyers are optimistic about seeing a return to previous spending levels—or beyond. There is some variation in predicted it spending by company size in 2021, but no discernible pattern. Optimism and pessimism about 2021 spending levels are roughly evenly distributed across company sizes. The highest levels of uncertainty are in companies with 500 or fewer employees, which makes sense as larger companies have more robust forecasting functions.

Where Software Spending Will Increase and Decrease in 2021

Besides overall technology spending, the pandemic has affected how and where we work. 100% of the buyer’s journey is now completed online, since in-person conferences, summits, and one-on-one meetings have been suspended for the better part of 2020.

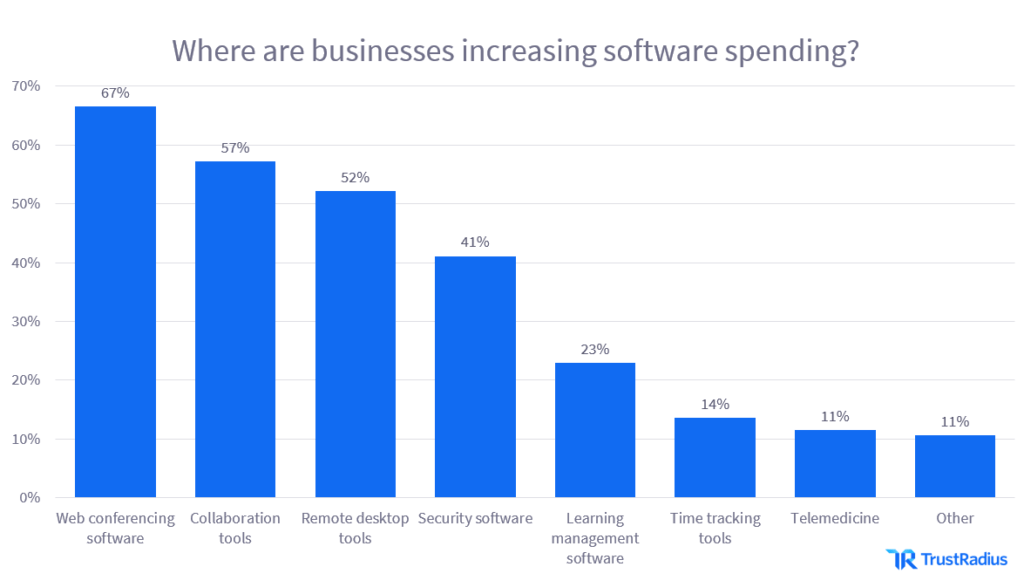

As much of the U.S. and global workforce has transitioned to remote working, certain pieces of technology have been either in higher or lower demand. One great example is the rapid expansion of web and video conferencing software usage.

But will these fluctuations in demand persist into 2021?

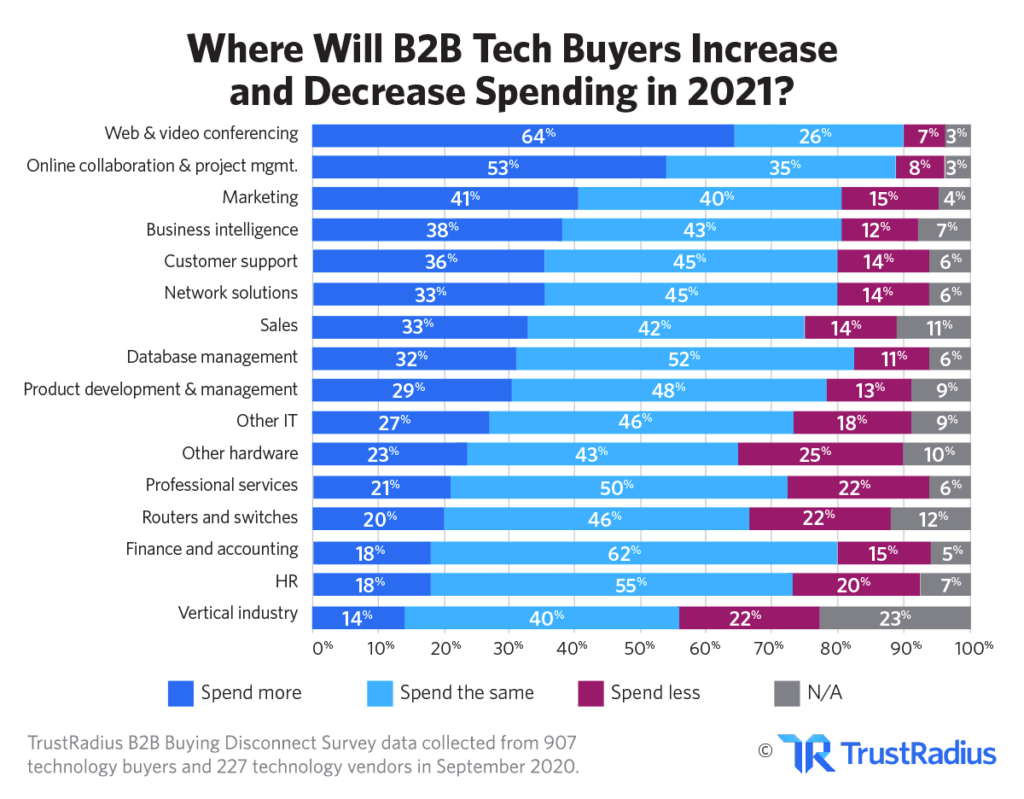

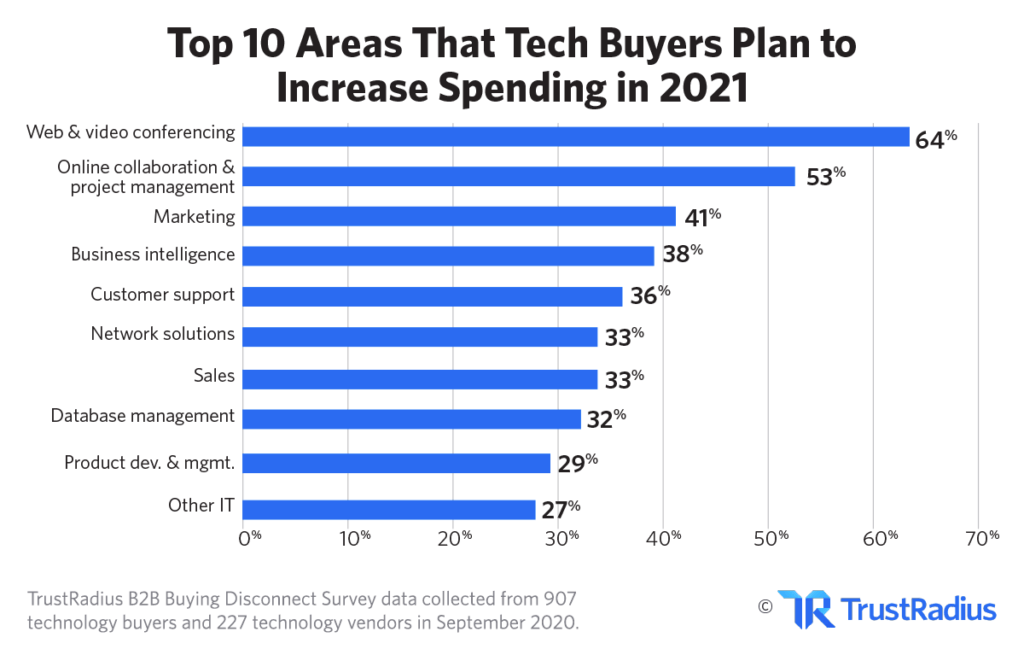

In our most recent survey, over half of buyers expect to spend more on video and web conferencing software (64%) and online collaboration & project management software (53%) in 2021. Some may see these as industries benefiting from coronavirus.

