Socure vs. Trustmatic (discontinued)

Socure vs. Trustmatic (discontinued)

| Product | Rating | Most Used By | Product Summary | Starting Price |

|---|---|---|---|---|

Socure | N/A | Socure is an AI-powered identity verification system designed to help financial services companies prevent identity fraud losses and remain compliant. The system is comprised of ID+, the identity verification mechanism, a KYC (Know Your Customers) Compliance add-on, which uses additional personally identifiable information to authenticate users, and Watchlist products to check international sanctions and enforcement lists for AML (Anti-Money Laundering) compliance. | N/A | |

Trustmatic (discontinued) | N/A | Trustmatic software supported verification processes and KYC compliance. The application is no longer available for sale. | N/A |

| Socure | Trustmatic (discontinued) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Editions & Modules | No answers on this topic | No answers on this topic | ||||||||||||||

| Offerings |

| |||||||||||||||

| Entry-level Setup Fee | No setup fee | No setup fee | ||||||||||||||

| Additional Details | — | — | ||||||||||||||

| More Pricing Information | ||||||||||||||||

| Socure | Trustmatic (discontinued) | |

|---|---|---|

| Likelihood to Recommend | - (0 ratings) | 10.0 (3 ratings) |

| Socure | Trustmatic (discontinued) | |

|---|---|---|

| Likelihood to Recommend | Socure No answers on this topic | Discontinued Products

|

| Pros | Socure No answers on this topic | Discontinued Products

|

| Alternatives Considered | Socure No answers on this topic | Discontinued Products

|

| Return on Investment | Socure No answers on this topic | Discontinued Products

|

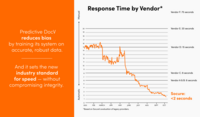

| ScreenShots | Socure Screenshots |