Fastest Growing Social Media Management Software for 2016

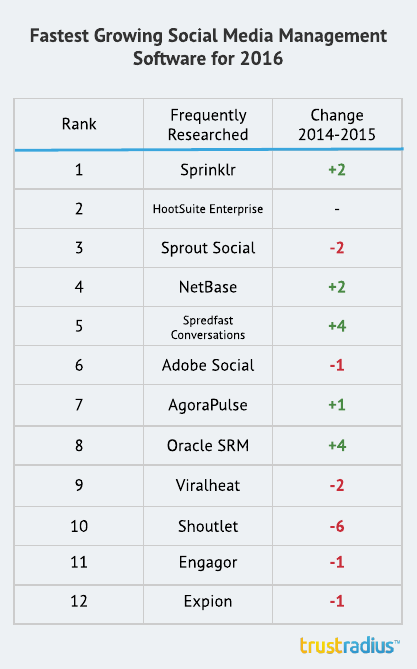

As we head into 2016, we took a look at trends in the social media management landscape. Here’s the year in review: several vendors gained visibility on TrustRadius over the last year, while others fell in the ranks—and these changes in buyer research activity seem to be a function of continuing social M&A. Check out our stack rank chart, based on changes in website traffic over the last year, below.

Spredfast, Oracle, Sprinklr, and NetBase are Fastest-Growing SMMS Vendors on TrustRadius

A Closer Look at Growth, Research Frequency & Company Status

Sprinklr, the clear leader in terms of research frequency on TrustRadius, has been particularly active over the last two years. Sprinklr’s recent acquisitions include the Dachis Group, TBG Digital, Branderati, Pluck, Get Satisfaction, Scup, newBrandAnalytics, and Booshaka.

Hootsuite, which held steady in second place between 2014-2015, has also been acquisitive—in 2014, Hootsuite acquired Zeetl, Brightkit, and uberVU—although the company has been less active in 2015.

Also of note in 2014, Spredfast merged with Mass Relevance, a provider of social media curation software for the media and entertainment sectors, and earlier this year Spredfast acquired Shoutlet, an SMMS tool focused on social marketing.

NetBase is an exception: it gained significant buyer attention share this year, but has not been acquisitive. However, NetBase did recently raise $33M Series E Funding (April 2015), and according to the vendor’s press release this money was intended to “accelerate NetBase’s market position within the core listening and analytics space, continue developing a rich innovation roadmap, support critical alliances and drive global expansion.” These goals are supported by its +2 climb to rank fourth most frequently researched SMMS product on TrustRadius.

On the flip side, acquired companies tend to draw less buyer attention. Among the tools that fell in research frequency ranking from 2014-2015, Shoutlet and Expion are notable because they were acquired within the last year, earlier this summer. Sysomos acquired Expion in July 2015, and Spredfast acquired Shoutlet in August 2015.

Was this helpful?