Developing Customer Insights Through Social Listening

Every business wants an answer to certain questions:

- What do people say about our product?

- Who is talking about – and who likes or dislikes – our product?

However, businesses have a few options for how to develop insight into their customers. They could run focus groups, but those are logistically difficult, expensive, and the data is inaccurate because the study subjects are psychologically “primed”.

They could dig into owned data they have on their current customers, which is a great idea. But this can only go so far: what about customers who chose not to purchase? Or who switched products?

The Social Web and Its Vast Data

There is a world of customer data out there, ready to be used to drive real business results. This is the social web (or web 2.0, or more commonly: “The Internet”).

Ever since the dawn of social networks, forums, blogs, comments, and all such 2-way conversation channels, people have been talking about what they do, like, eat, wear, hate, love, think, and feel. This massive set of unstructured data can actually be mined and analyzed. More often than that, the results produced can be used to define new assumptions, or modify existing ones.

Social Listening Provides Quick, Inexpensive and Accurate Customer Intelligence

Unlike its more traditional counterparts such as focus groups, surveys, and 1st party data analysis, social listening insights can be generated in a matter of hours. Some tools have the data stored and ready to be accessed within seconds.

And when you compare the aggregate costs for focus groups with enterprise-level social listening technology, the $3000-$10000 monthly fees for most social listening tools begin to look inexpensive.

Finally, the people you’re monitoring don’t know you’re listening (which would only be creepy if the data wasn’t as well-regulated and often anonymized as it is). This preserves the integrity of the results.

With the right Natural Language Processing (NLP) algorithms on top of the raw text data, businesses come away with all sorts of insights.

Telecom Example: How to use social listening tools to make business decisions

Let’s say, for example, that Verizon wants to learn about the perceptions of its brand vs. perceptions of its competitors’ brands. They are asking these questions:

- What do people think about Verizon and its products?

- Who is talking about (and who likes or dislikes) Verizon and its products?

- What do people think about AT&T, Sprint, T-Mobile and other competitors, and their products?

- Who is talking about (and who likes or dislikes) these competitors and their products?

- What do people think about mobile phones and carriers in general?

- Who is talking about (and who likes or dislikes) mobile phones and carriers in general?

With best-in-class social listening technology, Verizon would be able to answer all these questions in great detail. The results would include the following data sets:

What customers say:

- Positive and negative sentiment

- Emotions and thematic elements

- Major words in context (most mentioned topics)

- Strength of feeling (passion)

Who are the customers:

- Demographics (gender, age, financial demographics)

- Geographics (country, state/province, city)

