Cloud Storage Software Statistics and Trends

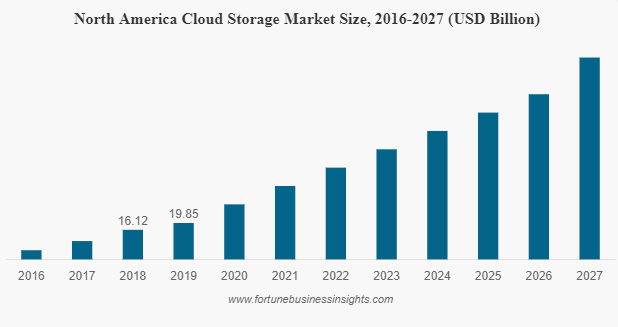

Over the past 5 years, cloud storage systems have seen growing buyer activity as more and more businesses move away from traditional storage solutions and remote work becomes more common. Cloud storage is only going to continue growing, with analysts predicting the market reaching 297.54 billion dollars by 2027. As more businesses consider cloud storage software, cloud storage vendors are focused on how to reach buyers and grab a share of the space for themselves.

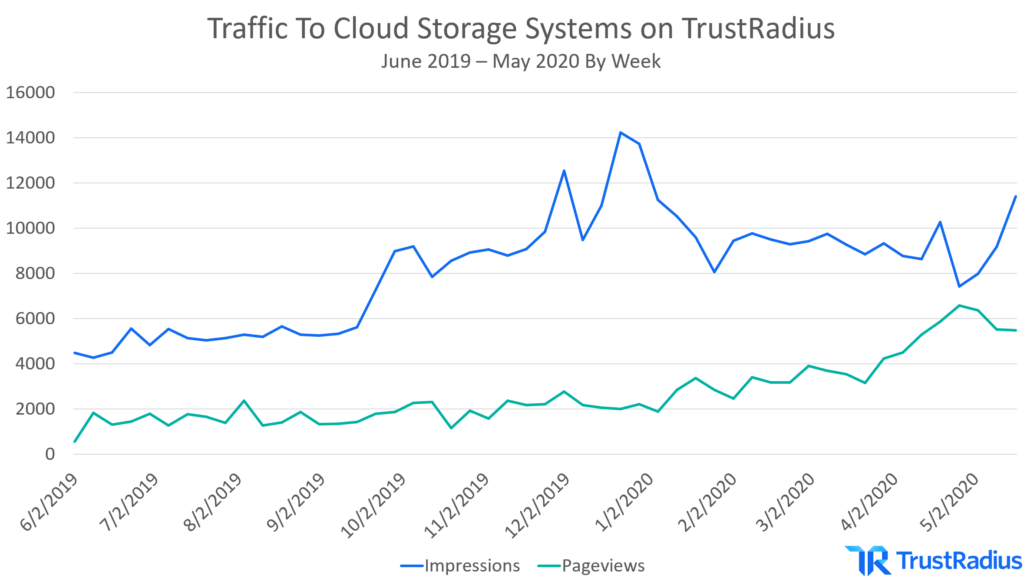

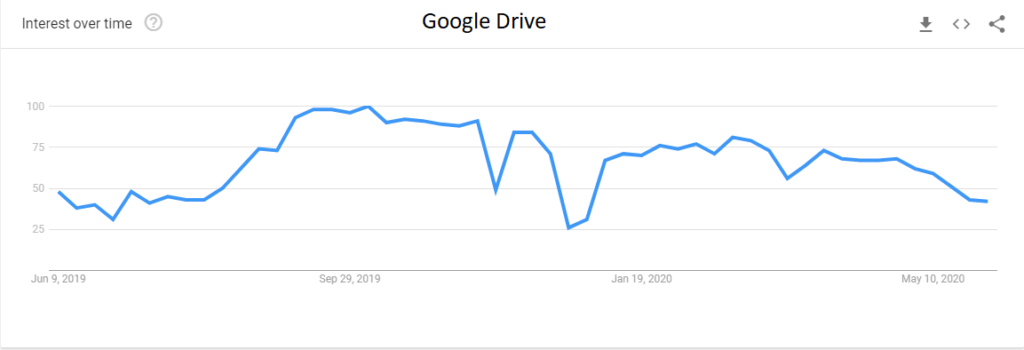

Despite stagnation in cloud storage Google search trends in 2020, traffic to cloud storage pages on Trustradius has doubled over the last year, with category leaders seeing major traffic growth since March 2020.

