Advapay Macrobank Digital Core Banking vs. Neofin

Advapay Macrobank Digital Core Banking vs. Neofin

| Product | Rating | Most Used By | Product Summary | Starting Price |

|---|---|---|---|---|

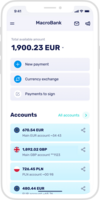

Advapay Macrobank Digital Core Banking | Small Businesses (1-50 employees) | Macrobank by Advapay is a front-to-back banking software solution encompassing an engine, API, web and mobile interfaces, and back-end infrastructure equipped with all essential banking and payment functionalities. Endorsed by numerous regulators, it boasts flexibility and customization options, operates on an API-based architecture, and can be deployed either on the cloud or on-premises. It is available in both Software as a Service (SaaS) and perpetual licensing models, with the added… | $7,000 | |

Neofin | N/A | Neofin is presented as a Shopify for lending business. It is a low-code SaaS for lending automation that allows launching any lending business in as fast as 15 minutes, establishing the credit products in 1 hour, and issuing credits the same day. It covers all the stages of the borrower's journey, including loan origination, servicing, loan management system, decisioning, underwriting, collection, and even out-of-box front-end components. Neofin's modulated platform enables a financial… | $1,599 |

| Advapay Macrobank Digital Core Banking | Neofin | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Editions & Modules | No answers on this topic | No answers on this topic | ||||||||||||||

| Offerings |

| |||||||||||||||

| Entry-level Setup Fee | Optional | No setup fee | ||||||||||||||

| Additional Details | — | — | ||||||||||||||

| More Pricing Information | ||||||||||||||||

| Advapay Macrobank Digital Core Banking | Neofin | |

|---|---|---|

| ScreenShots | Advapay Macrobank Digital Core Banking Screenshots |