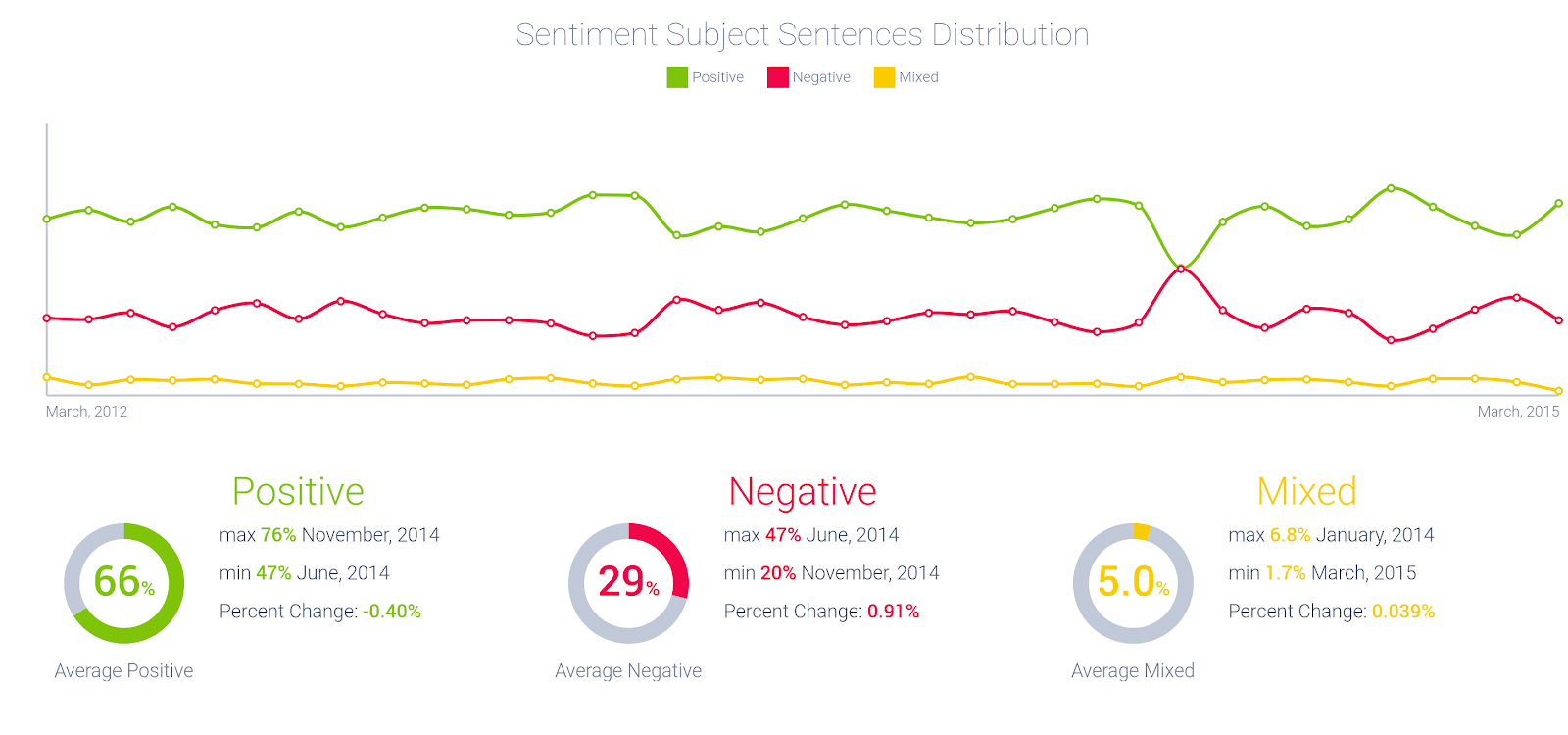

This data would be available as trends over time or as aggregate numbers. For example, we could glean from the sentiment over time (past 3 years) that Verizon customers feel mostly positive about the brand. There are a couple hiccups, however, especially in June 2014, and a sustained period of increased negative sentiment in the Summer of 2013.

The next step with sentiment analysis is to drill down into specific events and determine drivers, whether through simple observation, or through data modeling (regression analysis).