Below, we explore the top cloud storage products and industry trends over the last year, and what they indicate about the cloud storage market today.

Quick Access

- Buyer Behavior Since 2019

- Top Cloud Storage Systems

- Most Popular Product Comparisons

- Cloud Storage on TrustRadius vs G2

Cloud Storage Buyer Behavior Since 2019

Online buyer activity for the cloud storage market has been stable in from 2019-2020. Despite this, TrustRadius has seen growth in terms of impressions in 2019 and in terms of pageviews since 2020. Even as search impressions have steadied in 2020, TrustRadius has won cloud storage pageviews through detailed buyer reviews, product comparisons, and blog posts.

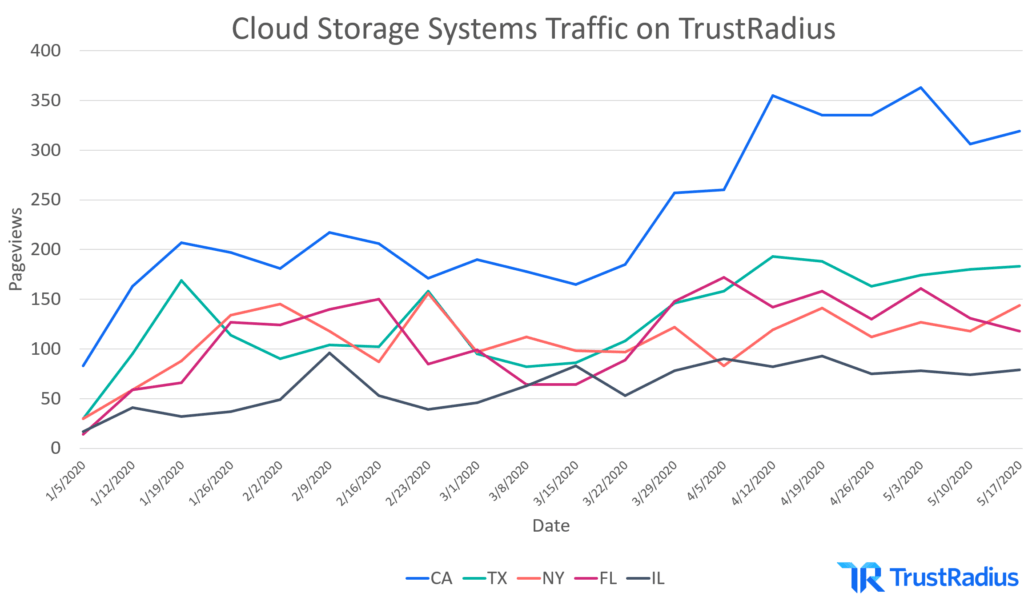

Most cloud storage traffic on TrustRadius comes from states like California and New York, which are filled with tech startups and enterprises. Notably, California had particularly high traffic spikes in March 2020, likely due to the uniquely high technology demands of areas like silicon valley. Even outside of highly technical regions, cloud storage is becoming important to all businesses as remote work becomes more common, along with a need for easily transferable data between offices. This increased need for cloud storage is indicated by an increase in web traffic related to cloud storage as well as the gradual growth of the cloud storage market.

