How Social Is Oracle After 3 Acquisitions?

Executive Interview Series By Vinay Bhagat, CEO TrustRadius

Executive Interview Series By Vinay Bhagat, CEO TrustRadius

In 2012 Oracle made a huge bet on Social Media Management Software making three acquisitions in rapid succession. In May they acquired Vitrue, a Social Marketing solution for $300 million; in June, social intelligence platform Collective Intellect; and in July social media development platform, Involver.

We wanted to understand how those acquisitions have turned out, and how Oracle was approaching social. As part of our Social Media Management vendor executive interview series, I interviewed Meg Bear, Group Vice President of Social Cloud at Oracle. This article follows interviews with executives at Sprinklr, Spredfast, and Hootsuite about the battle for the enterprise within social media management.

Oracle’s Social Media Management Offering Today

Oracle’s Social Media Management offering is called Social Relationship Management (SRM) and there are two primary components which can be purchased together or stand-alone:

- Social Engagement & Monitoring (SE&M); derived from Collective Intellect and Involver.

- Social Marketing (SM) – derived from Vitrue.

Per Meg, “The majority of our new customers are purchasing the SRM platform and many of our longtime SM customers have recently upgraded to the full SRM.”

Often times, when small, innovative software companies are acquired by large ones, innovation takes a long pause to focus on integration. In one of the Involver reviews on TrustRadius, this sentiment was echoed: “Involver got left behind after being bought by Oracle, and in a space as fast moving as social media, it is unacceptable to fall behind”.

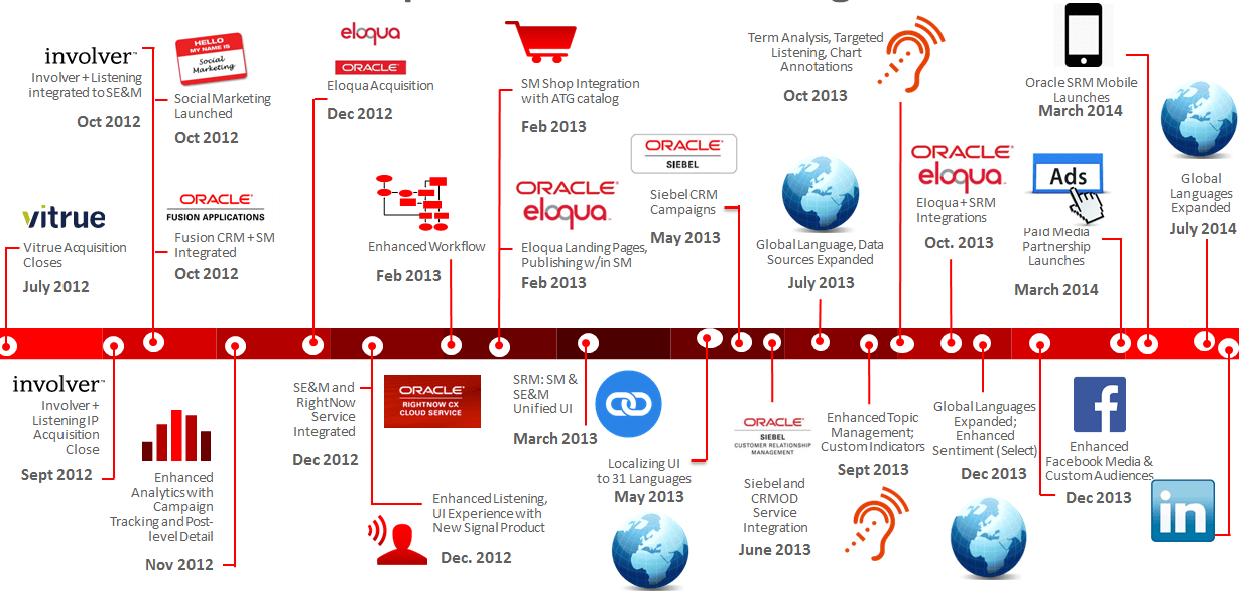

Meg responded, “The products have evolved greatly in terms of innovation and capabilities since the acquisitions”. Much work has been done around integration, but the core platform appears to have seen a lot of functional innovation. Key areas include:

- Internationalization – UI in 31 Languages; Advanced Semantic Listening to 18 languages; expanded Localized Data Sources (Reclameaqui, Baidu, Weibo, Vostu, etc);

- Market leading Term Analysis, Topic Management, and Custom Indicator capabilities;

- Influencer Identification;

- Enhanced Workflow;

- Social Shop Integration w/ Commerce Cloud;

- Social Service integration with Service Cloud;

- Custom Audiences (Marketing and Sales Cloud);

- Paid Media Partnerships (API based);

- Dynamic Link Tracking (Marketing Cloud);

- Smart CAPP (Publish enhancement);

- SRM Mobile App;

- Social Intelligence Center capabilities.

