10 Intriguing UCaaS Statistics for 2021

COVID-19 changed how we communicate with each other in ways that will long outlast the pandemic. With 80% of people not wanting to return to the office full time, effective communications systems will become more vital than ever.

Enter UCaaS (Unified communication as-a-service).

The pandemic created unique investment opportunities for this rapidly growing market. With new UCaaS tools, companies can free up resources, streamline collaboration, and improve efficiency.

These statistics show the state of the UCaaS market in 2021, its users, and where it may be going in the future.

Click on a Section to Explore:

10 Essential UCaaS Statistics for 2021

- The UCaaS market size is $47.64 billion in 2021. (GrandView Research 2021)

- The UCaaS market size is projected to reach $210.07 billion in 2028. (GrandView Research 2021)

- 61% of people report that they still typically dial into their conference calls rather than use video. (Loopup 2019)

- Companies lose $34 billion each year due to poor conference calls leading to wasted time. (Loopup 2019)

- 85% of people frequently experience issues with online meetings. (Cisco 2020)

- 42% of individuals attending online meetings become frustrated before the meeting begins because they can’t join a meeting easily. (Cisco 2020)

- 87% of remote team members feel more connected to their team when they can use video conferencing. (GigaOm 2020)

- 36% of employees would choose remote work over a pay raise. (GigaOm 2020)

- 37% of tech professionals would take a 10% pay cut in order to work from home. (GigaOm 2020)

- Two-thirds of people worldwide are video chatting more now than they were just 7 months ago. (Vonage 2020)

Who’s Winning the UCaaS Market in 2021

Over 1.2 million software buyers use TrustRadius each month. Many of them are shopping for UCaaS software—so we took a closer look at our data to see which products attract the most attention.

According to buyer interest, the top 8 leaders in today’s UCaaS market are:

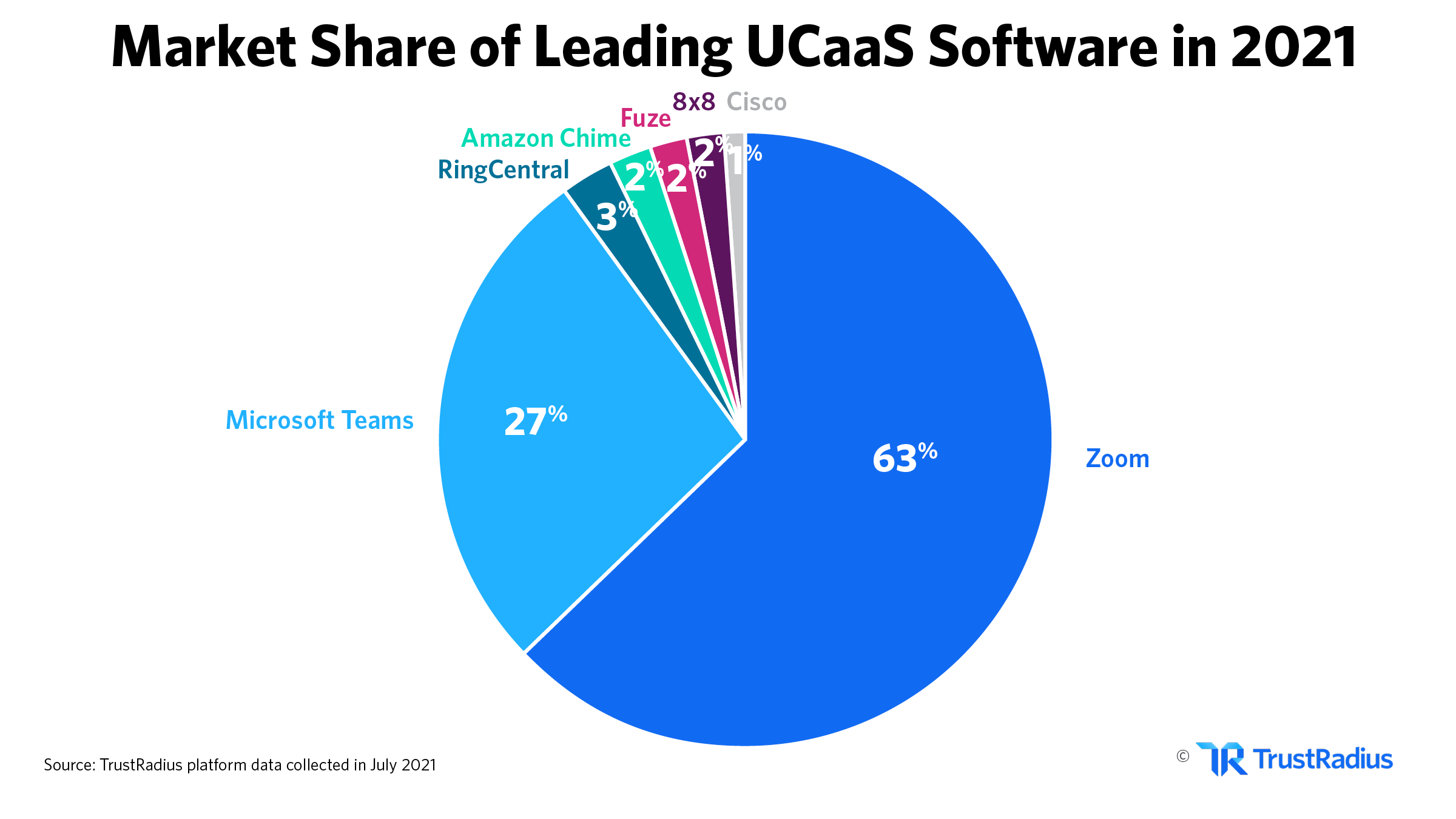

Out of those companies, we’re seeing clear winners when it comes to market share:

- Zoom is the UCaaS market leader in 2021, commanding 63% of the market share. (TrustRadius 2021)

- Microsoft Teams commands 27% of the UCaaS market share. (TrustRadius 2021)

- Ring Central commands 3% of the UCaaS market share. (TrustRadius 2021)