Top Cloud Storage Systems in 2020

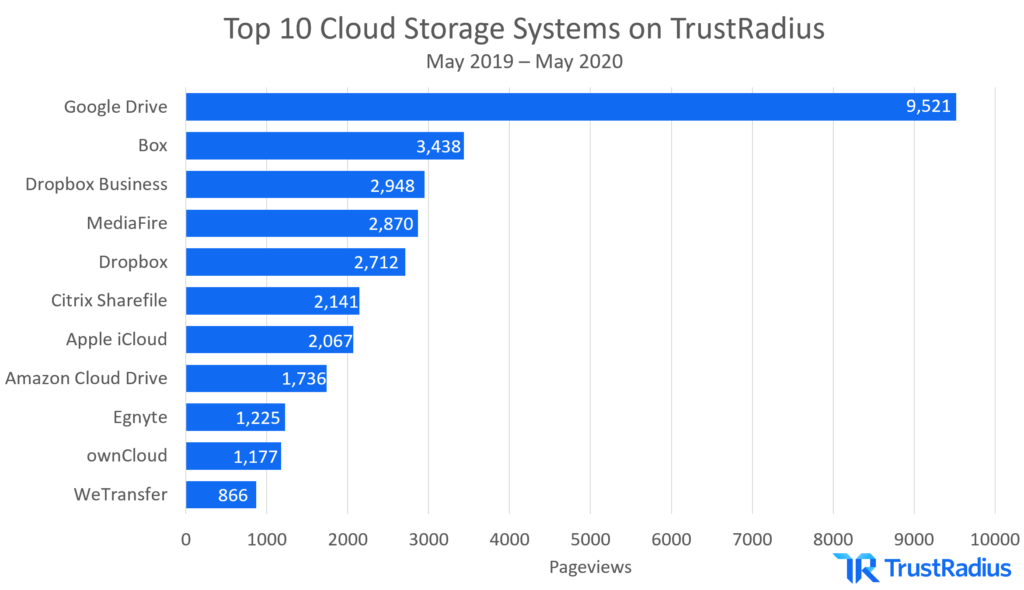

| # | Product | Pageviews |

| 1 | Google Drive | 9,521 |

| 2 | Box | 3,438 |

| 3 | Dropbox Business | 2,948 |

| 4 | MediaFire | 2,870 |

| 5 | Dropbox | 2712 |

| 6 | Citrix ShareFile | 2,141 |

| 7 | Apple iCloud | 2,067 |

| 8 | Amazon Cloud Drive | 1,736 |

| 9 | Egnyte | 1,225 |

| 10 | ownCloud | 1,177 |

| 11 | WeTransfer | 866 |

Leaders in the cloud storage market have seen significant traffic growth on their TrustRadius product pages since 2020. Google Drive is the category leader, with the biggest share of traffic by a large margin. After Google Drive, however, products in the cloud storage space are highly competitive, with the rankings fluctuating frequently. One example of this is MediaFire, which rose from being out of the top ten cloud storage products in December 2019 to having the fourth most page views in April 2020.

Despite increased need for cloud storage, there have been no major feature innovations over the last year. Most cloud storage systems offer similar feature sets when it comes to storage. Cloud storage vendors set themselves apart by offering integrations with other popular tools or by providing flexible pricing and sharing options for files of different sizes.

Most of the top products have some unique strength that sets them apart. For example, WeTransfer allows for free transfer of files through a browser based application while Google Drive includes a suite of collaboration tools. In this way, cloud storage systems appeal to different businesses despite offering the same basic storing and sharing functions. User reviews on TrustRadius help organizations decide which cloud storage product is right for their use case.

Another differentiating factor between these cloud storage products is pricing. Most of the products, including Google Drive, Box, Dropbox, Apple ICloud, OwnCloud, Egnyte and Citrix Sharefile only offer paid pricing packages, with powerful collaboration features and support for large files. In contrast, MediaFire and WeTransfer both offer free pricing, which can support small file transfer, making them popular choices for small businesses.

