Overview

What is CheckMark Payroll?

Engineered for small businesses, CheckMark Payroll software for Macintosh and Windows is a solution for small business owners, accountants, and payroll professionals. Features include direct deposit, MICR encoding blank check stock printing and users can process as many payrolls as…

Pricing

CheckMark Payroll 2023 Edition

$509

Entry-level set up fee?

- No setup fee

Offerings

- Free Trial

- Free/Freemium Version

- Premium Consulting/Integration Services

Starting price (does not include set up fee)

- $509 per year

Product Details

- About

- Integrations

- Competitors

- Tech Details

- FAQs

What is CheckMark Payroll?

CheckMark Payroll software is designed specifically for small business owners, accountants, and payroll professionals. Features include direct deposit, MICR encoding blank check stock printing, and users can process as many payrolls as desired for employees and companies. Up-to-date Federal and State tax withholding tables and printable IRS forms are included.

Additional Features:

- Windows and Mac compatible

- With CheckMark Payroll users can E-file W2s & W3s to the SSA and most states at no additional cost, or print completed Forms 941, 940, 944, 943, W-2, and W-3 forms on blank or pre-printed paper.

- CheckMark Payroll creates ACH files for Direct Deposit via a bank or web-based deposit service for all Employer and Employee payments at no additional charge. And users can e-mail pay stubs to employees.

- CheckMark offers cloud backup at an additional cost.

- The user can print MICR-encoded employee pay checks on blank check stock.

Additionally CheckMark provides certified payroll support representatives and US-based support, who can be reached by phone, email, or fax.

CheckMark Payroll Features

Payroll Management Features

- Supported: Pay calculation

- Supported: Support for external payroll vendors

- Supported: Off-cycle/On-Demand payment

- Supported: Payroll history for each employee

- Supported: Benefit plan administration

- Supported: Direct deposit files

- Supported: Payroll tracking and auditing

- Supported: Salary revision and increment management

- Supported: Reimbursement management

- Supported: Statutory form management

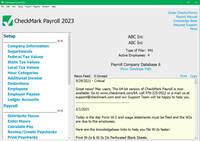

CheckMark Payroll Screenshots

CheckMark Payroll Videos

CheckMark Payroll Integrations

CheckMark Payroll Competitors

CheckMark Payroll Technical Details

| Deployment Types | On-premise |

|---|---|

| Operating Systems | Windows, Mac |

| Mobile Application | No |

| Supported Countries | United States |

| Supported Languages | English |

Frequently Asked Questions

Comparisons

Compare with

Reviews

Community Insights

- Business Problems Solved

- Pros

- Cons

Users have found CheckMark Payroll to be a versatile and user-friendly payroll app, offering multiple methods to ask for support, including phone, email, and trouble tickets. However, some users have expressed concerns about the lack of timely response from the support team, which can be problematic when staff payments are at stake. Additionally, there are mixed reviews from long-term users, with one expressing dissatisfaction and planning to explore other payroll software options. Another user mentioned switching to a full-service company due to the cost of updating tax tables annually. Despite these negative experiences, many users still appreciate the product for its affordability, ease of use, and ability to cut down recurring expenses.

CheckMark Payroll is well-regarded as an excellent solution for small businesses, providing DIY capabilities and the option to host their own data. Users have reported that the software has improved the accuracy of W2 and W3 reporting, pay stub review and printing, as well as vacation and sick day calculations. This has helped them save both time and money. The software also offers features like handling 401k, printing various tax forms, and ensuring compliance with IRS taxes. Quarterly and year-end reports are made easier with CheckMark Payroll, requiring only a double check of input. Overall, users find it to be a good payroll solution with useful features.

For Mac users specifically, CheckMark Payroll is praised for being user-friendly, with prompt and helpful customer support, easy updates, and reasonable pricing. It eliminates payroll headaches by taking care of calculations and filing taxes with minimal effort from users. The seamless payroll experience it provides along with easy employee hiring and available support when needed make it a preferred choice. Users have described the payroll processing as hassle-free. In general, there are positive experiences shared by users who appreciate CheckMark Payroll's ease of use and its ability to streamline payroll operations.

Easy to use and set up: Many users have found the CheckMark Payroll software to be easy to use and set up, even after using it for over 10 years. They appreciate the user-friendly interface and intuitive design, which requires very little training. This makes it a convenient choice for businesses of all sizes.

Compatible with other programs: Several reviewers have mentioned that the software is compatible with CheckMark's Accounting program, MultiLedger. They also appreciate that the cost remains the same regardless of the number of employees. This compatibility and flexibility make it a suitable option for businesses already using these programs or looking for seamless integration.

No monthly fee and excellent customer support: Users are pleased with the absence of a monthly or recurring fee associated with CheckMark Payroll software. They also commend the friendly and supportive customer support staff who are available to assist them whenever needed. This combination of affordability and reliable customer service adds value to their experience with the software.

Poor Customer Support: Several users have experienced poor customer support from CheckMark, with no response to emails, phone calls, or trouble tickets.

Compatibility Issues and Data Loss during Upgrade: Some users had to purchase a new software app after upgrading to the 2022 version because it was not compatible with their old computer. They were disappointed to lose their old company databases during the installation process.

Calculation Errors and Limited Functionality: Users have reported issues with the software's calculations, such as incorrect federal withholding for an employee and the software not adding vacation and sick time for all employees. Additionally, some users felt that the software was not advanced enough for their payroll needs.