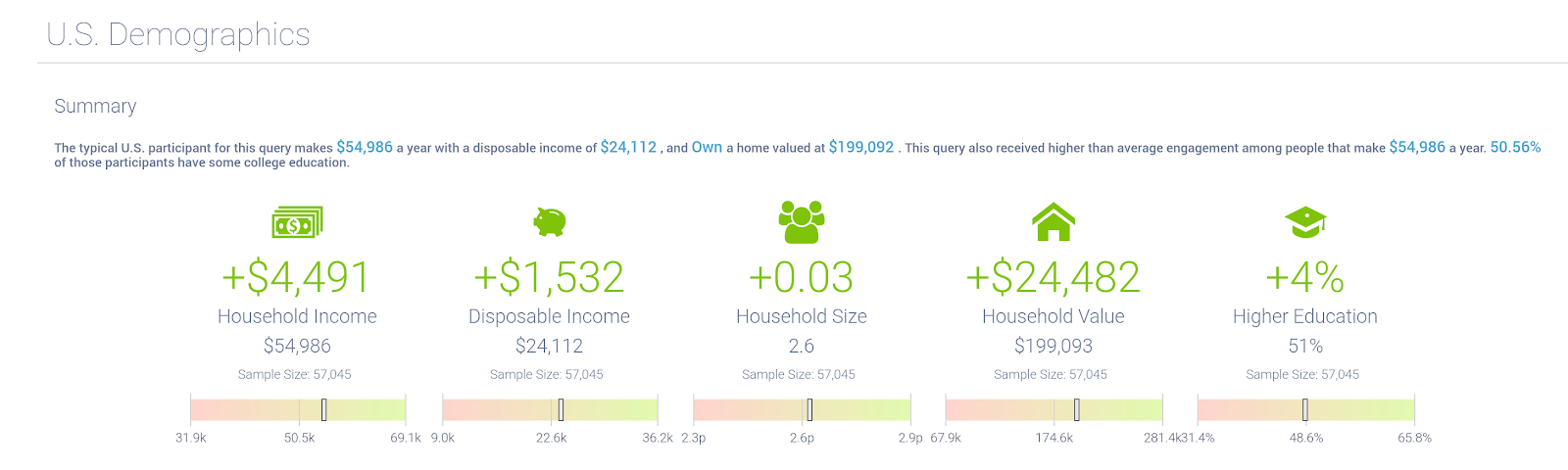

Verizon customers are also significantly wealthier than the median US citizen. This data is estimated based on zip code information gleaned from the results. This data can be used to develop targeted advertising. For example, Verizon could then build a paid Facebook advertising campaign targeting people with home values $200,000 and up, with incomes over $50,000, who have completed Bachelors degrees, and who have kids in the home.

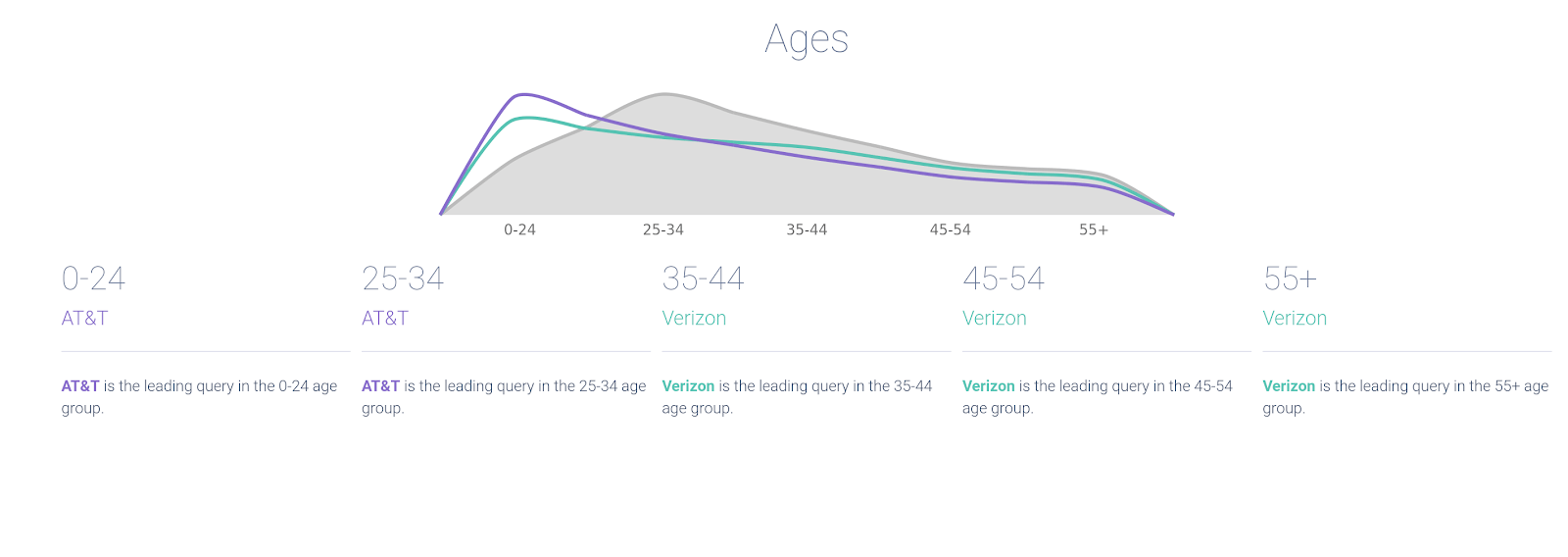

As for competitive intelligence, we can figure out where Verizon and AT&T resonate more, with both age (blue is Verizon, Purple is AT&T)…