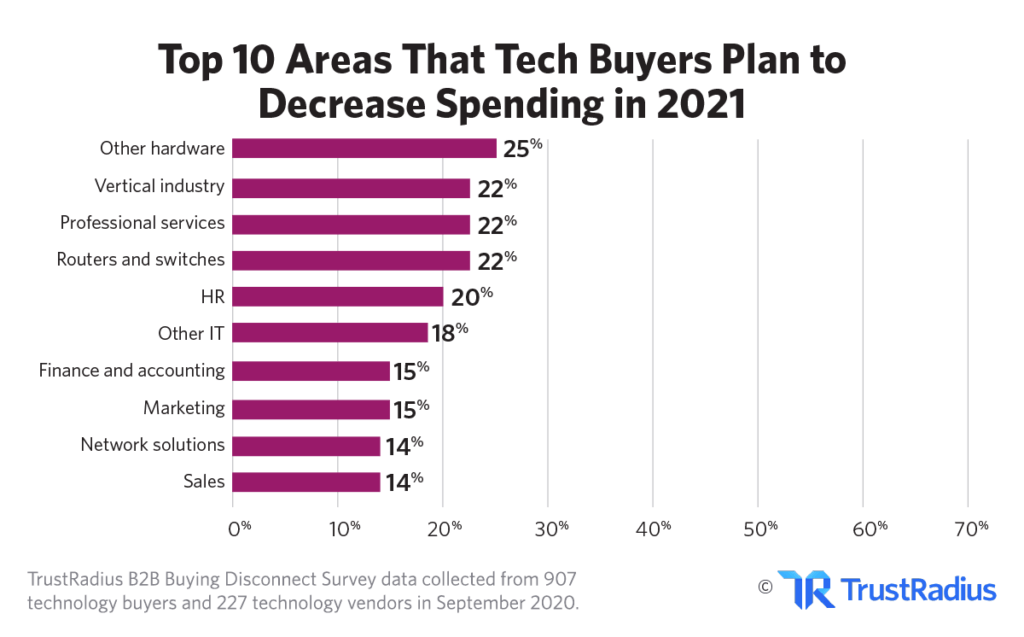

Conversely, buyers predict that hardware products, professional services, HR software, and vertical specific technology will be areas of low investment for 2021. About 1 out of 5 buyers said they expected to reduce tech spending for each of these areas. These could be a sign of industries most affected by coronavirus.

It may be the case that these types of business technology, especially vertical-specific software, are more tied to ‘in-person’ businesses and services. For businesses that are currently strapped for cash, these investments are likely seen as ‘nice-to-haves’ compared with other essential ‘must-have’ business expenses.

Technology and COVID-19: Survey Results From May 2020

We re-surveyed our audience of B2B software buyers on May 27, 2020 to see how they were forecasting the next two quarters. After a whirlwind 3 months of instability, uncertainty, and fear, it appeared that spending forecasts were finally stabilizing.

Understanding the Stabilizing B2B Software Market

For the first time in the COVID-19 pandemic, the near majority of our audience wasn’t expecting changes in their B2B software spend in the near future when we surveyed them in May. This change reflects a market stabilization after the pandemic threw the world into chaos.

Businesses in May were looking towards their long-term stability in the “new normal.” They were making software buying decisions to facilitate continuity and growth. We asked our community about these issues to see how spending as well as other aspects of B2B buying decisions may have been altered by COVID-19. How has the buyer’s journey changed, and who’s involved in that journey in the COVID-19 era?

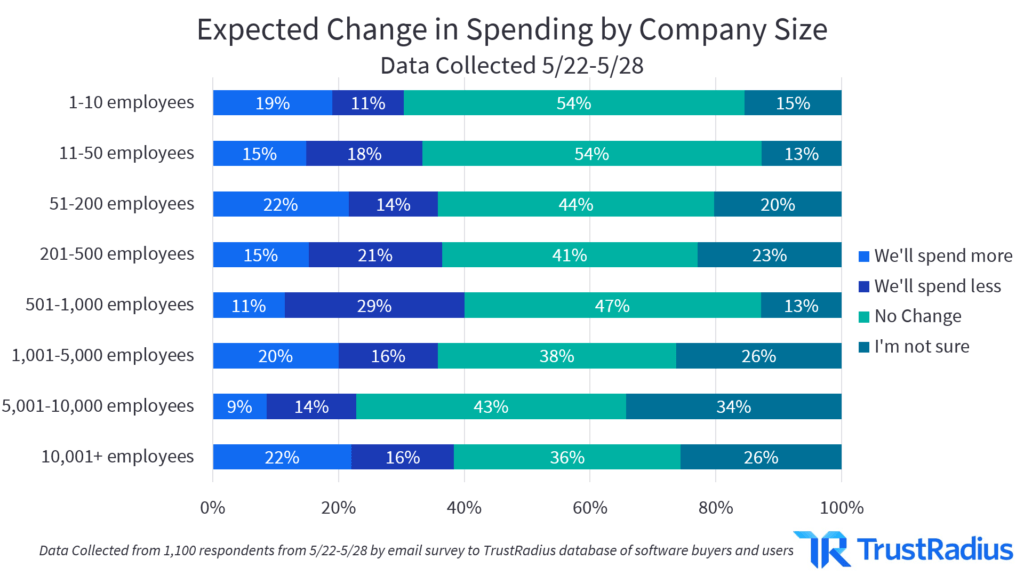

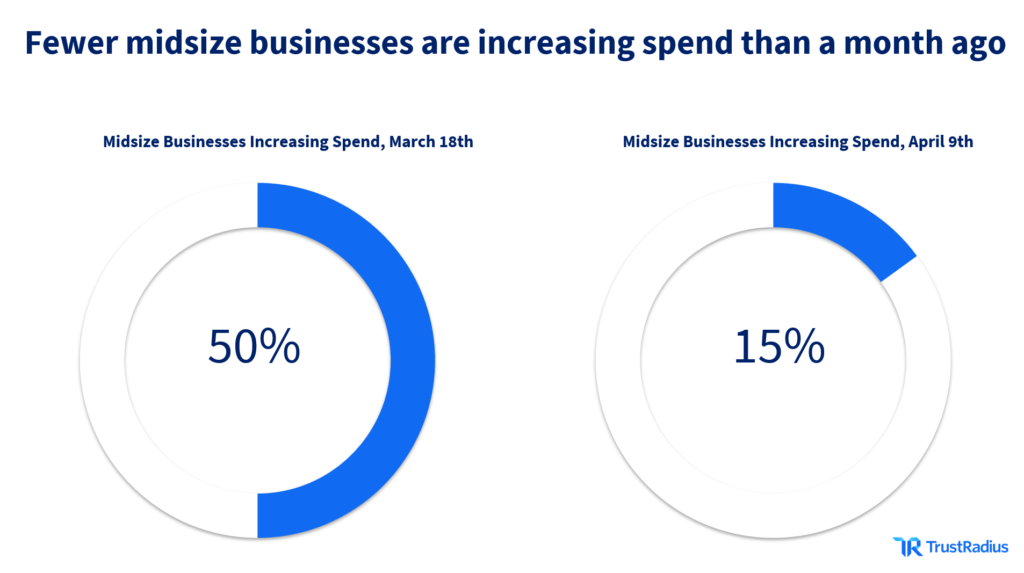

In April, we noted a decline in the number of SMBs planning to increase spending. This trend continued in May and broadened to most, if not all, company sizes.