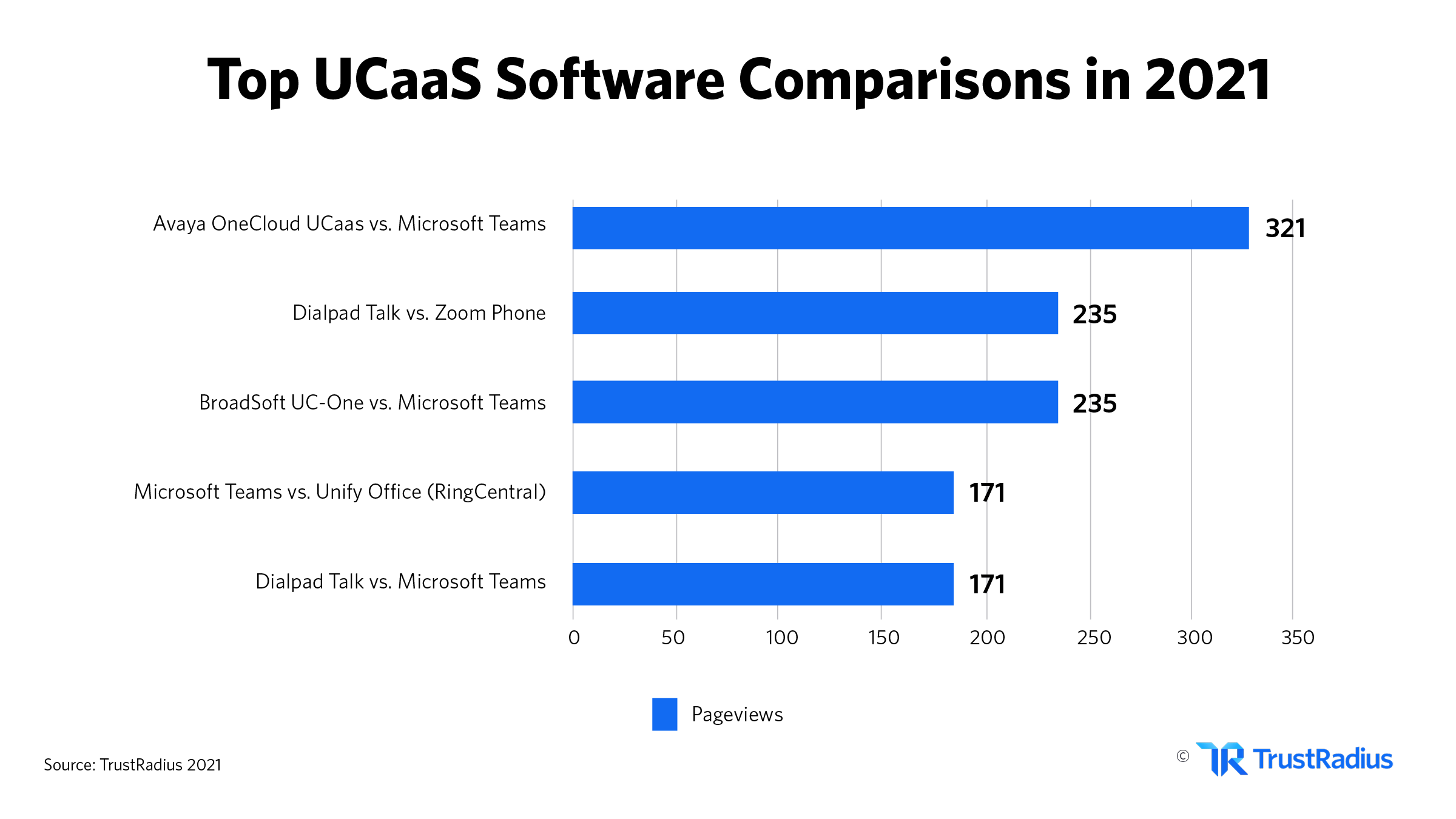

- Out of all ERP software, buyers spend the most time comparing Avaya OneCloud UCaaS and Microsoft Teams. (TrustRadius 2021)

UCaaS Funding and Development News

There are exciting developments in the UCaaS field. Strong investment and post-pandemic opportunities are setting the stage for innovation and growth. Here are some of the most interesting funding and development headlines in UCaaS for 2021 so far:

Zoom Buys Five9

One of the most intriguing headlines in UCaaS: Zoom’s acquisition of Five9. This move raises interesting questions. The purchase cost $14.7 billion. Zoom appears to be gambling on the future of the professional world relying on remote communications. Others have speculated Zoom fears their web conferencing platform will not be enough in the post-pandemic world. Either way, this is a big play by a huge player.

Fuze

Fuze is a company that truly puts the “U” in UCaaS.” The company is now only selling to larger organizations (>500 Employees). New convenience features allow users to participate in Zoom, Microsoft Teams, and other types of meetings directly from the Fuze interface. This combines with tablet and collaboration functionality to truly expand its communication potential.

Based on Fuze’s investments in mobile and multitasking features, the company is clearly striving to create a truly comprehensive communication platform. These innovations have seen Fuze named a leader in the 2021 Aragon Research Globe for Video Conferencing. Most recently, Fuze raised $13.6 million in January 2021.

Star2Star

This collaboration and communication company focuses on all aspects of remote work. Offering virtual desktops, connected workspaces, and collaboration tools, Star2Star has seen strong success over the past year. This has not gone unnoticed by market investors. The company has been acquired by Sangoma for a deal valued at around $437 million

Dialpad

Dialpad, a voice-focused company, has raised significant funding in the past calendar year. The company raised $100 million and has seen its valuation hit $1.2 billion. Dialpad also has acquired a video conferencing service in Highfive. The company is investing heavily in AI communications technology, including note-taking features and analysis. These may prove useful for more record-based UCaaS needs.