Market Trends for Google Drive, MediaFire, and Dropbox

Here’s how TrustRadius’ increase in cloud storage traffic has affected some of the category’s leading products:

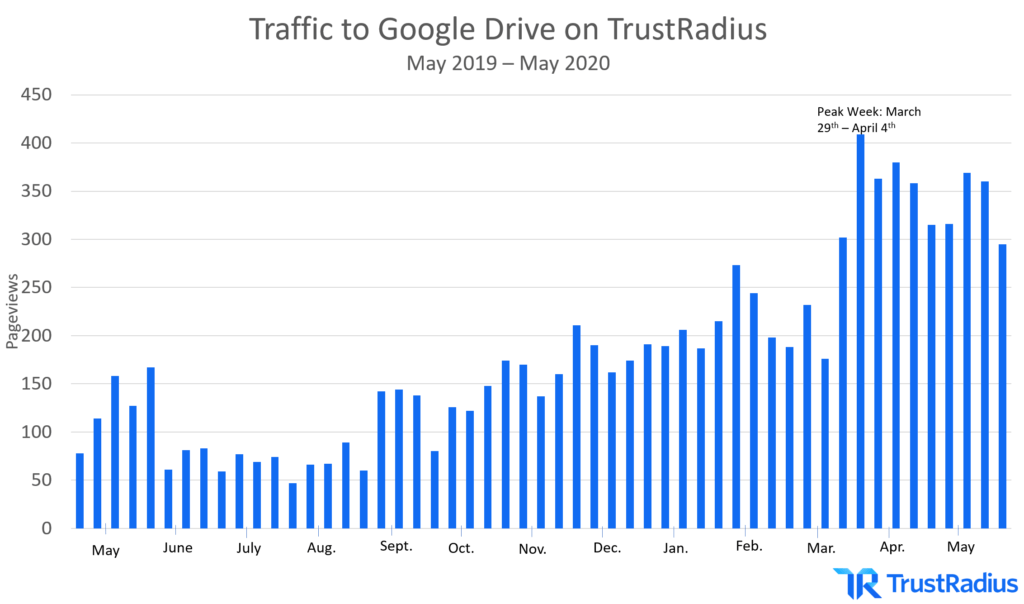

Google Drive

Google Drive had its biggest traffic spike on TrustRadius on the week of March 29th, at 409 weekly pageviews—a 100% increase since the beginning of that month. We’ve seen a slight decline in April and May, though buyer interest in Google Drive is still much higher now than before the COVID-19 pandemic and distancing measures set in.

Google Drive is a popular choice for many businesses due to its ease of implementation. It also offers seamless integrations with G Suite and popular third party tools like VMWare and Dell’s cloud software. For businesses looking for a cloud storage system with robust collaboration tools, Google Drive is an easy choice that fits into most IT infrastructures.

“Google Drive should be used by teams and departments in organizations that want to collaborate on the same files. Also, if you are a G Suite user, you definitely need to check it out. I love how there is a Google Drive app for every major operating system/ecosystem. If I am away from my laptop and have to quickly access a file, I do so on my mobile. The interface is quite beautiful and intuitive on the mobile ecosystem. I also think that the default storage space that they prove is more than sufficient.”

—Tanish Pruthi | Marketing Associate | Information Technology & Services | 501-1000 employees