For the most part, it spending remained aligned across company sizes. The plurality of respondents in May said that there are no software spending changes expected for the rest of 2020. There was more uncertainty at higher company sizes, but that can be attributed to a higher percentage of lower-level employees and employees who are not budget holders in these organizations. This trend is consistent with prior TrustRadius research, which found less certainty and confidence in the purchase process and selection decisions at enterprises than other company sizes.

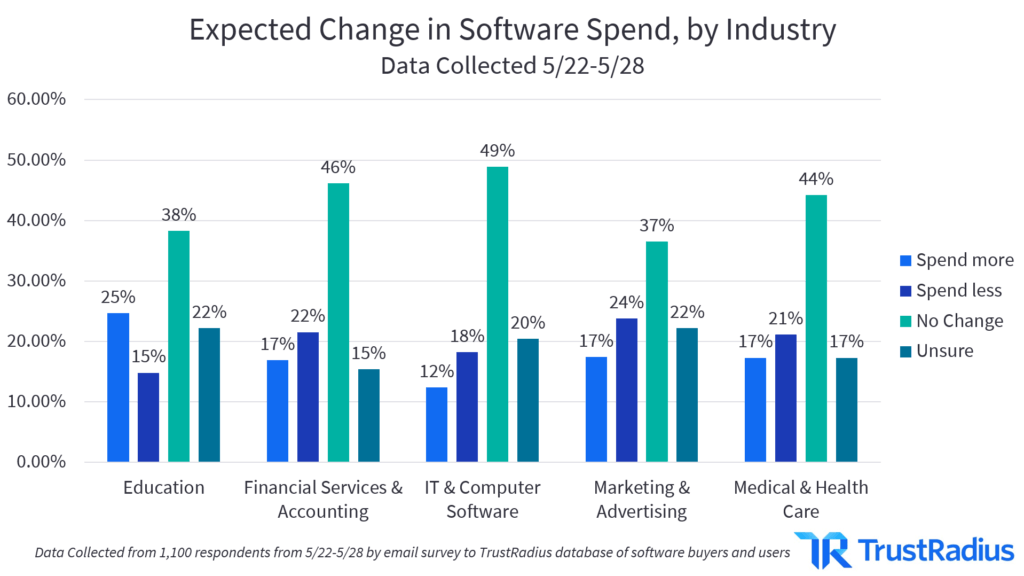

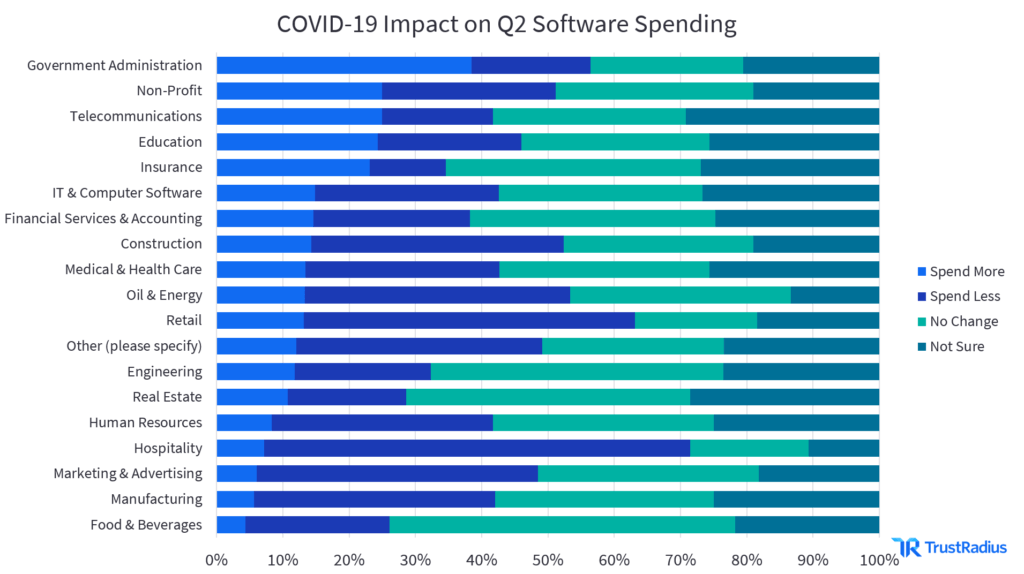

Spending changes noted in May 2020 were also fairly consistent across industries.

Within our May 2020 sample, we collected the most significant responses from organizations in Education, Financial Services, IT, Marketing, and Health Care. Among these industries, most buyers expected no changes in software spending through the rest of 2020.

Interestingly, a large minority (25%) of respondents working in Education said they were increasing spending—the largest segment of respondents to say so. These respondents were likely to increase spending during the summer in order to have their technology purchased and implemented by the time school started in the fall.

In May, we predicted that seasonally-based industries might still experience more change in software spending throughout the 2020 year. In order to fully convert to new and radically altered situations, such as all-virtual learning environments in the Education sector, organizations might have needed to increase or decrease investments in technology. The timing of these spending changes likely revolved around “off-seasons” where these companies could change technologies with minimal impact on their customers/users.

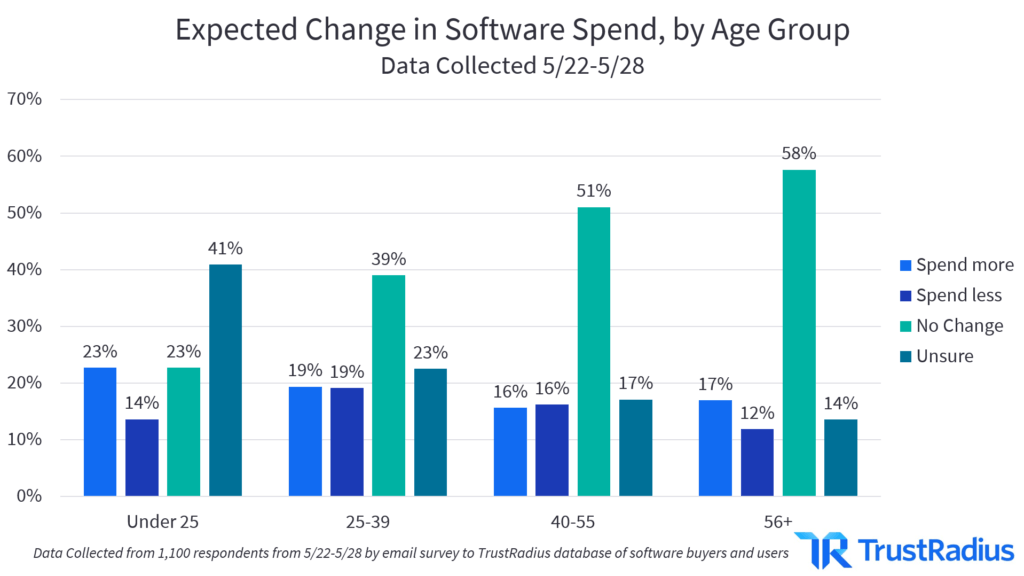

We also collected generational data from our community in May, which strongly signaled that more senior and experienced workers were the most confident that spending has stabilized.

Older respondents in our May 2020 sample were consistently more confident in there not being any further software spending changes in 2020. Younger generations, on the other hand, were more likely to be unsure. The clear upwards trend in confidence that there won’t be change, which correlates with greater experience in the workforce and through prior economic upheavals, supports the theory that companies had largely concluded their changes to their software spending for 2020.