Top UCaaS Trends 2021

Massive Popularity Increase

Effective remote work and reliable employee communication go hand in hand. No one is surprised to hear that UCaaS is more popular than ever, but some may be interested by just how much more. UCaaS is 86% more popular than it was before the pandemic. While this explosion in popularity was driven by the circumstances of the pandemic, we expect this trend to continue far into the future.

Workers are quitting rather than returning to the office. Video conferencing and other professional communication tools are here to stay, and this has a massive impact on UCaaS. While Covid-19 lockdowns will gradually end, the impact they had on UCaaS popularity is likely only beginning.

UCaaS Going Mobile

Unified communications are moving out of the office. For frontline employees, the ability to join in on the UCaaS systems of their organizations is essential. Traveling employees were more UCaaS hesitant than their stationary counterparts, and mobile UCaaS is essential to keeping them in the loop. In the same vein, many people who used to go to the office every day no longer will. These individuals will be working from more places, requiring more flexibility in communication to keep their companies running.

Security Investments are Key

One of the major concerns surrounding unified communication systems is security. Unified systems can result in unified vulnerabilities. 95% of businesses say they want to use VPN connections to keep data private. This type of security worry extends to communications, especially with more and more information shared across networks. More remote employees, more online information transfer, more points of vulnerability. The trend towards a security-focused mindset will continue as companies shift from crisis mode during the pandemic to a longer-term growth model.

Your Guide to UCaaS Pricing

| UCaaS | trScore | Starting Price | Free Trial | Free or Fremium | Premium Services | Setup Fee |

| Zoom | 8.7/10 | $14.99 | None | |||

| WooCommerce | 8.6/10 | Contact Vendor | None | |||

| Microsoft Teams | 8.4/10 | $5 | None | |||

| RingCentral | 7.7/10 | $19.99 | None | |||

| Fuze | 7.7/10 | $15 | Required | |||

| Squarespace |

8.4/10 | $12 | None | |||

| Amazon Chime | 7.9/10 | Contact Vendor | None | |||

| 8x8 X Series |

7.6/10 | Contact Vendor | None | |||

| Cisco Unified Communications Manager | 8.9/10 | Contact Vendor | None | |||

| Avaya Onecloud UCaaS |

8.0/10 | Contact Vendor | None |

Here are some stats from real buyers on TrustRadius:

- 72% of 8×8 X Series reviewers are from small businesses. (TrustRadius 2021)

- 57% of Cisco Unified Communications Manager reviewers are from enterprise-level businesses. (TrustRadius 2021)

- 93% of UCaaS reviewers say they would buy their UCaaS system again. (TrustRadius 2021)

- 95% of UCaaS reviewers are happy with their UCaaS’s feature set. (TrustRadius 2021)

- 75% of UCaaS reviewers say that implementation went as expected. RingCentral (91%), Avaya OneCloud UCaaS (85%), and Zoom (82%) beat this average. (TrustRadius 2021)