- Expanding platforms; added LinkedIn support; others coming

Response to Reviews on TrustRadius

The current reviews on TrustRadius are about the acquired, stand-alone products, and not the SRM suite as it is today. Nevertheless, we felt it was relevant to get Meg’s response to a few points that were raised by users:

About Collective Intellect (Social Monitoring)

Meg’s response. “Our listening and analysis capabilities are among the strongest in the industry. Sentiment analysis has recently been improved upon. We have ongoing enhancements scheduled on our roadmap, including expanding analysis in global languages. We currently offer sentiment analysis in 6 languages—English, Portuguese, Spanish, Chinese, German and French. That said, we do recognize that sentiment alone is never going to be perfect and it is for that reason we have market-leading capability to not only understand sentiment but also the automatic association of indicators so that we can understand meaning from the message not just sentiment. Some examples of the kinds of indicators we provide out of the box are things like intent to purchase, intent to switch, customer service, etc. Additionally, our Semantic API gives our customers the capability to take their unstructured data – like call center transcripts, community reviews, etc. – and run it through our listen and analyze engine to extract insights and sentiment.”

Meg’s response: “Listen & Analyze provides a comprehensive feed of social media and news data from over 40 million sites worldwide with new sites being added daily. These include Social Networks, Blogs, Video Sharing sites, Forums, News, and Review sites. Our data providers are constantly updating their sources so there is no static list..”

Meg’s response: “We know that data is the lifeblood for our customers and as such data accuracy, timing and integrity are high priority items for us. I would put our data capabilities up against any of our competitors and believe we’d outshine them every time.”

Meg’s response: “Integration has been a driving theme along our innovation story. We have pre-built integrations with all our Oracle CX portfolio products, but we also have open integration capabilities for web analytics tracking, paid media APIs, and are releasing additional APIs for additional extensibility in the next couple quarters.”

About Vitrue (Social Marketing)