Companies Impacted by Coronavirus

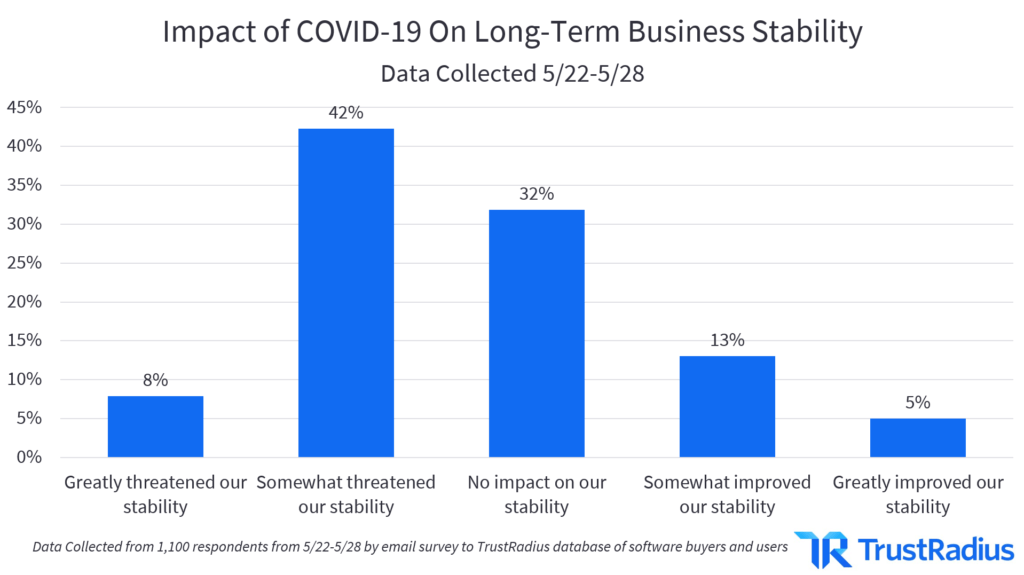

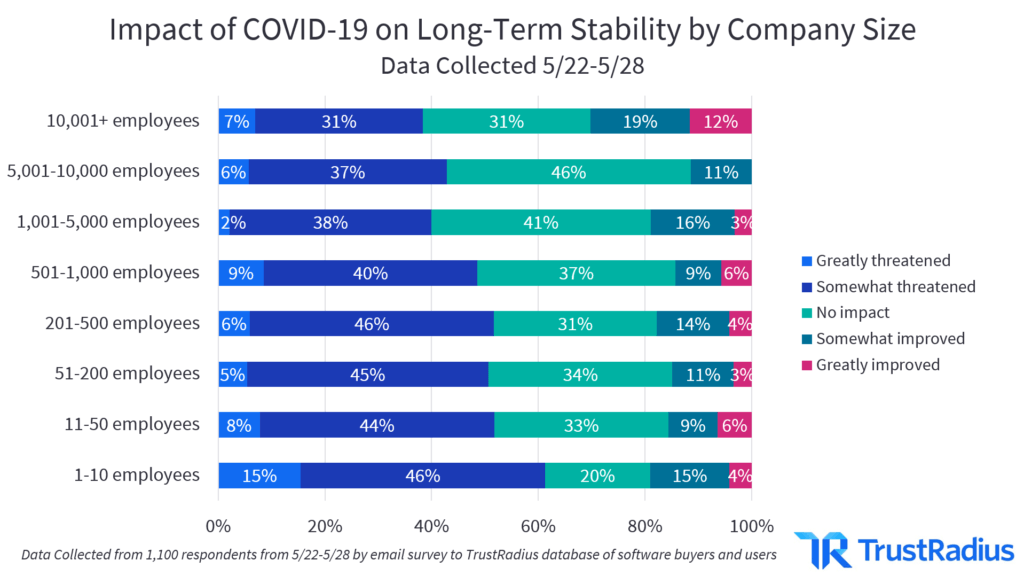

Since many companies had already completed their adjustments to a post-COVID-19 economy by the end of May 2020, our next question was whether they thought those changes would be enough to help them survive. In May, our audience reported that half of businesses felt their long-term stability is threatened to some degree by COVID-19.

The majority of threatened businesses felt “somewhat” threatened in May 2020. 8% of all businesses felt “greatly threatened” by COVID-19. 1 in 3 respondents felt no impact on their stability. This suggests a large minority of businesses’ finances, strategy, and spending had stabilized after the first few months of the pandemic.

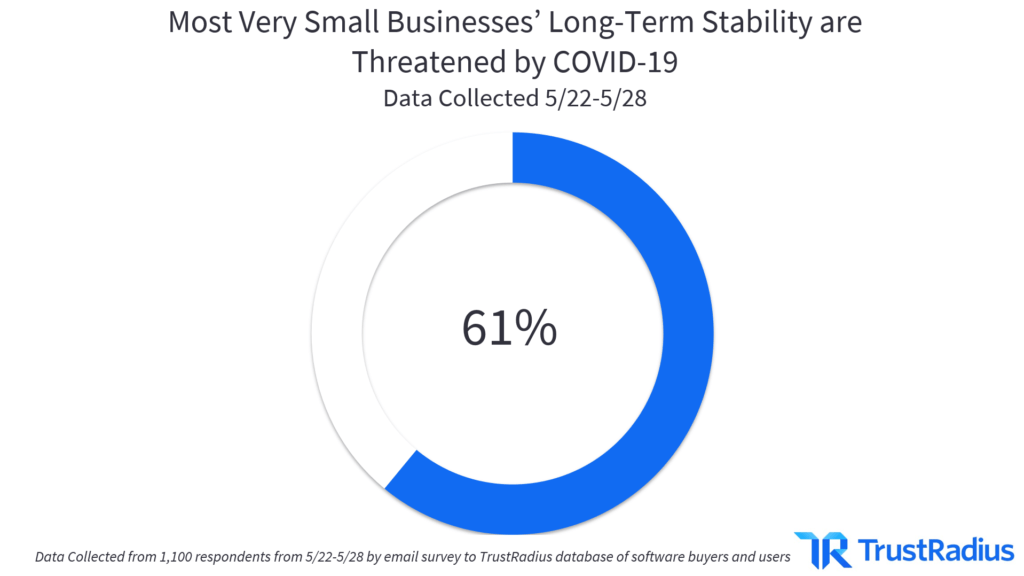

The threat to long-term business stability was also disproportionately felt by smaller companies.

When surveyed in May 2020, over 60% of companies with 1-10 employees felt their stability was threatened by COVID-19. They were twice as likely to feel greatly threatened than other businesses. Mid-sized businesses fared slightly better, with around half of businesses feeling some sort of threat.

Enterprises, especially large enterprises, were the most confident in their long-term stability when surveyed in May 2020. The majority of the largest companies, at 10,000+ employees, felt either no impact or a positive impact on their long term stability. Large enterprises were twice as likely to report “greatly improved” long term stability compared to other company sizes (12% vs. 5% overall).

The discrepancy between small businesses and large enterprises can be best explained by differences in cash and asset stockpiles not connected to immediate cash flow. Small businesses were much more likely to have tighter budgets and leaner operations and were especially vulnerable to the direct impacts of COVID-19. That leaves them with less flexibility and fewer options to downsize if necessary—such as in the case of a pandemic.

In contrast, larger enterprises were more likely to be able to absorb financial fluctuations and streamline their budgets. This gave enterprises better odds of surviving or thriving in tumultuous economic conditions.