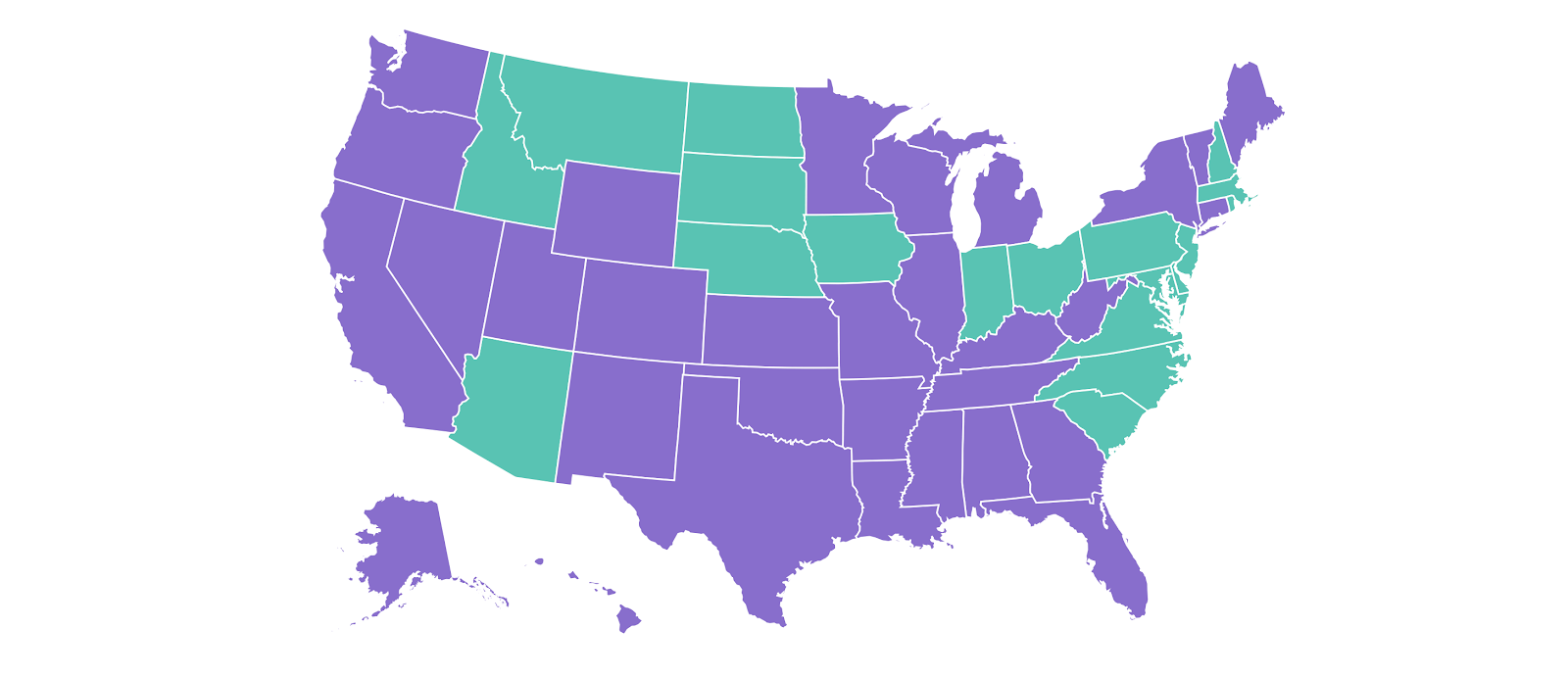

And US geographic information:

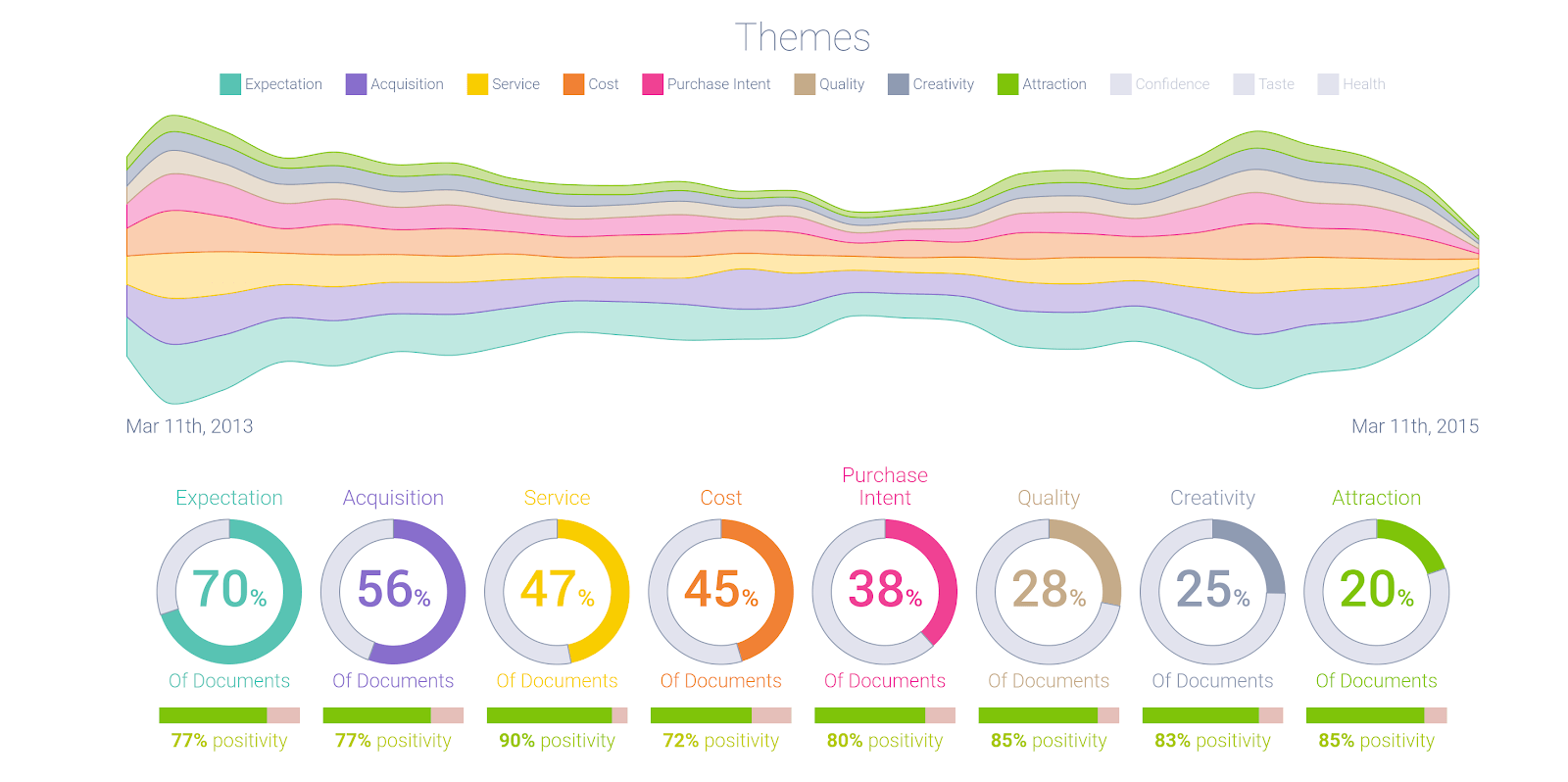

Finally, a quick industry analysis of the last 2 years tells us a few things:

- People who discuss mobile wireless plans tend to do so in the context of a buying decision, as seen by the high Acquisition, Cost and Purchase Intent metrics.

- They care about Service, more even than Quality or appeal (Creativity and Attraction).

But It Doesn’t End There

The beauty of social listening is that the data is provided in a living environment. Continual monitoring will increase the amount of historical data available. Historical data can be set alongside sales data and other key metrics to determine correlation between sentiment/emotions/themes and actual sales. Pre- and post-campaign snapshots of this data can determine whether the campaign influenced online dialogue, and who it influenced.

On top of all this, social networks continue to open up more data feeds. Facebook just announced the release of PYLON, a parallel product to Twitter’s Firehose, which will provide anonymized topic-level data. Social listening tools themselves continue to improve. NetBase recently added the Chinese-based social network Weibo as a data feed. Brandwatch recently deployed minute-by-minute data trends. Infegy Atlas offers financial demographic information based on zip code data.

Businesses have an incredible opportunity now to make data-driven decisions through the intelligent application of social listening.

Was this helpful?