Advapay Macrobank Digital Core Banking vs. Rebank

Advapay Macrobank Digital Core Banking vs. Rebank

| Product | Rating | Most Used By | Product Summary | Starting Price |

|---|---|---|---|---|

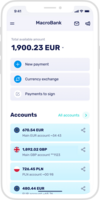

Advapay Macrobank Digital Core Banking | Small Businesses (1-50 employees) | Macrobank by Advapay is a front-to-back banking software solution encompassing an engine, API, web and mobile interfaces, and back-end infrastructure equipped with all essential banking and payment functionalities. Endorsed by numerous regulators, it boasts flexibility and customization options, operates on an API-based architecture, and can be deployed either on the cloud or on-premises. It is available in both Software as a Service (SaaS) and perpetual licensing models, with the added… | $7,000 | |

Rebank | N/A | Rebank provides a single dashboard for international startup founders and CFOs to manage all their business bank accounts, understand spend and send payments. Users can replace multiple logins with one secure login and see cash balances in real-time across all accounts. Users can make inter-company, bill payments or pay salaries with over 30 currencies. Notifications can be set up to view balances and transactions in apps including Slack and WhatsApp. | $0 per month |

| Advapay Macrobank Digital Core Banking | Rebank | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Editions & Modules | No answers on this topic |

| ||||||||||||||

| Offerings |

| |||||||||||||||

| Entry-level Setup Fee | Optional | No setup fee | ||||||||||||||

| Additional Details | — | — | ||||||||||||||

| More Pricing Information | ||||||||||||||||

| Advapay Macrobank Digital Core Banking | Rebank |

|---|

| Advapay Macrobank Digital Core Banking | Rebank | |

|---|---|---|

| Likelihood to Recommend | - (0 ratings) | 9.0 (2 ratings) |

| Advapay Macrobank Digital Core Banking | Rebank | |

|---|---|---|

| Likelihood to Recommend | Advapay No answers on this topic | Rebank

|

| Pros | Advapay No answers on this topic | Rebank

|

| Cons | Advapay No answers on this topic | Rebank

|

| Alternatives Considered | Advapay No answers on this topic | Rebank

|

| Return on Investment | Advapay No answers on this topic | Rebank

|

| ScreenShots | Advapay Macrobank Digital Core Banking Screenshots | Rebank Screenshots |