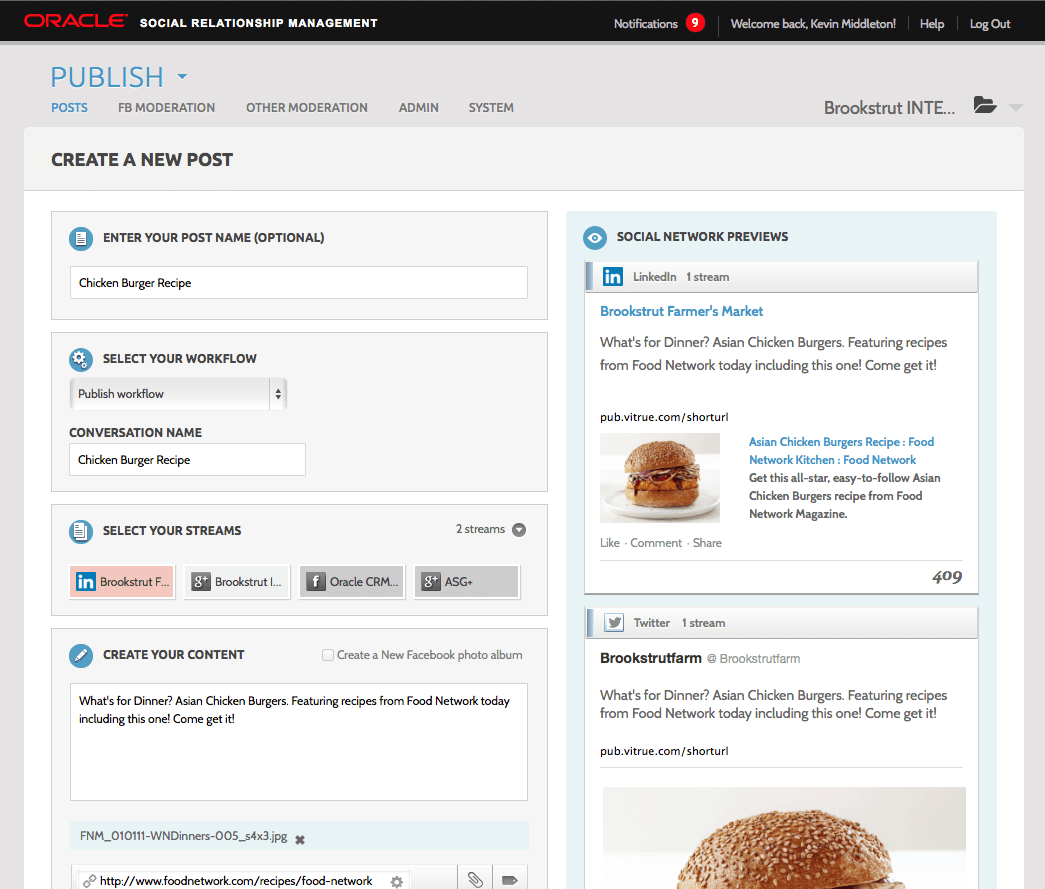

Meg’s response: “Today, SRM/SM has an intuitive interface with dynamic drag-and-drop capabilities with the ability to easily customize and stylize without CSS knowledge.”

“Slow load time on tabs caused issues for us.”

Meg’s response: “As part of Oracle we have expanded our hardware capacity and have dramatically improved performance.”

Meg’s response: “We’ve made major enhancements and today experience a paucity of scheduling issues. Our scheduling tool is now a user favorite. Our bulk uploading enhancement occurs this quarter.”

Meg’s response: “Major enhancements have been made. We have dramatically expanded our moderation and automation capabilities and added new guided workflows to help customers scale these functions.”

“Vitrue did not allow us to assign different tasks to team members.”

Meg’s response: “Today we have comprehensive workflow capabilities.”

Adoption

Oracle does not share customer counts, but did share mix, “Currently, approximately 35% [of customers] are SM; 35% SE&M and 25% the full SRM suite. However, we are seeing a strong trend of SM customers upgrading to the full SRM platform”. Oracle’s typical SRM customer is enterprise, i.e. a large multi-national corporations with $1b+ revenue, but they do also have mid-market clients (typically $100m-999m revenue).

The marketing function has been their primary customer, but they are selling to other lines of business including customer service, commerce and sales. Historically they have seen much more adoption among B2C companies as brands were first to social, but are now seeing an increase in B2B companies. They have catalyzed this demand through furthering their integration with the rest of the Oracle Marketing Cloud and by adding LinkedIn support.

Comprehensive Integrated Suite as Differentiation

Oracle sees its primary key competitors in the social space as Salesforce and Adobe and emphasizes the integration of Social with the rest of its broad customer experience software portfolio as its key competitive advantage. Integration has been a primary area of investment. SRM is now a core component of the Oracle Marketing Cloud. It has been integrated/ is being integrated with all other Marketing Cloud products including, Eloqua (B2B Marketing Automation), Responsys (B2C Marketing Platform), Compendium (Content Marketing), and BlueKai (Audience Data Management Platform).

When asked about pure-play social vendors, Meg responded, “These products are focused on a piece of the puzzle but none are really looking at the bigger picture of social woven throughout every customer touch point.”

Integration with Eloqua has been particularly important. “We implemented our first SRM + Eloqua integrations in February of 2013, just three months after the Eloqua acquisition. Approximately 15% of existing customers are using SRM and marketing automation, primarily Eloqua, from Oracle today, “We are seeing an increasing pipeline as our Marketing Cloud has evolved, especially offering both B2B and B2C solutions with Eloqua and Responsys, as well as the addition of BlueKai and Compendium.”

The first integrations with Eloqua included social marketing capabilities like publishing landing pages, lead creation and campaign tagging and analytics, and custom audiences. More recent integrations include smart publishing and Dynamic Link Tracking (DLT), Oracle’s proprietary functionality that tracks social actions taken by individuals. Most recently, SRM added LinkedIn support, a big plus for B2B Eloqua customers. “Customers can listen across relevant social channels to understand conversations that are happening around their brand, customers, potential customers and influencers. Those insights gleaned can be used to create targeted and relevant campaigns to generate stronger leads, conversions and sales. Oracle Social customers can create targeted social campaign pages where captured data (contacts and leads) easily flows directly into Eloqua offering a more complete customer profile. Integrated customers of SRM + Eloqua can also take advantage of creating and targeting custom audiences within Facebook and dynamic link tracking (DLT), which allows customers to tie social actions back to their customer profiles for a full picture.”

A new facet of integration is with BlueKai, Oracle’s new DMP (Data Management Platform). BlueKai provides aggregated data to combine with a customer’s current data (enterprise, CRM and social) and enables audience expansion through developing look-alike audience models. “BlueKai creates stronger audience profiles and custom audiences that are used in SRM to target publishing.”

SRM also has integrations with Oracle’s Service Cloud, Sales Cloud and Commerce Cloud. For example, the Service Cloud and Social Cloud integration allows for real-time routing and tracking of service issues for faster and more efficient customer support resolutions.

Closing Thoughts

Was this helpful?