How COVID-19 Impacted The Tech Buying Process

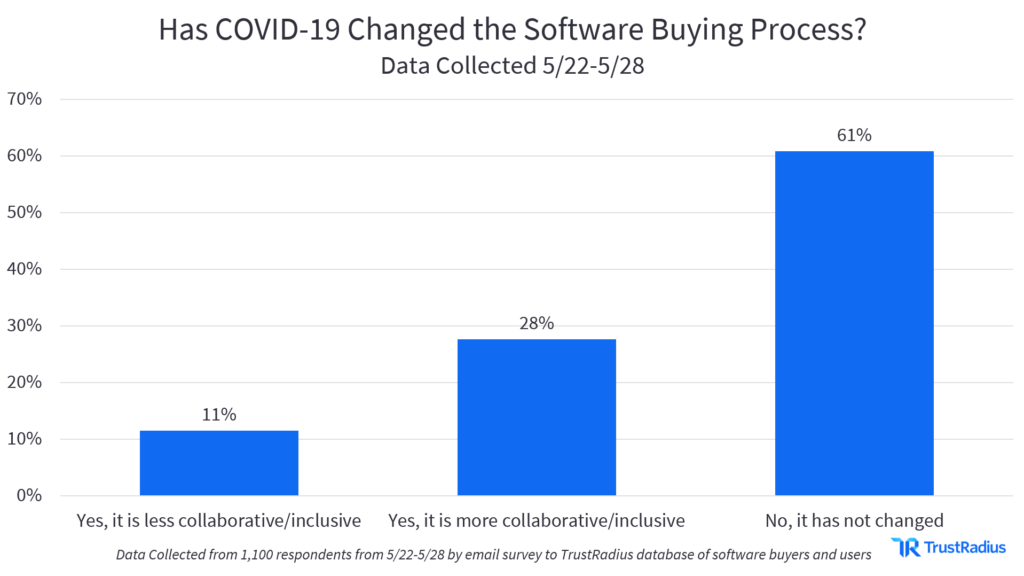

As the pandemic progressed through March and April of 2020, industry analysts hypothesized that B2B software buying power and decision making would consolidate around senior leadership and executives. Businesses faced tighter budgets and closer scrutiny of all purchasing decisions across the board. After 3 months of technology buying during the pandemic, we asked our community about those experiences to see whether purchases were becoming less collaborative.

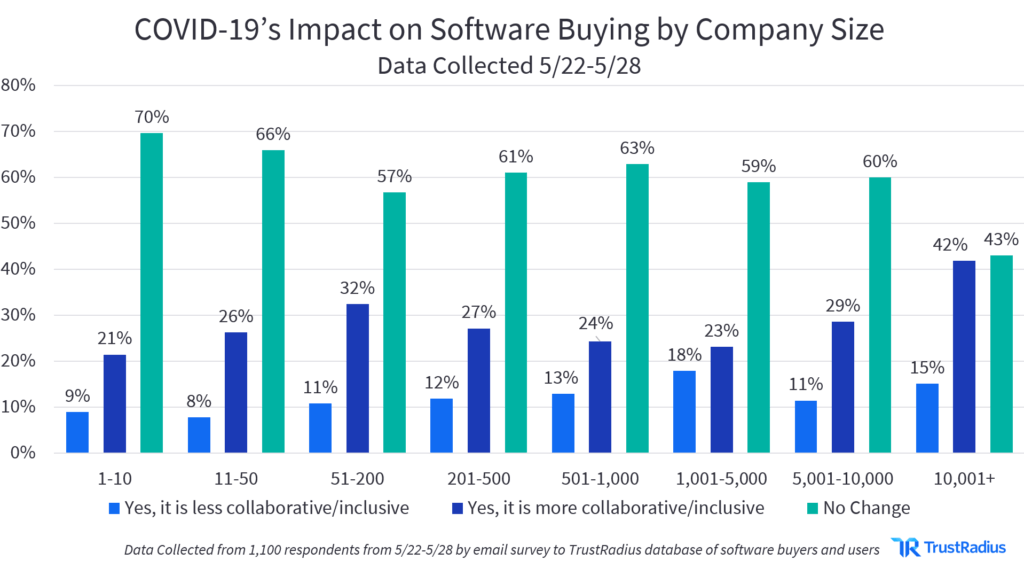

Our data from May 2020 reveals that the complex picture of B2B decision making did not appear to have changed radically due to the pandemic.

It’s clear that the majority (61%) of our community hadn’t experienced any changes in their businesses’ software buying processes during the COVID-19 pandemic. More interestingly, of those who have experienced some change, over two-thirds of them reported buying processes being more collaborative or inclusive than pre-COVID buying.

This data suggests that there had not been a centralization of B2B software buying processes to senior-level execs. Instead, companies may have been consulting more stakeholders to ensure that each purchase was as good a fit as possible before committing their budgets.

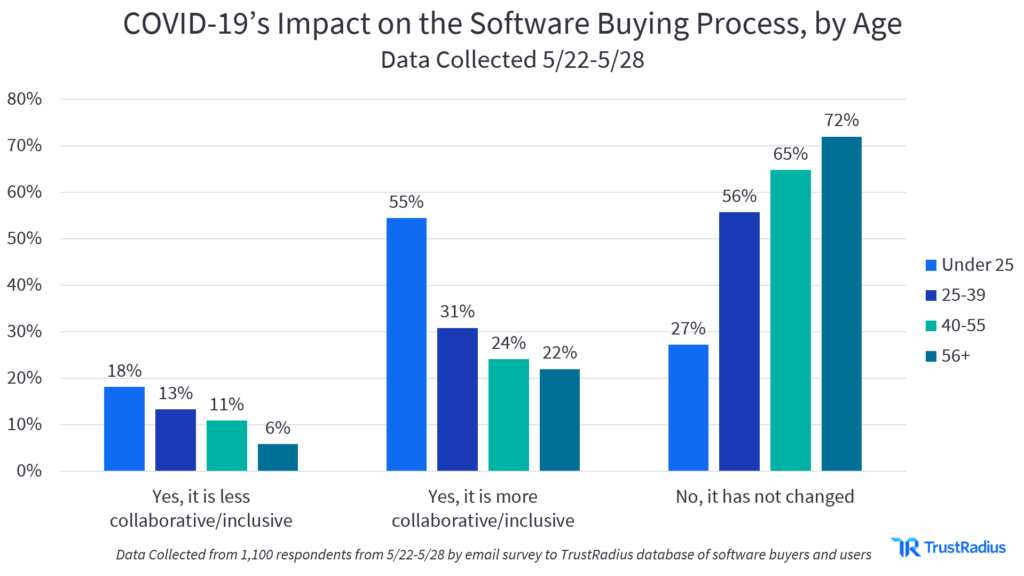

When respondents are segmented by age, which can be a proxy for experience and seniority, we see that the most experienced respondents were the most likely to say that B2B software buying processes hadn’t changed during COVID-19.

Older respondents, who were more likely to have a better historical perspective, were the most likely to say that buying processes haven’t changed as a result of the pandemic. Even more striking is that younger respondents, who often have a higher bar for collaboration and more democratic buying practices, observed a higher degree of collaboration. Since the average number of participants in buying committees is 2-5 people, software purchases remained fundamentally collaborative.

Respondents who saw shifts in the buying process during the COVID-19 pandemic were twice as likely to have experienced a more collaborative process, rather than involving only a single decision-maker.

Collaborative software buying rates also appear to increase among larger companies. One theory that could explain this trend is that larger companies make larger B2B software purchases, and more expensive purchases are under greater scrutiny than in the “before times.” This results in more people engaging in various stages of the buyer’s journey for each software purchase.

