Plaid vs. Socure

Plaid vs. Socure

| Product | Rating | Most Used By | Product Summary | Starting Price |

|---|---|---|---|---|

Plaid | N/A | Plaid in San Francisco offers a suite of applications supporting banks with risk management and customer account management features. Plaid is used by digital financial apps and services like Betterment, Expensify, Microsoft and Venmo, and by banks to make it easier for consumers to connect their financial accounts with the apps and services they want to use. Plaid connects with over 11,000 financial institutions across the U.S, Canada and Europe. | $500 per month | |

Socure | N/A | Socure is an AI-powered identity verification system designed to help financial services companies prevent identity fraud losses and remain compliant. The system is comprised of ID+, the identity verification mechanism, a KYC (Know Your Customers) Compliance add-on, which uses additional personally identifiable information to authenticate users, and Watchlist products to check international sanctions and enforcement lists for AML (Anti-Money Laundering) compliance. | N/A |

| Plaid | Socure | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Editions & Modules |

| No answers on this topic | ||||||||||||||

| Offerings |

| |||||||||||||||

| Entry-level Setup Fee | No setup fee | No setup fee | ||||||||||||||

| Additional Details | Contact sales team for additional pricing. There may be one-time fees, subscription fees, per-request flat fees, or payment initiation fees depending on your needs. | — | ||||||||||||||

| More Pricing Information | ||||||||||||||||

| Plaid | Socure | |

|---|---|---|

| Small Businesses | Square Invoices Score 9.2 out of 10 | No answers on this topic |

| Medium-sized Companies |  Apple Pay Score 8.7 out of 10 | No answers on this topic |

| Enterprises | Adyen Score 8.6 out of 10 | No answers on this topic |

| All Alternatives | View all alternatives | View all alternatives |

| Plaid | Socure | |

|---|---|---|

| Likelihood to Recommend | 10.0 (1 ratings) | - (0 ratings) |

| Plaid | Socure | |

|---|---|---|

| Likelihood to Recommend |  Plaid

| Socure No answers on this topic |

| Pros |  Plaid

| Socure No answers on this topic |

| Cons |  Plaid

| Socure No answers on this topic |

| Return on Investment |  Plaid

| Socure No answers on this topic |

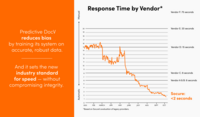

| ScreenShots | Socure Screenshots |