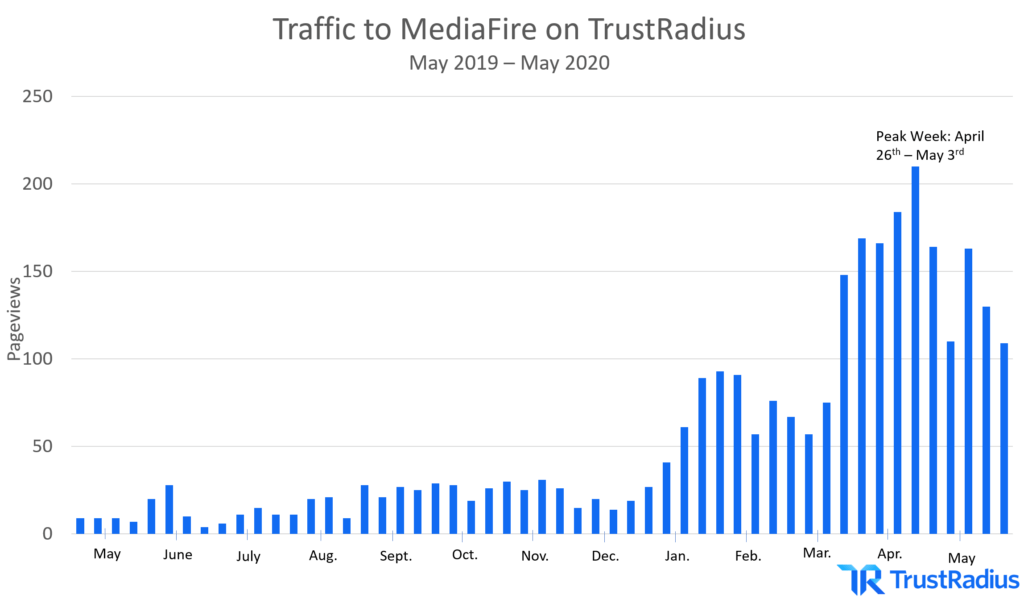

MediaFire

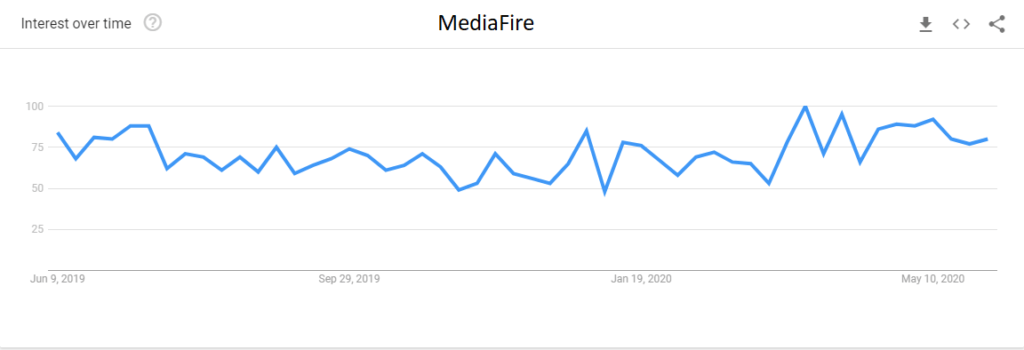

MediaFire has seen the biggest change in traffic on TrustRadius since 2019. Google trends data suggests a slight increase in search activity for MediaFire occurred in the beginning of 2020. However, we saw a colossal increase in MediaFire’s traffic on Trustradius from May 2019 to its peak week on April 6th 2020. MediaFire traffic increased over 100% compared to previous months.

MediaFire is a popular choice for small businesses due to its free pricing tier that can handle any amount of small files. Additionally, MediaFire provides fast file uploads and downloads to any device with a simple to use interface that won’t require significant training for employees.

“We use MediaFire in our small team. When we are working together on projects that require file storage and sharing, MediaFire is essential. Our demand is just for text and presentation files (generally small size) so the free accounts are suitable for us.”