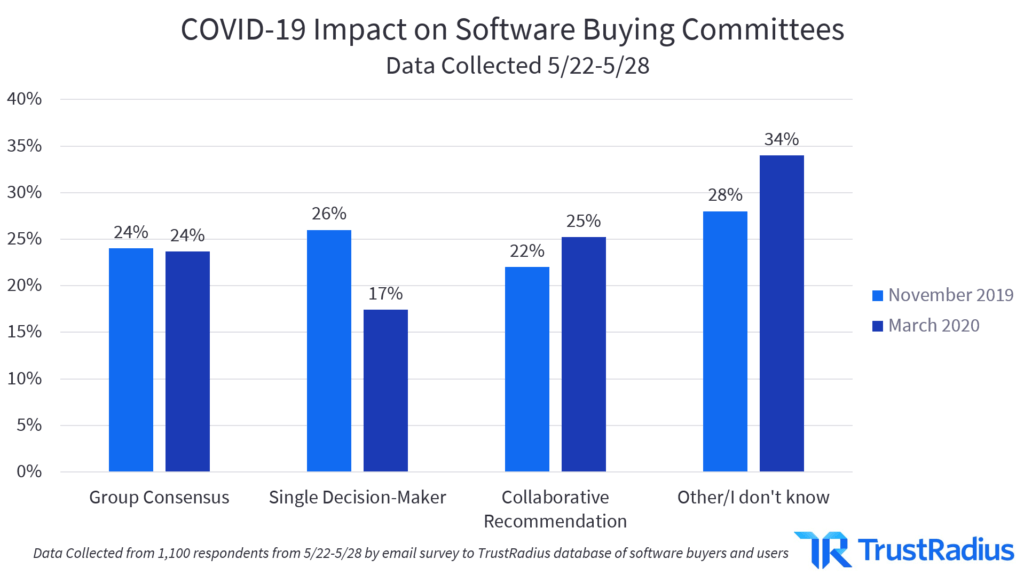

Buying Committee Changes During COVID-19

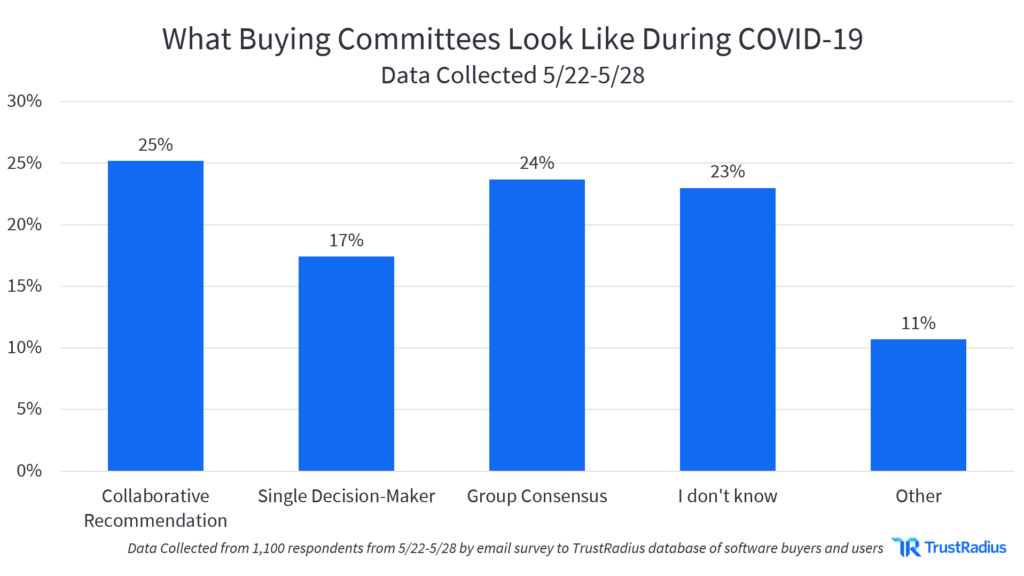

The two most common buying committee dynamics our community used to buy software during the pandemic employed some form of collaboration. However, not all collaboration styles are equal, and some dynamics involve more executive veto power than others.

Nearly half of respondents in May 2020 used either group consensus or a collaborative recommendation approach to buying software during COVID-19. Only 17% used a single decision-maker.

There was also a large minority of respondents who didn’t know about any COVID-related buying decisions. However, these were primarily lower-level employees who are generally less likely to be involved in purchase decisions anyway.

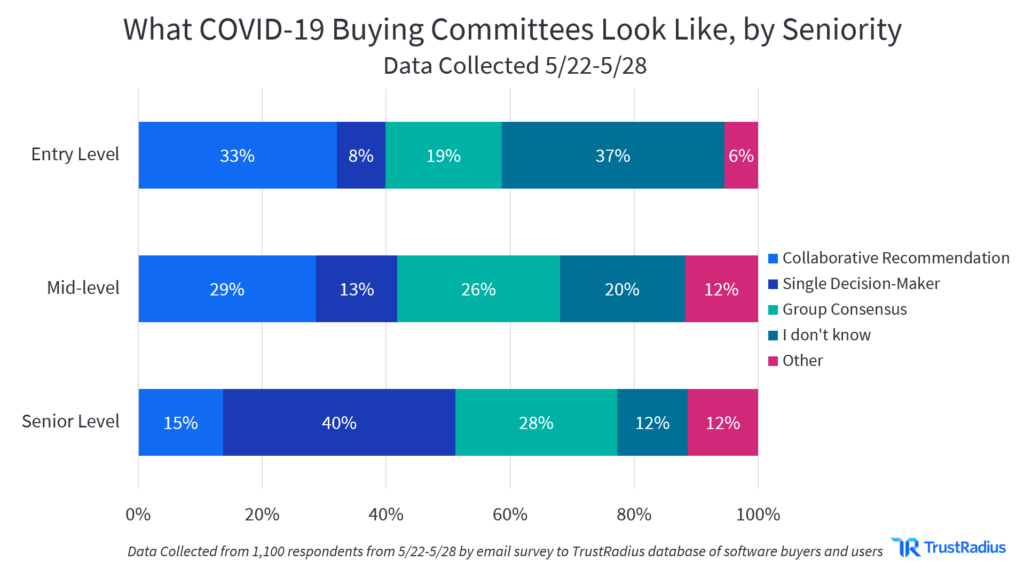

When segmenting responses by job title, a significant disconnect emerged between senior level and middle-upper management buyers. Buyers at the top of the organizational hierarchy, such as founders, owners, and CEOs, were much more likely to say that there was a single final decision maker (likely themselves).

In contrast, folks with mid-level and upper-level titles, such as C-suite, director, or manager, were more likely to identify a collaborative buying dynamic, such as recommending options to execs for a final decision. This disconnect suggests that recommendation-based dynamics and sole decider dynamics could very well be referring to the same situation.

In other words, stakeholders view the buying process differently depending on what role in the organization and the process they play. Mid-level management may provide recommendations to the executive buyer and see this as a collaborative purchasing process. By the same token, the executive buyer (likely the CEO, owner, or founder) may view the same situation as having a single-decision-maker buying model.

Executive Purchasing Power Before and After Coronavirus

While the technology buying process as a whole may have been more collaborative during the COVID-19 pandemic, there’s also evidence that executives were holding on to final decision-making power.

When comparing data from the 2020 B2B Buying Disconnect, published in December of 2019, and data collected in May 2020, there are some clear differences in buying committee dynamics. Most notably, the frequency of sole decision-makers declined by 35% in 6 months. More companies were providing recommendations to execs for the final decision than they were before the pandemic.

