FinnOne Neo vs. Margill Loan Manager

FinnOne Neo vs. Margill Loan Manager

| Product | Rating | Most Used By | Product Summary | Starting Price |

|---|---|---|---|---|

FinnOne Neo | N/A | FinnOne Neo is an automated, workflow-based and technologically advanced lending solution that provides loan lifecycle management capabilities, available on-premise or from the cloud. It enables customers to digitize and automate their processes, launch tailored products, and offer services across multiple channels. FinnOne Neo helps digitize the complete loan lifecycle end to end, from initial contact with customers and helping make better credit decisions faster to loan servicing and… | N/A | |

Margill Loan Manager | N/A | Margill Loan Manager is designed to handle a number of payment scenarios. According to the vendor, this solution’s sophisticated mathematics make it the choice of governments, public and private companies, private lenders, accountants and developments agencies that service between 10 and 30,000 loans. This solution is designed to handle the following types of loans: Consumer, Business, Inter-company, Employee, Construction, Litigation and Lines of Credit. Users can create… | N/A |

| FinnOne Neo | Margill Loan Manager | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Editions & Modules | No answers on this topic | No answers on this topic | ||||||||||||||

| Offerings |

| |||||||||||||||

| Entry-level Setup Fee | No setup fee | Optional | ||||||||||||||

| Additional Details | — | — | ||||||||||||||

| More Pricing Information | ||||||||||||||||

| FinnOne Neo | Margill Loan Manager |

|---|

| FinnOne Neo | Margill Loan Manager | |

|---|---|---|

| Likelihood to Recommend | 8.2 (3 ratings) | - (0 ratings) |

| FinnOne Neo | Margill Loan Manager | |

|---|---|---|

| Likelihood to Recommend | Nucleus Software Exports Ltd.

| Margill No answers on this topic |

| Pros | Nucleus Software Exports Ltd.

| Margill No answers on this topic |

| Cons | Nucleus Software Exports Ltd.

| Margill No answers on this topic |

| Alternatives Considered | Nucleus Software Exports Ltd.

| Margill No answers on this topic |

| Return on Investment | Nucleus Software Exports Ltd.

| Margill No answers on this topic |

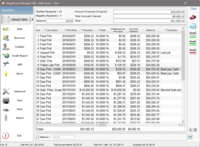

| ScreenShots | Margill Loan Manager Screenshots |