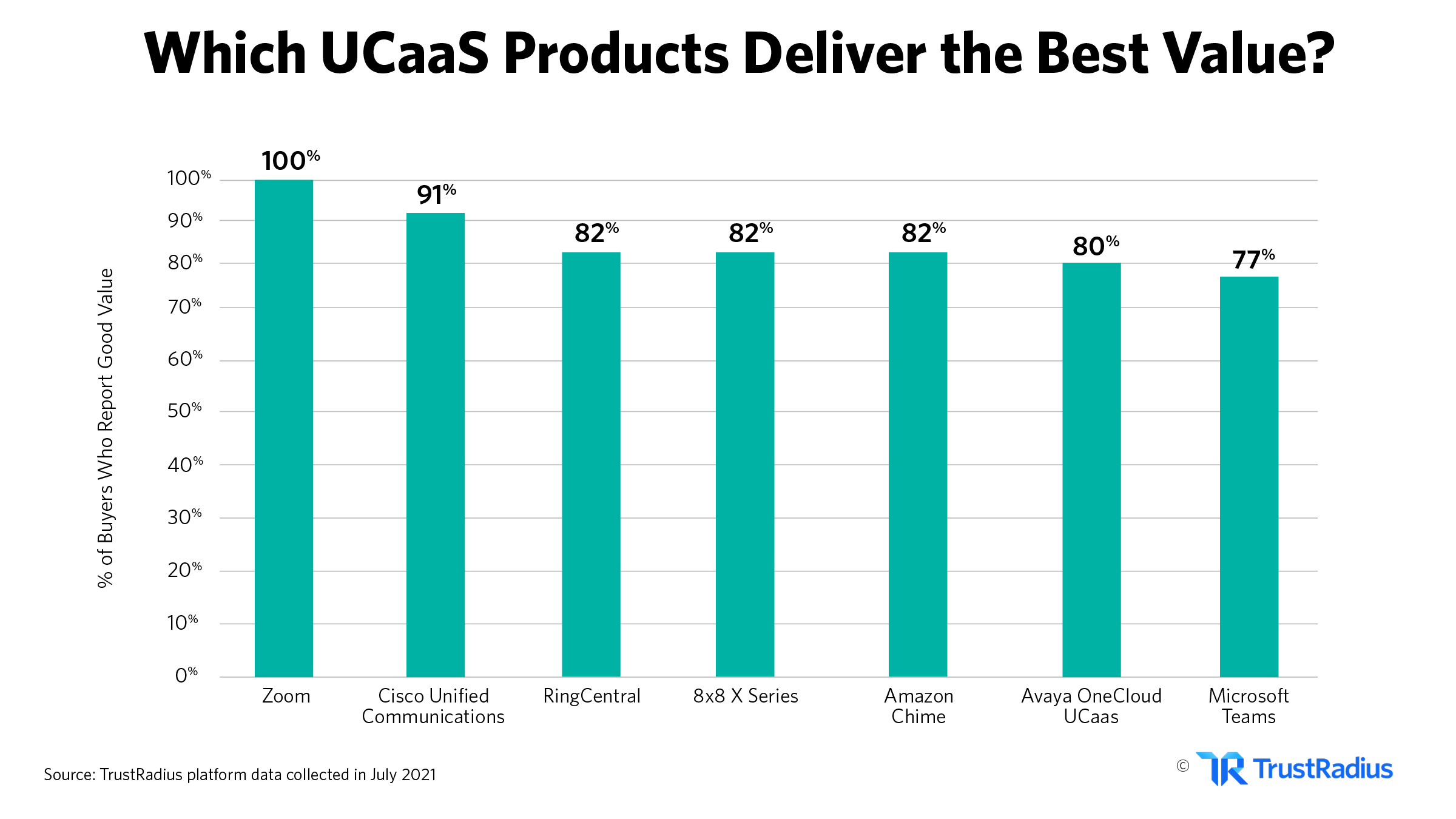

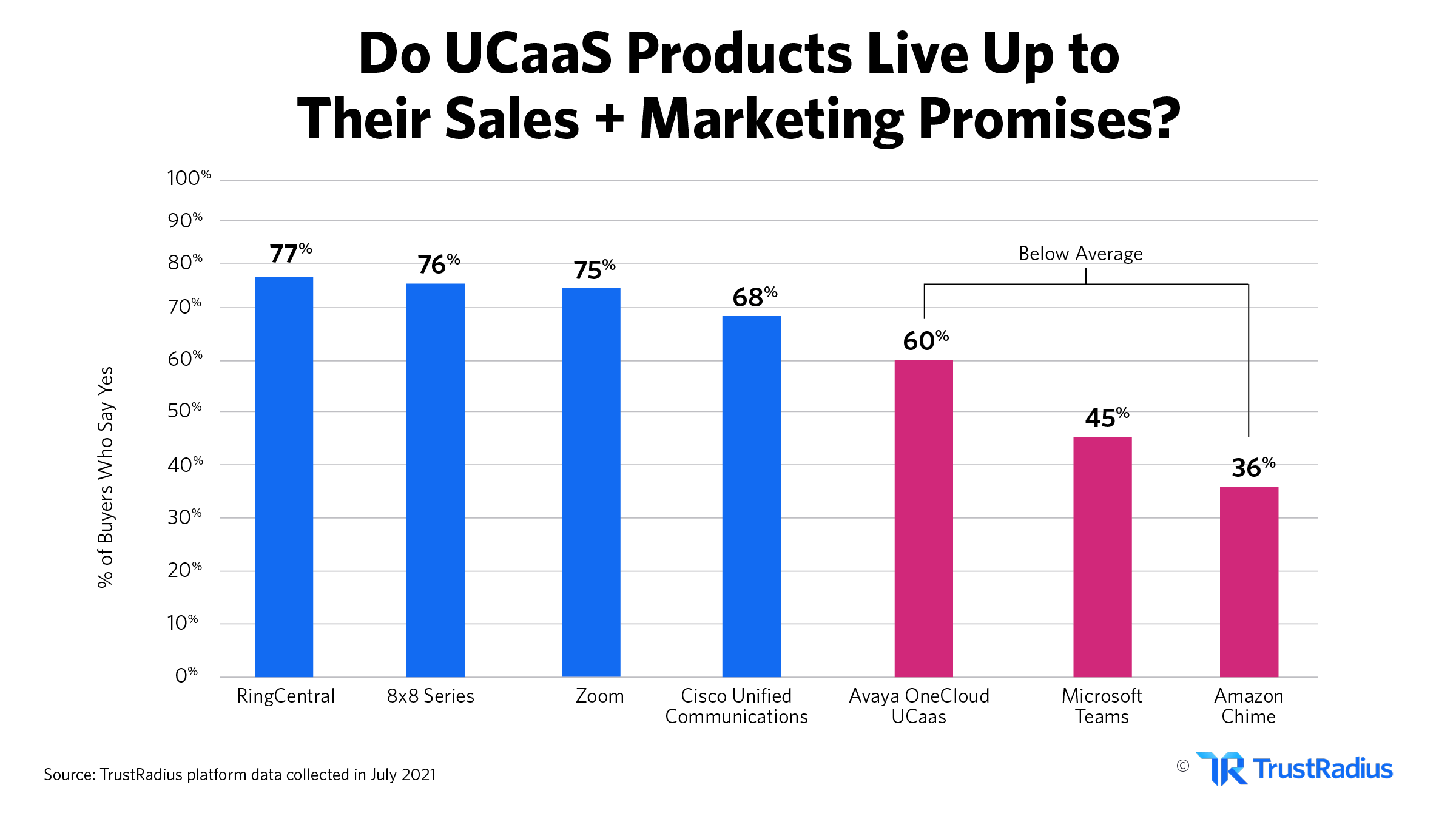

- 68% of UCaaS reviewers think their UCaaS product lives up to sales and marketing expectations. RingCentral (77%), 8×8 X Series (76%), and Zoom (75%) beat this average. (TrustRadius 2021)

- 85% of UCaaS reviewers think their product delivers good value for the price. Zoom (100%) and Cisco Unified Communications Manager (91%) both have above-average value ratings. (TrustRadius 2021)

- 100% of Zoom reviewers think their product delivers good value for the price. (TrustRadius 2021)