—Vinicius Lima | Computer Technician | Universidade de São Paulo | 5001-10000 employees

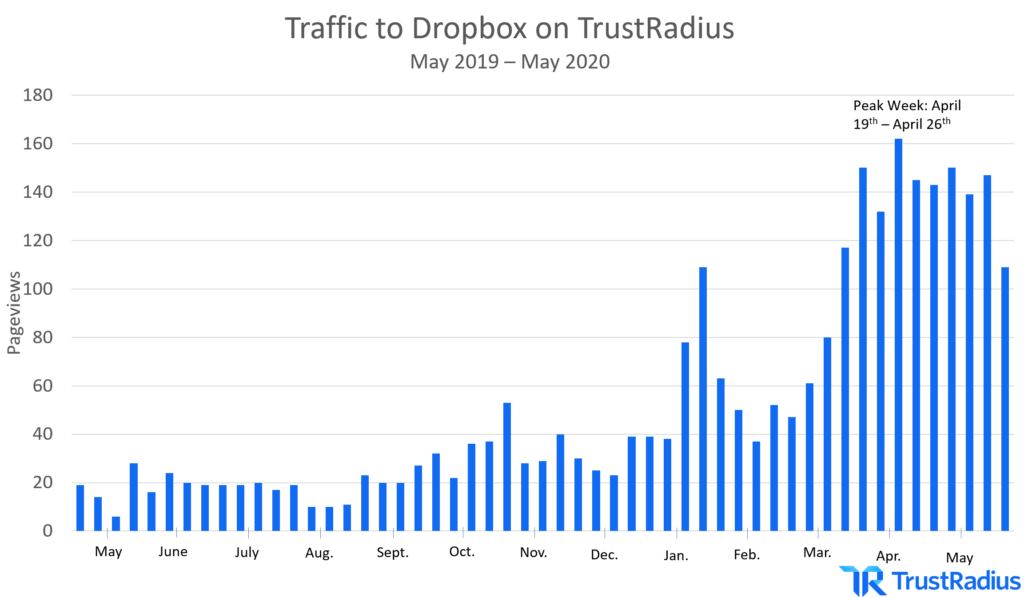

Dropbox

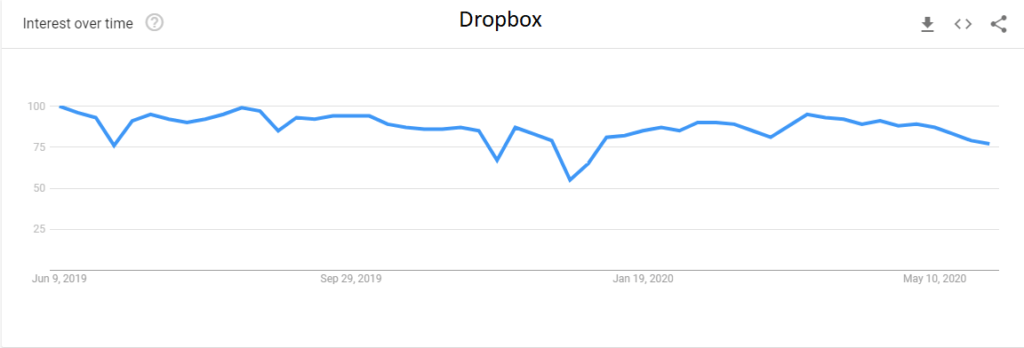

Dropbox saw slow increases in traffic on TrustRadius over 2019. Traffic spikes began in March 2020, increasing up to a peak week of 162 pageviews on the week of April 19th. Search trends for Dropbox remained steady over this time period, while the number of buyers relying on TrustRadius to evaluate Dropbox grew.

Dropbox is popular with businesses of all sizes because it is one of the best tools for transferring large files. While many cloud storage systems focus on collaborating on smaller files, Dropbox makes it easy for businesses to share large documents, or video files that might not be shareable on other cloud storage systems. Dropbox was initially released in 2008 and has been continuously developed since then. As a result, Dropbox supports many integrations and functions on almost all devices.

“For me, Dropbox is especially helpful when using a larger file (particularly video) across mobile devices. It allows me to access and share a video file that I can then upload to multiple places such as Twitter, Facebook and Instagram. The file system and search also makes it helpful to categorize and find what you’re looking for.”