This change suggests that, while buying processes were becoming more inclusive of additional stakeholders and participants, final decision-making power was indeed centralized at the executive level in nearly half of B2B technology purchases in May of 2020.

Using This Data to Your Advantage

Stabilization in software purchasing will allow B2B technology companies to more readily predict and plan on retention, lead generation, and new sales forecasting. The most promising news is for businesses focusing on retention—the market trend shows that most businesses have already made the cuts they expect to need to get through 2020.

The onus now falls on sales and demand gen teams to navigate engaging with buyers serving their needs in a more stabilized, but changed, COVID-19 environment. This may be the area where there is the most to be learned and tested to see what strategies are most effective.

We all understand that tech was not one of the industries most affected by coronavirus. But that doesn’t mean companies aren’t still struggling. To help software vendors engage with buyers in the market during the COVID-19 pandemic, we’re offering 30 days of free True Intent data to all qualifying B2B technology companies.

This resource shows you which accounts are evaluating your product and your competitors’ products on TrustRadius, as well as how frequently they’re researching. True Intent gives vendors insight into how many collaborators in an account are engaging with your products, and what research activities they are taking in the discovery, evaluation, and selection stages of their buyer’s journey.

Appendix

B2B Tech SpendingSurvey Results From April 2020

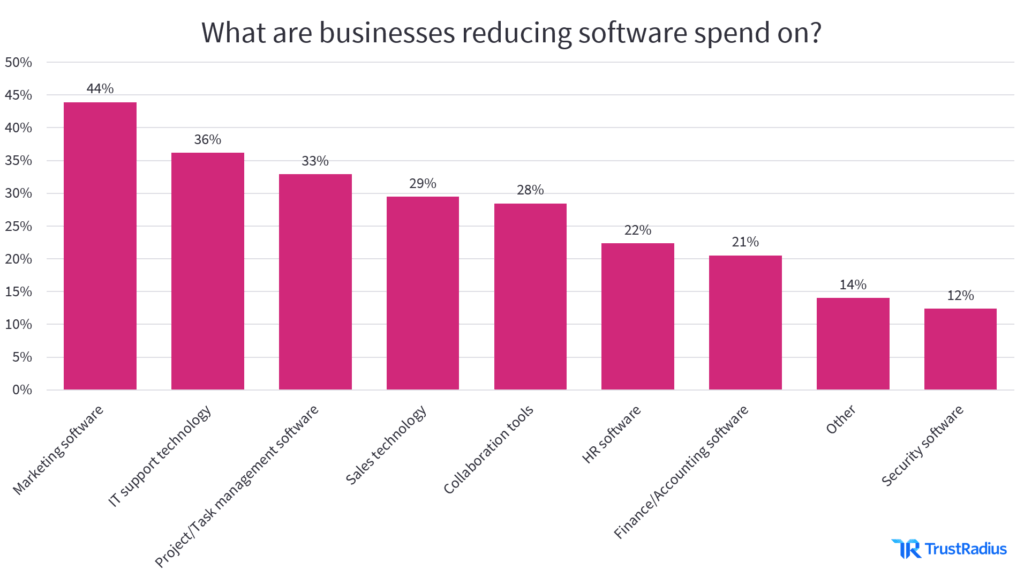

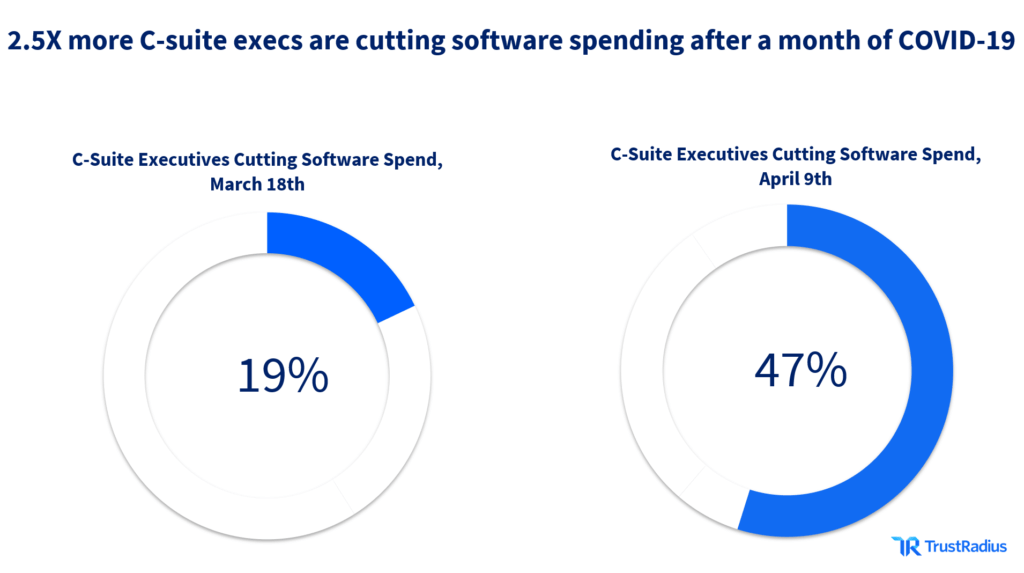

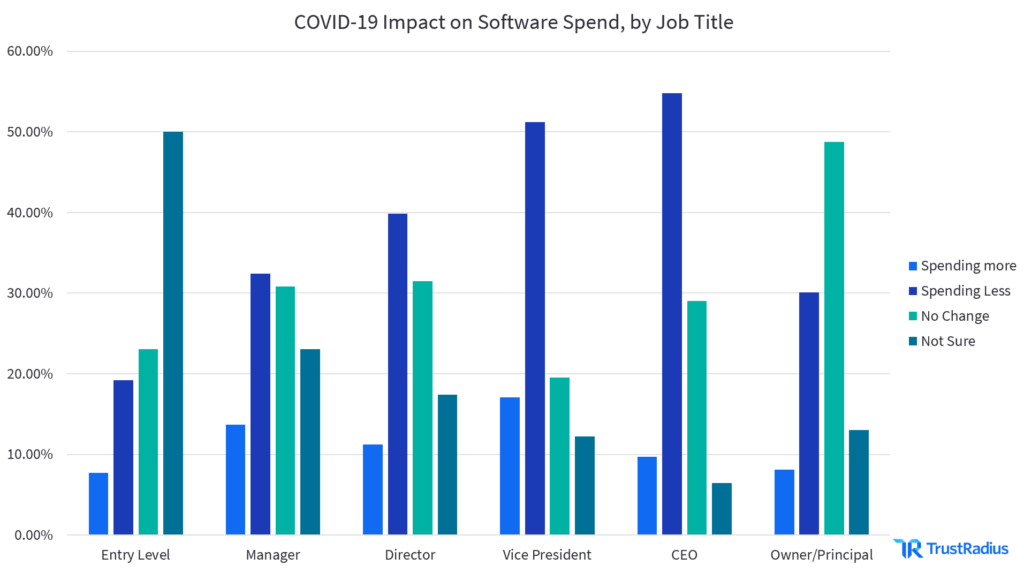

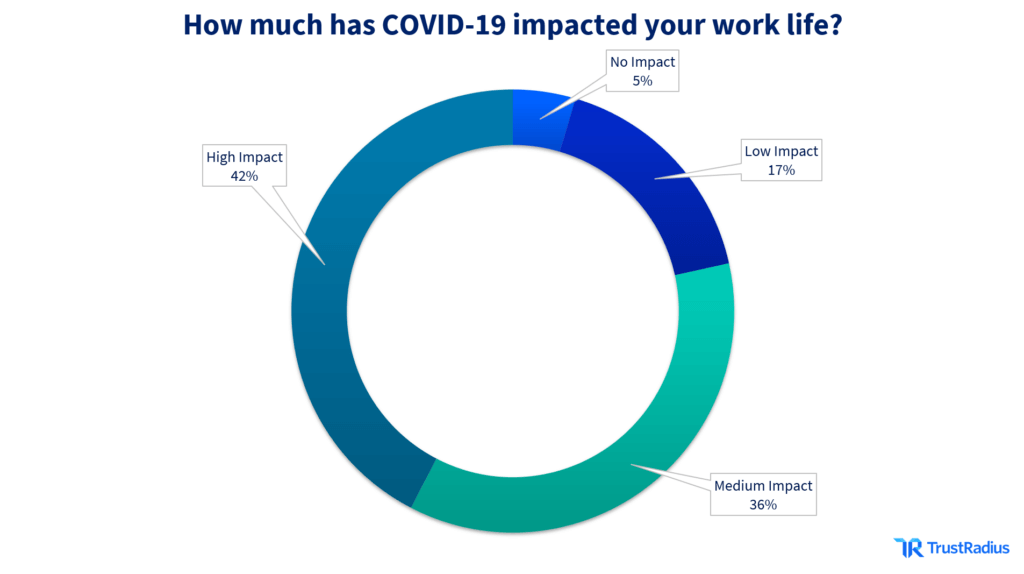

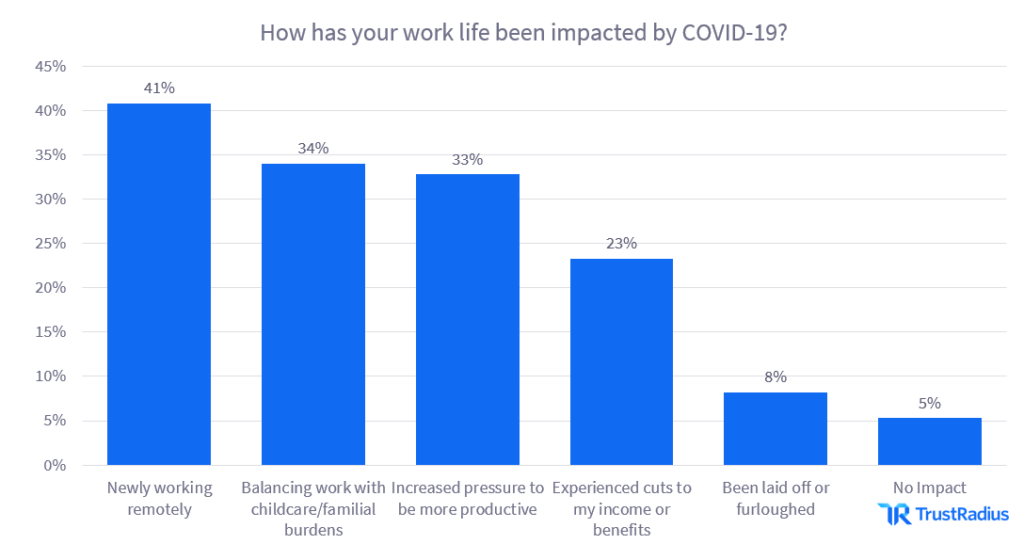

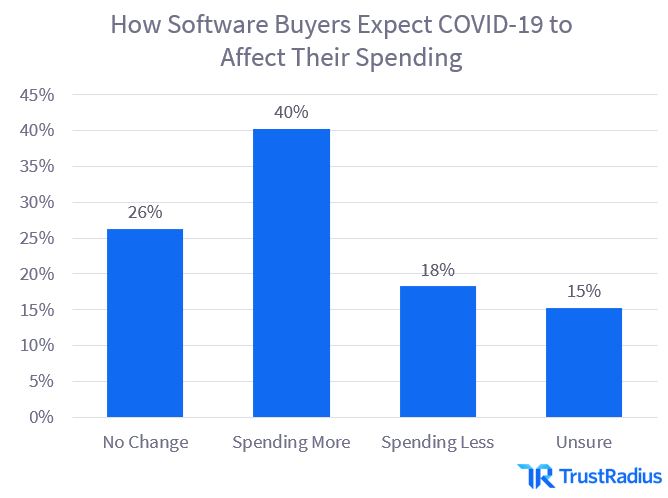

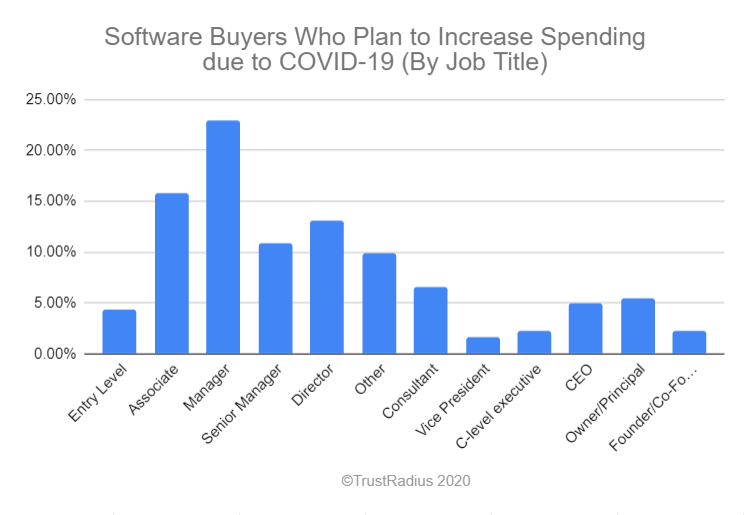

We collected data from 2,168 respondents from 4/9-4/10 through an email survey to the TrustRadius database of software buyers and users. Compared to March survey results (below) the data showed a sharp decline in new spending. This decline was particularly prominent among CEOs and midsize businesses. We also explored how COVID-19 has impacted our community’s professional lives on an individual level.

Explore the charts below for a historical look at businesses and software buyers’ expectations around the COVID-19 pandemic and its impacts from April 2020.

B2B Tech Spending Survey Results From March 2020

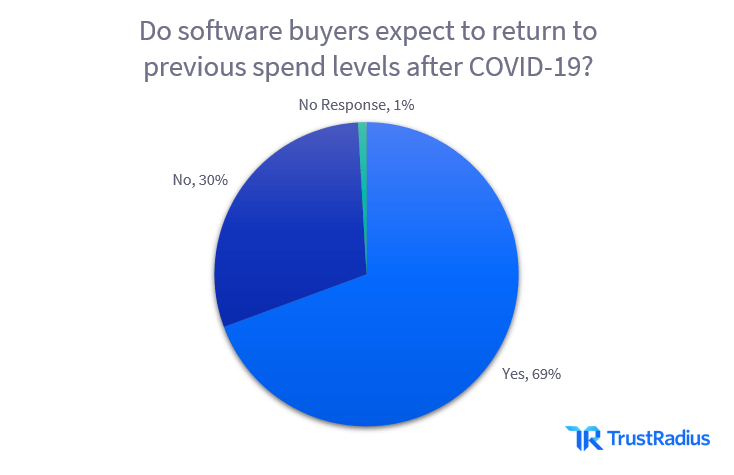

For the first iteration of this post, we collected data from 1688 respondents from 3/18-3/19 through an email survey to the TrustRadius database of software buyers and users. The data showed high rates of increased spending as businesses quickly pivoted to remote-first workforces. We also found high expectations among those decreasing spending to revert those losses once the pandemic is over.

Explore the charts below for a historical look at businesses and software buyers’ expectations around the COVID-19 pandemic and its impacts from March 2020.