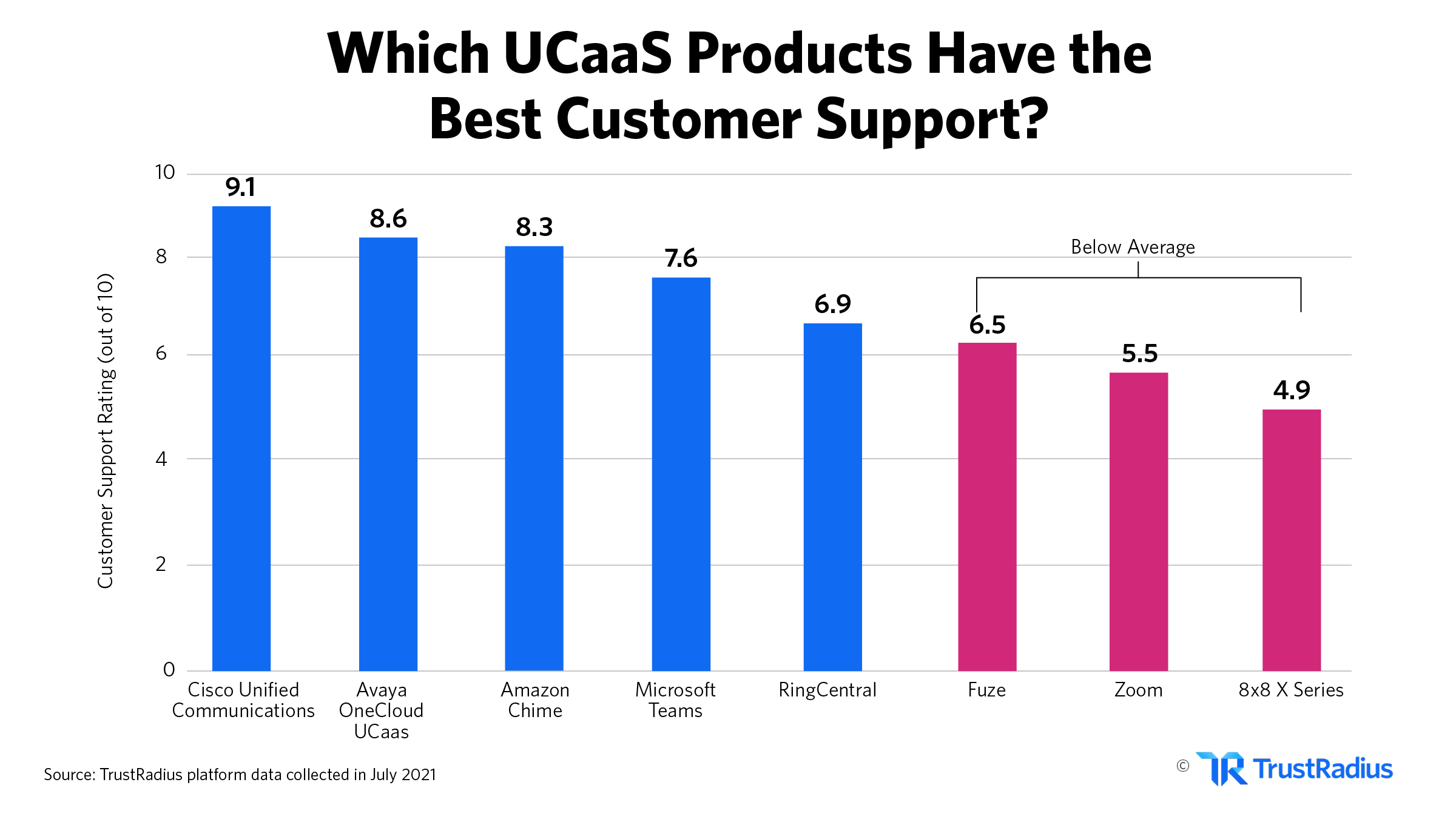

- The average customer support rating for UCaaS software is 7.91/10. Cisco Unified Communications Manager (9.1/10), Avaya OneCloud UCaaS (8.65/10), and Amazon Chime (8.34/10) beat this average. (TrustRadius 2021)

If you’re looking for your next UCaaS solution, check out reviews on TrustRadius. You’ll see 100% authentic reviews from buyers just like you.

Sources

- Unified Communication As A Service Market Report, 2021-2028 (GrandView Research 2021)

- Are poor conference call practices costing businesses billions? (Loopup 2019)

- The People Have Spoken (Cisco 2020)

- Why video conferencing is critical to business collaboration (GigaOm 2020)

- COVID-19 Reshapes the Global Customer Engagement Landscape (Vonage 2020)

- 10 Intriguing UCaaS Statistics for 2021(TrustRadius 2021)