—Tim Cigelske | Director of Integrated Content | Higher Education | 1001-5000 employees

Top Cloud Storage Product Comparisons

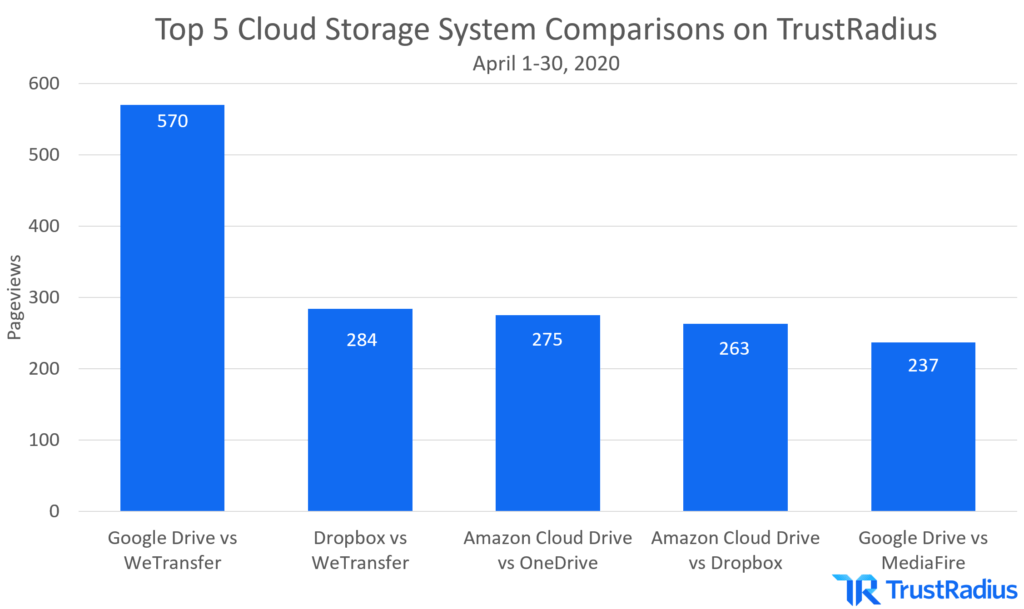

In addition to individual product pages, comparison pages for cloud storage systems also make up a significant portion of the cloud storage traffic on TrustRadius. Comparison pages allow buyers who have narrowed down their product search to compare options head to head and decide which is best for them. The below graph shows the most popular cloud storage product comparisons in the month of April 2020.

| # | Comparison | Pageviews |

| 1 | Google Drive vs WeTransfer | 570 |

| 2 | Dropbox vs WeTransfer | 284 |

| 3 | Amazon Cloud Drive vs OneDrive | 275 |

| 4 | Amazon Cloud Drive vs Dropbox | 263 |

| 5 | Google Drive vs MediaFire | 237 |

The most popular cloud storage comparisons on TrustRadius look at products with free options versus products that only have paid pricing plans. This indicates that many businesses are weighing whether or not paid premium features are worth it. Despite this, the top three individual cloud storage products in terms of traffic are all paid products (Google Drive, Box, Dropbox Business). The prominence of paid offerings indicates that many buyers don’t find free feature sets to be sufficient for their needs.

The Cloud Storage Market on TrustRadius vs. G2

Software buyers and vendors who seek high quality research and accurate insights on the cloud storage category will find that both of those outcomes depend on a high volume of users and meaningful content. TrustRadius has high quality content that generates meaningful insights that help software vendors stay ahead of the curve. TrustRadiusprovides quality cloud storage reviews averaging 299 words each, compared to G2’s sitewide average review word count of 130.

As the cloud storage market continues to grow, Trustradius will continue to monitor new surging products, buyer trends, and key developments in the industry and to share those insights with our community.

For software vendors that want to keep up to date on their market, TrustRadius provides category-level and product-level intent data showing the accounts researching your solutions and solutions offered by competitors. Learn more here.